Japan For Dividends! No Kidding.

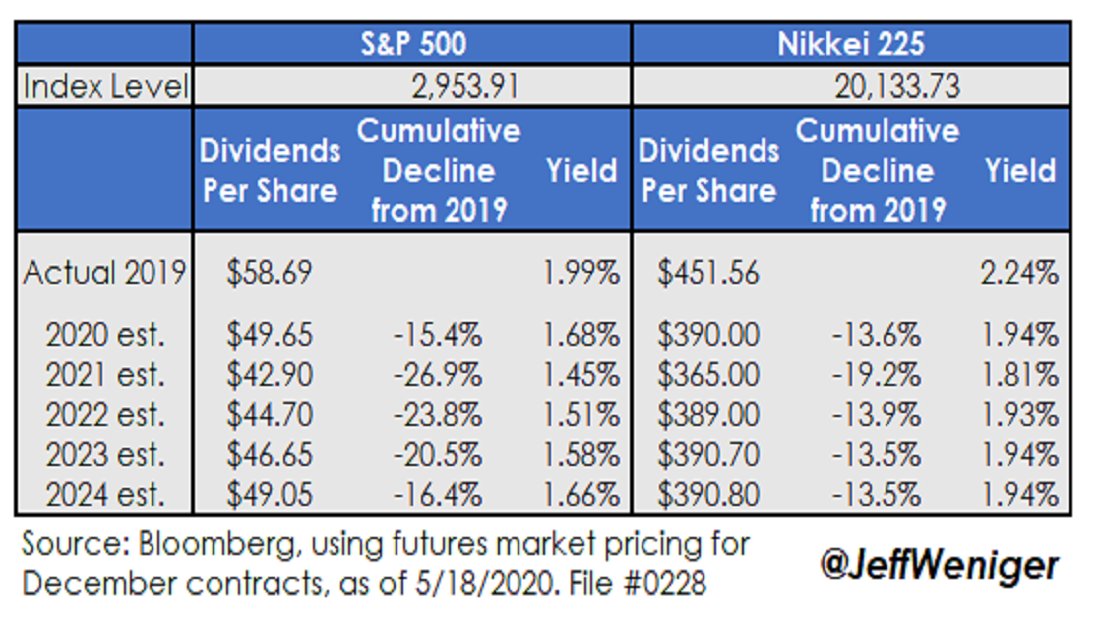

There is a futures market for Nikkei 225 dividends, just like there is one for the S&P 500. Look who the Street expects to cut more.

There is a futures market for Nikkei 225 dividends, just like there is one for the S&P 500. Look who the Street expects to cut more.

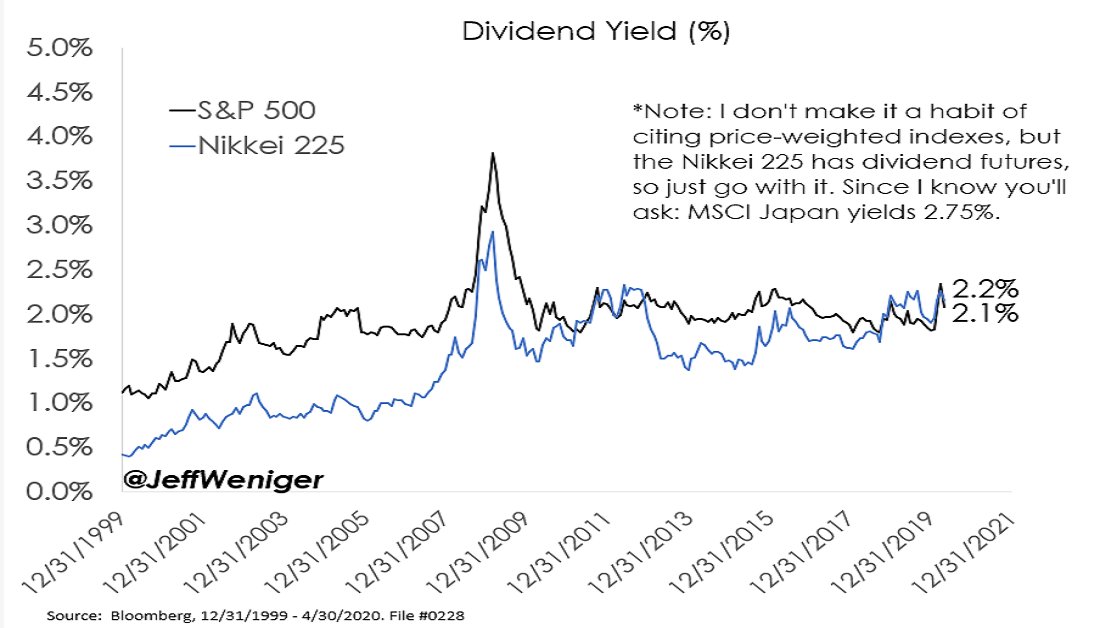

I don’t often refer to the price-weighted Nikkei 225, but let’s use it because of the dividend futures. It yields a tad more than the S&P 500. Not shown is MSCI Japan, which is market capitalization weighted. It yields 2.75%.

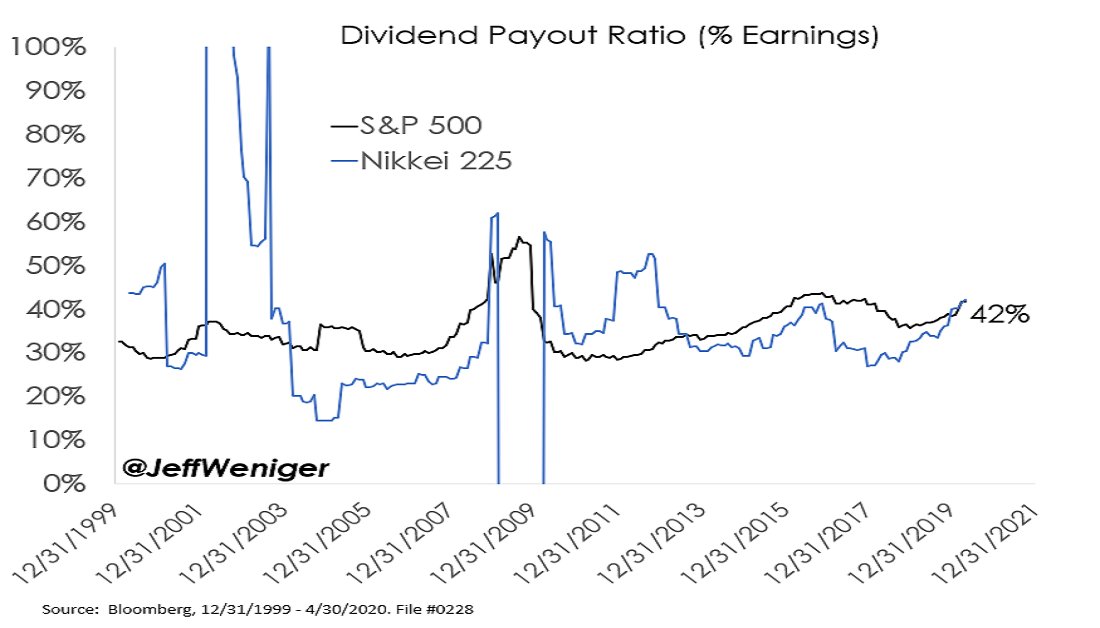

Dividend payout ratios are exactly the same. Both the S&P 500 and the Nikkei 225 pay 42 cents in dividends for every one dollar earned.

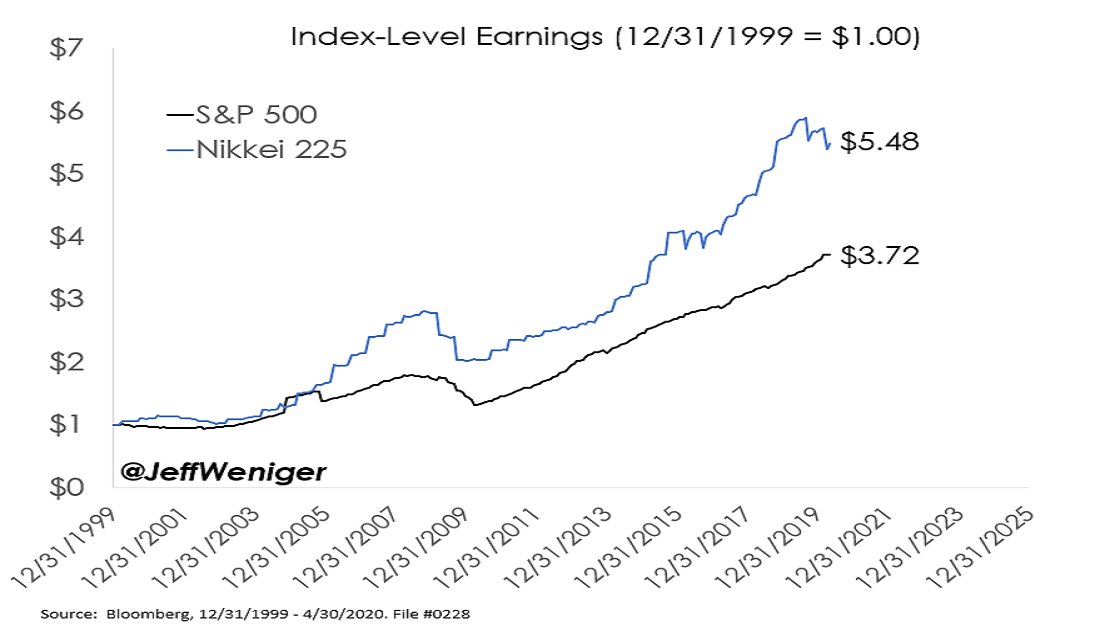

But people think US stocks grow earnings faster because Japan is lethargic. This chart surprises a lot of people.

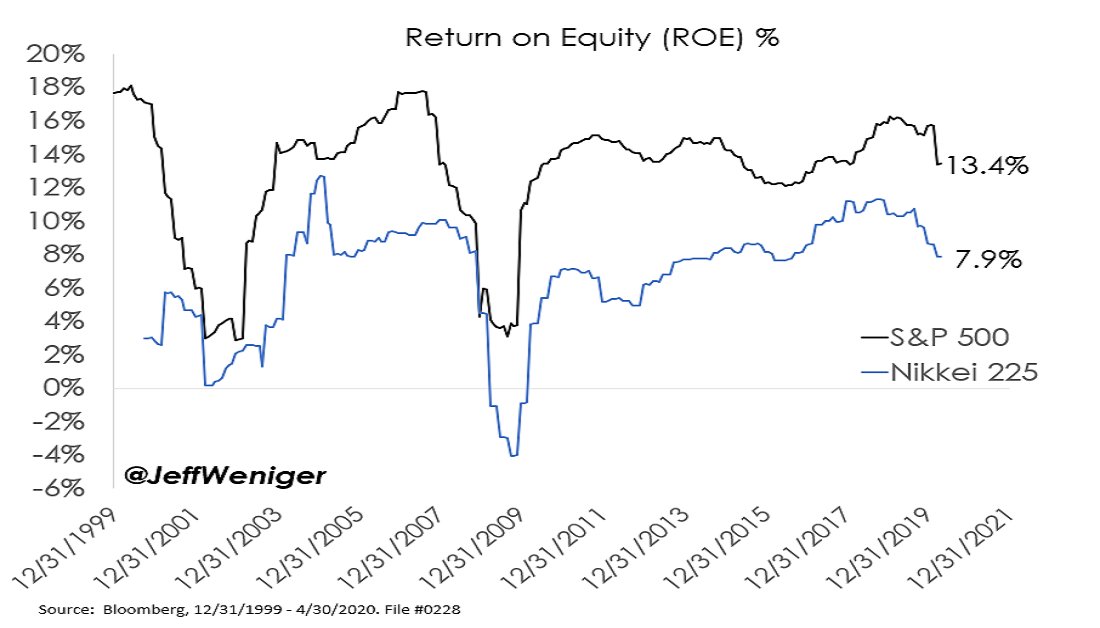

Let me show you the two profitability measures, ROA and ROE. The S&P 500’s ROA is 2.82%, not much different from the Nikkei’s 2.53%. One way to get ROE higher is to take on more debt…

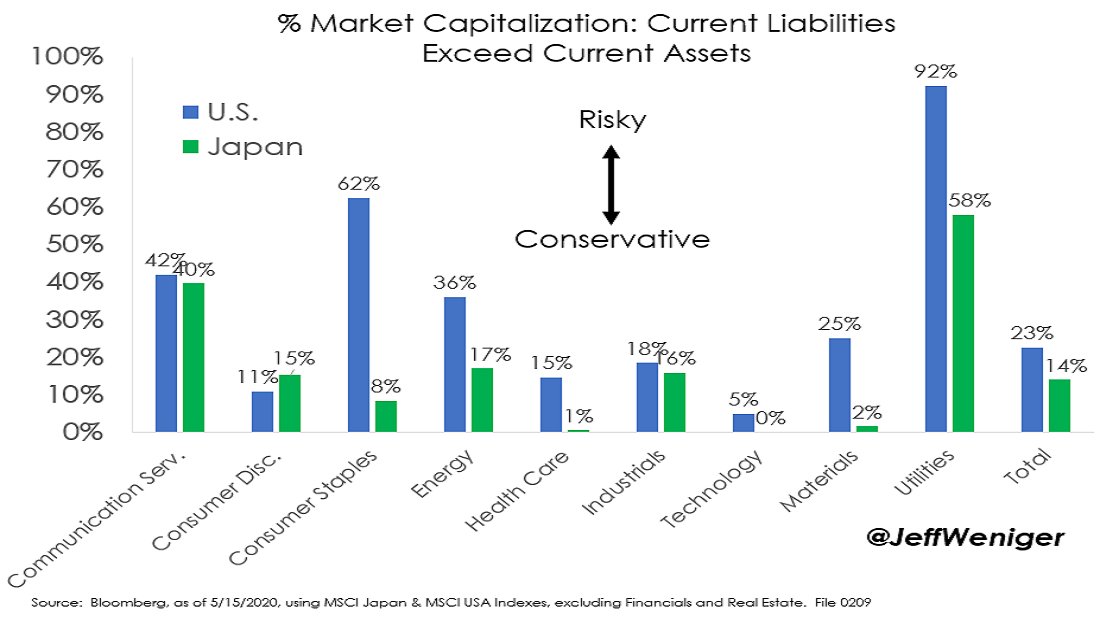

…and that’s what US firms have done. Yes, the S&P 500’s return on equity (ROE) is higher – because US firms have debt; Japanese firms have cash.

Read on Twitter

Read on Twitter