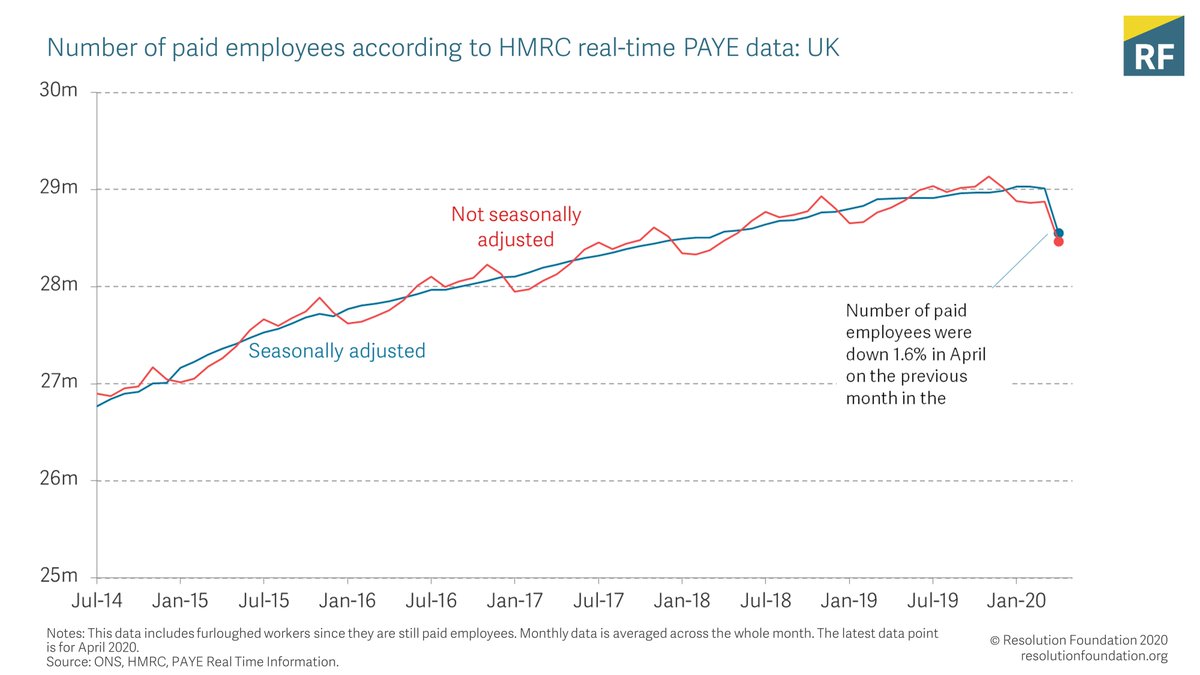

Starting with the employee count – HMC’s PAYE includes all employees being paid through PAYE, which will include furloughed workers. Even so, it shows a big drop, down 450k from March to April. (Data points are whole-month averages).

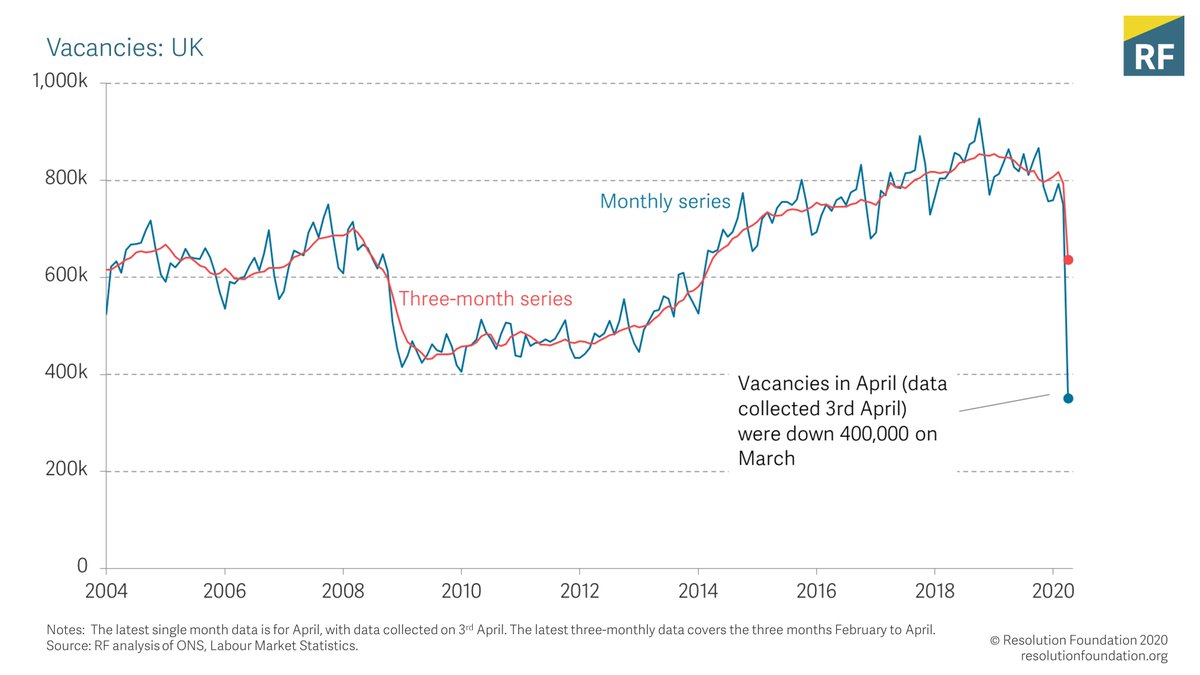

The second big move is vacancies. Using the single-month data (which are more timely but less reliable) shows that total vacancies in April were down 400k (or, by 50 per cent) on March. April data was collected on the 3rd April.

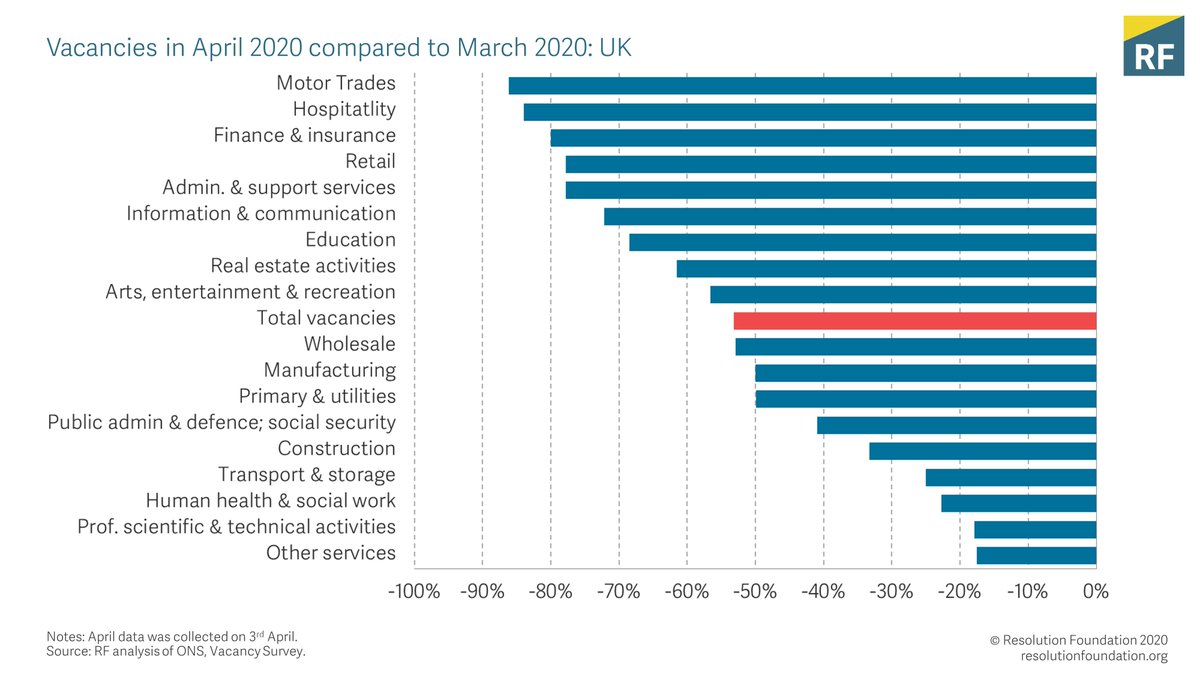

The effects are, unsurprisingly, much bigger in some sectors than others. Looking at the March to April change shows huge (+70 per cent) drops offs in Motor Trades, Hospitality and Retail and other sectors.

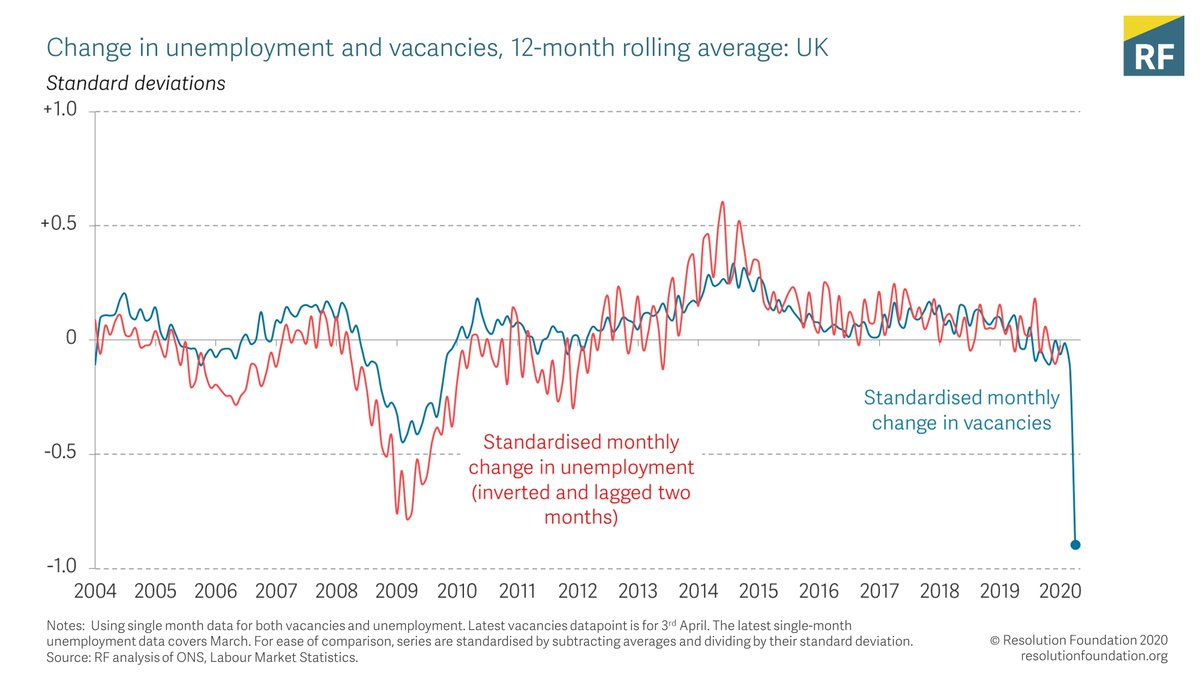

Vacancies mean less demand, which normally we’d expect to feed into the unemployment and employment figures pretty quickly (in about 2 months). The official unemployment data (see lower in thread) hasn’t moved yet though – with data up to march.

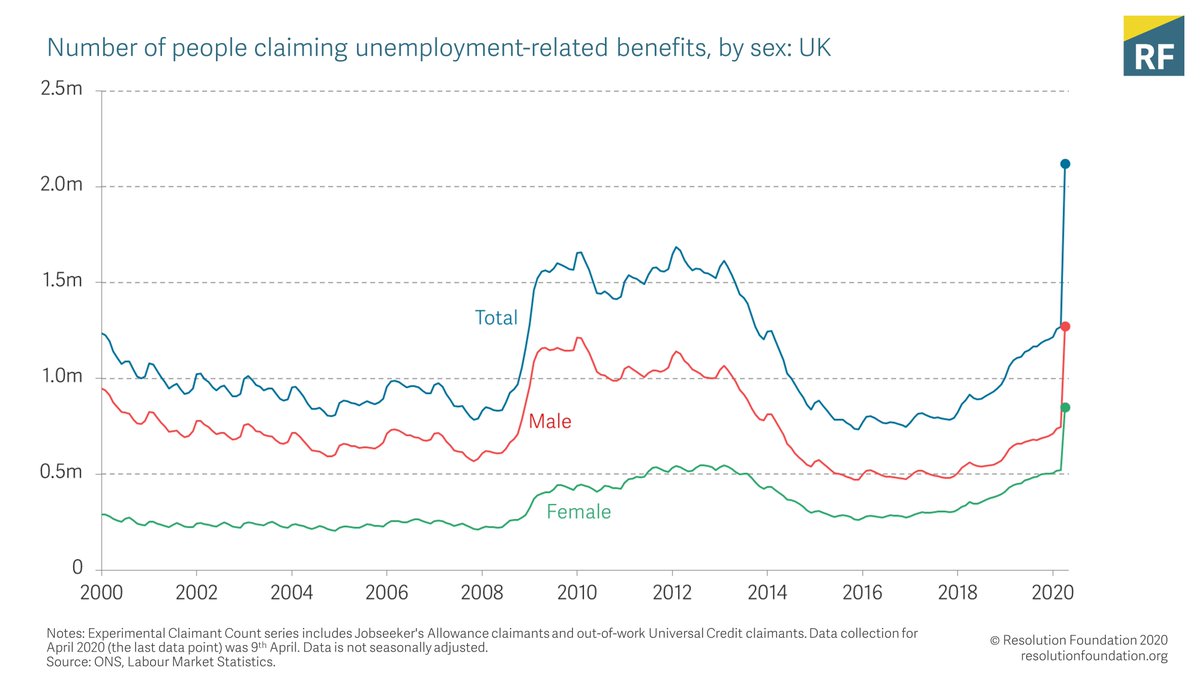

The third big move is in the claimant count, which comes from data collected on the 9th April. The overall count is up 850k on March, taking it to 2.1 million, about a third higher than the levels seen after the financial crisis.

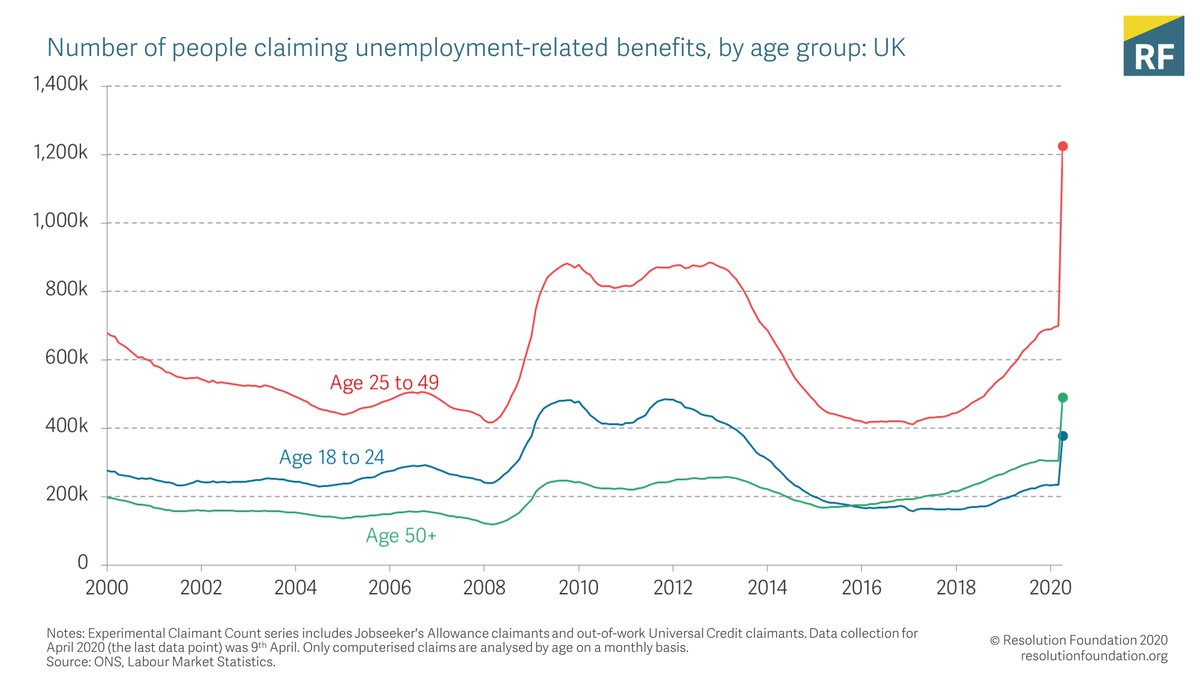

We have an age breakdown of the claimant count and it backs up our research by @gustafmaja published today showing that under-25s have borne the brunt of job losses: https://www.resolutionfoundation.org/publications/young-workers-in-the-coronavirus-crisis/">https://www.resolutionfoundation.org/publicati...

The official unemployment data hasn’t moved yet – with data up to March showing a 50,000 increase in the numbers unemployed on three months earlier. We expect to see a big rise in this measure in next month’s figures.

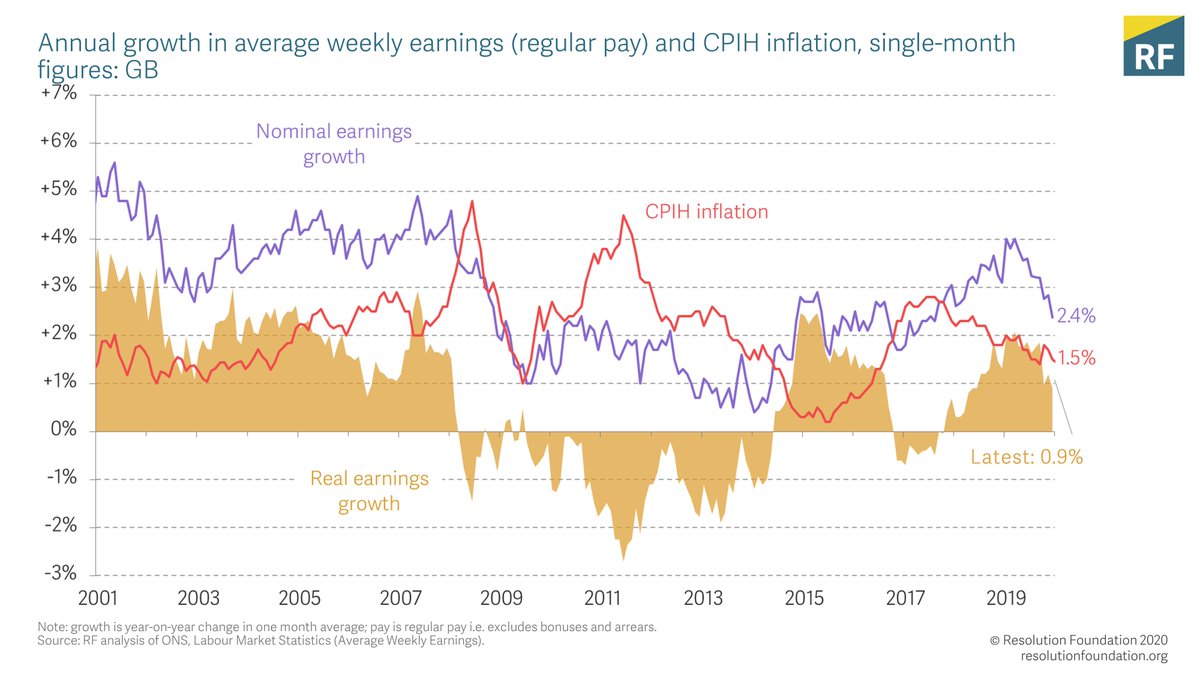

Regular pay in March grew 0.9% compared to last March after adjusting for inflation (on a one-month basis). This is slightly below February’s growth rate of 1.2% – but pay growth was already weak coming into this crisis.

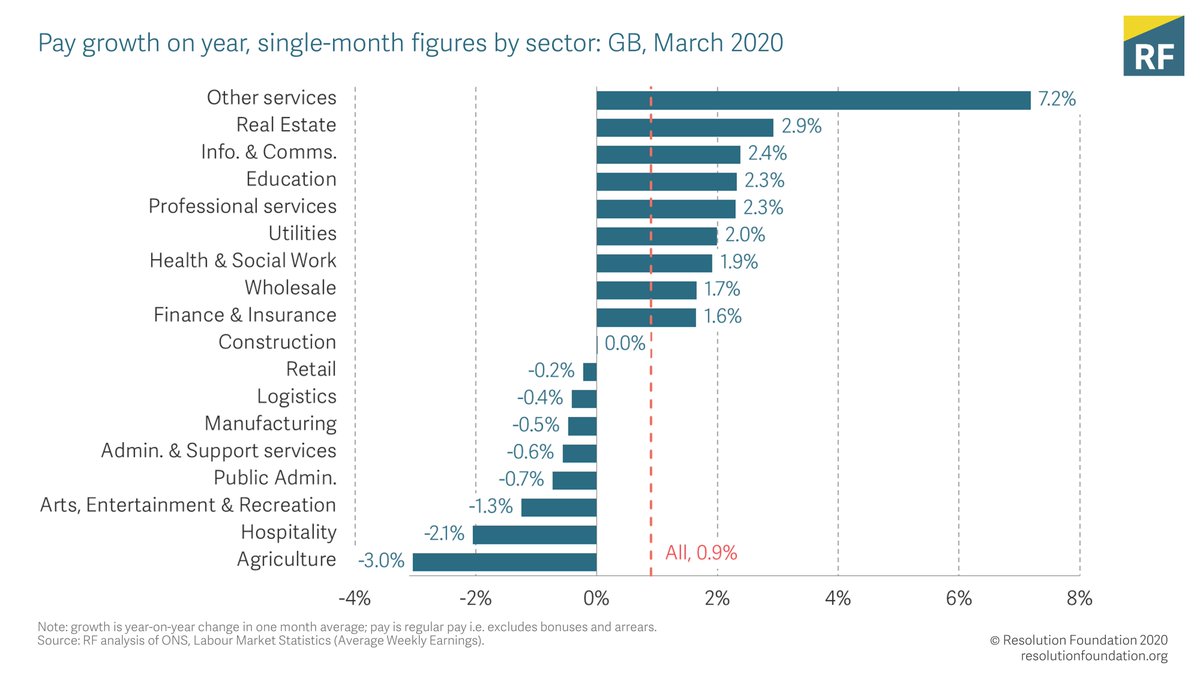

There were big disparities between sectors. For example, pay in the hospitality sector – one of those hardest hit by coronavirus – fell by 2.1% in real terms, whereas earnings in the ‘other services’ sector rose by 7.2% year on year.

These shocking figures would be far worse were it not the Job Retention Scheme, which has so far protected 7.5m jobs. But even so, Britain could be facing the highest unemployment levels it has had in over a quarter of the century. Read our response here: https://www.resolutionfoundation.org/press-releases/britains-jobs-crisis-bites-as-employee-jobs-fall-by-450000-and-vacancies-dry-up-at-record-rates/">https://www.resolutionfoundation.org/press-rel...

Read on Twitter

Read on Twitter