1/7 Thread: Ergodicity

Let’s play a game.

Assume you have $100. We’ll flip a coin 100 times. Your wealth will be +50% for each Heads, and -40% for Tails.

Wanna play?

Of course, you should! The expected value for each flip is $5.

But should you really? Let’s figure out.

Let’s play a game.

Assume you have $100. We’ll flip a coin 100 times. Your wealth will be +50% for each Heads, and -40% for Tails.

Wanna play?

Of course, you should! The expected value for each flip is $5.

But should you really? Let’s figure out.

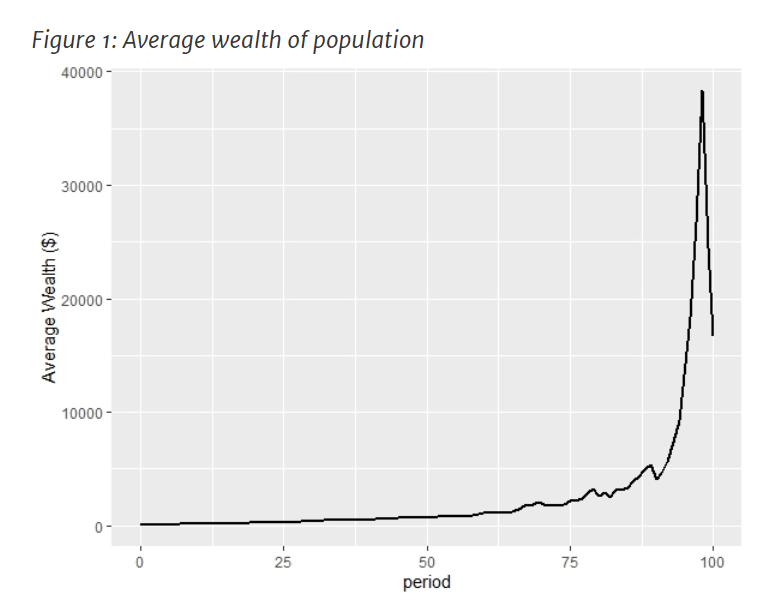

2/7 Let& #39;s say 10,000 people are playing this game.

After flipping the coin 100x, the avg wealth of these 10k people is ~$16,000 although it& #39;s kinda volatile.

But $16k from just $100? Wow, you should definitely play this game, right?

Wait...

After flipping the coin 100x, the avg wealth of these 10k people is ~$16,000 although it& #39;s kinda volatile.

But $16k from just $100? Wow, you should definitely play this game, right?

Wait...

3/7 So the avg wealth is ~$16,000. What& #39;s the median?

51 cents! The median person loses >99% of their wealth!

86% people finish with <$100!

1.7% ends up with >$10,000!

The wealthiest person has $117 million i.e. ~70% of total wealth!

51 cents! The median person loses >99% of their wealth!

86% people finish with <$100!

1.7% ends up with >$10,000!

The wealthiest person has $117 million i.e. ~70% of total wealth!

4/7 So if you don& #39;t want to play this game, are you exhibiting loss aversion or you& #39;re just being rational?

@ole_b_peters wrote a fascinating paper on ergodicity economics last year in "Nature Physics".

Behavioral economics routinely ignores the circumstances around us.

@ole_b_peters wrote a fascinating paper on ergodicity economics last year in "Nature Physics".

Behavioral economics routinely ignores the circumstances around us.

5/7 You should all certainly play the game if 10,000 of "YOU" can simultaneously play the game i.e. there& #39;s a 10,000 parallel universe where you are playing the same game.

Since one of "YOU" will certainly win, you can take care of 9,999 of "YOU"s in all the other universes.

Since one of "YOU" will certainly win, you can take care of 9,999 of "YOU"s in all the other universes.

6/7 Sigh. That& #39;s NOT how our mundane world works.

If a Billionaire and you (assume $100k net worth) play the above game with $50K at stake, you probably should not play this game.

Greater risk aversion can be rational under certain circumstances. And our circumstances differ.

If a Billionaire and you (assume $100k net worth) play the above game with $50K at stake, you probably should not play this game.

Greater risk aversion can be rational under certain circumstances. And our circumstances differ.

7/7 @ole_b_peters paper: https://www.nature.com/articles/s41567-019-0732-0

Ergodicity">https://www.nature.com/articles/... primer: https://jasoncollins.blog/2020/01/22/ergodicity-economics-a-primer/

Relevant">https://jasoncollins.blog/2020/01/2... Animation: https://www.farmersfable.org/ ">https://www.farmersfable.org/">...

Ergodicity">https://www.nature.com/articles/... primer: https://jasoncollins.blog/2020/01/22/ergodicity-economics-a-primer/

Relevant">https://jasoncollins.blog/2020/01/2... Animation: https://www.farmersfable.org/ ">https://www.farmersfable.org/">...

Read on Twitter

Read on Twitter