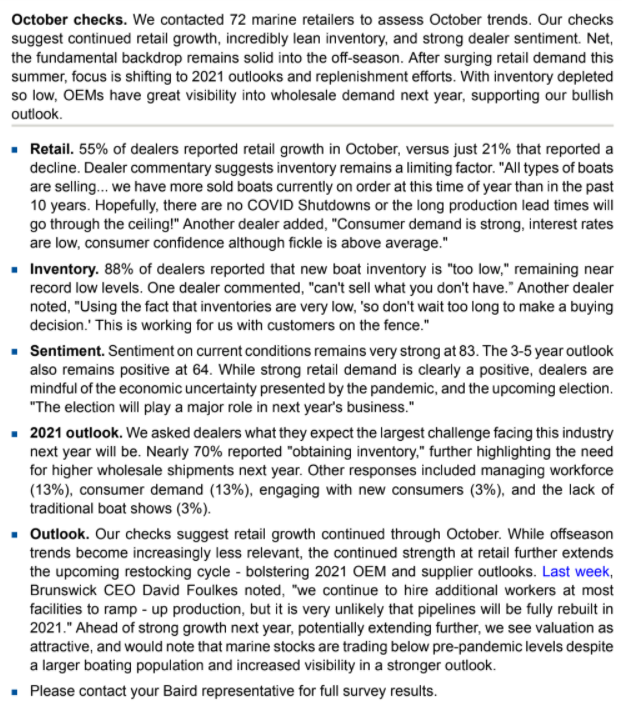

$HZO, largest recreational boat + yacht retailer in the US, on 4/23:

When the virus first hit, we saw a significant deceleration of contracts. However, towards the end of Mar, we were fighting our way back from those declines. Thus far in Apr, our trend has turned positive.

When the virus first hit, we saw a significant deceleration of contracts. However, towards the end of Mar, we were fighting our way back from those declines. Thus far in Apr, our trend has turned positive.

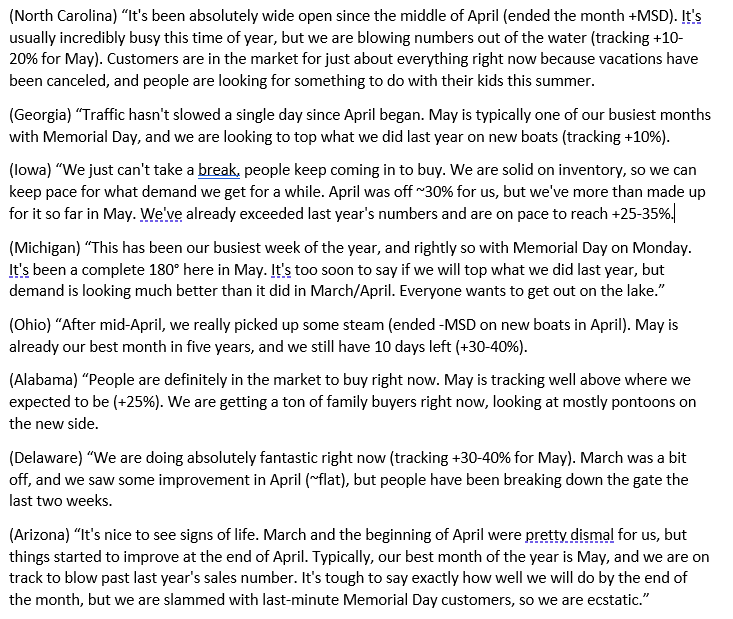

$ONEW, another large boat dealer, on 5/7:

Sales in Apr were up >10% and have been strong in certain locations like GA, AL and FL...once weather breaks, we expect to see a bump from other areas as well.

We& #39;re still very early in May, but the pace of activity has continued.

Sales in Apr were up >10% and have been strong in certain locations like GA, AL and FL...once weather breaks, we expect to see a bump from other areas as well.

We& #39;re still very early in May, but the pace of activity has continued.

$MBUU, boat mfg, 5/7:

Today, we are almost exclusively building retail sold orders thru May. This highlights strength of order book + means we won& #39;t resume building stock orders til Jun. So well go 2.5 months without adding channel inventory, while dealers continue selling boats

Today, we are almost exclusively building retail sold orders thru May. This highlights strength of order book + means we won& #39;t resume building stock orders til Jun. So well go 2.5 months without adding channel inventory, while dealers continue selling boats

$MCFT, boat mfg, 5/6:

While Mar retail was down, we were encouraged by the resilience which continued through Apr. Dealer inventories are down versus same time last year, and we are already hearing some dealers say theyre concerned they may be short of boats this selling season.

While Mar retail was down, we were encouraged by the resilience which continued through Apr. Dealer inventories are down versus same time last year, and we are already hearing some dealers say theyre concerned they may be short of boats this selling season.

$BC, boats, engines, parts, 4/30:

Applications for retail financing have been healthy in Apr with applications similar to or higher than in 19.

We have seen good leading indicators on loan applications, which are up substantially recently vs 19 particularly at the premium end.

Applications for retail financing have been healthy in Apr with applications similar to or higher than in 19.

We have seen good leading indicators on loan applications, which are up substantially recently vs 19 particularly at the premium end.

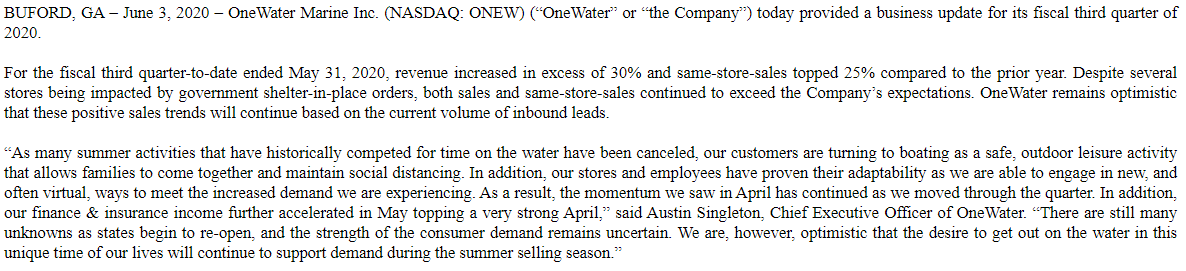

$PII, off-road vehicles, 4/28:

So through yesterday, we are up mid-teens % YoY in ORVs.

Its mostly industry but also some share gains in ORVs. Side-by-side still continue to be best op for growth. Motorcycles still neg, but getting less bad. Boat demand has been reasonably good

So through yesterday, we are up mid-teens % YoY in ORVs.

Its mostly industry but also some share gains in ORVs. Side-by-side still continue to be best op for growth. Motorcycles still neg, but getting less bad. Boat demand has been reasonably good

$CWH commentary worth flagging here because its part of the same theme. People want to get outside. https://twitter.com/marcuslemonis/status/1258735378883907584">https://twitter.com/marcuslem...

https://teamtalk.mastercraft.com/showthread.php?t=104556

Spring">https://teamtalk.mastercraft.com/showthrea... boat sales have been near excellent

Dealers are busier than ever

Dealers cant keep boats in stock

Have never seen my lake this crowded...exponentially > holiday wknds

It looked like the 4th on our lake this wknd

Selling record number of boat lifts

Spring">https://teamtalk.mastercraft.com/showthrea... boat sales have been near excellent

Dealers are busier than ever

Dealers cant keep boats in stock

Have never seen my lake this crowded...exponentially > holiday wknds

It looked like the 4th on our lake this wknd

Selling record number of boat lifts

$HZO along with amended credit facility put out an 8-k:

"With approaching warmer weather, it is nice to see the strong interest and positive sales activity that we experienced in April continue, which is a testimony to the demand for the boating lifestyle"

"With approaching warmer weather, it is nice to see the strong interest and positive sales activity that we experienced in April continue, which is a testimony to the demand for the boating lifestyle"

Floor traffic at Mike Regan’s two RV dealerships outside Austin, Texas, is up 30% compared with last May...After a six-week hiatus, Regan said business has been so brisk that he may not have enough trailers and motor homes to meet demand. https://www.bloomberg.com/news/articles/2020-05-26/-covid-campers-rv-motor-home-and-travel-trailer-sales-shoot-up">https://www.bloomberg.com/news/arti...

Boats, ATVs, ORVs are strong, but so is demand for new pool construction: https://twitter.com/1MainCapital/status/1266038890445619200">https://twitter.com/1MainCapi...

Used boat prices  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

We sold our boat in 30 mins on local san diego CraigsList ... full price, no negotiations

It hasn’t been like this my entire lifetime. Like you, we sold our pontoon in less than an hour for top $

https://teamtalk.mastercraft.com/showthread.php?t=104812">https://teamtalk.mastercraft.com/showthrea...

We sold our boat in 30 mins on local san diego CraigsList ... full price, no negotiations

It hasn’t been like this my entire lifetime. Like you, we sold our pontoon in less than an hour for top $

https://teamtalk.mastercraft.com/showthread.php?t=104812">https://teamtalk.mastercraft.com/showthrea...

$ONEW SSS +25%. We remain optimistic these positive trends will continue based on the current volume of inbound leads.

https://twitter.com/conorsen/status/1269952385390194693">https://twitter.com/conorsen/...

RV dealer: $LAZY said customer orders for recreational vehicles rose about 90% in May from a year ago. The company expects demand trends to persist in June, anticipating interest in the vehicles as a way to travel with social-distancing measures in place.

h/t @Bengordon2013

h/t @Bengordon2013

$HZO: for the June quarter, revenue will exceed the same quarter in the prior year, as retail trends continue to be driven by very strong demand for the boating lifestyle.

https://www.nytimes.com/2020/07/02/style/boat-sales-summer.html

Kelly’s">https://www.nytimes.com/2020/07/0... Port, a boat dealership in Mo., is down to <5% of its usual inventory. The 44-yo co, whose average sale is $100k, has since broken every record “dude, by the hour or by the day or the weekend or any way you want to count it.

h/t @coldtakescap

Kelly’s">https://www.nytimes.com/2020/07/0... Port, a boat dealership in Mo., is down to <5% of its usual inventory. The 44-yo co, whose average sale is $100k, has since broken every record “dude, by the hour or by the day or the weekend or any way you want to count it.

h/t @coldtakescap

“It’s busier (here) than it’s ever been in history,” said Joe Bega, owner of Apopka Marine in Inverness. “We’re doing a high percentage of work. Our problem is getting product now.” https://www.chronicleonline.com/news/coronavirus/citrus-boat-dealers-setting-sales-records-during-pandemic/article_23354a0e-bbca-11ea-8c4a-8fe2ac98c688.html">https://www.chronicleonline.com/news/coro...

$LCII Q2 net sales will be $515-530m vs $385m consensus.

“Increased demand for RVs drove accelerated outdoor recreational products sales, which was well ahead of increasingly bullish expectations as we moved through the early part of Q2."

h/t @CompGrady

“Increased demand for RVs drove accelerated outdoor recreational products sales, which was well ahead of increasingly bullish expectations as we moved through the early part of Q2."

h/t @CompGrady

$HZO, one of the largest boat dealers in the country, today reported same-store sales growth of 37% for the June quarter.

EPS grew 88% YoY.

Wild.

EPS grew 88% YoY.

Wild.

$ONEW, one of the largest boat dealers, reported SSS growth of 44% for the June quarter.

Unprecedented retail demand.

Significant growth across all segments.

New boat sales +59%.

Trends continued in Jul at a robust pace and the backlog for Aug is building.

Adj EBITDA +95% YoY.

Unprecedented retail demand.

Significant growth across all segments.

New boat sales +59%.

Trends continued in Jul at a robust pace and the backlog for Aug is building.

Adj EBITDA +95% YoY.

$BC, a boat and boat parts/engine manufacturer, reported revs of $988m vs consensus $806m. Adj EPS of 99c vs 45c consensus.

Inventories at 23 weeks, 34% fewer boats in dealer inventory vs Q2 19.

Anticipate 2H& #39;20 revenue and operating earnings > 2H& #39;19.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

Inventories at 23 weeks, 34% fewer boats in dealer inventory vs Q2 19.

Anticipate 2H& #39;20 revenue and operating earnings > 2H& #39;19.

$ONEW on earnings call - expects to see a high teens comp in the upcoming quarter.

$WMT commentary from yest: we think about 25m Americans would go fishing on a regular basis before February, and that number has now moved to 35m. So 10 million people decided to pick-up just this one hobby.

h/t @FullySynergized

h/t @FullySynergized

$DOOO Q2  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

NA powersports retail sales +40% YoY

Normalized EPS +61%

FY 21 EPS guidance of $3.80 at mid vs consensus of $2.12

NA powersports retail sales +40% YoY

Normalized EPS +61%

FY 21 EPS guidance of $3.80 at mid vs consensus of $2.12

$MBUU inventory at historic lows. Order books for our brands are completely full through 1H and extending into Q3& #39;21...channel inventories will likely not be caught up until end of model year & #39;21 at earliest...may extend into FY& #39;22 before channel inventories are at normal levels.

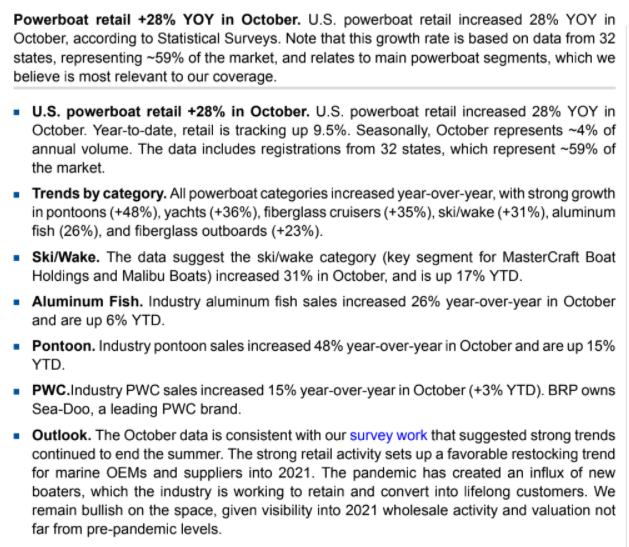

Baird contacted 86 marine retailers to assess trends. Checks suggest continued strength. Inventory remains very lean. Retail activity limited by inventory. $BC expects well into 21 or potentially later before channel is restocked. 82% of dealers report that inventory is too low.

$HZO - national boat dealer

-Highest revenue in company history

-SSS growth of 33% in Q4, 25% for full year

-YoY EPS more than tripled in Q3, more than doubled for full year

-2021 EPS guidance $3.80 at midpoint, +12% YoY growth and 60% higher than consensus $2.38

-Highest revenue in company history

-SSS growth of 33% in Q4, 25% for full year

-YoY EPS more than tripled in Q3, more than doubled for full year

-2021 EPS guidance $3.80 at midpoint, +12% YoY growth and 60% higher than consensus $2.38

$PII yest pointed out how much of recent strength is from new customers.

"when you look at the fact that we& #39;re pulling in so many new customers, and we know one thing for sure that those new customers tend to bring even more new customers in and we continue to see that trend."

"when you look at the fact that we& #39;re pulling in so many new customers, and we know one thing for sure that those new customers tend to bring even more new customers in and we continue to see that trend."

$PII from yest also pointed out they recent strength has continued unabated...

$BC strong q3.

-Revs +26% yoy

-Adj operating inc +49%

-Historically low pipeline inventories at 14 weeks, 48% fewer boats in dealer inventory vs q3’19

-Robust retail environment has created improved visibility for remainder of 2020 and 2021

-2021 eps guide +26% higher than 2020

-Revs +26% yoy

-Adj operating inc +49%

-Historically low pipeline inventories at 14 weeks, 48% fewer boats in dealer inventory vs q3’19

-Robust retail environment has created improved visibility for remainder of 2020 and 2021

-2021 eps guide +26% higher than 2020

$CWH nice Q3 results

-SSS +27%

-Revenue +21% YoY

-GP +57.5% YoY

-Adj EBITDA +258% YoY

2020 EBITDA guidance at mid increased by 6% from $475m previously to $505m

-SSS +27%

-Revenue +21% YoY

-GP +57.5% YoY

-Adj EBITDA +258% YoY

2020 EBITDA guidance at mid increased by 6% from $475m previously to $505m

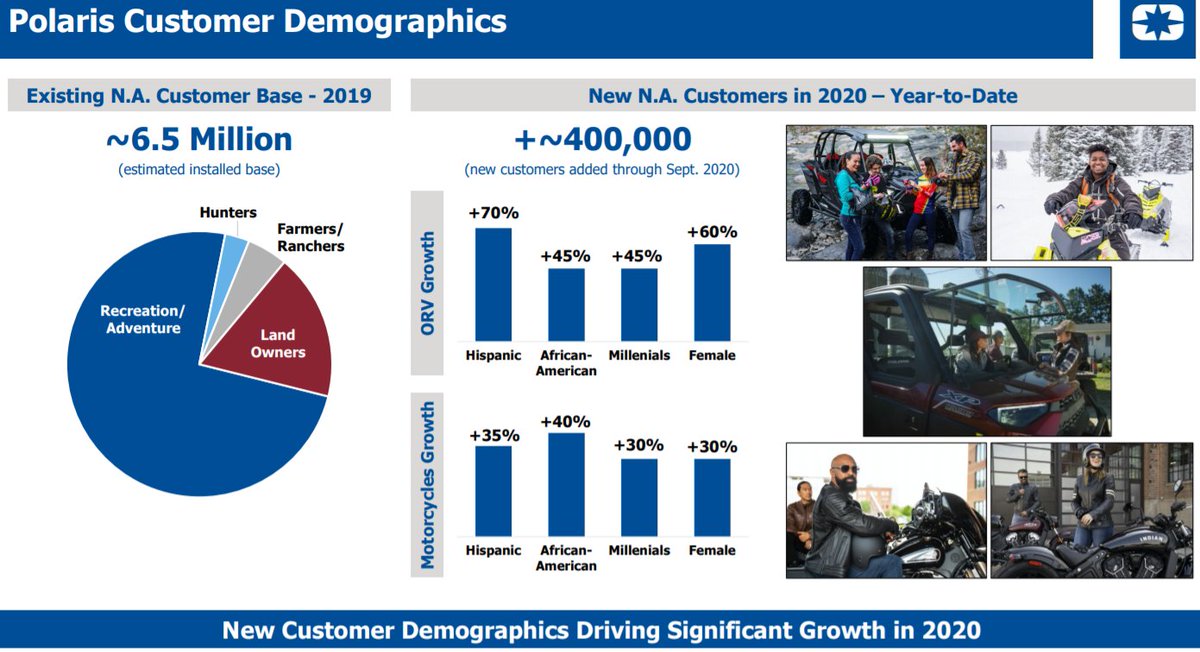

Still not a bad time to get long boating stocks $MCFT $MBUU

Dealer commentary suggests inventory remains a limiting factor: "all types of boats are selling... we have more sold boats currently on order at this time of year than in the past 10 years"

Dealer commentary suggests inventory remains a limiting factor: "all types of boats are selling... we have more sold boats currently on order at this time of year than in the past 10 years"

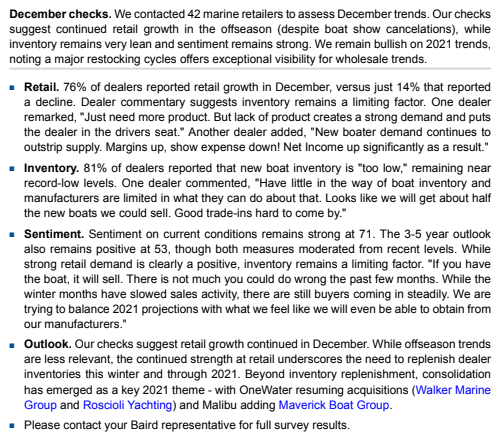

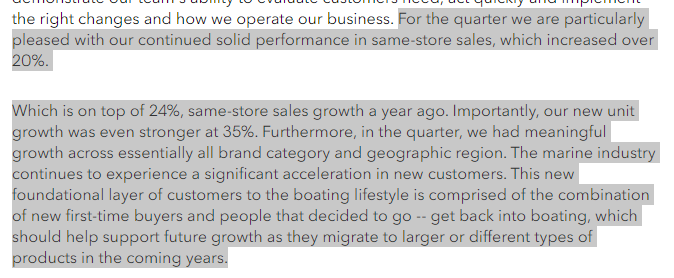

$ONEW SSS increased 25%, on top of a 20% increase in the comparable period of 2019. Not bad...

Boat sales continue to be very strong for this time of year. Sales leads continue to come in at 3-4 times normal pace.

83% of dealers reported that new boat inventory is "too low," remaining near record-low levels.

h/t Baird

83% of dealers reported that new boat inventory is "too low," remaining near record-low levels.

h/t Baird

https://twitter.com/powerlunch/status/1336053462350655489?s=21">https://twitter.com/powerlunc... https://twitter.com/PowerLunch/status/1336053462350655489">https://twitter.com/PowerLunc...

$WGO

Strong Q1 (ended Nov)

Revs +35% YoY

Gross margin +390bps YoY

Adj eps +132% YoY

Dec trends remain strong

Strong Q1 (ended Nov)

Revs +35% YoY

Gross margin +390bps YoY

Adj eps +132% YoY

Dec trends remain strong

h/t B. Riley

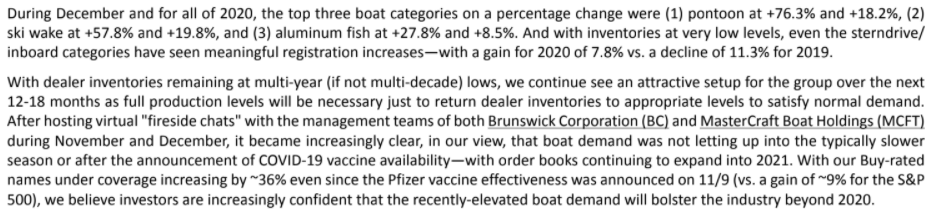

Channel Inventory imbalance worsened into year-end. Recent channel checks / fireside chats with $BC + $MCFT made it increasingly clear that depleted dealer inventory levels worsened into winter + order books continue to grow even after successful vaccines announced.

Channel Inventory imbalance worsened into year-end. Recent channel checks / fireside chats with $BC + $MCFT made it increasingly clear that depleted dealer inventory levels worsened into winter + order books continue to grow even after successful vaccines announced.

SSI reporting 37% increase in boat registrations in Dec. Pontoons (+76%) and ski/wake (+58%) leading the way.

h/t B Riley

h/t B Riley

$BC strong Q4 results

Revs +27%

Adj EPS +61%

Boat pipeline inventory at historical lows, with 40% fewer boats in dealer inventory than last Q4

Guidance for 22% adj EPS growth in 2021 (at midpoint)

Revs +27%

Adj EPS +61%

Boat pipeline inventory at historical lows, with 40% fewer boats in dealer inventory than last Q4

Guidance for 22% adj EPS growth in 2021 (at midpoint)

$HZO nice Q1

SSS +20%

New units SSS +35%

Diluted EPS +154%

Website and lead traffic up substantially in January

SSS +20%

New units SSS +35%

Diluted EPS +154%

Website and lead traffic up substantially in January

Read on Twitter

Read on Twitter