Something is really wrong at Smartsheet $SMAR

1) New accounting risk factors

2) Auditor finds material weaknesses

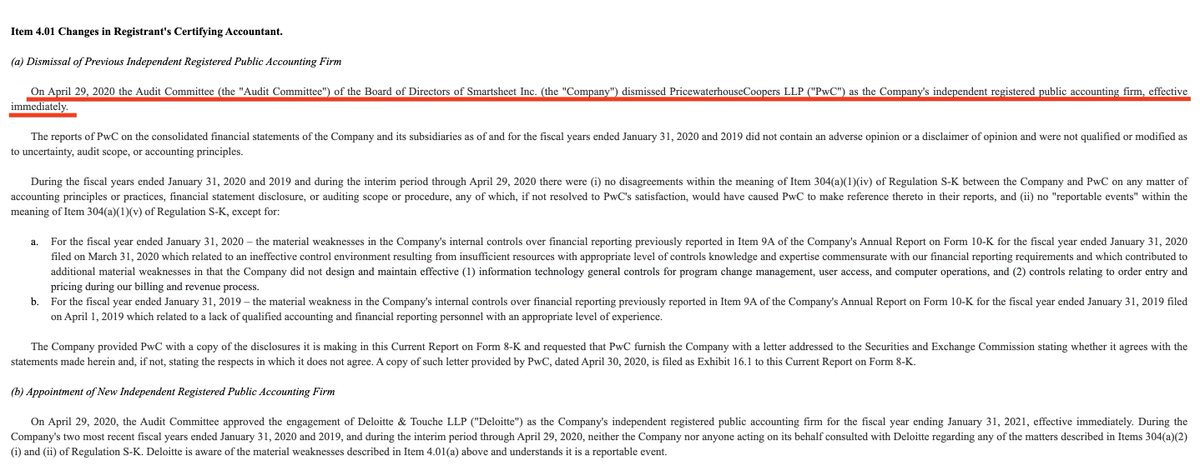

3) Auditor fired the day before Q1 ends

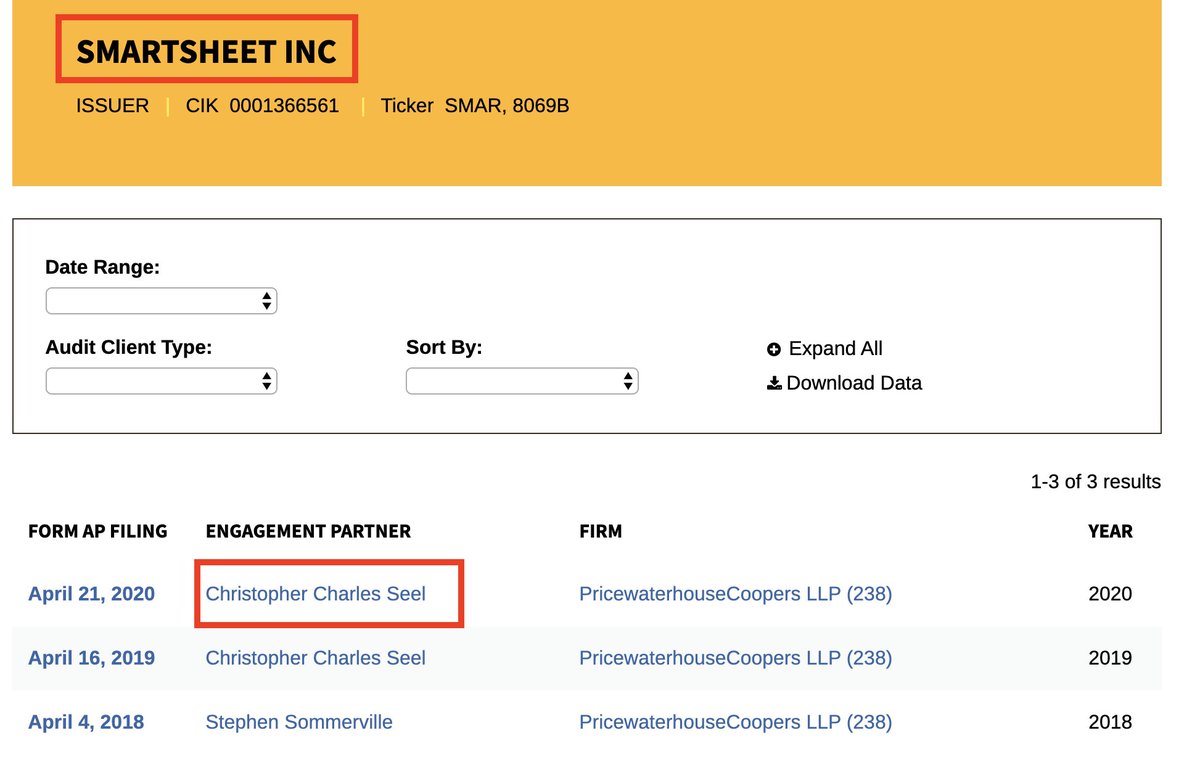

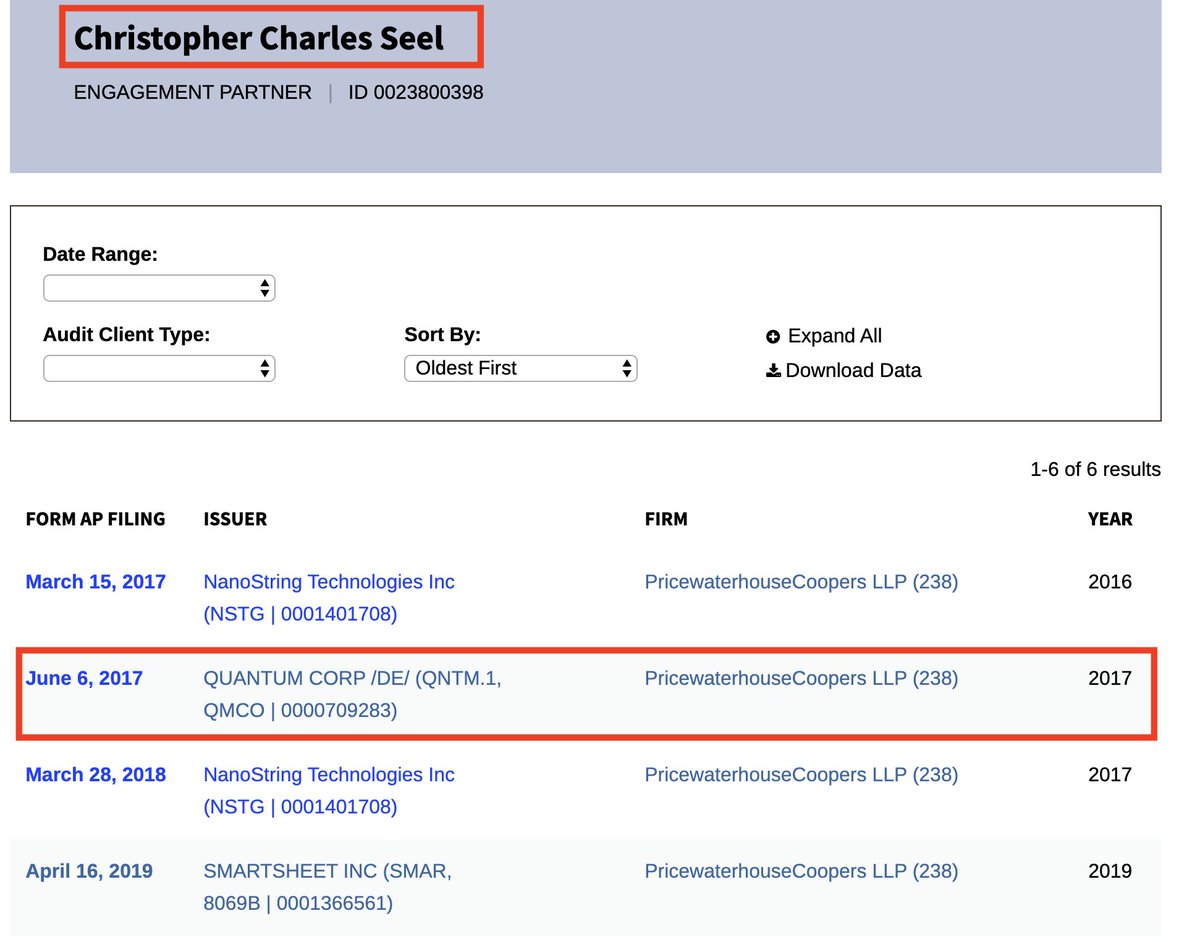

4) Audit partner had a bad history

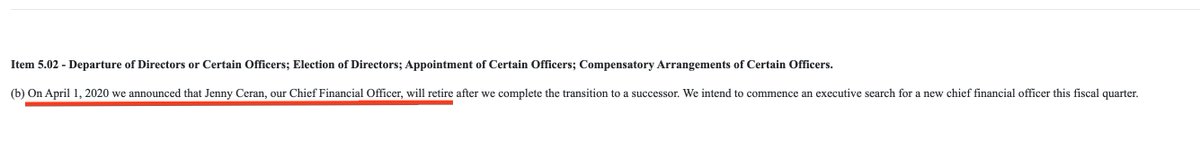

5) CFO “retired”

6) Stock at all-time highs https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Thinking face" aria-label="Emoji: Thinking face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Thinking face" aria-label="Emoji: Thinking face">

Let’s explore (thread)

1) New accounting risk factors

2) Auditor finds material weaknesses

3) Auditor fired the day before Q1 ends

4) Audit partner had a bad history

5) CFO “retired”

6) Stock at all-time highs

Let’s explore (thread)

In its 10-K, Smartsheet added a new risk factor, saying “a significant portion of our larger transactions [occur] in the last few days and weeks of each quarter.” This is especially odd considering SMAR’s fiscal year ends January 31. (March 31)

In addition, SMAR’s auditor, PwC, noted material weaknesses and wrote, “[SMAR] did not design and maintain effective controls related to the completeness, accuracy and occurrence of order entry and pricing during the billing and revenue processes.” (March 31)

Then, one day before the end of fiscal Q1, SMAR dismissed PwC as their auditor “effective immediately" (April 29)

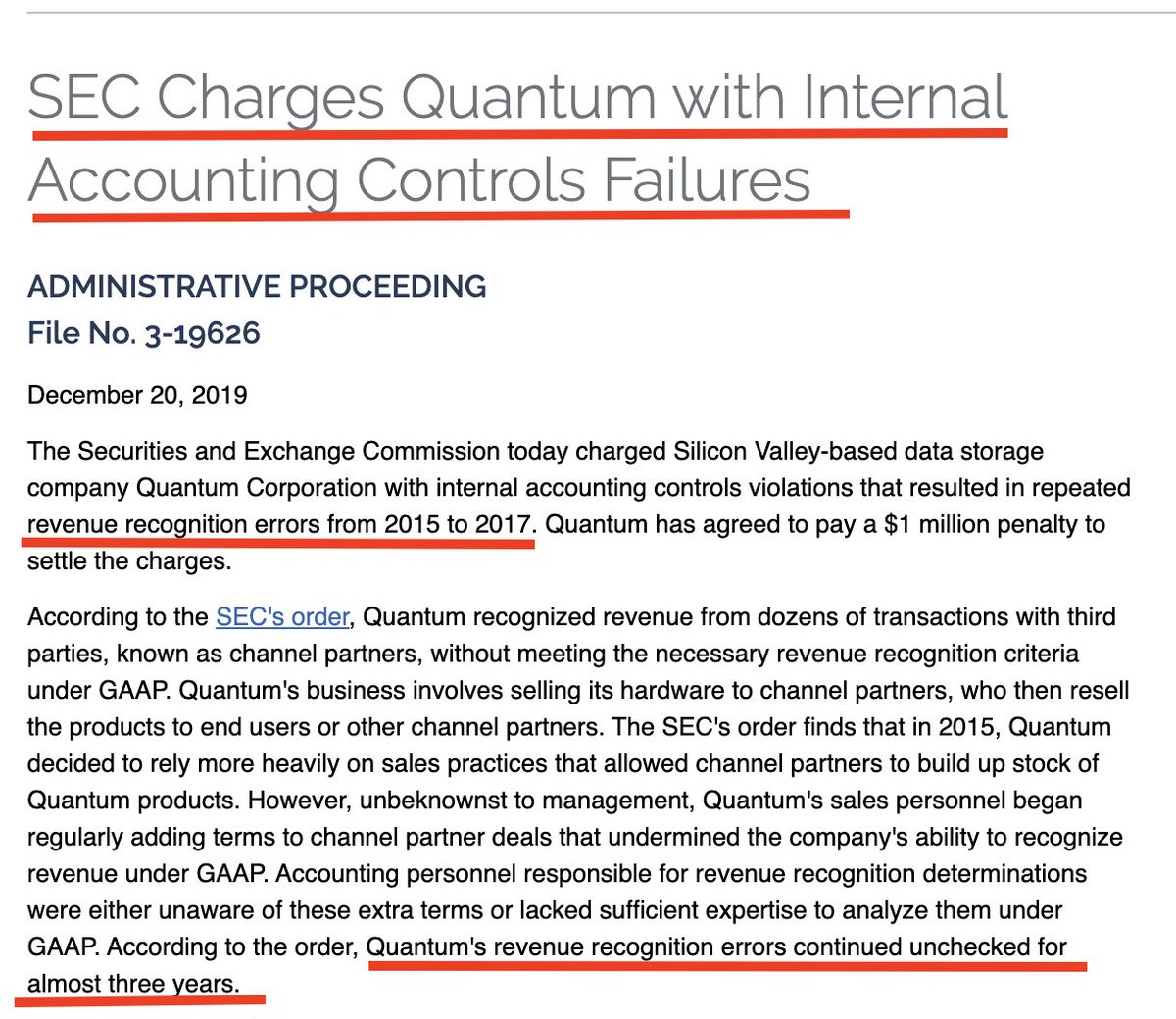

In 2017 Mr. Seel audited Quantum, another tech company. Quantum needed to restate financial over revenue recognition errors and paid $1 million to settle with the SEC.

PwC has also come under fire for a culture of lenient auditing of tech companies https://www.pogo.org/investigation/2018/05/pwc-whistleblower-alleges-fraud-in-audits-of-silicon-valley-companies/">https://www.pogo.org/investiga...

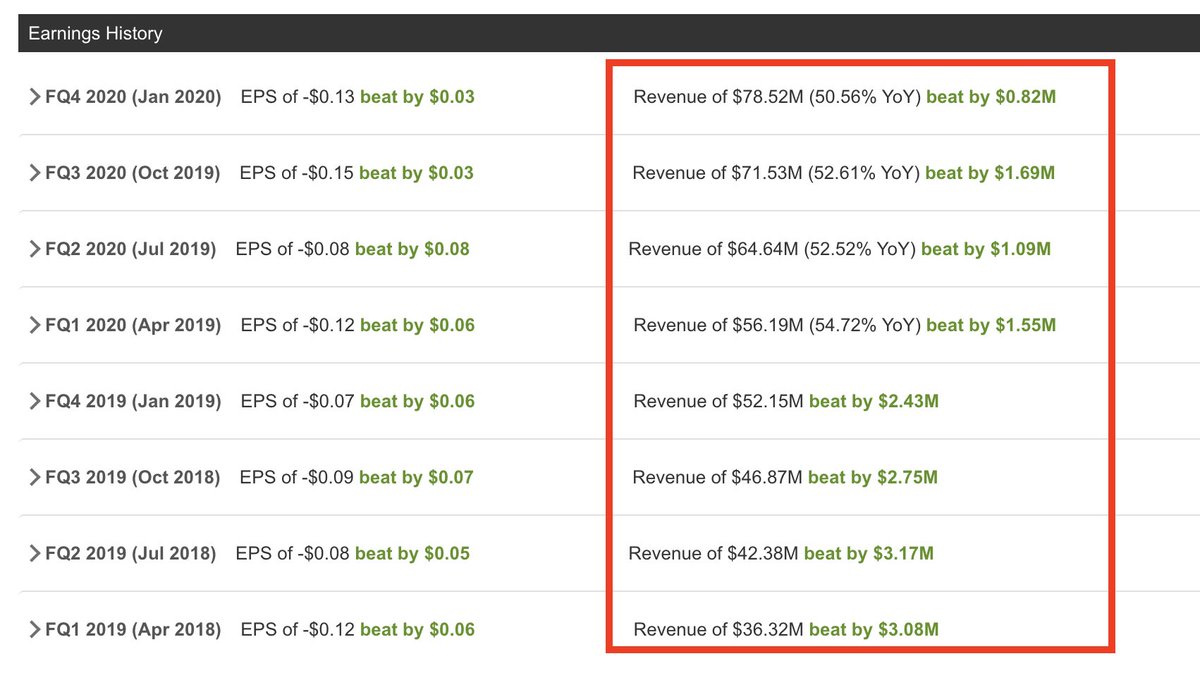

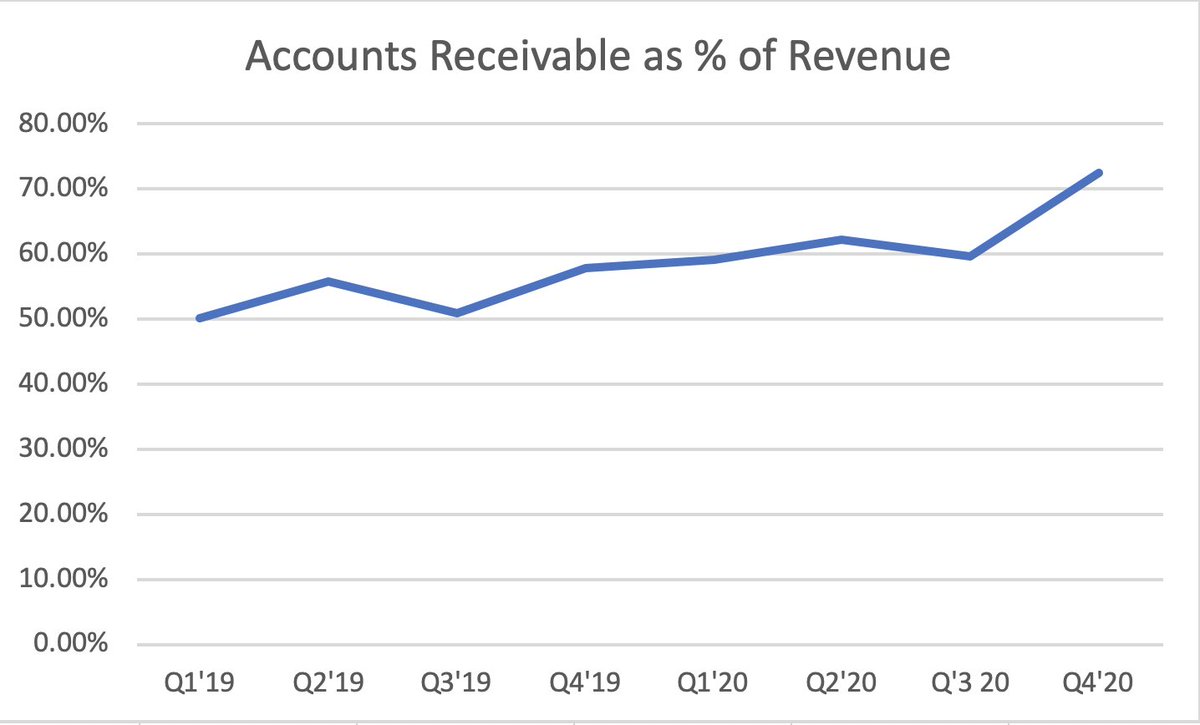

Smartsheet has beat consensus revenue estimates every quarter since IPO and accounts receivable are 70%+ of revenue (an all-time high).

For more content like this consider joining my free, weekly email newsletter: https://thebearcave.substack.com/ ">https://thebearcave.substack.com/">...

Also, much of this was stolen from @CrowdedTradeCap (a great account worth following)

Read his thread here: https://twitter.com/CrowdedTradeCap/status/1260161566357536770">https://twitter.com/CrowdedTr...

Read his thread here: https://twitter.com/CrowdedTradeCap/status/1260161566357536770">https://twitter.com/CrowdedTr...

Read on Twitter

Read on Twitter![In its 10-K, Smartsheet added a new risk factor, saying “a significant portion of our larger transactions [occur] in the last few days and weeks of each quarter.” This is especially odd considering SMAR’s fiscal year ends January 31. (March 31) In its 10-K, Smartsheet added a new risk factor, saying “a significant portion of our larger transactions [occur] in the last few days and weeks of each quarter.” This is especially odd considering SMAR’s fiscal year ends January 31. (March 31)](https://pbs.twimg.com/media/EX_pdqJWsAMqFt-.jpg)

![In its 10-K, Smartsheet added a new risk factor, saying “a significant portion of our larger transactions [occur] in the last few days and weeks of each quarter.” This is especially odd considering SMAR’s fiscal year ends January 31. (March 31) In its 10-K, Smartsheet added a new risk factor, saying “a significant portion of our larger transactions [occur] in the last few days and weeks of each quarter.” This is especially odd considering SMAR’s fiscal year ends January 31. (March 31)](https://pbs.twimg.com/media/EX_pdqsXgAYEZrR.jpg)

![In addition, SMAR’s auditor, PwC, noted material weaknesses and wrote, “[SMAR] did not design and maintain effective controls related to the completeness, accuracy and occurrence of order entry and pricing during the billing and revenue processes.” (March 31) In addition, SMAR’s auditor, PwC, noted material weaknesses and wrote, “[SMAR] did not design and maintain effective controls related to the completeness, accuracy and occurrence of order entry and pricing during the billing and revenue processes.” (March 31)](https://pbs.twimg.com/media/EX_pnMOXYAEHNBa.jpg)