THE FUTURE OF THE U.S. ECONOMY CAN NOT BE TECH

In today& #39;s @Markets newsletter, I wrote about why, despite what we& #39;re seeing in stocks, it doesn& #39;t make sense to talk about a transition to some new economy driven by tech companies https://www.bloomberg.com/news/newsletters/2020-05-14/five-things-you-need-to-know-to-start-your-day?sref=vuYGislZ">https://www.bloomberg.com/news/news...

In today& #39;s @Markets newsletter, I wrote about why, despite what we& #39;re seeing in stocks, it doesn& #39;t make sense to talk about a transition to some new economy driven by tech companies https://www.bloomberg.com/news/newsletters/2020-05-14/five-things-you-need-to-know-to-start-your-day?sref=vuYGislZ">https://www.bloomberg.com/news/news...

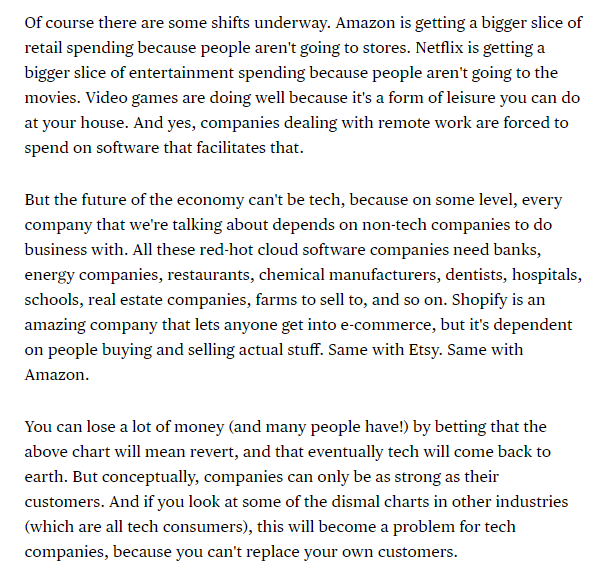

The problem is, tech companies need non-tech companies to sell to. All your Twilio& #39;s, and Slacks, DataDogs, DocuSigns need customers. But how are the customers doing?

Here are some charts of other industries.

Banks:

Here are some charts of other industries.

Banks:

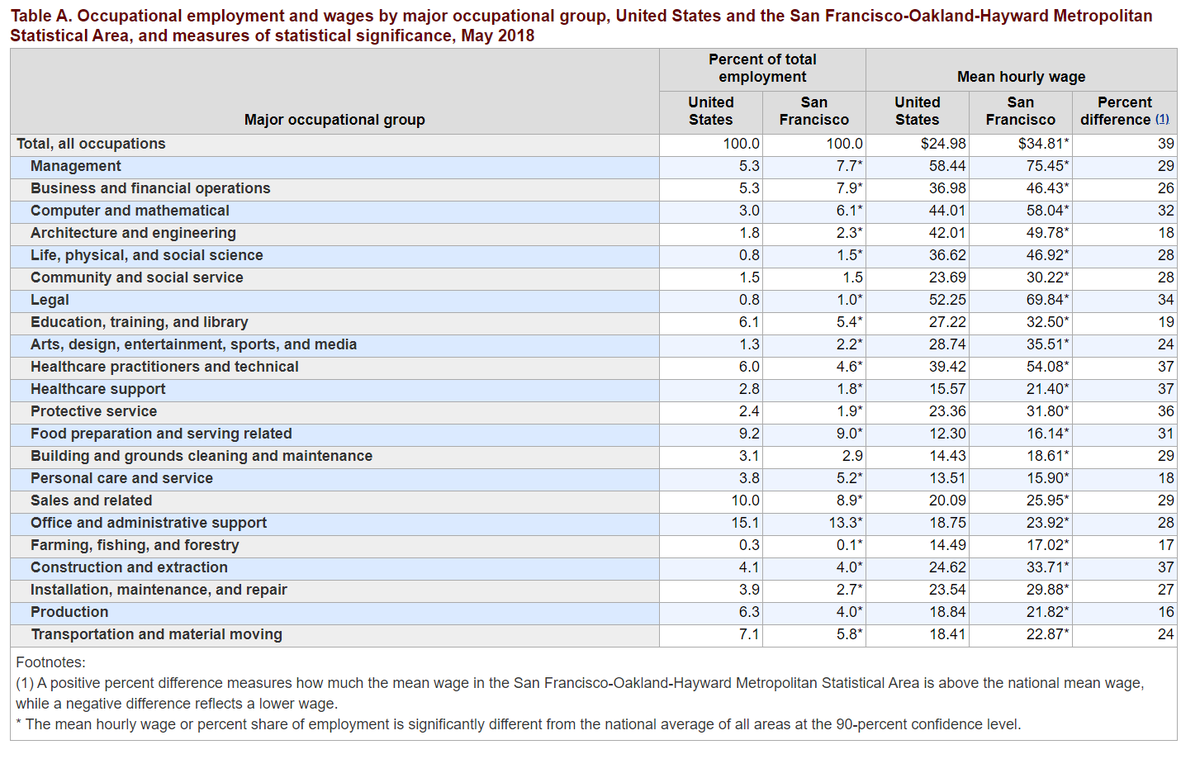

On a real economy basis, even in a place like San Francisco, probably one of the most tech industry dominated places in the world, food prep employes way more people than computers/math/engineering https://www.bls.gov/regions/west/news-release/occupationalemploymentandwages_sanfrancisco.htm">https://www.bls.gov/regions/w...

While the current crisis is certainly causing some behavioral consumption shifts that benefit certain tech players. There& #39;s almost certainly a behavioral shift among investors, who want to stay exposed to stocks, but in a safe way. This captures it well https://twitter.com/FerroTV/status/1260866135433641985">https://twitter.com/FerroTV/s...

Read on Twitter

Read on Twitter