After seeing many "Covid-19 is killing #insurtech VC funding" articles (which is funny because we were blaming WeWork in 01.2020), I did some research to highlight things aren& #39;t bad

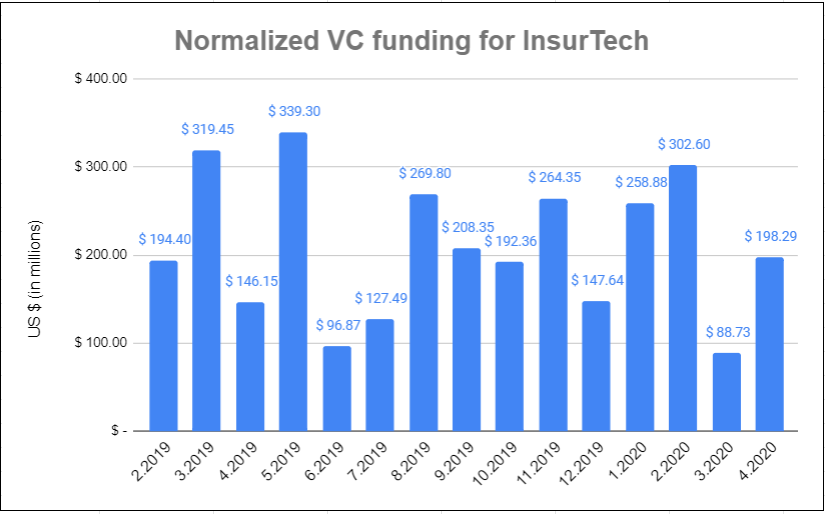

(1) Looking at normalized funding below (removing the $100M+ outliers); what& #39;s up here?

(1) Looking at normalized funding below (removing the $100M+ outliers); what& #39;s up here?

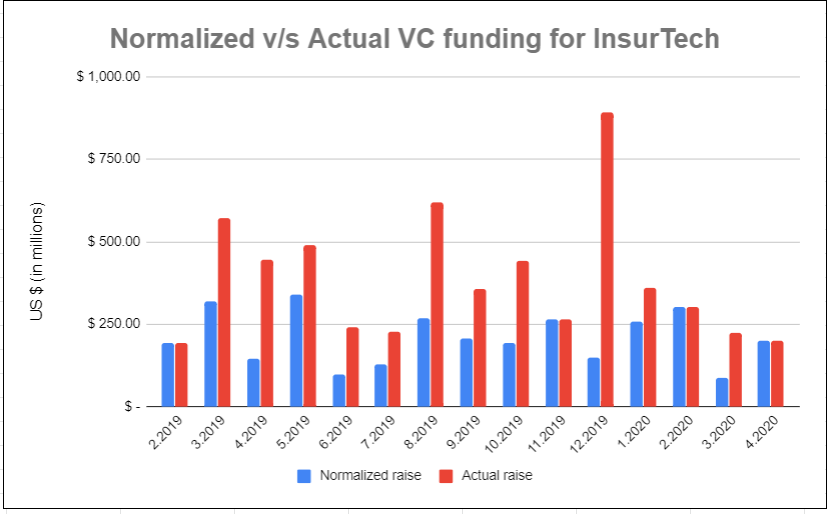

The challenge is we look at "absolute deals volume" (in red below)

- This is subject to outlier effects (e.g. Root, Lemonade & other D2C players which are capital intensive)

- Also VC power laws apply to capital in-flows

Hence, absolute volume doesn& #39;t track the entire ecosystem!

- This is subject to outlier effects (e.g. Root, Lemonade & other D2C players which are capital intensive)

- Also VC power laws apply to capital in-flows

Hence, absolute volume doesn& #39;t track the entire ecosystem!

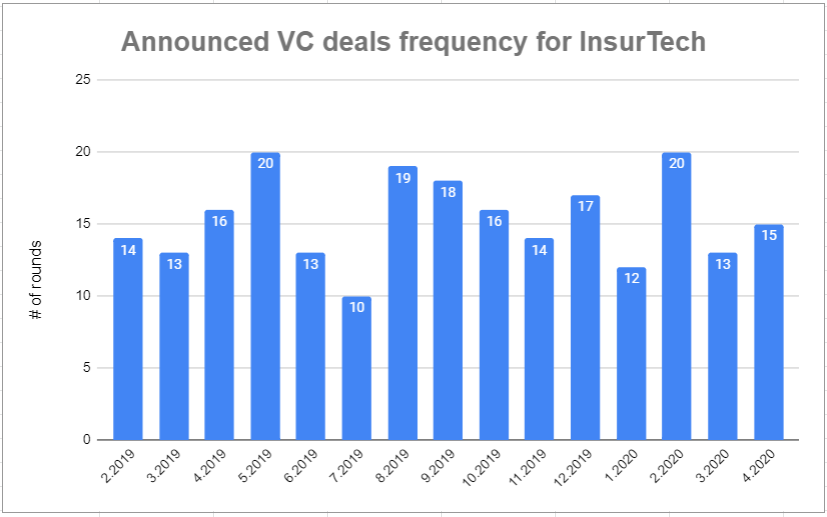

Deals frequency is more robust to outlier rounds & weights B2B and D2C fairly; hence, it is a good proxy for ecosystem activity.

I& #39;ve written a slightly longer piece as part of my April InsurTech funding update on @LinkedIn here:

https://www.linkedin.com/posts/rahul-jaideep-mathur_cutting-through-the-press-noise-on-insurtech-activity-6666615768966410241-9EzE">https://www.linkedin.com/posts/rah...

I& #39;ve written a slightly longer piece as part of my April InsurTech funding update on @LinkedIn here:

https://www.linkedin.com/posts/rahul-jaideep-mathur_cutting-through-the-press-noise-on-insurtech-activity-6666615768966410241-9EzE">https://www.linkedin.com/posts/rah...

Also, how can you blame Covid-19 for changes in #insurtech funding?

- There are reporting lags in VC funding to the public

- Macro impacts on reported funding rounds has a ~6+ month lag

- Also, did you know large rounds carry a 18-24 month run-away; is YoY comparison fair?

- There are reporting lags in VC funding to the public

- Macro impacts on reported funding rounds has a ~6+ month lag

- Also, did you know large rounds carry a 18-24 month run-away; is YoY comparison fair?

Read on Twitter

Read on Twitter