Details of the LA Discretionary Grants Fund have been published. This will be open to charity properties receiving charity business rates relief which would otherwise have been eligible for #SmallBusinessRatesRelief / #RuralRateRelief as proposed by CTG 1/ https://www.charitytaxgroup.org.uk/commentary/proposal-allow-certain-charities-claim-small-business-grant/">https://www.charitytaxgroup.org.uk/commentar...

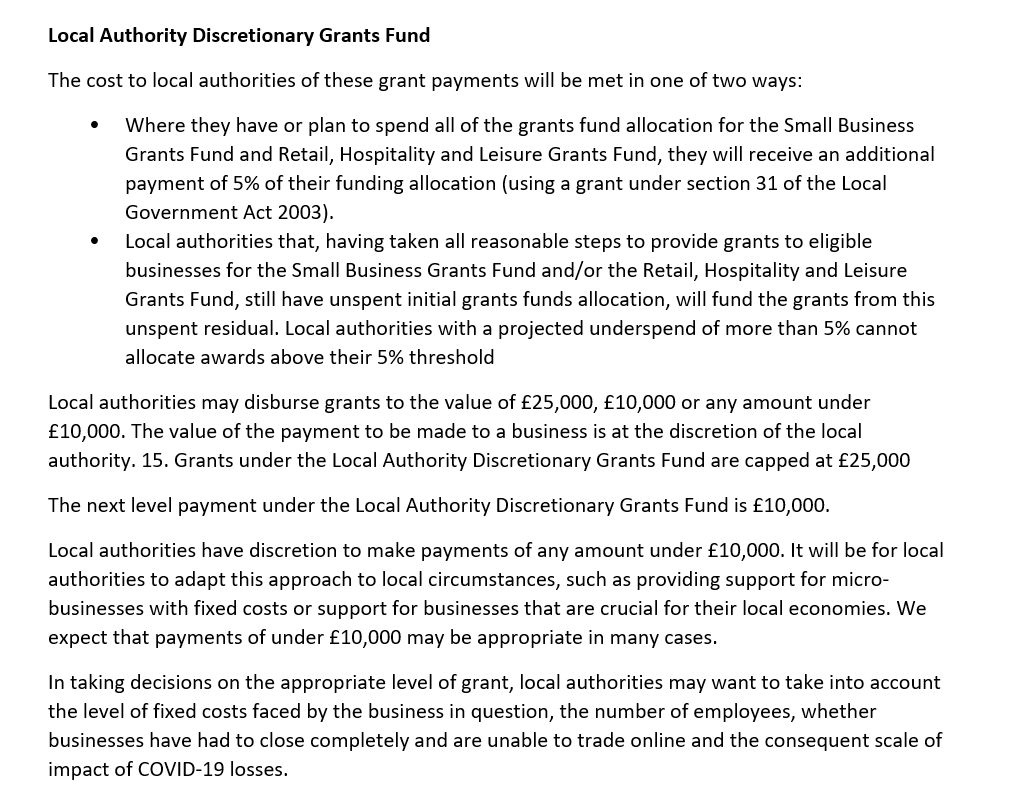

Local Authorities may disburse grants to the value of £25k, £10k or any amount under £10k. The value of the payment to be made to a business is at the discretion of the local authority. Grants under the LA Discretionary Grants Fund are capped at £25k 2/ https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/885011/local-authority-discretionary-grants-fund-guidance-local-government.pdf">https://assets.publishing.service.gov.uk/governmen...

In taking decisions on the appropriate level of grant, LAs may want to take into account the level of fixed costs faced by the business, the no. of employees, whether businesses have had to close completely & are unable to trade online & the scale of impact of COVID-19 losses 3/

Grant funding is for businesses that aren& #39;t eligible for other support schemes (EXCEPT #JobRetentionScheme) Businesses which have received cash grants (inc Retail Grants, SEISS & Small Business Grants) from any central government COVID-related scheme are ineligible for funding 4/

LAs will need to run some form of application process as the potential beneficiaries are highly unlikely to be known directly by the local authorities. LAs must use their discretion in identifying the right person to receive this funding, based on their application process 5/

Interestingly, the cost to LAs will either be met by an additional grant (capped at 5% of their original grant funding allocation) from central Government where they plan to allocate all grants, or from their original allocation where they project not to spend it in full 6/

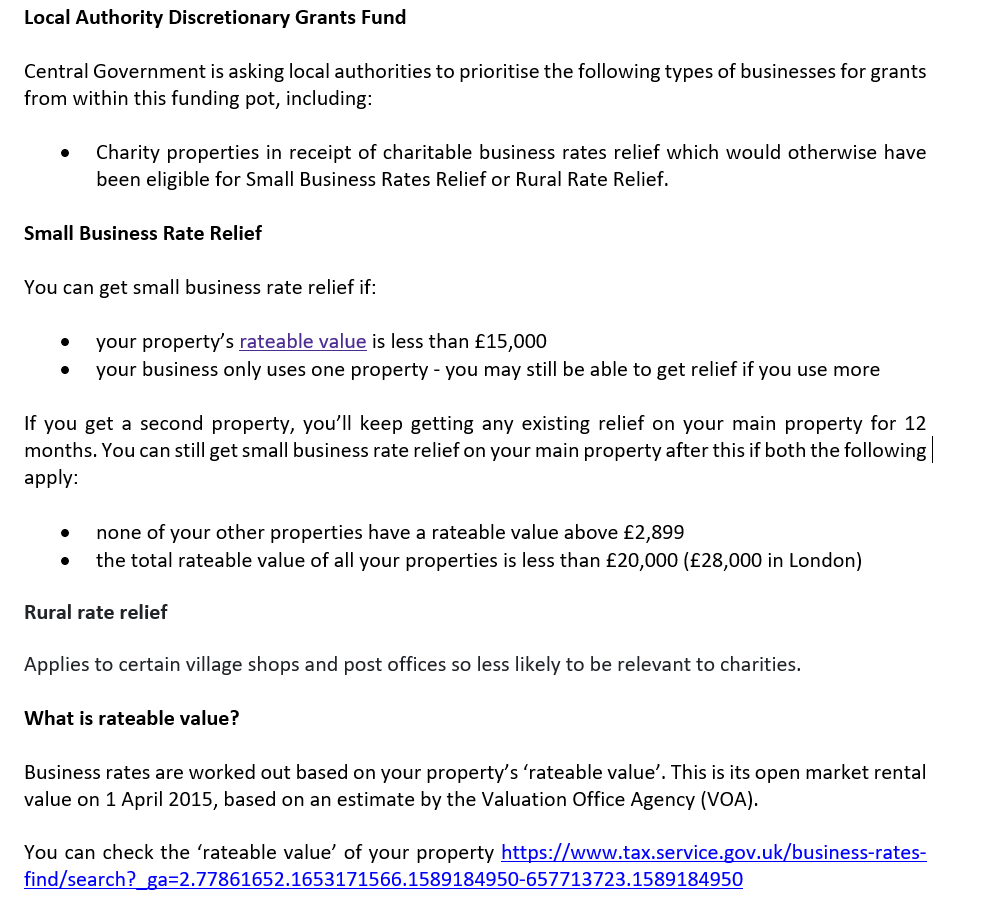

CTG has been pleased to work with @NAVCA @sccoalition @ComMattersYorks @CFGtweets @NCVO on this proposal which should help a number of #smallcharities. We& #39;ll be working with partners to help charities understand the rateable value of their properties and whether they are eligible

Important to mention that this applies to ENGLAND only. In Wales the smallest charity shops can now access grants. Small Scottish charities can now also access grants via their scheme https://twitter.com/CharityTaxGroup/status/1260621997081575425">https://twitter.com/CharityTa...

We know that @sccoalition & @NAVCA are developing helpful resources on understanding #rateablevalue & eligibility for #SmallBusinessRatesRelief. In the meantime, a short overview of both in the image below. Remember you can check your #rateablevalue online https://www.tax.service.gov.uk/business-rates-find/search?_ga=2.142848309.1653171566.1589184950-657713723.1589184950">https://www.tax.service.gov.uk/business-...

Read on Twitter

Read on Twitter