1/ Did a thought experiment last weekend: what if, in addition to paying for 1 year of software service fees for @barrelny, we took that same amount and bought stock in these companies? What would the investment be worth now?

2/ I made a quick list of the publicly traded software companies we used and they were:

$ADBE

$ZM

$WORK

$SMAR

$MSFT

$BILL

$NET

$TEAM

$ADBE

$ZM

$WORK

$SMAR

$MSFT

$BILL

$NET

$TEAM

3/ We spent close to $50k/year across these the first year.

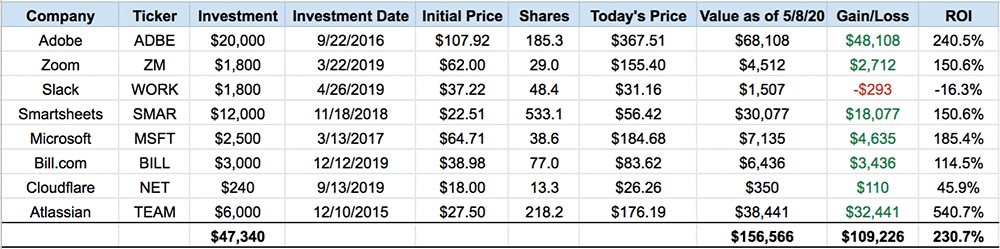

I made a chart to show what 1 year& #39;s worth of fees invested in these stocks would& #39;ve gained from when we started using the service. 4 of these stocks IPO& #39;d after we started using them so I used their IPO date instead.

I made a chart to show what 1 year& #39;s worth of fees invested in these stocks would& #39;ve gained from when we started using the service. 4 of these stocks IPO& #39;d after we started using them so I used their IPO date instead.

4/ The $50k spent on software, if also invested in stock, would be worth close to $157k as of 5/8/20, a return of over 230%. If we had bought an S&P 500 ETF instead for each of these, the overall gains would& #39;ve been 23%.

A gain of $109k vs. $11k.

A gain of $109k vs. $11k.

5/ Of course, most gains in our "Work Tools Portfolio" were from 3 of the 8 companies: $ADBE, $TEAM, and $SMAR because 1) we would& #39;ve held their stocks for longer and 2) they were for larger amounts.

6/ So what& #39;s the lesson/takeaway of all this?

There were moments when we made remarks in passing about how $TEAM must be killing it b/c JIRA was getting more and more popular (pre-IPO!). Maybe I could& #39;ve used that knowledge to take a position earlier (I bought some this year).

There were moments when we made remarks in passing about how $TEAM must be killing it b/c JIRA was getting more and more popular (pre-IPO!). Maybe I could& #39;ve used that knowledge to take a position earlier (I bought some this year).

7/ As I& #39;ve taken an interest in investing, I think there are advantages to being paying customers and having firsthand knowledge of competitors, adoption rates, and stickiness.

This, along with additional research, would be Peter Lynch& #39;s "invest in what you know" approach.

This, along with additional research, would be Peter Lynch& #39;s "invest in what you know" approach.

8/ Today, I have positions in $TEAM, $ZM, $MSFT, and $NET, but I bought these wayyy after we were using them (with the exception of $ZM which I bought at IPO).

There& #39;s one more business whose stock I wish I had bought at IPO which I was intimately familiar with...

There& #39;s one more business whose stock I wish I had bought at IPO which I was intimately familiar with...

9/ You can check out my full write-up about this thought experiment and this "missed opportunity IPO stock" on my blog: https://www.peterkang.com/what-if-we-had-invested-in-the-software-companies-we-use-at-work/">https://www.peterkang.com/what-if-w...

Read on Twitter

Read on Twitter