Some people asked what I think of the 10% fiscal stimulus by India. Here are some thoughts: it looks like Japan& #39;s 20% of GDP stimulus that if you dig deeper, it& #39;s much small than it looks. The word fiscal stimulus is used pretty loosely by Asian governments. Let& #39;s break down why.

What is fiscal & monetary? Fiscal, well, 2 sides to it: taxation & expenditure.

When u lower taxes/social security costs/etc, u are lowering a burden on companies/individuals that are likely running a loss anyway so the benefit is marginal. People call it discretionary support.

When u lower taxes/social security costs/etc, u are lowering a burden on companies/individuals that are likely running a loss anyway so the benefit is marginal. People call it discretionary support.

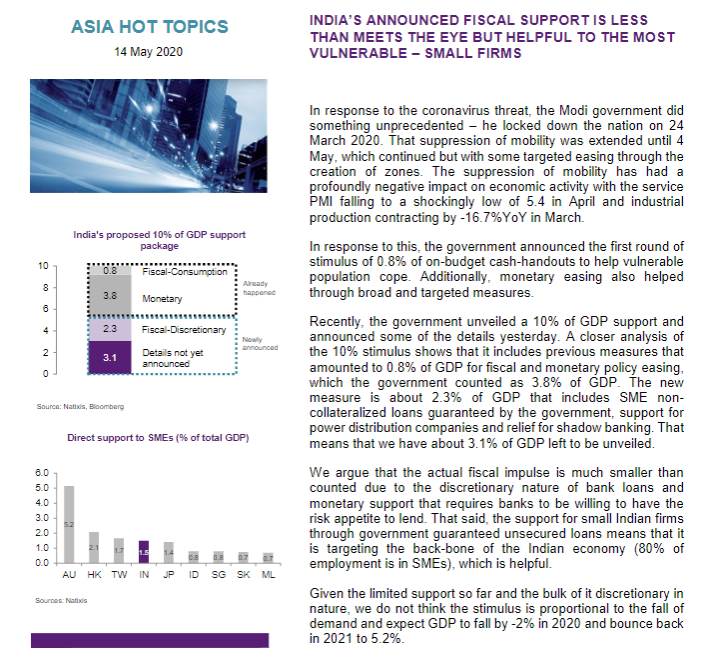

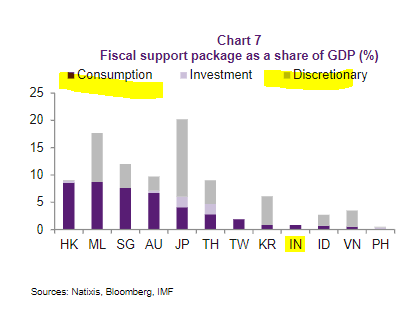

Here is a chart that breaks down fiscal support as a share of GDP by consumption & investment (actual on budget spending or expenditure support) & discretionary (revenue side support like lower taxes & social security requirement etc).

India fiscal before this 10% of GDP https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

India fiscal before this 10% of GDP

Why do we distinguish b/n this? Well, if you have income collapse, or shall I say DEMAND collapse, lowering taxes or social security requirements help on the margin but companies are running at a loss so they are not gonna spend more on this. Same w/ households.

So u need DEMAND

So u need DEMAND

Gov can do consumption oriented or investment spending (the USA style cash-handouts & +2400 per month unemployment handouts on top of state to make sure people got income to demand stuff).

Okay, so if u look at Asia, more stingy. Even HK, it announced but not yet in pockets

Okay, so if u look at Asia, more stingy. Even HK, it announced but not yet in pockets

Beyond fiscal, there is monetary policy, which can be broad-base or targeted. For monetary policy, just because a CB lower rates, doesn& #39;t mean it goes into the economy as banks VaR model may say no & that makes sense. CB may try to do targeted or even direct lending to bypass.

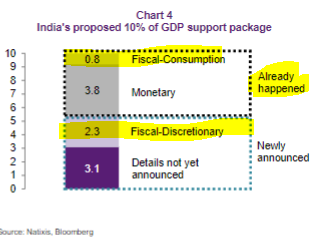

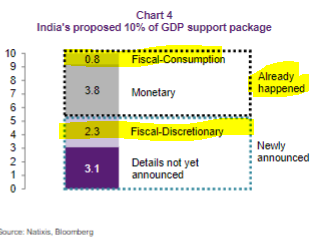

Again, monetary policy usually is not counted in fiscal and even fiscal, I am very stringent to count what& #39;s actually stimulative in terms of demand. And this is what the 10% of GDP adds up to. Btw, a lot of monetary policy & also most of it already announced/done. So what& #39;s new?

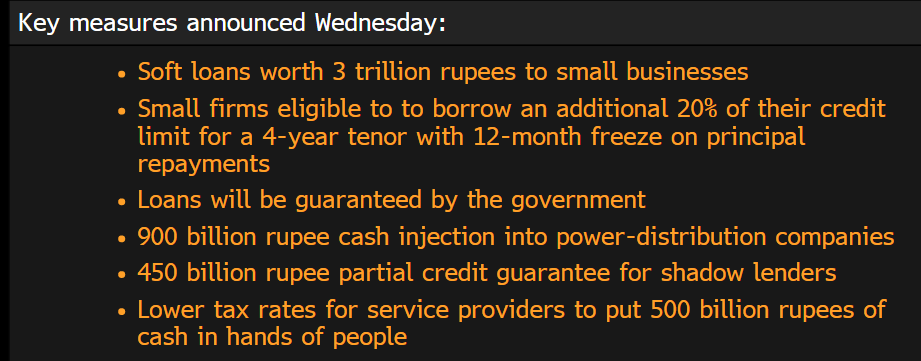

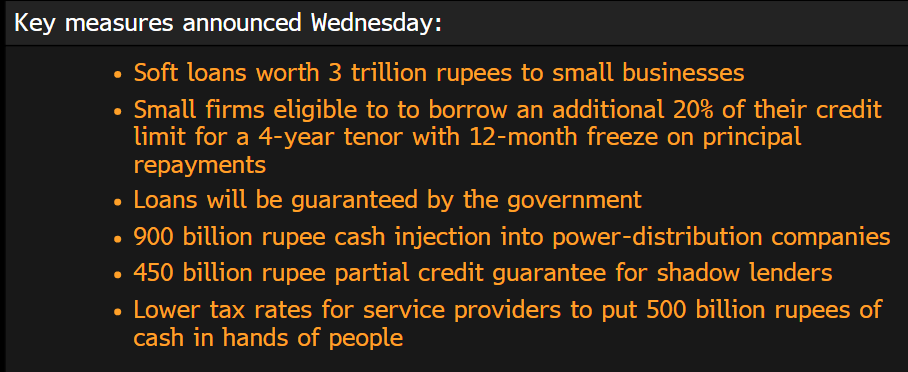

New stuff below:

*Basically small businesses getting loans

*Tax rate for services providers cut

So the 10% of GDP sounds a lot bigger than it really is b/c it includes previously announced monetary + fiscal & we know the fiscal small (see chart above) & new is loans + tax cut.

*Basically small businesses getting loans

*Tax rate for services providers cut

So the 10% of GDP sounds a lot bigger than it really is b/c it includes previously announced monetary + fiscal & we know the fiscal small (see chart above) & new is loans + tax cut.

Not saying the measures are not important. And especially because they focus on small business. We know that small businesses are KEY but they are limited in access to credit.

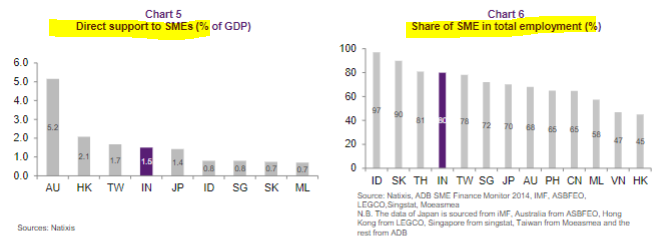

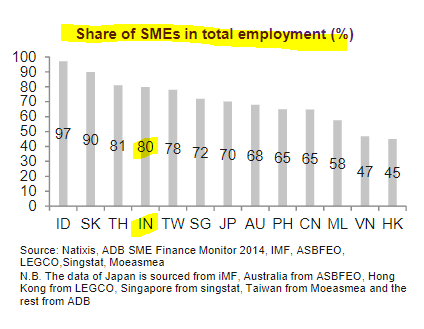

In India SMEs employ 80% of total employment so key to lend to small firms (+USD40bn unsecured loans).

In India SMEs employ 80% of total employment so key to lend to small firms (+USD40bn unsecured loans).

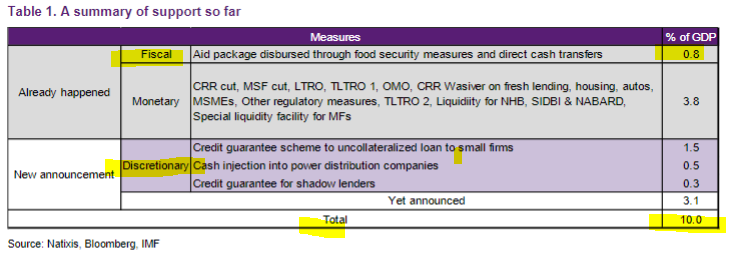

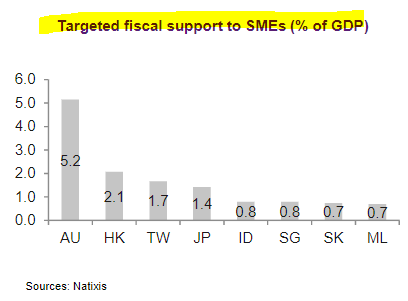

Here is the fiscal support for SMEs in Asia before India announced new measures. After the loan support, India would jump to between Taiwan & Japan in terms of fiscal support for small firms so it is a big deal.

So in short, new measures great https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏🏻" title="Clapping hands sign (light skin tone)" aria-label="Emoji: Clapping hands sign (light skin tone)"> & target where most vulnerable!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏🏻" title="Clapping hands sign (light skin tone)" aria-label="Emoji: Clapping hands sign (light skin tone)"> & target where most vulnerable!

So in short, new measures great

But the meaning of it is not +10% of GDP fiscal stimulus but rather much smaller in support & that help is targeted for small business.

Thread ends.

Thread ends.

Guys, want to see the latest report on India???? I put everything together in an easy to understand info-graphic!!!

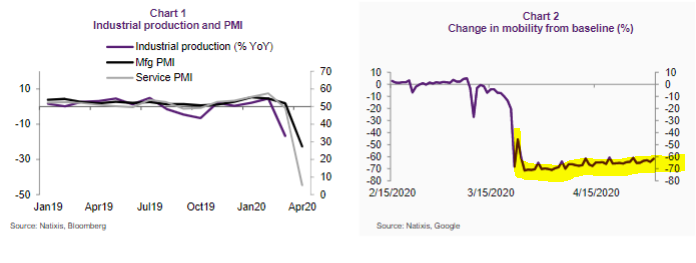

First, why do we need stimulus? Well, because growth COLLAPSED. Here is the latest data:

Service PMI 5.4 in April

Industrial production -16.7%YoY in March

Service PMI 5.4 in April

Industrial production -16.7%YoY in March

Why? Well, lock-downs from 24 March to 4 May & extended w/ some easing of mobility based on zones.

Look at the Google mobility or shall I say lack there of

Look at the Google mobility or shall I say lack there of

So help totally needed! And help came! The gov had a 0.8% of GDP fiscal spending (on-budget & actual spending) to help w/ food security measures + direct cash transfers for vulnerable people.

Also did monetary support but I disagree w/ counting monetary easing in terms of GDP..

Also did monetary support but I disagree w/ counting monetary easing in terms of GDP..

Why? Because when you do these broad-based & targeted support, it& #39;s up to the discretion of those who have access to this supply of money to say, well, do I then lend it out or do I keep this money because I don& #39;t want to take risk.

So I don& #39;t think u can say it& #39;s 3.8% of GDP...

So I don& #39;t think u can say it& #39;s 3.8% of GDP...

New stuff is in purple & if u read people listing a lot of details or analyst reports listing a bunch of stuff, remember this:

a) Unsecured loans for small firms but it& #39;s not really gov spending but more gov GUARANTEED. So more incentive for banks to lend & a contingent liability

a) Unsecured loans for small firms but it& #39;s not really gov spending but more gov GUARANTEED. So more incentive for banks to lend & a contingent liability

Meaning if banks do lend, then the gov guarantee in case of default & so it isn& #39;t on the gov& #39;s budget (no widening of the fiscal on the expenditure side) but on the liability so it can impact the gov& #39;s debt if these businesses default for example.

Anyway and other stuff too like cash injection for power distribution + credit guarantee for shadow lenders.

Wanna see what it looks like? So seems like we got about 3.1% of GDP missing to be announced. So far, 4.6% was the old stuff & frankly I& #39;d count only 0.8% as spending.

Wanna see what it looks like? So seems like we got about 3.1% of GDP missing to be announced. So far, 4.6% was the old stuff & frankly I& #39;d count only 0.8% as spending.

New stuff is in purple & as u can see we& #39;re missing some so hopefully we& #39;ll get some announcement soon on details. The new details, I tag as discretionary rather than spending because it& #39;s not gov spending but gov guarantee of loans so an incentive to LEND.

Still helpful cuz it& #39;s helping small firms & we all know they got problems getting credit etc so gov guarantee will hopefully help them get these loans they need.

And as I said, this makes India one of the top countries to help SMEs.

Fiscal spending less than meets the eye.

And as I said, this makes India one of the top countries to help SMEs.

Fiscal spending less than meets the eye.

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" title="Here is a chart that breaks down fiscal support as a share of GDP by consumption & investment (actual on budget spending or expenditure support) & discretionary (revenue side support like lower taxes & social security requirement etc). India fiscal before this 10% of GDP https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" title="Here is a chart that breaks down fiscal support as a share of GDP by consumption & investment (actual on budget spending or expenditure support) & discretionary (revenue side support like lower taxes & social security requirement etc). India fiscal before this 10% of GDP https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" class="img-responsive" style="max-width:100%;"/>

& target where most vulnerable!" title="Here is the fiscal support for SMEs in Asia before India announced new measures. After the loan support, India would jump to between Taiwan & Japan in terms of fiscal support for small firms so it is a big deal.So in short, new measures great https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏🏻" title="Clapping hands sign (light skin tone)" aria-label="Emoji: Clapping hands sign (light skin tone)"> & target where most vulnerable!" class="img-responsive" style="max-width:100%;"/>

& target where most vulnerable!" title="Here is the fiscal support for SMEs in Asia before India announced new measures. After the loan support, India would jump to between Taiwan & Japan in terms of fiscal support for small firms so it is a big deal.So in short, new measures great https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏🏻" title="Clapping hands sign (light skin tone)" aria-label="Emoji: Clapping hands sign (light skin tone)"> & target where most vulnerable!" class="img-responsive" style="max-width:100%;"/>