1) @CoinMarketCap some thoughts on the liquidity metric:

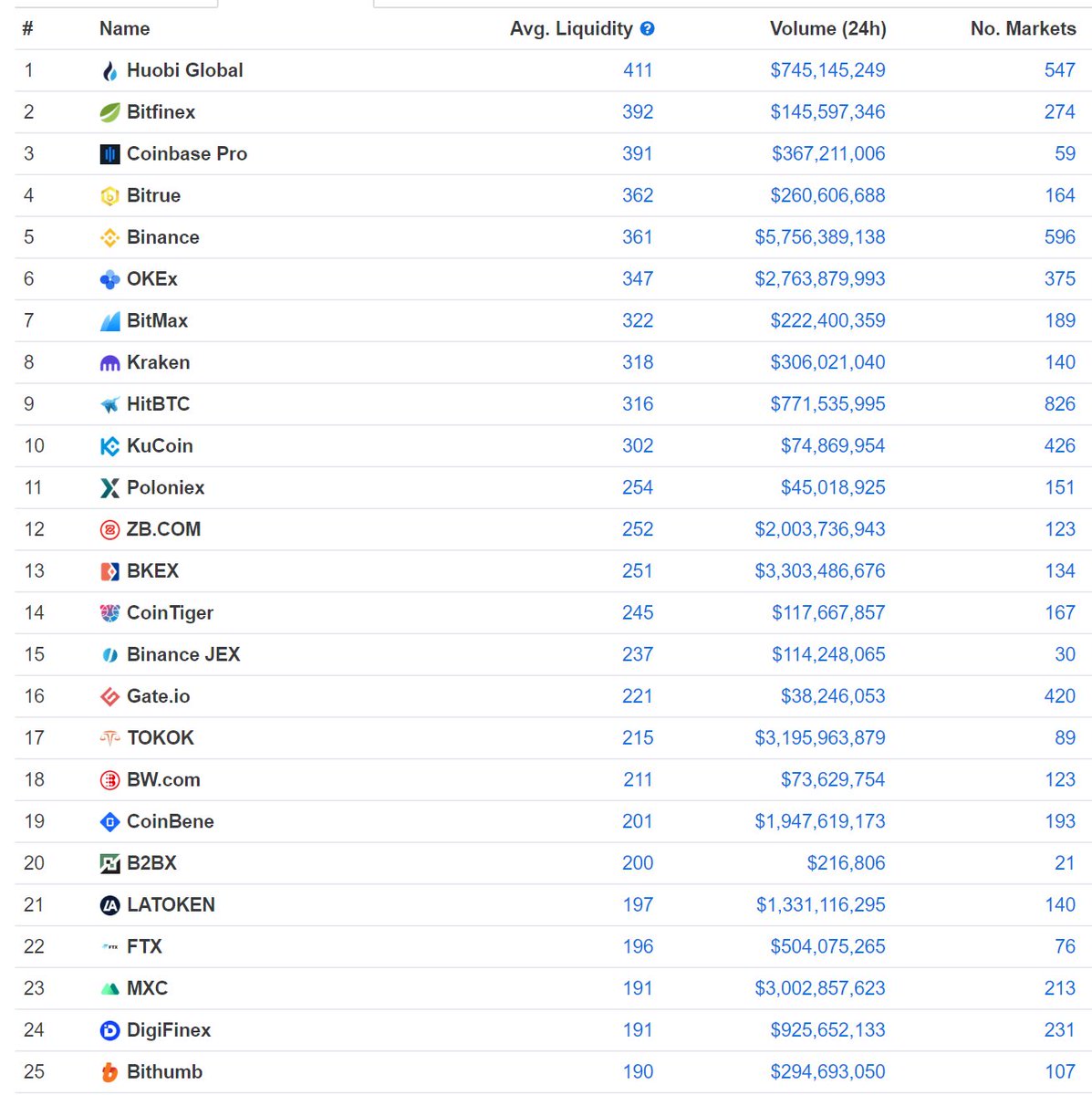

First, it& #39;s definitely better than what you& #39;ve had before! This table isn& #39;t crazy:

First, it& #39;s definitely better than what you& #39;ve had before! This table isn& #39;t crazy:

2) that being said, there are some improvements you could make.

First, there are still some fake exchanges here. They& #39;re a bit tricky to catch--their orderbooks often look real! They tend to be quite thin though. I suspect you may be overweighting spread relative to depth.

First, there are still some fake exchanges here. They& #39;re a bit tricky to catch--their orderbooks often look real! They tend to be quite thin though. I suspect you may be overweighting spread relative to depth.

3) I& #39;m confused about how you& #39;re combining markets. It& #39;s definitely not a straight average, not is it the top, or anything like that. What is it?

4) I think it& #39;s weighting stablecoin-stablecoin markets too much. E.g. the PAX creation portal has a 0-slippage infinite size PAX/USD market at $1; so providing liquidity in that pair isn& #39;t as important. Does this mean https://www.paxos.com/ ">https://www.paxos.com/">... should have a score of 1000?

5) And, e.g. FTX actually has this too! You can deposit USD and withdraw PAX 1:1 for infinite size, which is basically a 0-slippage PAX/USD market. But we don& #39;t call it a market, because it& #39;s.... basically a USD/USD market.

6) The order size you check for is mostly up to $10k. That makes sense for many coins! But not for BTC/USD. A significant % of BTC/USD volume comes in lots of size > $10k. You probably want this to be a % of ADV instead (maybe up to 0.01% of an ADV).

Read on Twitter

Read on Twitter