If there’s a better analysis on DeFi protocols I haven’t seen it

@0x_Lucas brings the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Fire" aria-label="Emoji: Fire"> today

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Fire" aria-label="Emoji: Fire"> today

Don’t buy LEND, KNC, SNX, MKR, ZRX—none of it—before understanding this post

I& #39;m serious

Read:

https://bankless.substack.com/p/how-to-value-crypto-capital-assets

Thread">https://bankless.substack.com/p/how-to-... summary below:

@0x_Lucas brings the

Don’t buy LEND, KNC, SNX, MKR, ZRX—none of it—before understanding this post

I& #39;m serious

Read:

https://bankless.substack.com/p/how-to-value-crypto-capital-assets

Thread">https://bankless.substack.com/p/how-to-... summary below:

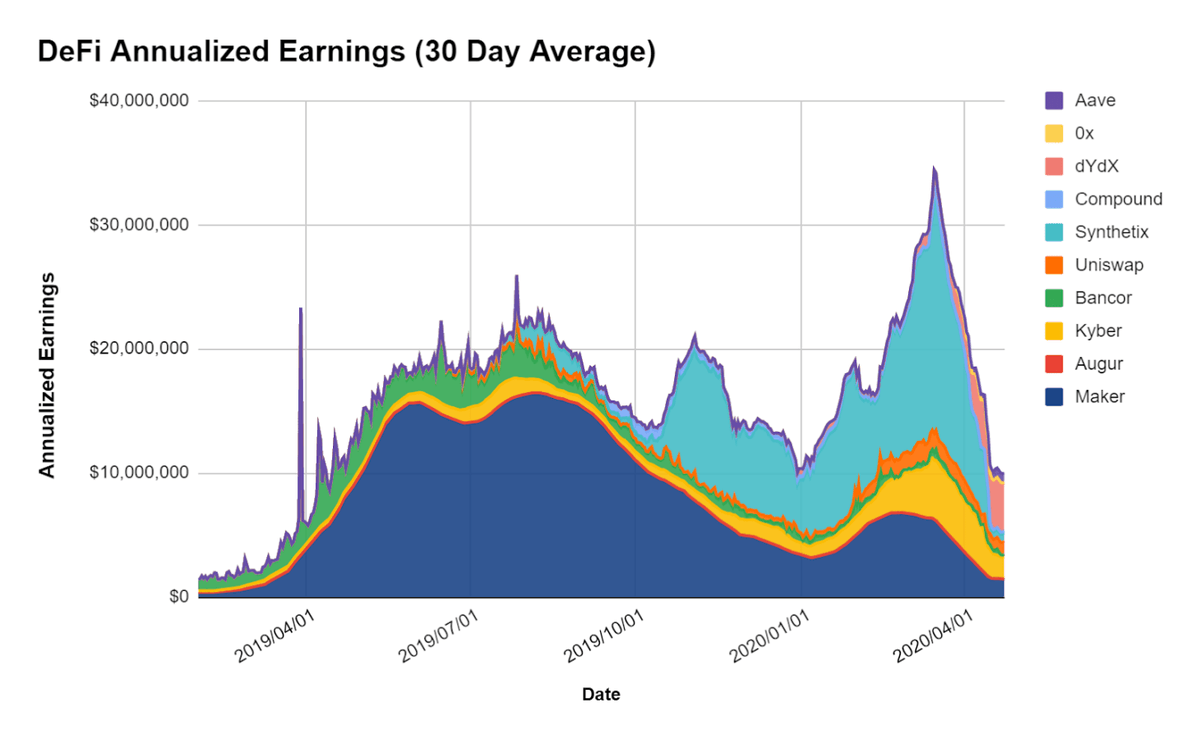

1/ On-chain cash flows means the birth of a new asset class.

The crypto capital asset.

Unlike traditional capital assets (real-estate, stocks) these can be valued using transparent on-chain cash flows.

@0x_Lucas looks at protocol earnings over the past year:

The crypto capital asset.

Unlike traditional capital assets (real-estate, stocks) these can be valued using transparent on-chain cash flows.

@0x_Lucas looks at protocol earnings over the past year:

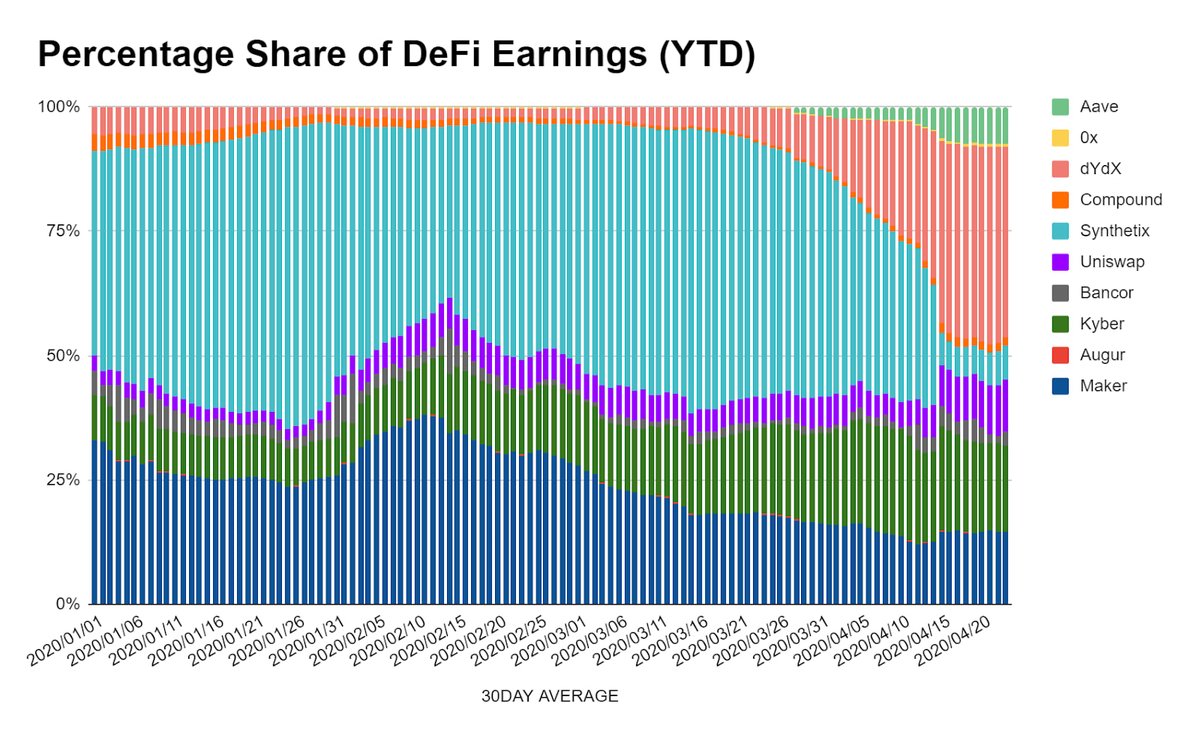

2/ Big shifts from quarter to quarter!

MKR far less dominant

SNX way up, then down after quashing front-running

KNC growing steadily

LEND (Aave) making headway

DYDX crushing it

If Uniswap had a token it& #39;d place 5th

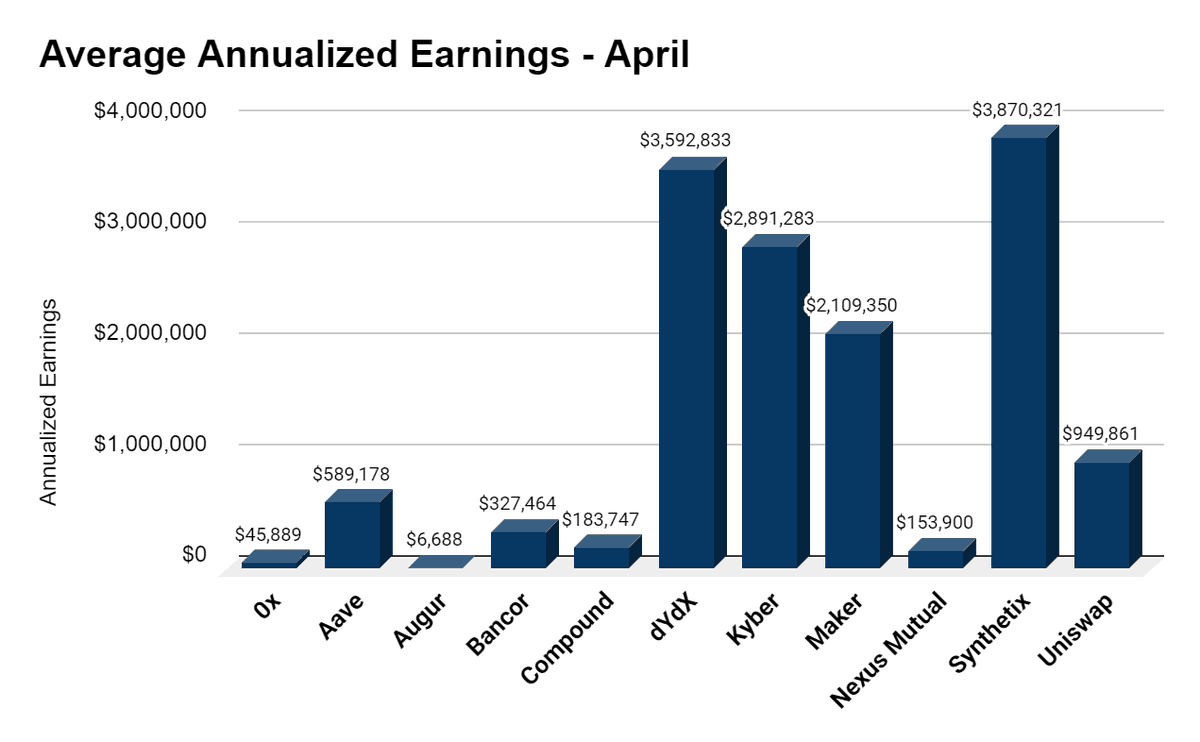

Here& #39;s what April looked like:

MKR far less dominant

SNX way up, then down after quashing front-running

KNC growing steadily

LEND (Aave) making headway

DYDX crushing it

If Uniswap had a token it& #39;d place 5th

Here& #39;s what April looked like:

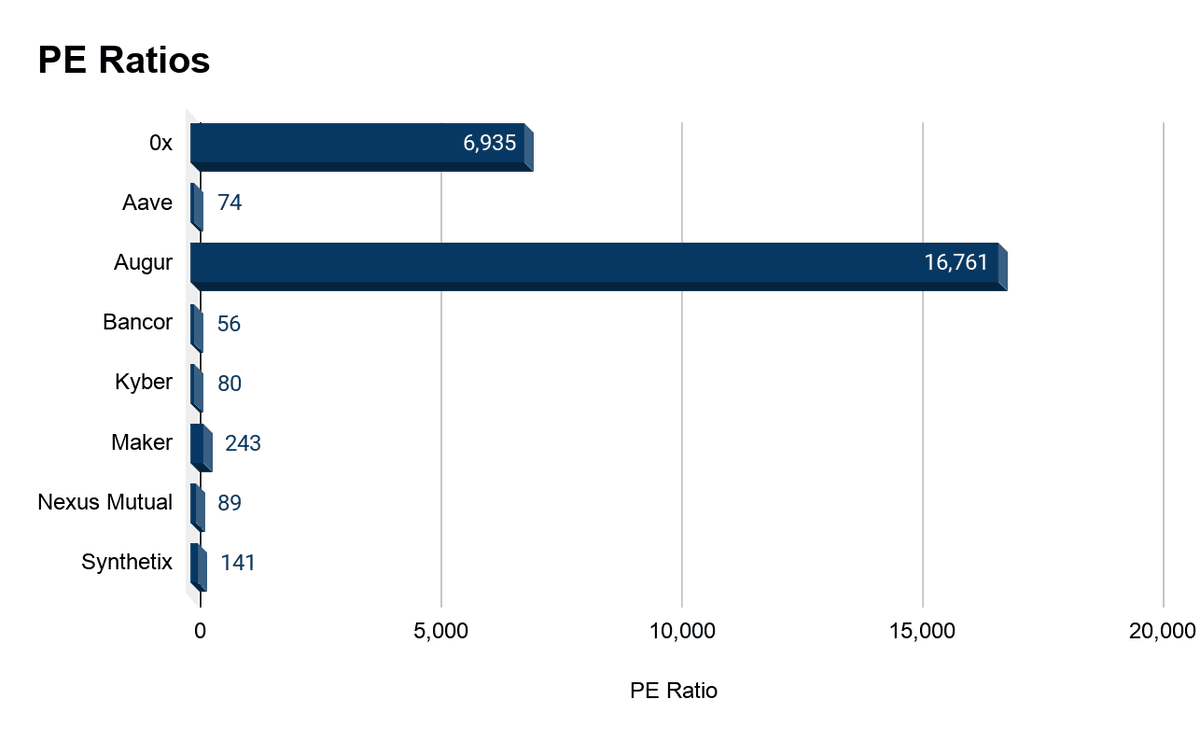

3/ Like traditional capital assets we can look at PE ratios to see how protocols are valued relative to cash they generate

@Bancor, @AaveAave, & @KyberNetwork have the lowest PE ratios

While @AugurProject & @0xProject have the highest

(lower implies more attractive valuation)

@Bancor, @AaveAave, & @KyberNetwork have the lowest PE ratios

While @AugurProject & @0xProject have the highest

(lower implies more attractive valuation)

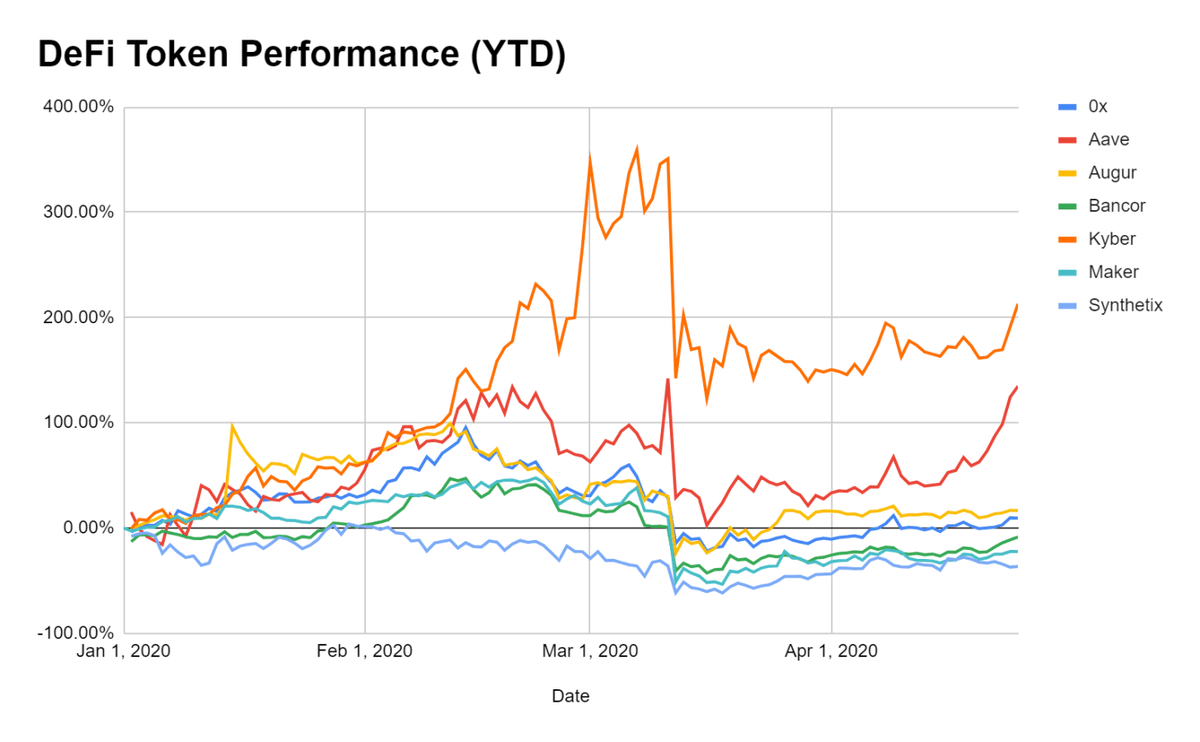

4/ DeFi tokens up +43% on average YTD

There& #39;ve been some breakout price performers YTD too

Aave + Kyber (+213%!)

While Maker and Snythetix lost ground

The big question: is there a correlation between token price and annualized earnings?

There& #39;ve been some breakout price performers YTD too

Aave + Kyber (+213%!)

While Maker and Snythetix lost ground

The big question: is there a correlation between token price and annualized earnings?

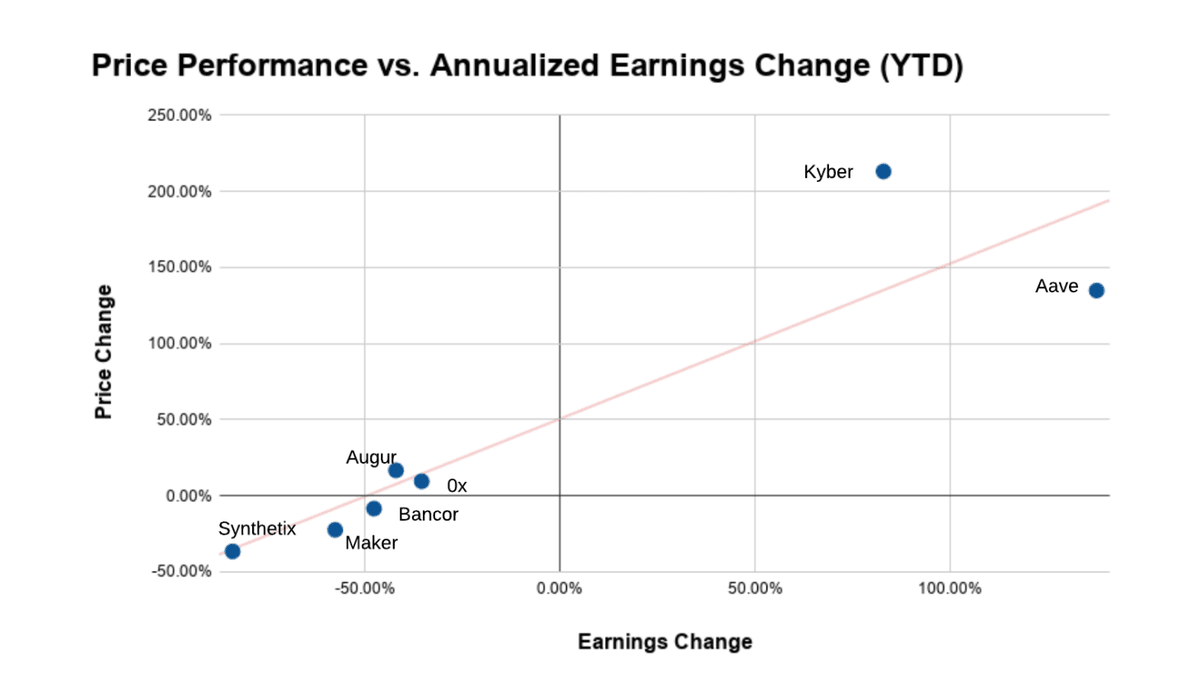

5/ Yes!

And this was my favorite part of the piece

Look at how DeFi Tokens relative to changes in earnings

Looks like increases in annualized earnings for Kyber and Aave translated to a positive trend in token performance!

Are we starting to understand this asset class?

And this was my favorite part of the piece

Look at how DeFi Tokens relative to changes in earnings

Looks like increases in annualized earnings for Kyber and Aave translated to a positive trend in token performance!

Are we starting to understand this asset class?

6/ Just the full article

It& #39;ll help you understanding DeFi tokens before 99% of VCs, before 99.9% of Wall Street, & before 99.999% of the general population.

This is the birth of a new asset class and you’re front-running the opportunity.

Read: https://bankless.substack.com/p/how-to-value-crypto-capital-assets">https://bankless.substack.com/p/how-to-...

It& #39;ll help you understanding DeFi tokens before 99% of VCs, before 99.9% of Wall Street, & before 99.999% of the general population.

This is the birth of a new asset class and you’re front-running the opportunity.

Read: https://bankless.substack.com/p/how-to-value-crypto-capital-assets">https://bankless.substack.com/p/how-to-...

Read on Twitter

Read on Twitter