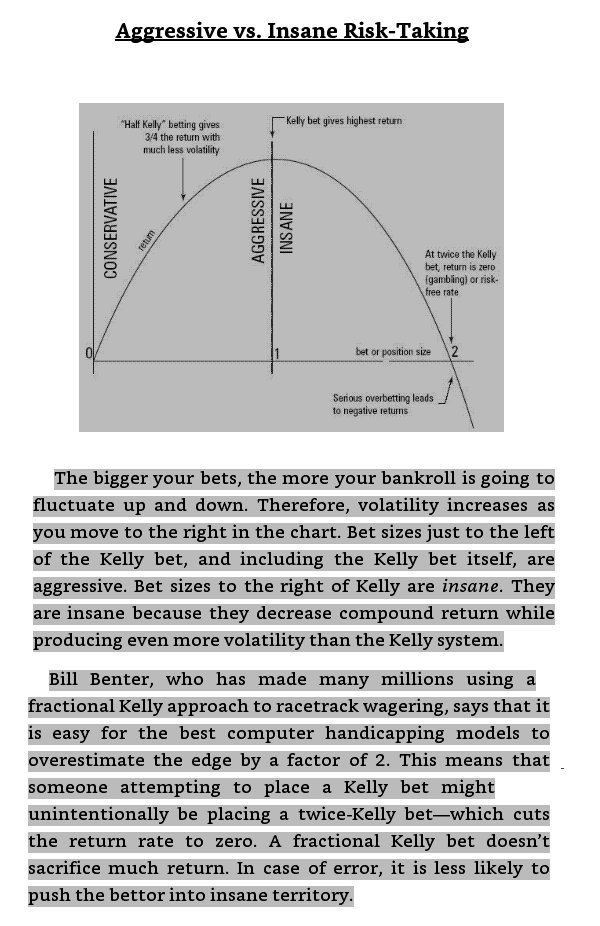

2.) Kelly formula: Bet-It-All vs. Martingale vs. Fixed-Wager vs. Kelly (pic. 1-2), Effects of Over- and Underbetting with the Kelly criterion (pic. 3-4)

3.) Kelly formula:

The rule of 1/n: "the chance of your bankroll ever dipping down to half it& #39;s original size is ... 1/2."

How to smooth the ride: fractional kelly and diversification.

The rule of 1/n: "the chance of your bankroll ever dipping down to half it& #39;s original size is ... 1/2."

How to smooth the ride: fractional kelly and diversification.

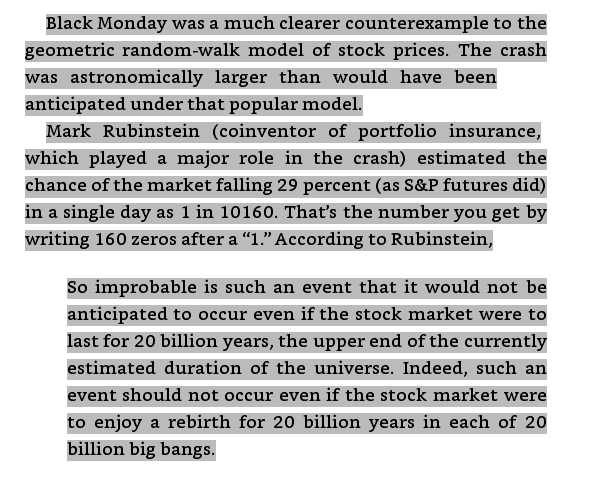

4.) Random walk: first discovered by Bachelier and than rediscovered by Savage and Samuelson (pic. 1-3); probability of Black Monday as counterexample (pic. 4).

5.) Arithmetic vs. Geometric mean

"The returns and volatility of your investments will change with time. When they do, you should adjust your portfolio accordingly, again with the sole object of attaining the highest geometric return"

Sounds like straigt from @breakingthemark

"The returns and volatility of your investments will change with time. When they do, you should adjust your portfolio accordingly, again with the sole object of attaining the highest geometric return"

Sounds like straigt from @breakingthemark

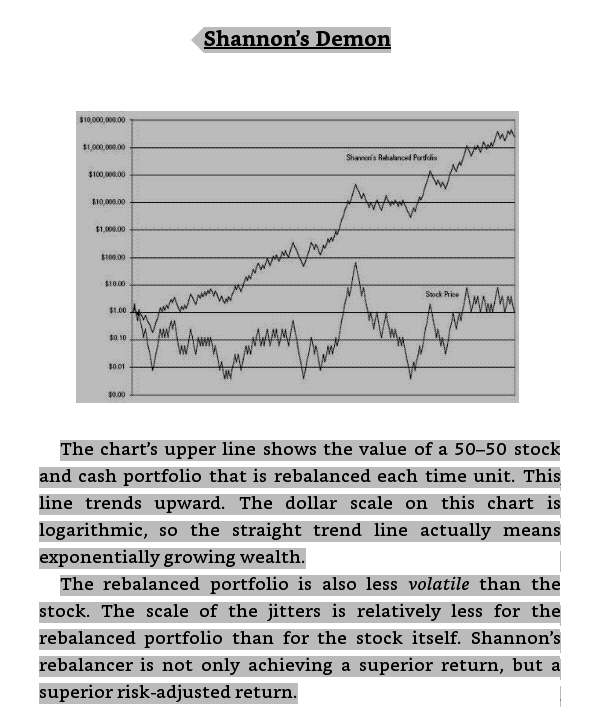

8.) Shannon& #39;s Demon - profiting from randomness (in theory) - Part 1.

@walt373 recently made me aware of this concept

@walt373 recently made me aware of this concept

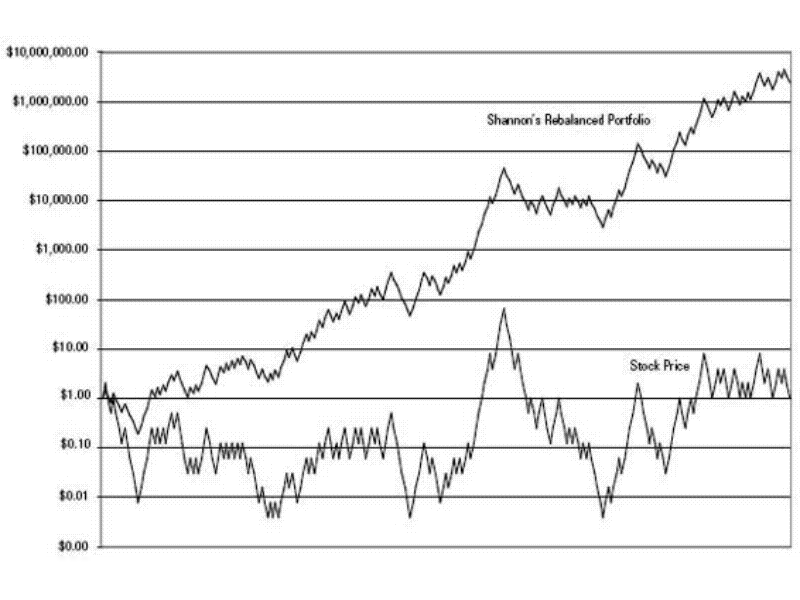

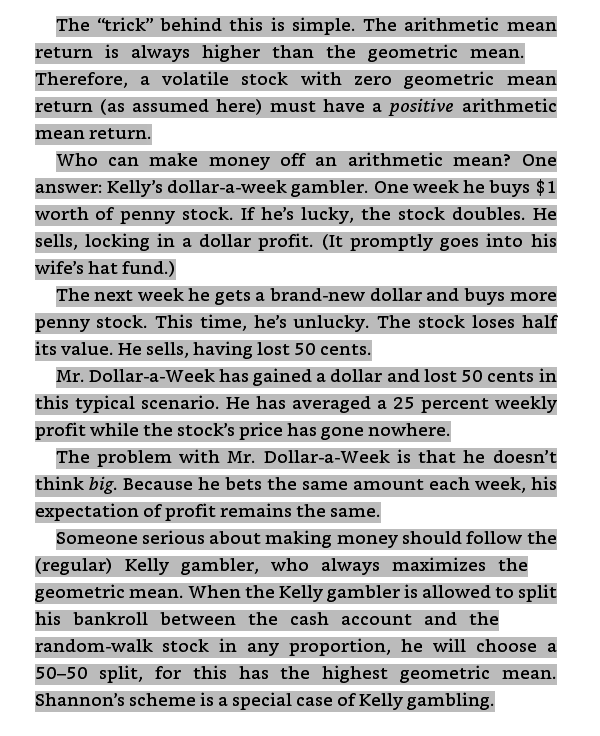

9.) Shannon& #39;s Demon - profiting from randomness (in theory) - Part 2.

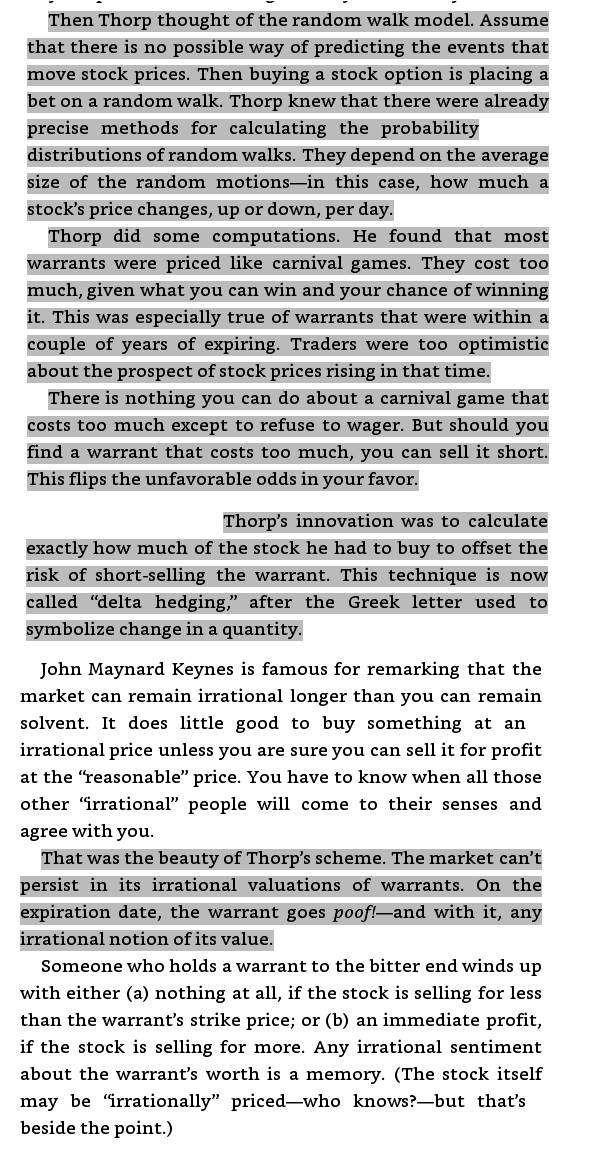

11.) How Thorp did it: used the random walk to value warrants and then delta hedged his market risk (pic. 1-2); Example 1: Resort International warrants (pic. 3); Example 2: AMC warrants (pic. 4)

12.) How Thorp did it: Example 3: AT&T warrants (pic. 1); What is a S&P futures contract worth? (pic. 2); Black, Scholes and Merton get burned speculating in National General warrants (pic. 3); different conclusions (pic. 4).

13.) How Thorp did it: Stat. Arbitrage

Later they refined the system first by dividing the stocks into industry groups and after that they used a more flexible "factor analysis" system + a "restricted list" of companies entangled in corporate events.

18% p.a. from 1994-2002.

Later they refined the system first by dividing the stocks into industry groups and after that they used a more flexible "factor analysis" system + a "restricted list" of companies entangled in corporate events.

18% p.a. from 1994-2002.

Other: Newton went broke playing the market, Gauss became rich (but no one knows how).

LTCM collapse: too much leverage and false security in VaR reports.

Shannon was a highly concentrated stock picker. Helped Singleton choose acquisition targets.

LTCM collapse: too much leverage and false security in VaR reports.

Shannon was a highly concentrated stock picker. Helped Singleton choose acquisition targets.

Read on Twitter

Read on Twitter