food delivery is a category case study for the record books. so much intrigue and game theory if you know where to look under the hood. major externalities also brewing around modularity that will shift value longterm 1/x

the intrigue started with ubereats, doordash and postmates all going over the top (not actually partnering with restaurants) to dramatically increase supply versus the incumbent grubhub. @sarahtavel has a great breakdown here: https://medium.com/@sarahtavel/food-delivery-wars-3-takeaways-from-the-ubereats-postmates-grubhub-doordash-ecosystem-how-it-bda13a059430">https://medium.com/@sarahtav... 2/x

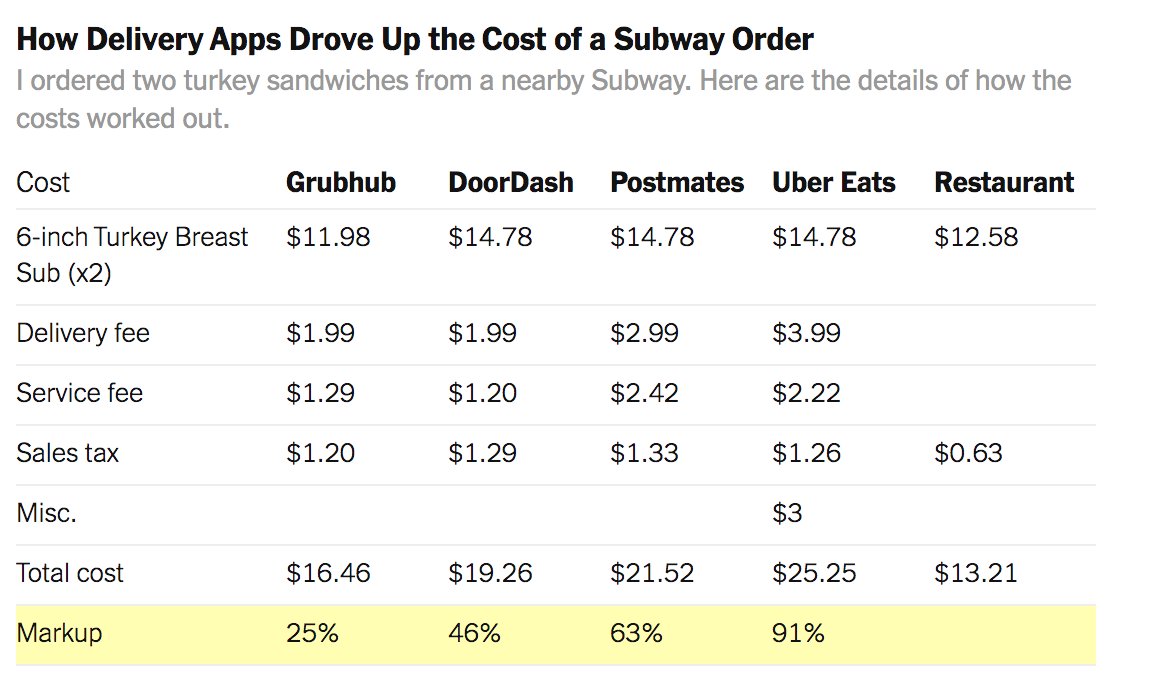

grub dug in believing that consumers would prioritize value + consistency. (nearly every independent study has shown grub to be the lowest markup.) but this incorrectly underestimated WTP for previously offline restaurants 3/x https://www.nytimes.com/2020/02/26/technology/personaltech/ubereats-doordash-postmates-grubhub-review.html">https://www.nytimes.com/2020/02/2...

in the background is this analysis from @bgurley re runway. lots of strong willed ceos in this cohort. survival instinct is manifest but time is short. going OTT was more expensive due to lack of take-rate from suppliers. appetite decreasing for burn. https://twitter.com/bgurley/status/1218015916744560641?s=20">https://twitter.com/bgurley/s... 4/x

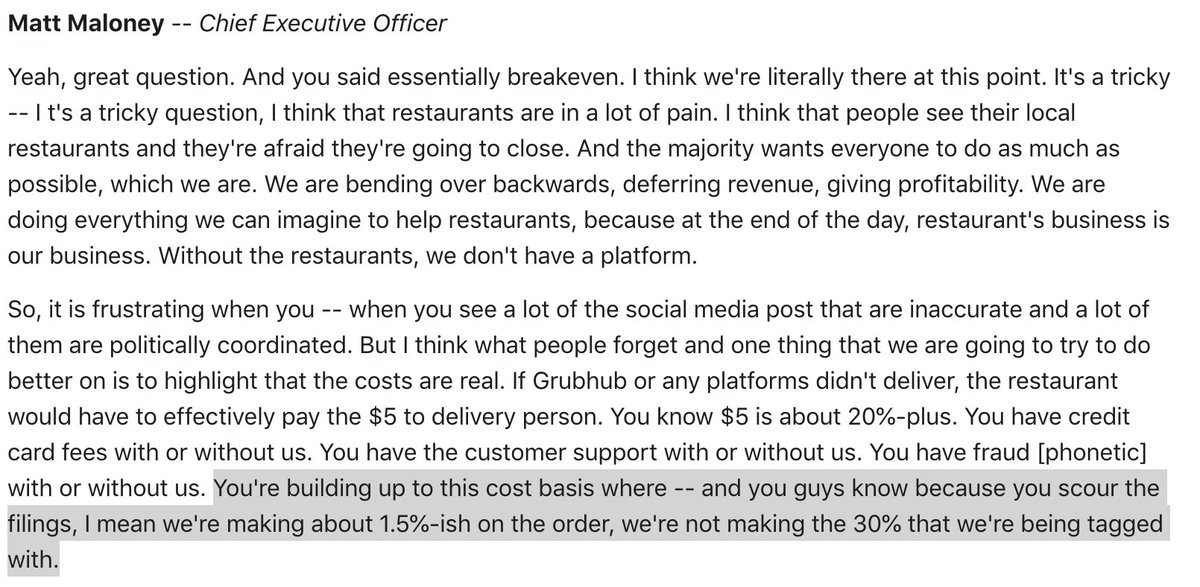

grub and eats have done a very good job training analysts on what "healthy" operations look like. emphasizing repeatedly that scale is ~1.5% contribution profit/order. pushes heavy burden on unprofitable players to get there...or else? 5/x

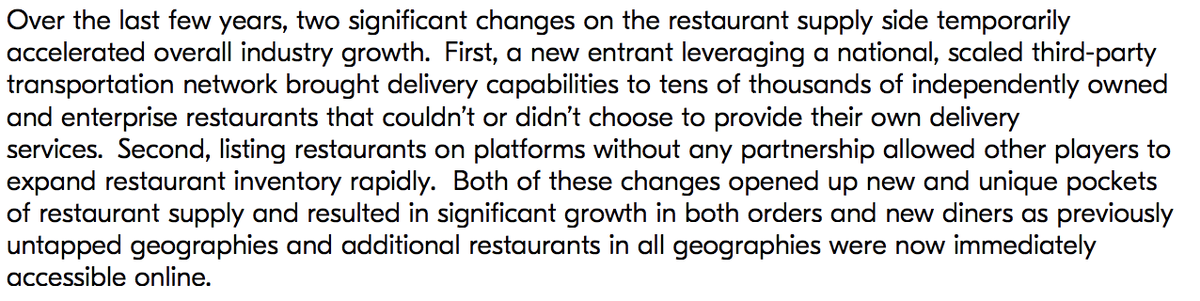

somehow in the midst of many $Bs of venture subsidies for consumers, grub manages to grow at 30%+ y/y and generate 9 figs of ebitda. best explanation is from their own shareholder letter - basically supply side tailwinds so strong we could do no wrong. 6/x https://s2.q4cdn.com/772508021/files/doc_financials/2019/q3/October-2019-Shareholder-Letter.pdf">https://s2.q4cdn.com/772508021...

so basically at this point "we& #39;re in the end game" as @NonGaap eloquently describes current state - which is why yesterday we saw uber make a bid for grub 7/x https://nongaap.substack.com/p/doordash-initial-public-restructuring">https://nongaap.substack.com/p/doordas...

but as the stakes got higher and more intense, plenty of other subterfuge develops beneath the surface.

tax collection uncertainty becomes an issue which could impact the solvency of certain players 8/x https://www.vox.com/recode/2019/11/20/20973401/food-delivery-companies-doordash-grubhub-instacart-delivery-fees">https://www.vox.com/recode/20...

tax collection uncertainty becomes an issue which could impact the solvency of certain players 8/x https://www.vox.com/recode/2019/11/20/20973401/food-delivery-companies-doordash-grubhub-instacart-delivery-fees">https://www.vox.com/recode/20...

https://www.votwitter.com/recode/2019/11/20/20973401/food-delivery-companies-doordash-grubhub-instacart-delivery-fees

cramer implies something very awry regarding a wsj m&a story: "what happened there? if you& #39;re not for sale, how could a major publication say you are for sale?" 9/x https://www.cnbc.com/2020/01/23/grubhub-ceo-on-merger-odds-we-would-evaluate-any-offer.html">https://www.cnbc.com/2020/01/2...

the great driver tip debate (or uproar) bursts open again that could once again impact certain business models 10/x https://www.nytimes.com/2019/07/24/nyregion/doordash-tip-policy.html">https://www.nytimes.com/2019/07/2...

the battle for the consumer is the foreground. but the battle for the restaurant is the background:

the integrators - ordermark, chowly, checkmate and more -are commoditizing the app/restaurant relationship. with a single click, a restaurant can go live on all platforms. 11/x

the integrators - ordermark, chowly, checkmate and more -are commoditizing the app/restaurant relationship. with a single click, a restaurant can go live on all platforms. 11/x

these products increase dependency on delivery apps but decrease dependency on any particular player. efforts to shut them down failed as the restaurants held the leverage and demanded them for operational needs. 12/x

niche players such as chowbus + tock to go, see hyper growth by focusing on unlocked pockets of supply. often have only low double digit supply overlap with the big4 in most cities. starting to pull demand away from big4. these are valuable supply relationships. 13/x

chownow also seeing growth surge during covid as consumers hunker down with their local favorites. unclear whether consumer demand will sustain if travel + local discovery return to pre-covid levels. 14/x

in summary, winning consumer mindshare is cutthroat. winning supplier exclusivity has never been harder. dynamics demanding consolidation. 15/x

curiosity for me is down the line: will current platforms remain sticky in spite of modularity/lower switching costs (such as in travel - booking, priceline dominant) or will we see a rise of integrated players such as in RE (with opendoor, ribbon, ibuyers.) /done

Read on Twitter

Read on Twitter