[ #BNPPTime https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗞️" title="Rolled-up newspaper" aria-label="Emoji: Rolled-up newspaper">]Conversational banking aims at developing different touch points for clients to enhance the #customerjourney by interacting in an easy & efficient way. The pandemic shows us the unprecedented necessity to develop it to face the challenges & better serve our #clients.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗞️" title="Rolled-up newspaper" aria-label="Emoji: Rolled-up newspaper">]Conversational banking aims at developing different touch points for clients to enhance the #customerjourney by interacting in an easy & efficient way. The pandemic shows us the unprecedented necessity to develop it to face the challenges & better serve our #clients.

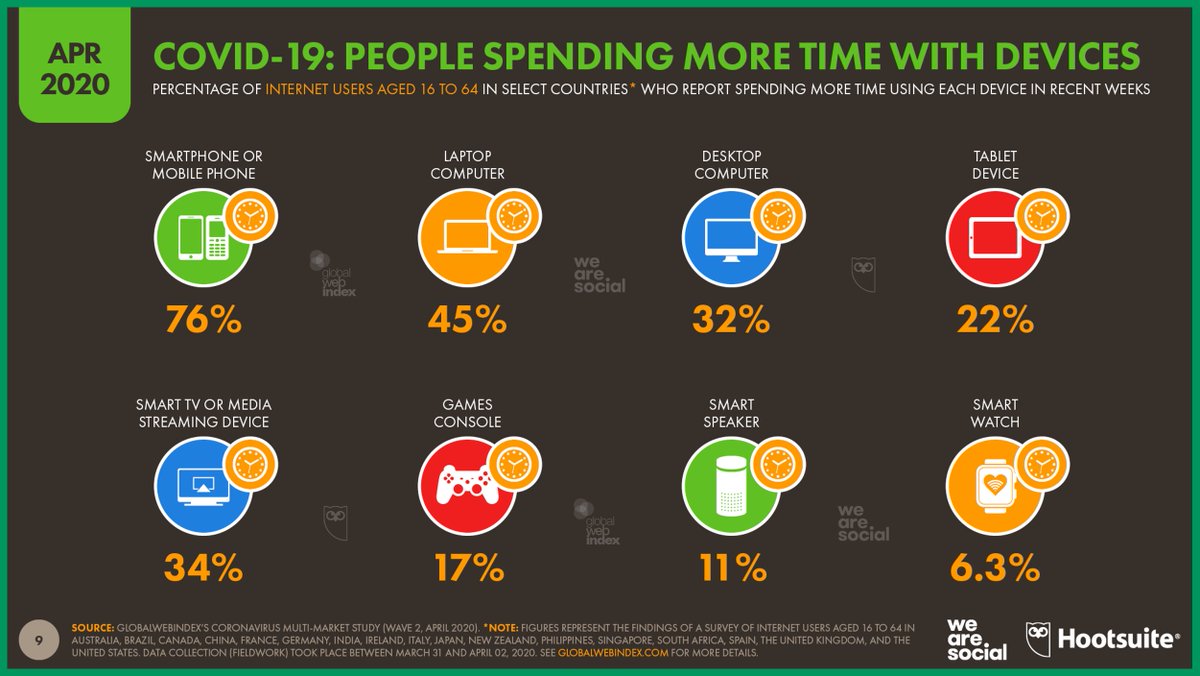

Indeed the current situation, due to the #COVID19 crisis, with lockdowns observed in many countries has drastically accelerated the use of #digital devices. For instance 76% internet users report spending more time on their #mobile in the recent weeks.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobile phone" aria-label="Emoji: Mobile phone">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobile phone" aria-label="Emoji: Mobile phone">

https://bit.ly/2Z3wcbV ">https://bit.ly/2Z3wcbV&q...

https://bit.ly/2Z3wcbV ">https://bit.ly/2Z3wcbV&q...

In order to protect our clients, our employees & slowdown the pandemic all our retail #banks recommend to prioritize #digital channels to realize banking operations.

@mabanque_bnpp @BankoftheWest @BNPPFBelgique @BNLBNPParibas_ @ukrsibbank @BNPParibas_PL @BMCI_BNPP @Hellobank_fr

@mabanque_bnpp @BankoftheWest @BNPPFBelgique @BNLBNPParibas_ @ukrsibbank @BNPParibas_PL @BMCI_BNPP @Hellobank_fr

As an example in  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇫🇷" title="Flag of France" aria-label="Emoji: Flag of France">, 2 #bots help the teams in their daily activity. Telmi for @mabanque_bnpp & Helloïz for @Hellobank_fr provide support to our clients and prospects 24/24 & 7/7 by answering more than 500 questions.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇫🇷" title="Flag of France" aria-label="Emoji: Flag of France">, 2 #bots help the teams in their daily activity. Telmi for @mabanque_bnpp & Helloïz for @Hellobank_fr provide support to our clients and prospects 24/24 & 7/7 by answering more than 500 questions.

https://bit.ly/3cvF65N ">https://bit.ly/3cvF65N&q...

https://bit.ly/3cvF65N ">https://bit.ly/3cvF65N&q...

What& #39;s next? We’ve identified  https://abs.twimg.com/emoji/v2/... draggable="false" alt="4⃣" title="Keycap digit four" aria-label="Emoji: Keycap digit four">axis to work on #voices in

https://abs.twimg.com/emoji/v2/... draggable="false" alt="4⃣" title="Keycap digit four" aria-label="Emoji: Keycap digit four">axis to work on #voices in  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇫🇷" title="Flag of France" aria-label="Emoji: Flag of France">:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇫🇷" title="Flag of France" aria-label="Emoji: Flag of France">:

-Voice biometric recognition

-Voice command to execute services in a simpler & faster way

-Qualification & reorientation to better know speakers’ requests

-Organize the insertion with third party providers as #GAFA

-Voice biometric recognition

-Voice command to execute services in a simpler & faster way

-Qualification & reorientation to better know speakers’ requests

-Organize the insertion with third party providers as #GAFA

Read on Twitter

Read on Twitter ]Conversational banking aims at developing different touch points for clients to enhance the #customerjourney by interacting in an easy & efficient way. The pandemic shows us the unprecedented necessity to develop it to face the challenges & better serve our #clients." title="[ #BNPPTimehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗞️" title="Rolled-up newspaper" aria-label="Emoji: Rolled-up newspaper">]Conversational banking aims at developing different touch points for clients to enhance the #customerjourney by interacting in an easy & efficient way. The pandemic shows us the unprecedented necessity to develop it to face the challenges & better serve our #clients." class="img-responsive" style="max-width:100%;"/>

]Conversational banking aims at developing different touch points for clients to enhance the #customerjourney by interacting in an easy & efficient way. The pandemic shows us the unprecedented necessity to develop it to face the challenges & better serve our #clients." title="[ #BNPPTimehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗞️" title="Rolled-up newspaper" aria-label="Emoji: Rolled-up newspaper">]Conversational banking aims at developing different touch points for clients to enhance the #customerjourney by interacting in an easy & efficient way. The pandemic shows us the unprecedented necessity to develop it to face the challenges & better serve our #clients." class="img-responsive" style="max-width:100%;"/>

https://bit.ly/2Z3wcbV&q..." title="Indeed the current situation, due to the #COVID19 crisis, with lockdowns observed in many countries has drastically accelerated the use of #digital devices. For instance 76% internet users report spending more time on their #mobile in the recent weeks. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobile phone" aria-label="Emoji: Mobile phone"> https://bit.ly/2Z3wcbV&q..." class="img-responsive" style="max-width:100%;"/>

https://bit.ly/2Z3wcbV&q..." title="Indeed the current situation, due to the #COVID19 crisis, with lockdowns observed in many countries has drastically accelerated the use of #digital devices. For instance 76% internet users report spending more time on their #mobile in the recent weeks. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobile phone" aria-label="Emoji: Mobile phone"> https://bit.ly/2Z3wcbV&q..." class="img-responsive" style="max-width:100%;"/>

, 2 #bots help the teams in their daily activity. Telmi for @mabanque_bnpp & Helloïz for @Hellobank_fr provide support to our clients and prospects 24/24 & 7/7 by answering more than 500 questions. https://bit.ly/3cvF65N&q..." title="As an example in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇫🇷" title="Flag of France" aria-label="Emoji: Flag of France">, 2 #bots help the teams in their daily activity. Telmi for @mabanque_bnpp & Helloïz for @Hellobank_fr provide support to our clients and prospects 24/24 & 7/7 by answering more than 500 questions. https://bit.ly/3cvF65N&q..." class="img-responsive" style="max-width:100%;"/>

, 2 #bots help the teams in their daily activity. Telmi for @mabanque_bnpp & Helloïz for @Hellobank_fr provide support to our clients and prospects 24/24 & 7/7 by answering more than 500 questions. https://bit.ly/3cvF65N&q..." title="As an example in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇫🇷" title="Flag of France" aria-label="Emoji: Flag of France">, 2 #bots help the teams in their daily activity. Telmi for @mabanque_bnpp & Helloïz for @Hellobank_fr provide support to our clients and prospects 24/24 & 7/7 by answering more than 500 questions. https://bit.ly/3cvF65N&q..." class="img-responsive" style="max-width:100%;"/>