Insurance. In India the first thing that comes to everyone& #39;s mind, on hearing the word & #39;insurance& #39;, is LIC - expanded as Life Insurance Corporation of India. In this thread we will discover few lesser-known facts about LIC and why insuring/investing with LIC is not a smart move

How many of us actually know what LIC is and how it functions? In fact, we often ignore to understand what LIC does with our money. All we know is that, after a certain period of time, for so and so amount of monthly/quarterly/annual premiums we will get a lump sum with returns

i.e principal + interest.

Many of us here actually have this idea that LIC provides us or our family a lump sum when we die irrespective of the time of death during the policy period. This is in fact true but we fail to recognize the other options that are even more profitable

Many of us here actually have this idea that LIC provides us or our family a lump sum when we die irrespective of the time of death during the policy period. This is in fact true but we fail to recognize the other options that are even more profitable

Also, how many of you know about the policy you have taken? LIC has various policies weird Hindi names which non-Hindi speakers cannot pronounce/understand. To an extent, you will know about the monthly premium that you pay and the lump sum you are promised to get at maturity

99% of the policyholders have no clue of their policies and state that they took the policy because an LIC agent said so. In India, every Tom, Dick and Harry becomes an LIC agent. Peep out of your window, your neighbour is one. Go to the office, your colleague& #39;s spouse is one.

Attend a family function, you mom& #39;s 2nd cousin& #39;s sister in law& #39;s brother will introduce himself as an LIC agent and will start advising you that at this age, for your salary, this is the perfect policy, makes you retire happily. And then we settle to buy that dross he sells.

India is a country where people lack financial knowledge and deliberately ignore to learn about it. Firms like LIC have been taking advantage of this for several decades and have made huge losses for people. Tbh, even banks produce better returns when compounded than LIC policies

To understand how LIC will provide our money at the time of death or maturity, let us first understand how LIC functions as a firm. Its not an insurance company per se. LIC is an investment firm which also sells insurance policies.

The premiums for the policies are used as investments of LIC which are directly invested into the market in stocks and bonds. This makes the policyholders to be investors of the market. The shocking truth is that the policyholders are not even aware of this.

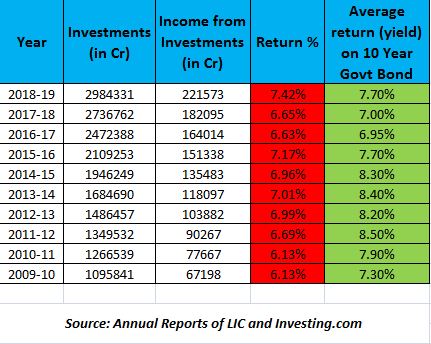

Considering that the insurance policies are nothing but investments plans, we have to check how does LIC handles these investments. Why? Because it is our money, of course. The image below shows some calculation which I did which compares two things - check red & green columns

Assuming you haven& #39;t gone through the numbers, allow me to explain it. The red column is rate of return on investments of LIC and green is rate of return on Govt bonds. LIC as a firm invests in the stock market like mutual fund houses. So consider it as an FD or MF to understand

Check out 2011-12. In the year in which Govt bonds gave 8.5% return, LIC gave a measly 6.69% return. If LIC were stupid they would& #39;ve invested in bonds alone to get a higher interest. But they are clever and will invest only in poor stocks. Idiots.

If LIC is gaining only a poor 6.5% average ROI on its investments (your money), how do you expect them to give better returns for you? Here is a shocking truth. If you sit and calculate, these policies barely generate 4-5% ROI annually. This hurts because even bank FD is better

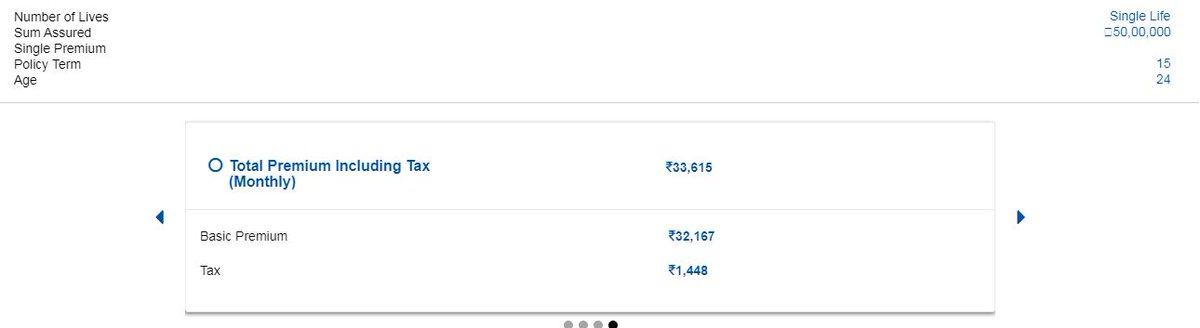

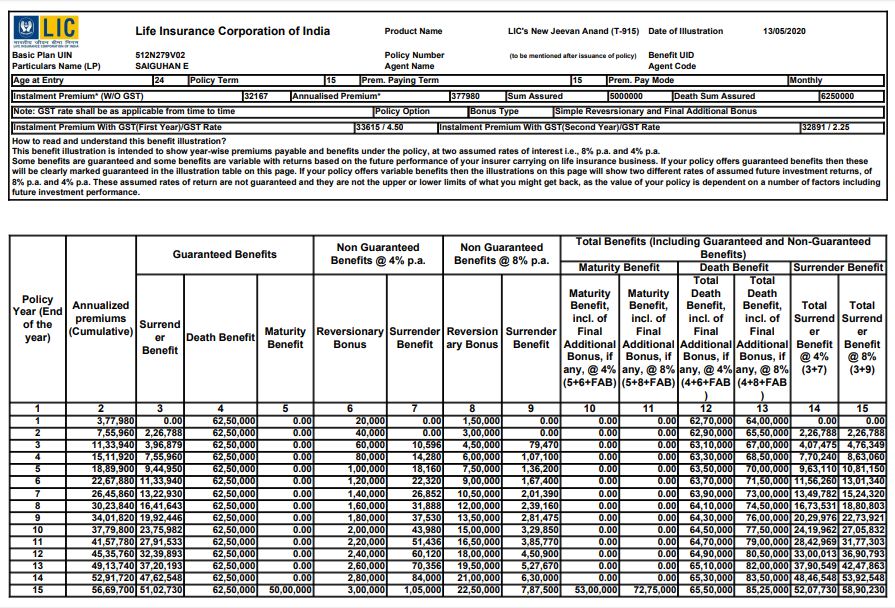

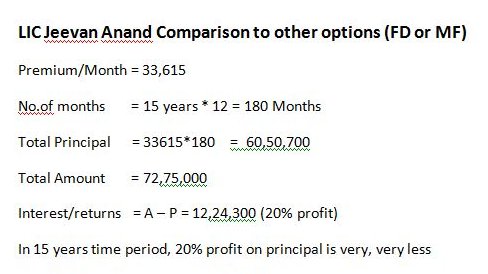

Here is something which I did yesterday. I tried to figure out how much returns does this famous endowment plan called New Jeevan Anand worked against other investment options. For a sum assured of 50L, I have to pay 33,615 INR monthly and will return me 73L in 15 years

So for a premium Principal of 33615 INR per month, this what the LIC Jeevan Anand can do provided I live at the time of maturity. 20% in 15 years is a joke. LIC is, in fact, a huge reason to a very poor transition from lower-middle-class to upper-middle-class population

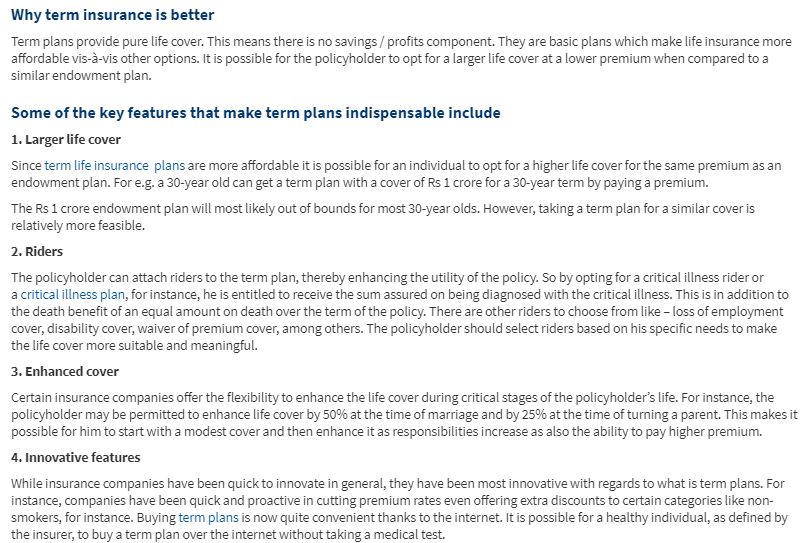

Now, what are the better options available for insurance now? How many of you have heard term insurance? Please read by yourselves, it is self-explanatory. This is so that you don& #39;t complain what if I die between the policy period. Cheers, term insurance to the rescue.

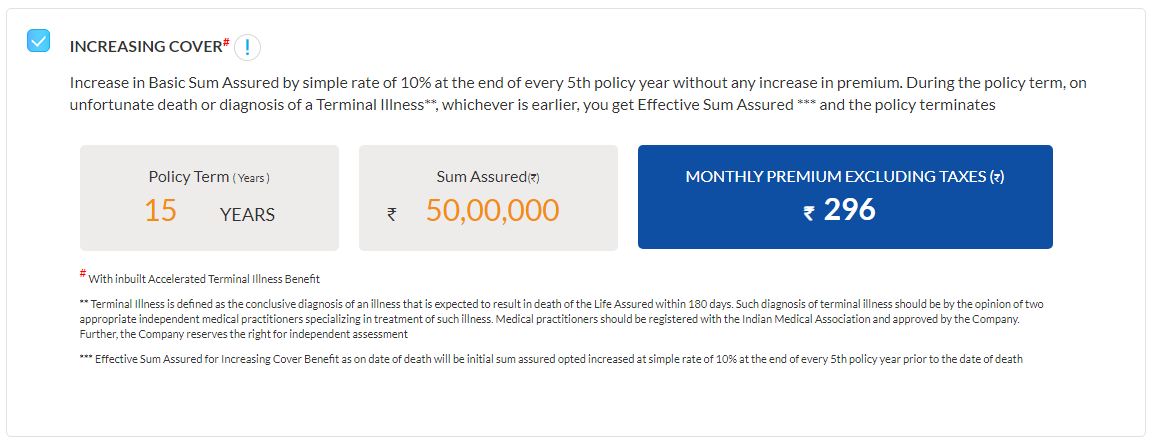

To make things easy, I have taken a look at SBI term insurance plan monthly for the same sum of 50L that was assured in LIC (15 years). SO THE AMOUNT YOU HAVE TO PAY FOR THE SAME IS A MEASLY 300 BUCKS PER MONTH!

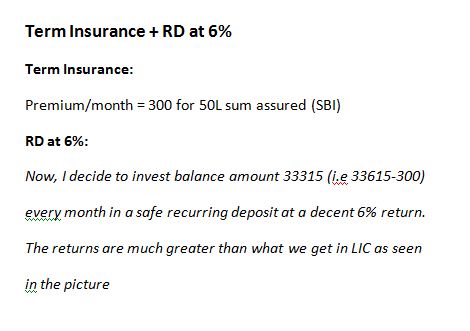

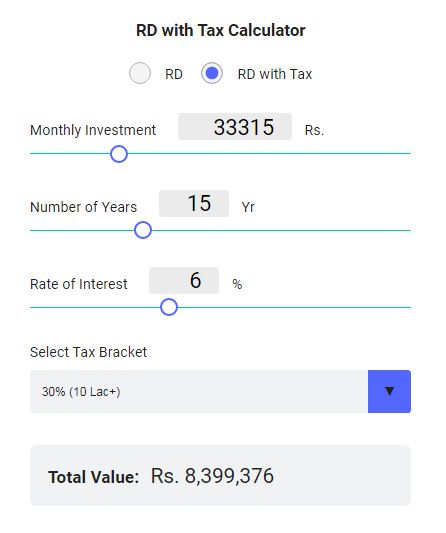

Now taking term insurance per month into the calculation. Let us subtract term insurance amount from the Jeevan Anand monthly premium. Now let us consider we are going to invest that LIC monthly premium in recurring deposit in a bank which gives an okayish interest of ~6%.

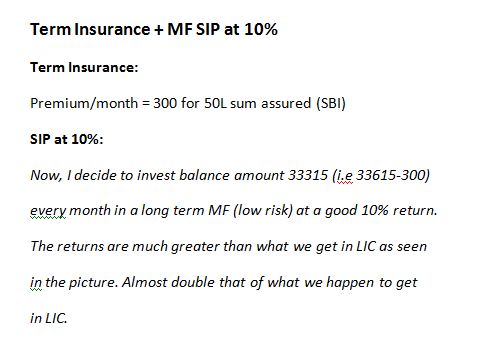

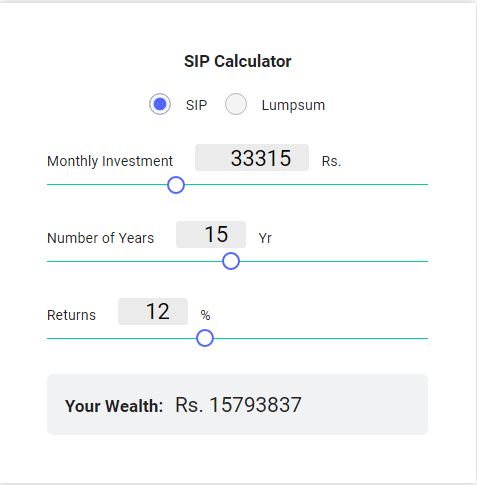

Astounding right? Even RD, at 6%, gives you 11L more than what you would get in LIC. Now let& #39;s look at a Mutual Fund (low risk, considering it is over a long period of 15 years). So you have to SIP the same amount of Jeevan Anand Monthly Premium minus the term insurance premium

Now you would& #39;ve realized what I am trying to convey now. Money, when invested in the right place, can do wonders and will exceed your expectations. An MF over 15 years with 12% interest will give you more than double than that of the LIC and almost 2.5 times your Principal money

Coming to a statement which few people think as an intellectual one. & #39;I treat LIC as a tax saver, it really helps me& #39; One of the basic lessons in money is to never mix up investments and income tax. There are various ways to reduce your tax deductions and better options than LIC

I get quite surprised when people say that LIC is the safest bet that is out there. But in reality, any investment over a period as long as 15 years is a safe investment. If you say investing in mutual funds or the markets is risky, think again, where does LIC invest your money?

If you still think you want the safest option, then you can stick to bank deposits and bank/govt bonds. As shown earlier, even they provide better returns than LIC. And yeah, please don& #39;t forget about term insurance. Oops, health insurance as well.

So with this tweet, we have come to the end of this long thread, I suppose. Please insure yourself and your family. To save money is important and to save it in a proper way is even more important. RT and like this thread if you find this useful. Thanks for reading!

Read on Twitter

Read on Twitter