(Thread) Why do I own individual stocks?

Thesis:

1. The digitalization of our world is 10% complete.

2. This megatrend will continue for at least another decade.

3. If you enjoy spending your free time on individual stocks, then the potential for outsized returns is possible.

Thesis:

1. The digitalization of our world is 10% complete.

2. This megatrend will continue for at least another decade.

3. If you enjoy spending your free time on individual stocks, then the potential for outsized returns is possible.

I invest intending to hold my shares indefinitely and allow my investments to compound over time. I don’t believe that it is possible to time the market. Markets go up and down. I hold on knowing that quality businesses tend to bounce back.

If you believe in your thesis and what you think is a fair valuation, then go ahead. Don& #39;t wait for a stock to potentially drop another 2-3%. It doesn& #39;t matter if you have a long term investment horizon.

Holding on through bad and good times has resulted in the following 10 Baggers in my personal portfolio in the last 2 decades - $EBAY $TTWO $ATVI $AMZN $NTES $ORCL

There were also costly lessons where the noise made me sell way too early. $APPL $ADBE $NKE $NVDA $SHOP

There were also costly lessons where the noise made me sell way too early. $APPL $ADBE $NKE $NVDA $SHOP

Some investments also went to $0 (CMGI, SEGA) during the Dot Com crash. In other years I realized losses of more than 50% e.g. in $UAA $GPRO

In the grand scheme of things, it didn& #39;t matter. That& #39;s what keeps me motivated to keep going.

I look at 3 types of companies:

In the grand scheme of things, it didn& #39;t matter. That& #39;s what keeps me motivated to keep going.

I look at 3 types of companies:

1.Established companies who adapt their business models for the digital age $SBUX

2.Companies who successfully disrupt an industry with new business models $AMZN

3.Companies that further enable the digital transformation with their services $WORK

Approach developed by @the_dlf

2.Companies who successfully disrupt an industry with new business models $AMZN

3.Companies that further enable the digital transformation with their services $WORK

Approach developed by @the_dlf

The majority of my investments fall into category 2 and 3, with a focus on high growth companies.

I will only invest in companies whose business models I understand.

I will only invest in companies whose business models I understand.

Some examples of industries where I am comfortable placing my bets are:

1. Online Gaming

2. Social Media

3. SaaS

4. Cloud

5. FinTech

6. Online Advertising

You will never see me invest money in the banking, oil, airline industry. These are out of my circle of competence.

1. Online Gaming

2. Social Media

3. SaaS

4. Cloud

5. FinTech

6. Online Advertising

You will never see me invest money in the banking, oil, airline industry. These are out of my circle of competence.

I evaluate

- the underlying business,

- the competitive landscape,

- the size of the total addressable market,

- quality of the management,

- their plans, and a proven track record of strong execution against those plans

- the underlying business,

- the competitive landscape,

- the size of the total addressable market,

- quality of the management,

- their plans, and a proven track record of strong execution against those plans

I try to find companies whose product or service has or is about to catch on with mass adoption.

I like companies led by founder CEO& #39;s, who have significant skin in the game via high insider ownership.

I don’t invest in IPO& #39;s.

I like companies led by founder CEO& #39;s, who have significant skin in the game via high insider ownership.

I don’t invest in IPO& #39;s.

I need to see intact customer growth, strong and stable or even improving retention metrics

I need to see high gross margins and a clear and believable path towards profitability via positive operating margins and cash flows.

I need to see high gross margins and a clear and believable path towards profitability via positive operating margins and cash flows.

From a bird& #39;s eye perspective, the ideal software company has

Gross Margin >75%,

Rule of 40 >50%,

Revenue Growth >40%,

with consistent revenue growth numbers over several years, at a reasonable EV/Sales valuation

Gross Margin >75%,

Rule of 40 >50%,

Revenue Growth >40%,

with consistent revenue growth numbers over several years, at a reasonable EV/Sales valuation

Evaluate your holdings at a frequency you are comfortable with.

When in doubt, get out. Avoiding risk is fundamental to accumulating wealth. Don’t fall in love with a stock.

Ignore "Infotainment" and people who make predictions about where the economy is going.

When in doubt, get out. Avoiding risk is fundamental to accumulating wealth. Don’t fall in love with a stock.

Ignore "Infotainment" and people who make predictions about where the economy is going.

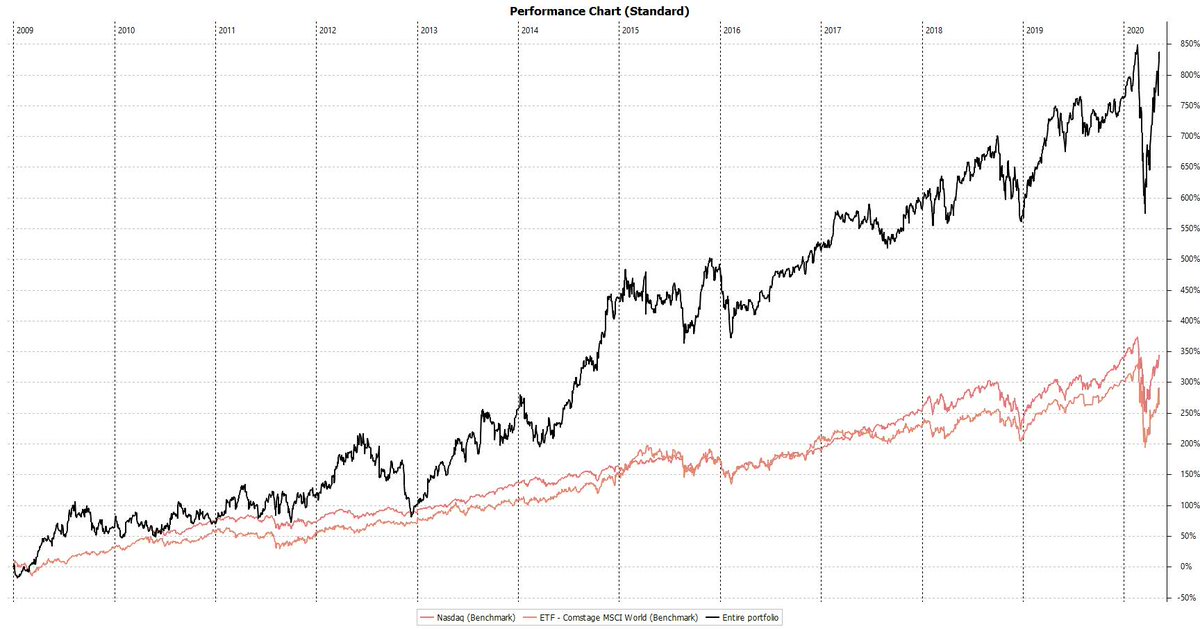

I openly share my portfolio performance once a month here on Twitter and on https://highgrowthinvesting.substack.com/ ">https://highgrowthinvesting.substack.com/">... .

I have nothing to sell. I do this to keep me accountable, my thinking sharp, and to connect and learn more from the incredible FinTwit crowd.

I have nothing to sell. I do this to keep me accountable, my thinking sharp, and to connect and learn more from the incredible FinTwit crowd.

Special thanks to the following people whose content has influenced my thinking and has helped me further fine-tune my personal investment style.

@the_dlf @FromValue @saxena_puru @richard_chu97 @adventuresinfi @StockNovice @7investing

@the_dlf @FromValue @saxena_puru @richard_chu97 @adventuresinfi @StockNovice @7investing

Read on Twitter

Read on Twitter