@nsitharaman says coming from south India, i know some people were wondering what aatmanirbhar means and translates the word into 4 south Indian languages. Have to give it to this woman  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">

Land, labour, liquidity and law. Will be the pillars of reform #economicpackage.

Aatmanirbhar doesn& #39;t mean India will be an isolationist country. It means a confident India which can rely on its capabilities.

Now she& #39;s talking about reforms done earlier for the poor. DBT. JAM Trinity. Micro insurance. Awas Yojana. Ujjwala yojana. Swachh bharat and Ayushmann bharat. For agri, Fasal bima, fisheries dept, krishi sinchai

Reasserts achievement of India becoming power surplus and cleaning up of coal mine sector.

Anurag thakur takes over. Talks about challenges of COVID and refers to PM& #39;s speech. & #39;Indians are now looking for opportunities during a crisis& #39;. First step taken was through PM garib kalyan yojana to deal with pandemic. 3 months moratorium for compliance etc

Talks about demographic power, youth power.

@nsitharaman takes over again.

She talks about proactive role played by government in consulting after the budget in July 2019. Gives stats on garib kalyan and transfer of pulses and grains.

Beginning today, for the next few days she& #39;ll be coming with her team to put forward details of the economic package in various tranches. Talks about responsibility towards, poor, migrant workers, senior citizens, divang, etc.

18,000cr worth of refunds wer e given through IT drive.

Today they& #39;ll be announcing 15 measures out of which 6 will be for msme, 2 for provident funds, 2 for nbfc, 1 for discoms.

3L cr worth of automatic loans fro businesses including msmes.

No new collateral, no guarantee fees on it.

20,000 cr subordinate debt for stressed msmes. Stressed msmes do have a problem of equity. 2L msmes to benefit from this. NPAs or stressed msmes will be eligible for it.

Anurag thakur gives hindi translation of the same.

50,000 cr. Equity infusion through a fund of funds. Benefits to msmes who are viable and may need handholding due to covid. Will also help these msmes to get listed in the market in the future.

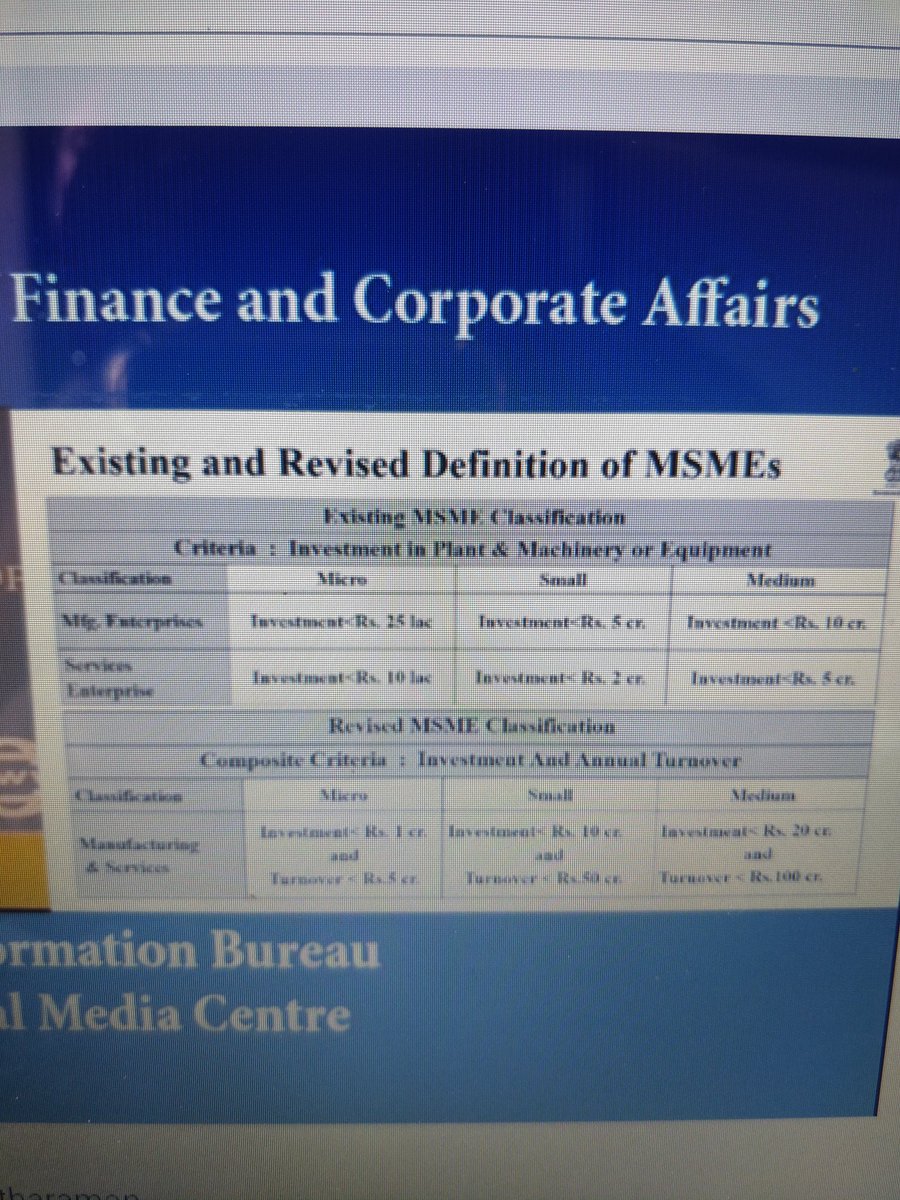

New definition of MSMEs. Investment limit will be revised upwards. Additional criteria of turnover also being introduced. This is to address fears of MSMEs who worried about growing and losing benefits. Amendments will be brought about it.

Manufacturing and Service MSME shall be defined as uniformly.

For government procurement, global tenders to disallowed upto 200cr. To prevent unfair competition from foreign companies.

Post-COVID trade fairs will be difficult, so emarket linkages to be promoted.

Within next 45 days, all receivables from GoI to be cleared.

Rs. 2500cr epf support for business and workers for 3 months.

Another 3 months extension i.e. for months of June, July and August. Benefit for 3.67 lakhs establishments and for 72.22L employees

Statutory PF contribution is being reduced from 12% to 10% for 3 months. So that employers have more funds. Government employers will still pay 12%, however gov employees will have the benefit of paying 10%

30,000 cr special liquidity scheme for NBFCs/HFCs/MFIs. Investment will be made in both primary and secondary market transactions in investment grade debt papers.

This will be wholly guaranteed by GoI.

45,000 cr partial credit guarantee scheme for NBFCs. Existing scheme which will be extended to cover borrowings such as primary issuance of bonds/CPs etc. AA papers and below unrated paper eligible for investment.

90,000 cr liquidity injection for DISCOMs. All states discoms in crisis. This is to address unprecedented cash flow problems. Loans 2 be given against state guarantees for exclusive purpose of discharging liabilities of discoms. CPSGCs shall give rebate to discoms to be passed on

All GoI agencies like Railways, etc will give upto 6 months extension to contractors to comply with contract conditions. Extension of concessional period in PPP contracts. Government agencies will partially release Bank Guarantees to the extent of contract completed.

Extension of Registration and Completion Date of Real Estate Projects under RERA. @MoHUA_India will advise regulators to treat COVID-19 as & #39;Force Majeur& #39; under RERA. All registration and completion dates suo moto extended by 6 m for all regd. projects expiring on or after25/03/20

TDS/TCS rates reduced by 25% of existing rates. Shall be applicable from tomorrow till 31st March 2021. Reduction will release liquidity of 50,000 crs.

All pending refunds to charitable trusts and non corporate businesses and professions shall be issued immediately. Like proprietorships, partnerships etc.

Due date of all income tax return for FY 2019-20 will be extended 31st July 2020 and 31/10/20 to 30/11/20.

Date of assesment getting barred on 30/09/20 extended to 31/12/20 and those getting barred on 31/03/21 extended to 30/09/21.

Period of Vivad se Vishwas scheme for making payment without additional amount will be extended to 31/12/2020.

Read on Twitter

Read on Twitter