Watch Live: Union Finance Minister @nsitharaman addressing a Press Conference. https://youtu.be/J2AIUbvr4OI ">https://youtu.be/J2AIUbvr4...

Essentially, the goal is to build a #SelfReliantIndia, that is why the #EconomicPackage is called #AatmaNirbharBharatAbhiyan: FM @nsitharaman

Given pillars based on which we seek to build #AatmanirbharBharat, our focus would be on land, labour, liquidity and law. A global value chain integration is a part of this vision: FM @nsitharaman #AatmaNirbharBharatAbhiyan

The Government under PM @narendramodi has been a listening and responsive government, hence it is fitting to recall some reforms which have been undertaken since 2014: FM @nsitharaman

#AatmaNirbharBharatAbhiyan

#AatmaNirbharBharatAbhiyan

New fisheries departments, Krishi Sinchayee Yojana, PSB cleanups, public sector recapitalization, FDI liberalization, #EaseOfDoingBusiness reforms, IBC reforms, GST reforms: FM @nsitharaman recalls various reforms undertaken by the Govt. #AatmaNirbharBharatAbhiyan

The resolve to build an #AatmanirbharBharat brings in a new energy to the nation, where we see opportunity in crisis, this is part of the reason why India has been able to manage #COVID19 with strength: MoS, @ianuragthakur

#AatmaNirbharBharatAbhiyan

#AatmaNirbharBharatAbhiyan

PM @narendramodi is known to make big decisions, this mindset is going to become India #AatmanirbharBharat. PM has announced a historic package of ₹ 20 lakh crore: MoS @ianuragthakur

#AatmaNirbharBharatAbhiyan

#AatmaNirbharBharatAbhiyan

Soon after #Budget2020 came #COVID19. Within hours of the announcement of lockdown, #PradhanMantriGaribKalyanPackage was announced. We are going to build on this package: FM @nsitharaman

#AatmaNirbharBharatAbhiyan

#AatmaNirbharBharatAbhiyan

Beginning today, for the next few days, I shall be coming with the entire @FinMinIndia team to detail the PM& #39;s vision for #AatmanirbharBharat laid out by him yesterday: FM @nsitharaman

#AatmaNirbharBharatAbhiyan

#AatmaNirbharBharatAbhiyan

We ensured that ₹ 18,000 crore of refund was given to all taxpayers, the intention being that liquidity should be in the hands of the people. 14 lakh taxpayers have benefited from this: FM @nsitharaman

#AatmaNirbharBharatAbhiyan

#AatmaNirbharBharatAbhiyan

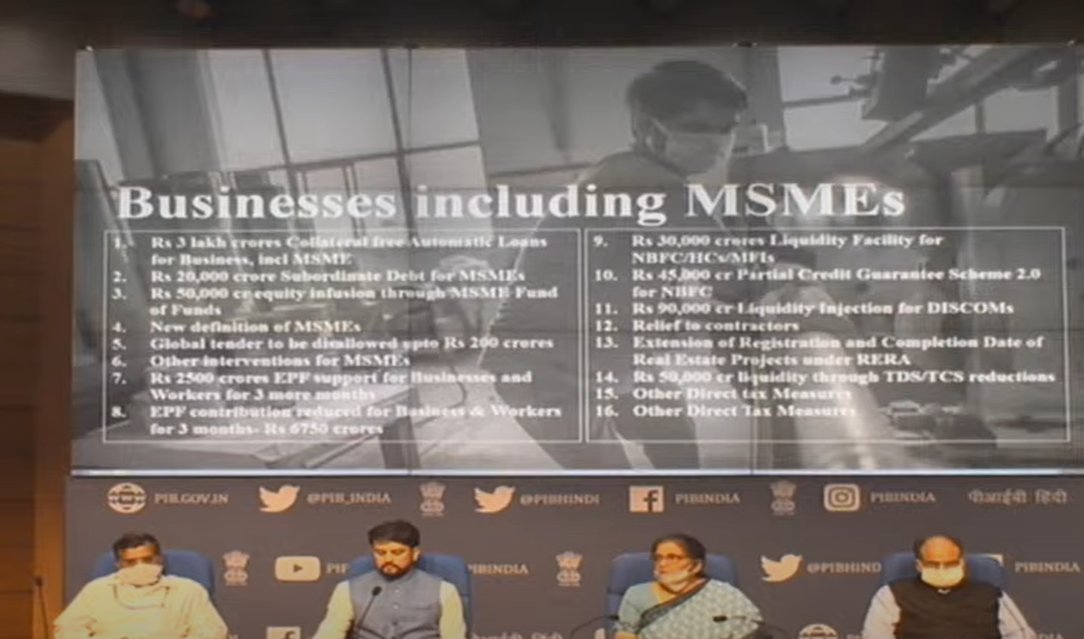

Today, the #EconomicPackage has 16 different measures

6 of which deal with MSMEs

2 relating to EPF

2 relating to NBFCs, housing finance corporations and MFIs

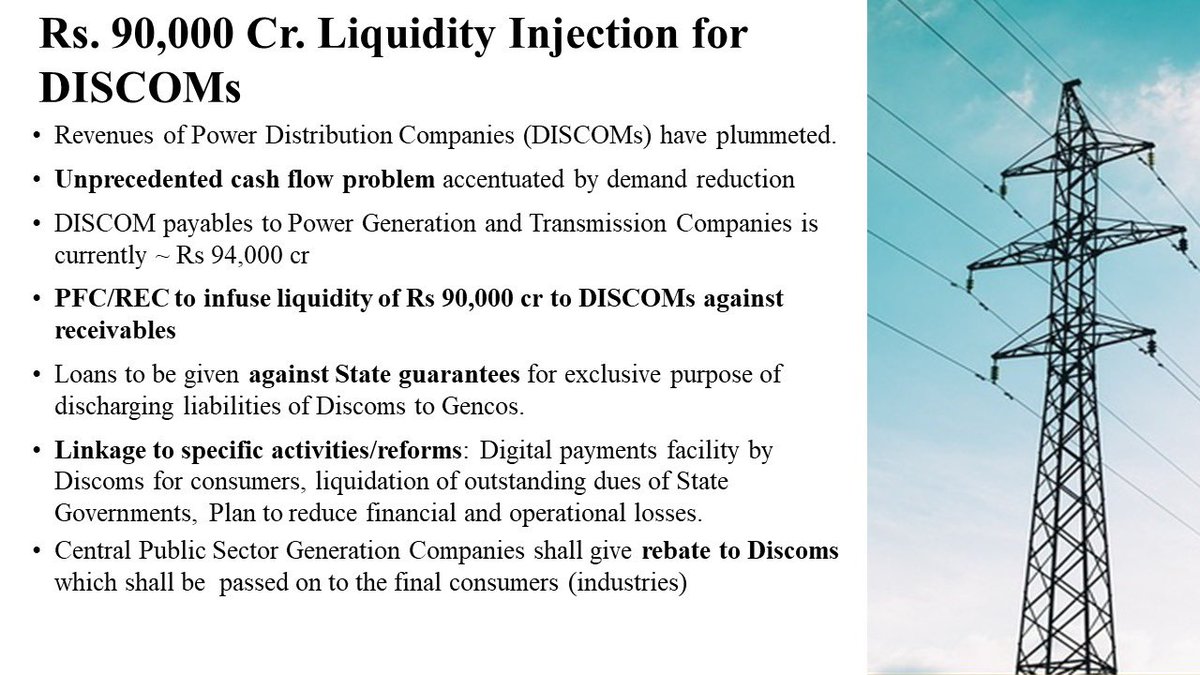

1 on discoms

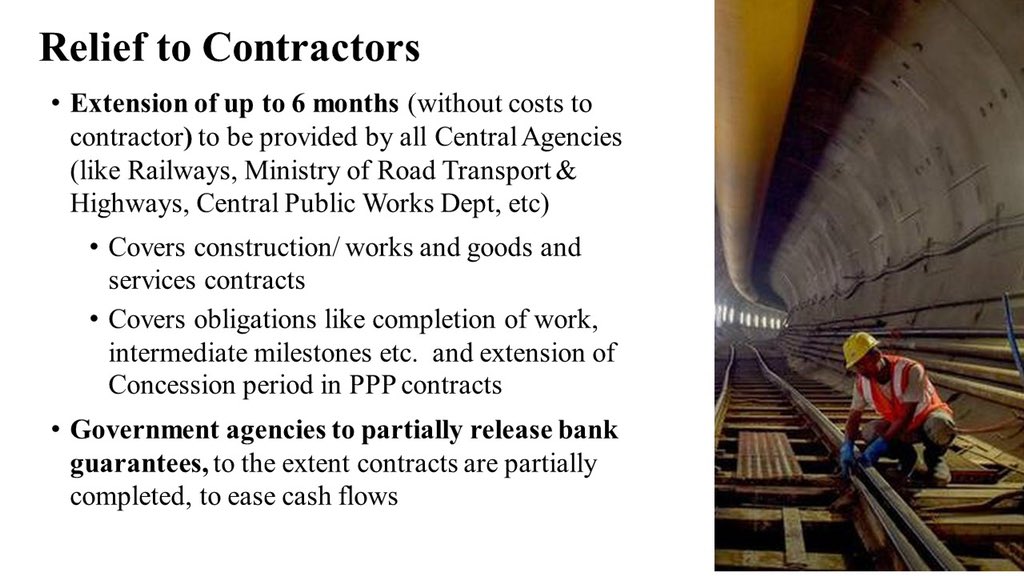

1 on contractors

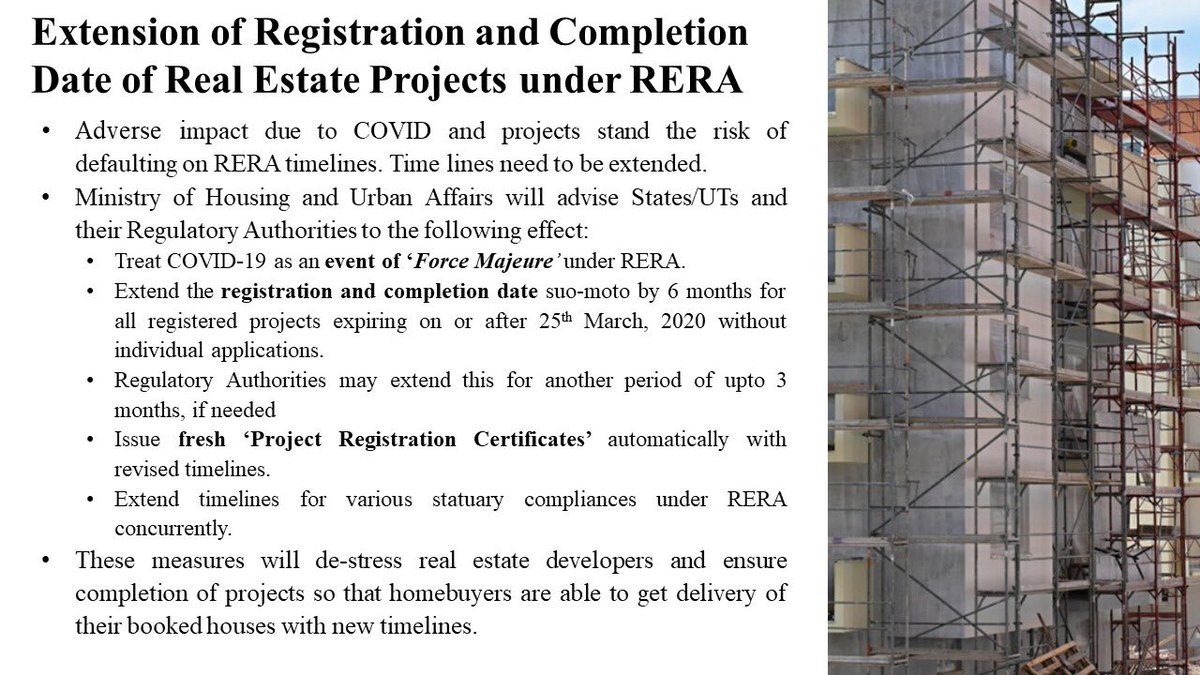

1 on real estate

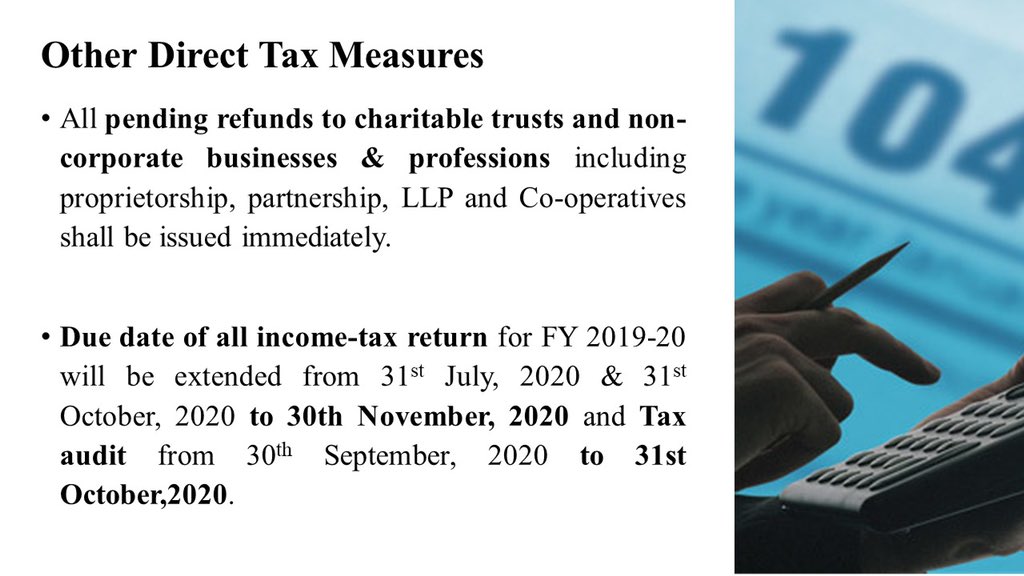

3 on tax measures: FM @nsitharaman #AatmaNirbharBharatAbhiyan

6 of which deal with MSMEs

2 relating to EPF

2 relating to NBFCs, housing finance corporations and MFIs

1 on discoms

1 on contractors

1 on real estate

3 on tax measures: FM @nsitharaman #AatmaNirbharBharatAbhiyan

A collateral-free automatic loan is being given to MSMEs, with a facility of ₹ 3 lakh crores.

This will enable 45 lakh MSME units to resume business activity and also safeguard jobs: FM @nsitharaman

#AatmaNirbharBharatAbhiyan #EconomicPackage #AatmanirbharBharat

This will enable 45 lakh MSME units to resume business activity and also safeguard jobs: FM @nsitharaman

#AatmaNirbharBharatAbhiyan #EconomicPackage #AatmanirbharBharat

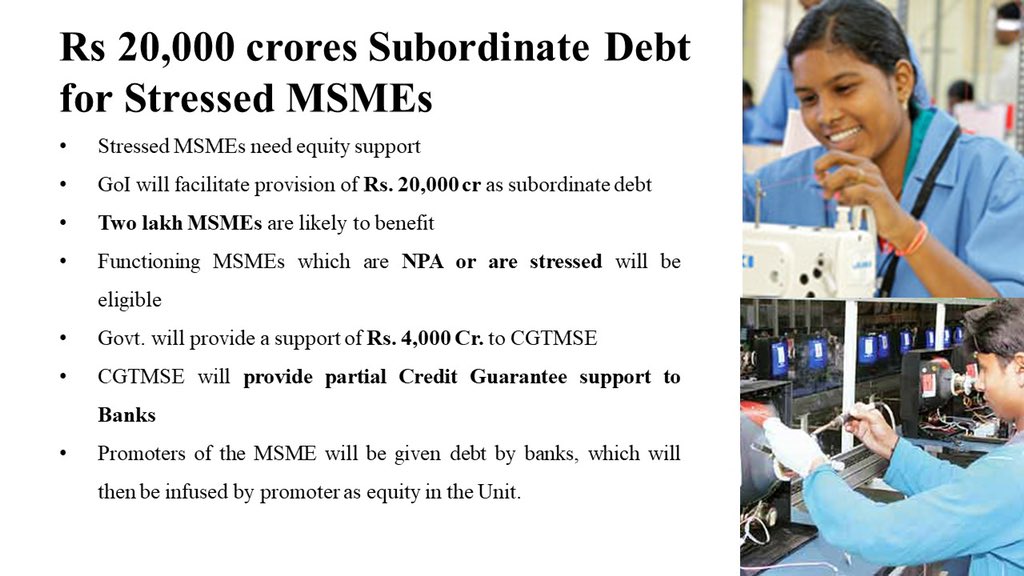

The second measure is for stressed MSMEs, who will be provided 20,000 crore via subordinate debt, will benefit about 2 lakh MSMEs : FM @nsitharaman #AatmaNirbharBharatAbhiyan #EconomicPackage

For MSMEs needing handholding, A ₹50,000 crore #FundofFunds through mother fund - daughter fund framework is being created, to expand their capacity and to get listed on markets which they choose : FM @nsitharaman #AatmaNirbharBharatAbhiyan

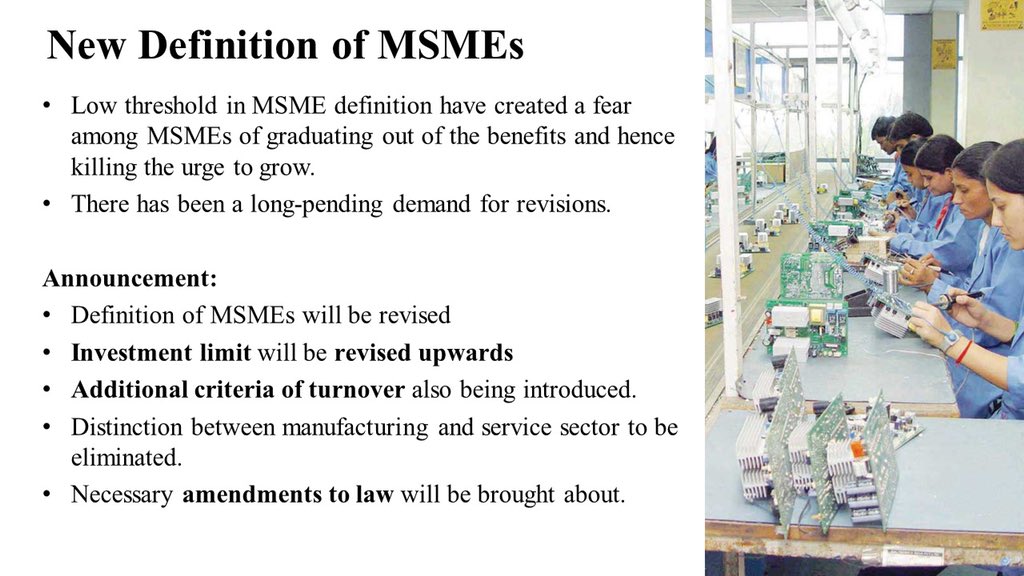

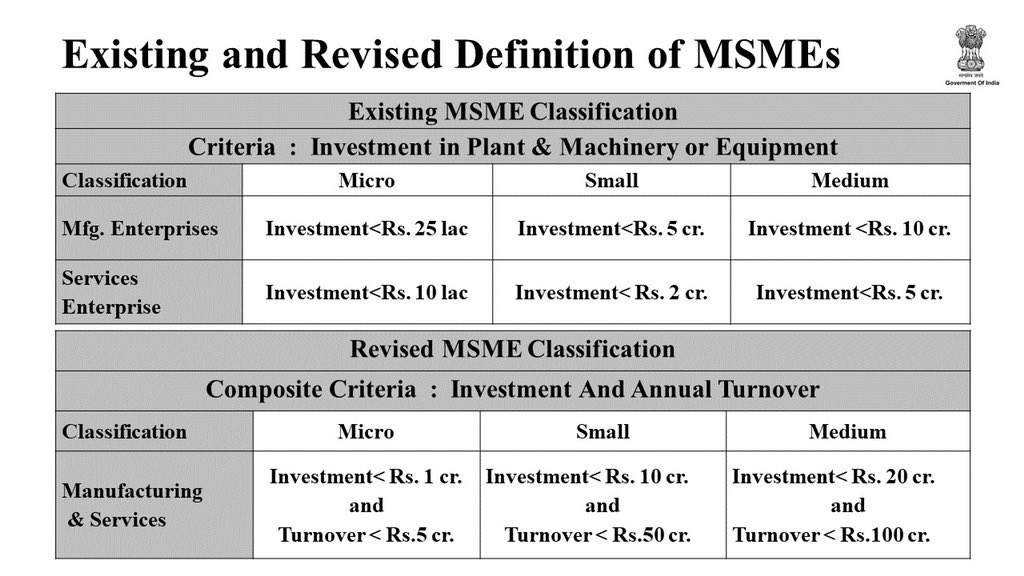

FM @nsitharaman anounces #NewMSMEDefinition, in favour of MSMEs, to address MSMEs& #39; fear of losing benefits due to outgrowing the MSME definition.

Now, MSMEs need not worry about growing in size, they can continue to receive MSME benefits.

#AatmaNirbharBharatAbhiyan

Now, MSMEs need not worry about growing in size, they can continue to receive MSME benefits.

#AatmaNirbharBharatAbhiyan

#AatmaNirbharBharatAbhiyan

Global tenders will be disallowed in government procurement for tenders up to ₹ 200 crore. This will address unfair competition being faced by MSMEs, and enable them to participate actively in government purchases : FM @nsitharaman #AtmaNirbharBharatAbhiyan

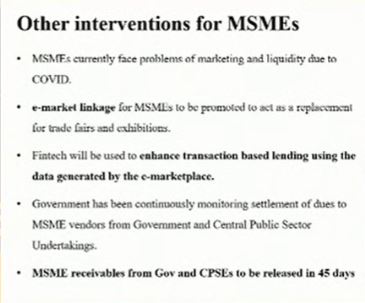

Seamless e-market linkages across the board will be provided to MSMEs, considering their inability to participate in trade fairs due to #COVID19.

All pending payments to MSMEs, from central govt. bodies & PSUs to be done within next 45 days: FM #AtmaNirbharBharatAbhiyan

All pending payments to MSMEs, from central govt. bodies & PSUs to be done within next 45 days: FM #AtmaNirbharBharatAbhiyan

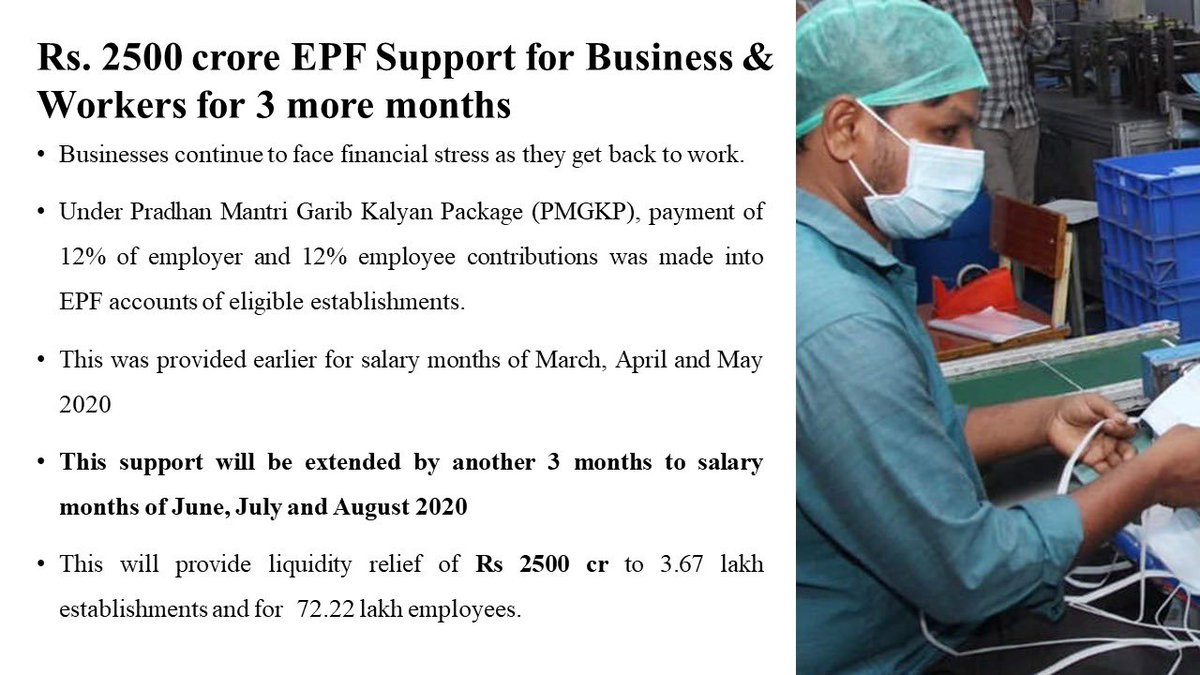

To ease financial stress as businesses get back to work, Government decides to continue EPF Support for Business & Workers for 3 more months providing a liquidity relief of Rs 2,500 crore. #AatmaNirbharBharatAbhiyan

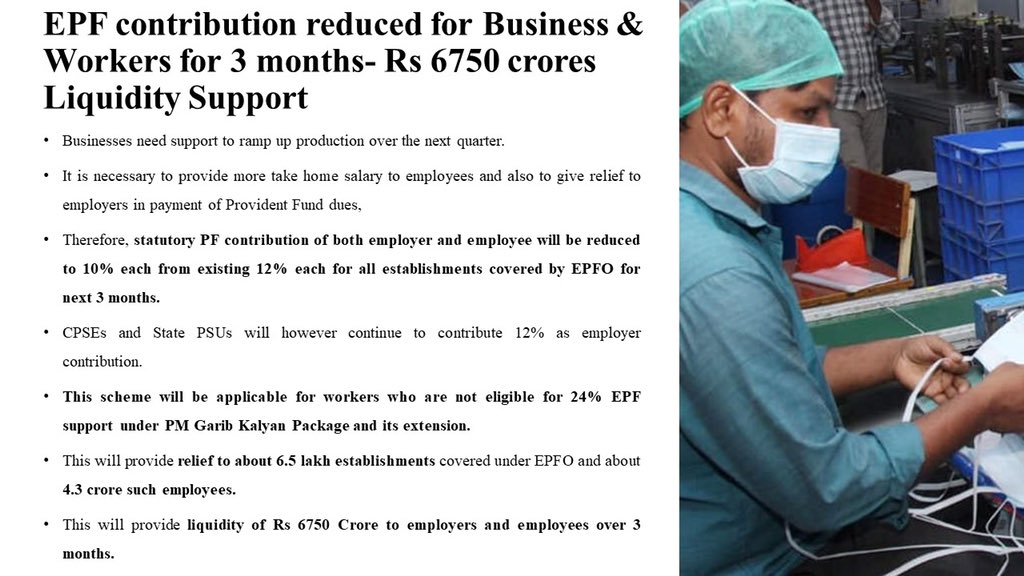

In order to provide more take home salary for employees and to give relief to employers in payment of PF, EPF contribution is being reduced for Businesses & Workers for 3 months, amounting to a liquidity support of Rs 6750 crores. #AatmaNirbharBharatAbhiyan

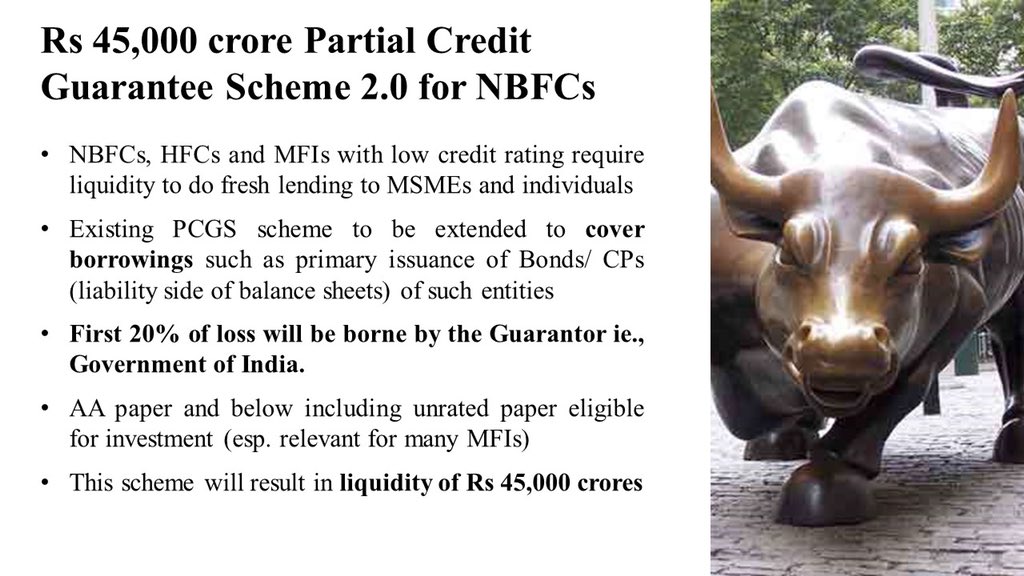

Government announces Rs 45,000 crore liquidity infusion through a Partial Credit Guarantee Scheme 2.0 for NBFCs. #AatmaNirbharBharatAbhiyan

To give a fillip to DISCOMs with plummeting revenue and facing an unprecedented cash flow problem, Government announces Rs. 90,000 Crore Liquidity Injection for DISCOMs. #AatmaNirbharBharatAbhiyan

In a major relief to contractors, all Central agencies to provide an extension of up to 6 months, without cost to contractor, to obligations like completion of work covering construction and goods and services contracts. #AatmaNirbharBharatAbhiyan

. @MoHUA_India will advise States/UTs and their Regulatory Authorities to extend the registration and completion date suo-moto by 6 months for all registered projects expiring on or after 25th March, 2020 without individual applications.

Government to infuse Rs 50,000 crores liquidity by reducing rates of TDS, for non-salaried specified payments made to residents, and rates of Tax Collection at Source for specified receipts, by 25% of the existing rates. #AatmaNirbharBharatAbhiyan

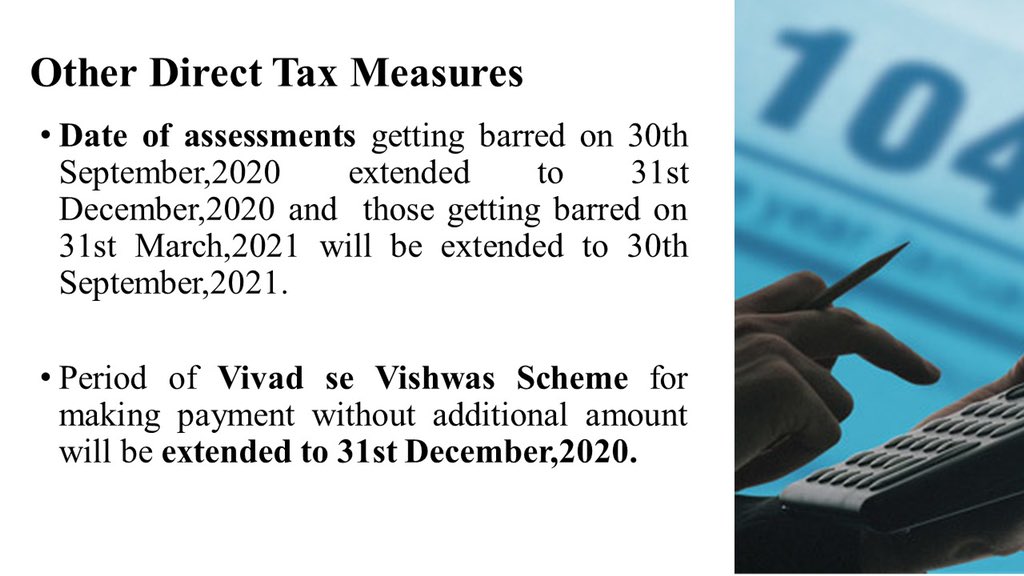

Among other measures, Due date of all income-tax return for FY 2019-20 will be extended from 31st July, 2020 & 31st October, 2020 to 30th November, 2020 and Tax audit from 30th September, 2020 to 31st October,2020. #AatmaNirbharBharatAbhiyan

Read on Twitter

Read on Twitter

Investment limit for MSME increasedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Additional criteria for turnover sizehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Distinction between manufacturing and service MSME removed! : FM @nsitharaman announcing #NewMSMEDefinition #AatmaNirbharBharatAbhiyan" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Investment limit for MSME increasedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Additional criteria for turnover sizehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Distinction between manufacturing and service MSME removed! : FM @nsitharaman announcing #NewMSMEDefinition #AatmaNirbharBharatAbhiyan" class="img-responsive" style="max-width:100%;"/>

Investment limit for MSME increasedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Additional criteria for turnover sizehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Distinction between manufacturing and service MSME removed! : FM @nsitharaman announcing #NewMSMEDefinition #AatmaNirbharBharatAbhiyan" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Investment limit for MSME increasedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Additional criteria for turnover sizehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Distinction between manufacturing and service MSME removed! : FM @nsitharaman announcing #NewMSMEDefinition #AatmaNirbharBharatAbhiyan" class="img-responsive" style="max-width:100%;"/>