People misunderstand this $$ investment thing.

It& #39;s more about the preservation of the value of your money than it is about making more money.

But they don& #39;t know.

It& #39;s more about the preservation of the value of your money than it is about making more money.

But they don& #39;t know.

Here& #39;s the thing, when you buy $$ today and try to sell it that same today to get your Naira back, you are not in anyway better of but worse of.

Why?

Because of spread (bid - ask). You sell at a lower rate buy at an higher rate.

Buy for 420, sell for 415.

Why?

Because of spread (bid - ask). You sell at a lower rate buy at an higher rate.

Buy for 420, sell for 415.

If you let it be for one year within that one year, if $ exchange rate to Naira was stable, the only appreciation you get is the interest you earn for investing in $

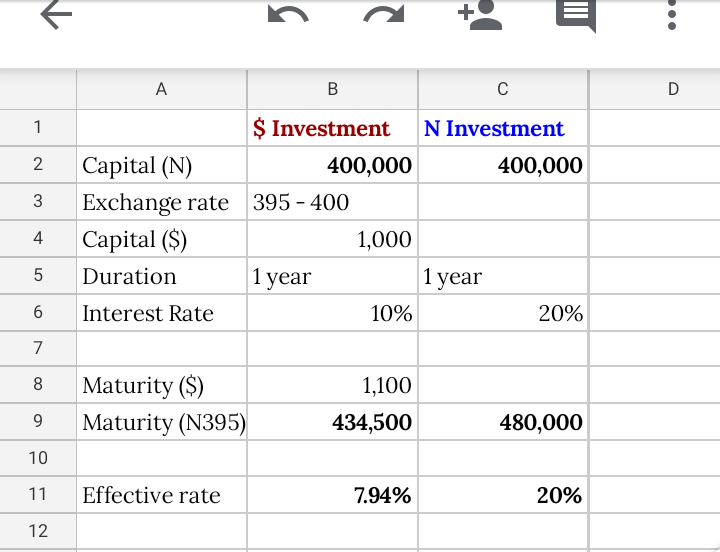

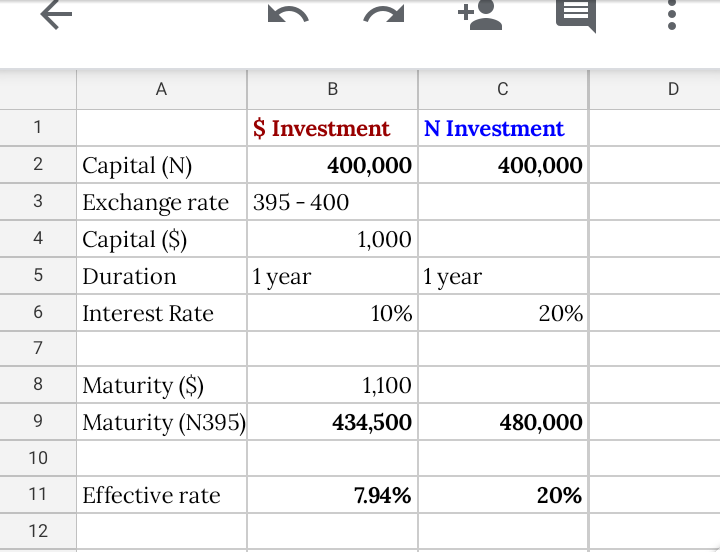

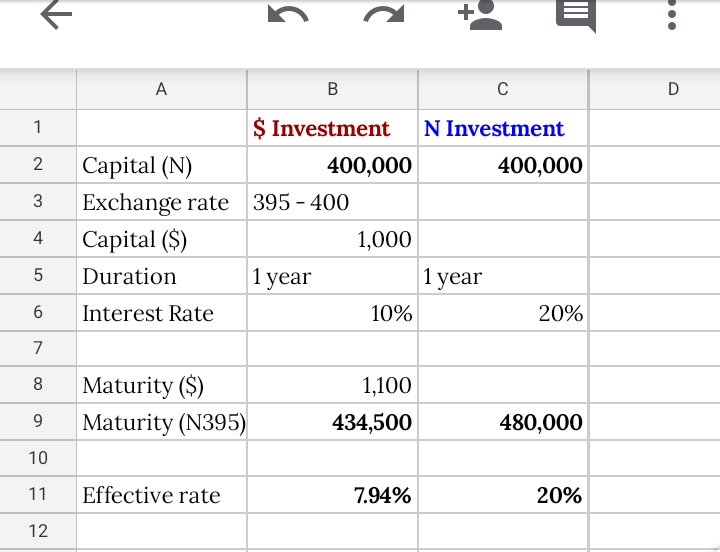

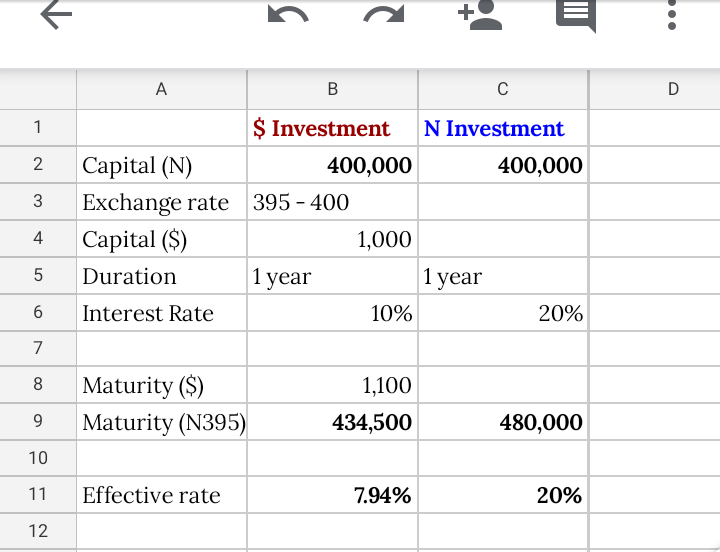

Let& #39;s assume that is like 10%. Your 1,000$ turns $1,100

Let& #39;s assume you need to turn that $ back to Naira...

Let& #39;s assume that is like 10%. Your 1,000$ turns $1,100

Let& #39;s assume you need to turn that $ back to Naira...

You get N440,000 (assuming a stable exchange rate of 400).

But remember you would have bought for higher. Which means your effective return is less than 10%.

But remember you would have bought for higher. Which means your effective return is less than 10%.

If the condition of a stable $$ hold true within that year, the question you want to ask yourself in order to fully quantify your return is what was the opportunity cost?

Are there other Naira investments that I could& #39;ve done that will return higher than 10%?

Are there other Naira investments that I could& #39;ve done that will return higher than 10%?

If the answer is yes, and it is yes as it stands today, then you are no way better off than those who didn& #39;t change their money to $$.

Why?

Let& #39;s assume you find a Naira investment that can pay you 20% on your N400k at maturity, you get N480k unlike your friend who gets <N440k

Why?

Let& #39;s assume you find a Naira investment that can pay you 20% on your N400k at maturity, you get N480k unlike your friend who gets <N440k

When then does $$ investment makes sense?

I will come back to answer that under this thread.

Stay connected.

I will come back to answer that under this thread.

Stay connected.

Read on Twitter

Read on Twitter