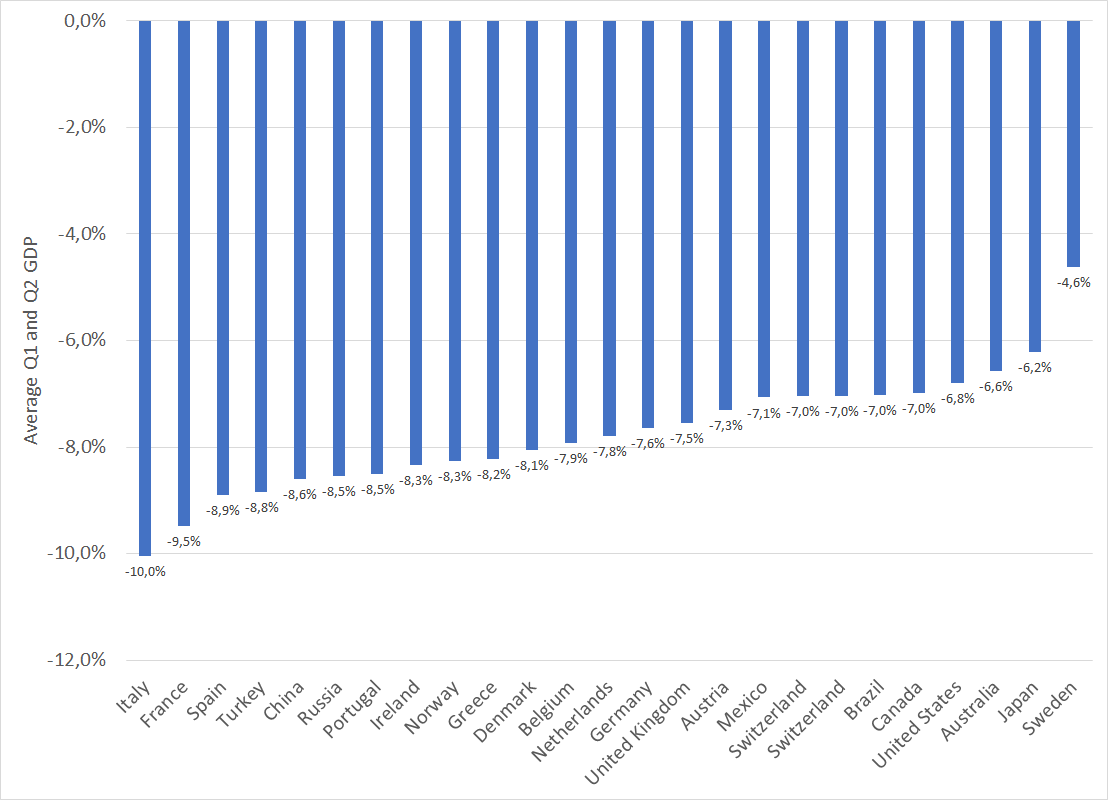

This is v. interesting - basically oxford econ did a huge database of world lockdown measures and ONS regressed it against known GDP prints. It works pretty well, so I applied it to latest values of "lockdown index". Here& #39;s the current cumulated Q1+Q2 estimates for some ctrys https://twitter.com/DuncanWeldon/status/1260461744444538882">https://twitter.com/DuncanWel...

(Countries were chosen mostly because they& #39;re relevant for banking risk - sorry that& #39;s my bias!)

Italy, France and Spain not really a surprise. More surprised by China, Turkey or even Russia.

Italy, France and Spain not really a surprise. More surprised by China, Turkey or even Russia.

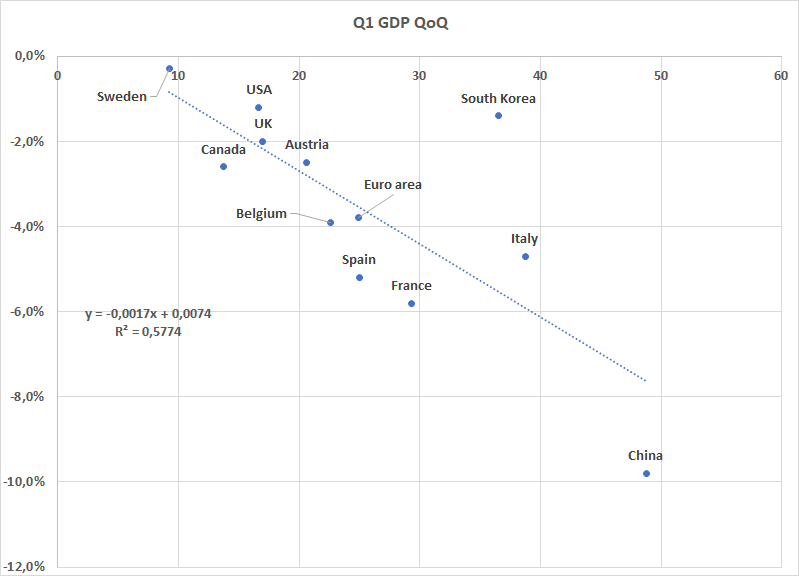

Obviously, apart from China/SK the regression was mostly done on western Europe/ US/Can so not sure it works for EM countries. It will be worth updating this as we get more prints (and maybe improve regression with other variables)

this is the ONS chart with country labels, in case you wondered, because they& #39;re not on the ONS& #39; version of the chart

So to be clear: I think on EM the analysis lacks at least a "baseline / trend growth" that would substantially change the numbers. I would use this more as "deviation from baseline" then as an absolute number.

Read on Twitter

Read on Twitter