I& #39;ve spent a month+ thinking on energy in an age of abundance, pandemic-induced or not. Today& #39;s math is different from the old math, be it in expected sector return on capital to structural readiness for negative prices. Hint: one sector comes out looking better-prepared.

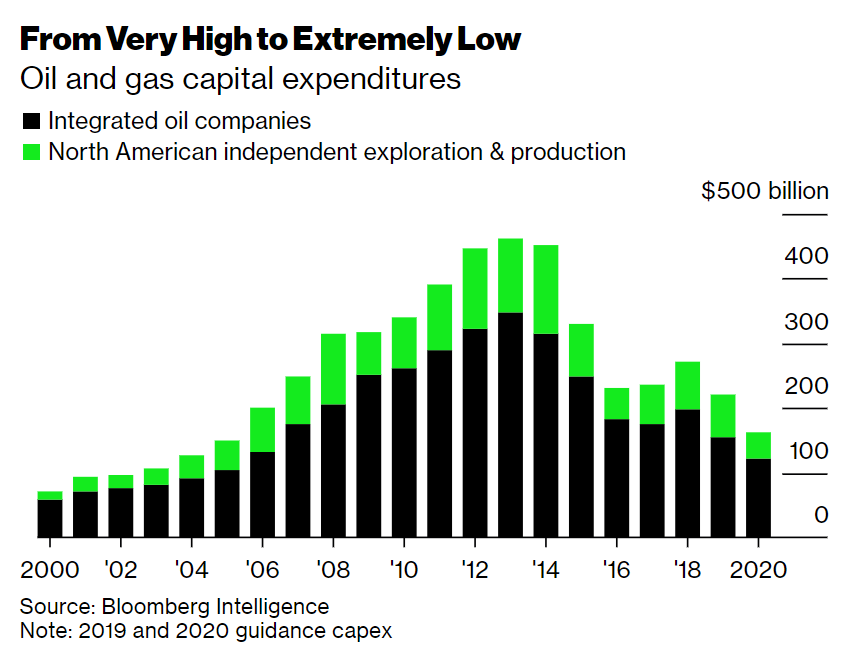

1/ Oil majors tightening their belt - inevitable, given current market; not great for any energy source, given that the majors are considerable asset and corporate investors in clean energy https://www.bloomberg.com/news/articles/2020-04-09/oil-s-belt-tightening-is-bad-news-for-clean-power-too?sref=JMv1OWqN">https://www.bloomberg.com/news/arti...

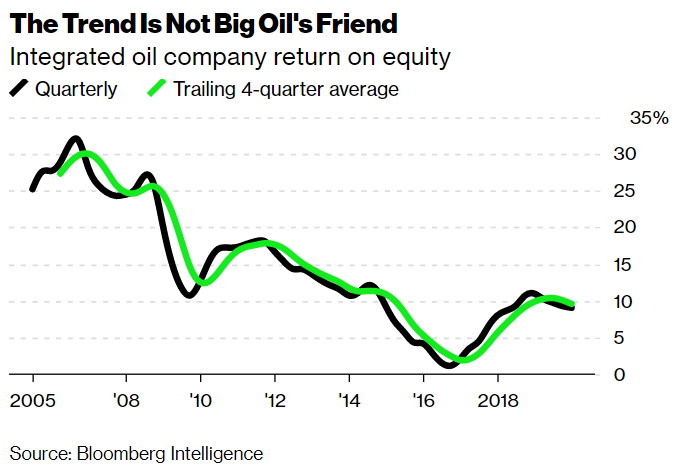

2/ Integrated oil company returns on equity: Far from the heady days of the early 2000s, and trending back down again https://www.bloomberg.com/news/articles/2020-05-07/the-new-investor-math-in-the-wake-of-the-oil-market-crash?sref=JMv1OWqN">https://www.bloomberg.com/news/arti...

3/ Contrast: renewable levelized cost of electricity at 8-11% return on equity. Onshore wind and solar PV are now the lowest-cost new sources of power generation for at least 2/3 global population, 71% of global GDP, and 85% of global power generation. https://www.bloomberg.com/news/articles/2020-05-07/the-new-investor-math-in-the-wake-of-the-oil-market-crash?sref=JMv1OWqN">https://www.bloomberg.com/news/arti...

4/ Contrast: Oil at -$37/barrel is a sign of profound dislocation - and even then, negative oil isn& #39;t free, can& #39;t really induce demand, cannot shape consumer behavior, as @liamdenning and I wrote here https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

5/ Contrast: Electricity prices go negative too - but that& #39;s not as big a deal. A power plant can reduce or shut off capacity, or isolate or give away its output*, but no one says "you& #39;re offline and never coming back" the way a well can be shut in. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

6/ Difference: A barrel of oil isn’t a product in its own right; it’s an input to other processes. Even free oil isn’t free, since it needs physical transformation to be useful. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

7/ Difference: Electrons arrive at an end user ready to go — a finished input into lighting, refrigeration, data processing, arc welding, whatever, and at any scale. It’s as useful to an aluminum smelter as to a Tesla as to an electric toothbrush. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

8/ That makes electricity easier to give away, and demand for it to shift temporally and spatially. Google knows this. https://www.bloomberg.com/news/articles/2020-04-30/google-enters-upside-down-world-of-renewable-supply-and-demand?sref=JMv1OWqN">https://www.bloomberg.com/news/arti...

9/ Which is why Google has inverted the paradigm of demand response, to now turn on energy-intensive loads to capture low (and surely at some times, negative) power prices, with zero emissions - and to shift demand from data center to data center https://www.bloomberg.com/news/articles/2020-04-30/google-enters-upside-down-world-of-renewable-supply-and-demand?sref=JMv1OWqN">https://www.bloomberg.com/news/arti...

10/ Electrons can do that. Molecules can& #39;t.

"Yes, but intermittency!" "Yes, but storage!" "Yes, but scale!"

OK. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

"Yes, but intermittency!" "Yes, but storage!" "Yes, but scale!"

OK. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

11/ Intermittency: yes, intermittency of renewable energy poses complications for grids. But the relative predictability of supply and demand and the inherent flexibility of networked power means it’s a complication grids turn out to handle quite easily. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

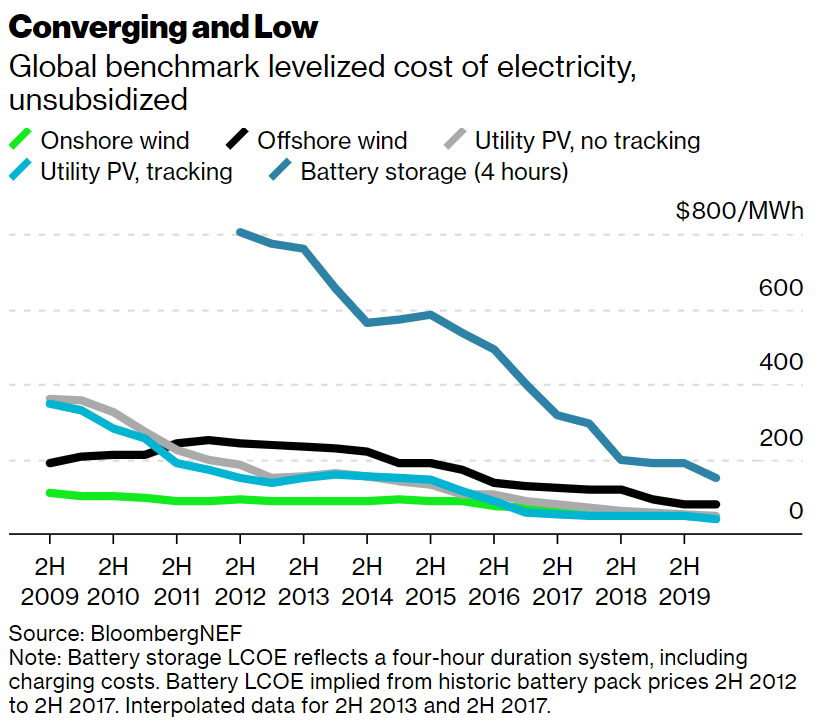

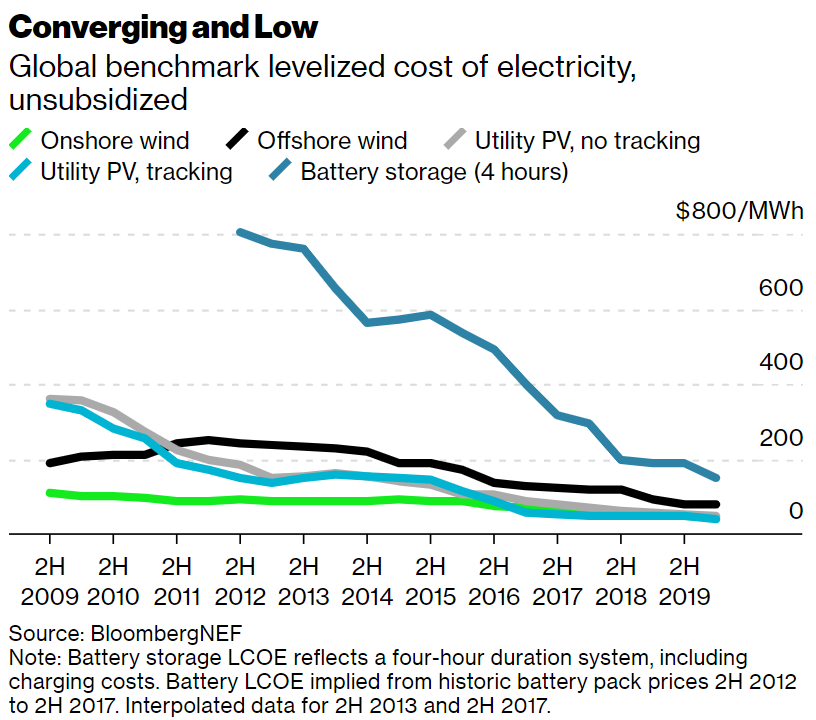

12/ Storage: Falling battery costs will eventually change that game entirely, obviating the need for some peaking power capacity and creating trading opportunities. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

13/ Scale: modularity is a feature, not a bug, of a world of abundant supply and uncertain demand. Building more renewable capacity to, say, displace internal combustion engines represents a huge investment. But it is also scalable and relatively quick. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

14/ Scale: you can’t drill 10% of a deepwater oil well and see how it goes; it’s a one-shot affair relying on a multi-decade demand and price projection. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

15/ One reason the majors eventually muscled into shale was because of its faster schedules. Moreover, investment in domestic power is well-suited to post-Covid economic recovery plans and increasingly fractious energy geopolitics. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

16/ Oil demand (and pricing) will recover from April’s nadir, though the extent and timing remain up for debate. Even so, the oil system’s inertia — physical, economic, political — in the face of change is much clearer. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

17/ Two energy worlds - one of molecules, one of electrons - are crashing into each other. One will recover - though the extent and timing of that recovery is up for debate. https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a...

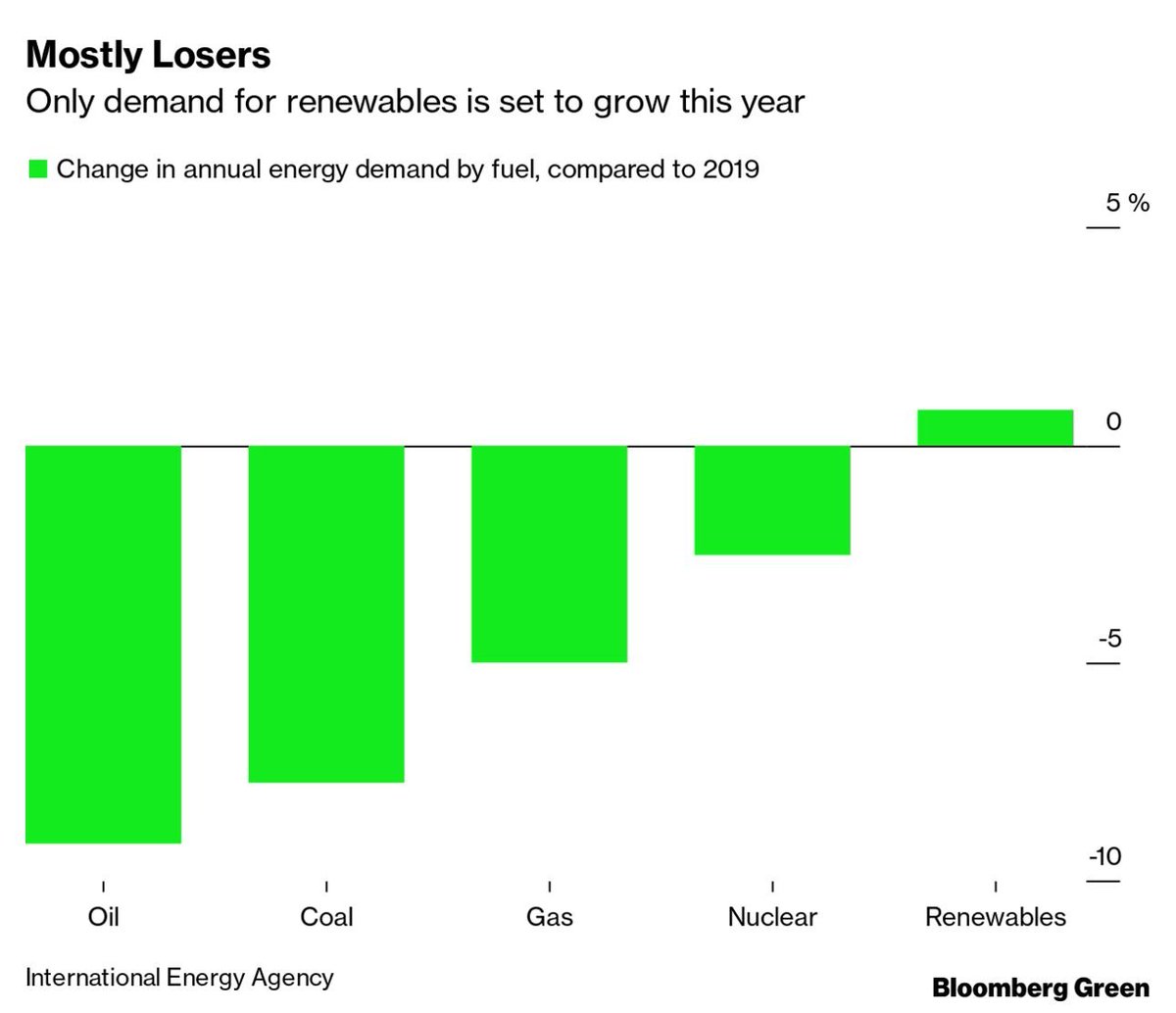

18/ One will continue to grow (in fact, it will be the only growth in energy this year). Change is now the constant, and the contours of growth in a time of constant change could be very different https://www.bloomberg.com/opinion/articles/2020-05-10/negative-oil-prices-are-positive-for-clean-power?sref=JMv1OWqN">https://www.bloomberg.com/opinion/a... /end

Read on Twitter

Read on Twitter