Let& #39;s see some data points regards to Nifty 50.

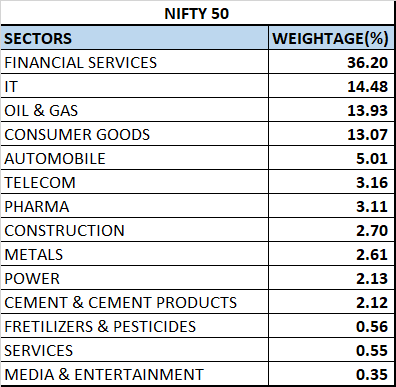

If we see the sector allocation of Nifty50 you can see that nifty is heavily influenced by the financial services, IT, Oil and Gas and consumer goods which is ~78% of the nifty50 index. ( As on April 30,2020)

If we see the sector allocation of Nifty50 you can see that nifty is heavily influenced by the financial services, IT, Oil and Gas and consumer goods which is ~78% of the nifty50 index. ( As on April 30,2020)

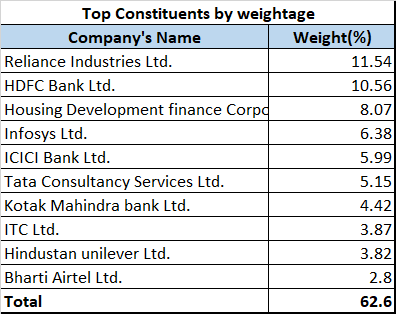

Now let us see which are the top constituents companies of the nifty 50 index.

You can see that major allocation/weightage is given to Reliance Industries and HDFC group which makes total weightage of ~30% of the nifty50 Index.

You can see that major allocation/weightage is given to Reliance Industries and HDFC group which makes total weightage of ~30% of the nifty50 Index.

Top Heavyweights

1. Top 5 stocks = 42.5% of Nifty

2. Top 7 stocks = 52.1% of Nifty

3. Top 10 stocks = 62.6% of Nifty

4. Top 20 stocks = 80% of Nifty

5. The bottom 20 = 11% of Nifty

You can Notice that Top 20 stocks are 80% allocation of nifty50 Index.

1. Top 5 stocks = 42.5% of Nifty

2. Top 7 stocks = 52.1% of Nifty

3. Top 10 stocks = 62.6% of Nifty

4. Top 20 stocks = 80% of Nifty

5. The bottom 20 = 11% of Nifty

You can Notice that Top 20 stocks are 80% allocation of nifty50 Index.

Total BSE Market Captialization= 1,23,83,500 Crs.

Top 10 stocks =33.5%

Top 20 Stocks=44.5%

Top 30 Stocks= 51.5%

You will be surprised that 30 stocks make 51.5% of the total market capitalization of total BSE

Top 10 stocks =33.5%

Top 20 Stocks=44.5%

Top 30 Stocks= 51.5%

You will be surprised that 30 stocks make 51.5% of the total market capitalization of total BSE

Only the top 10 stocks are the key drivers to the nifty50 Index.

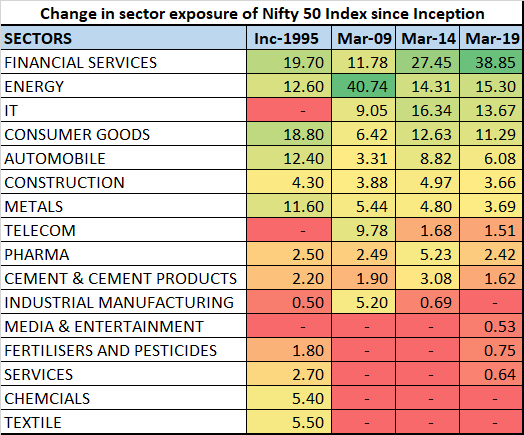

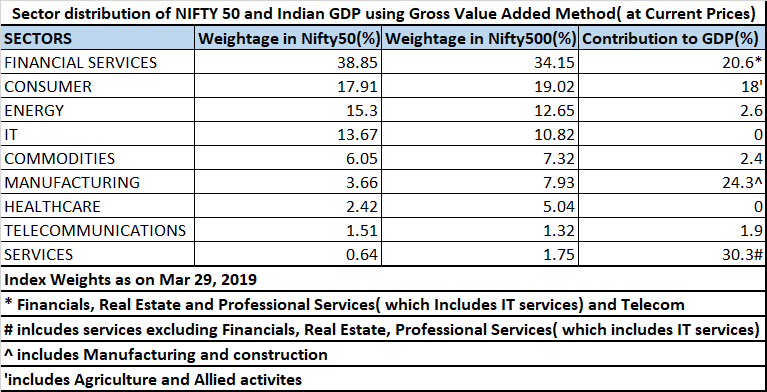

Power, Metals, Construction, cement doesn& #39;t even have 10% of the nifty, while these sectors are the most key drivers for jobs and GDP.

Power, Metals, Construction, cement doesn& #39;t even have 10% of the nifty, while these sectors are the most key drivers for jobs and GDP.

Nifty50 doesn& #39;t reflect the true picture of the economy because of survivorship bias and major allocation to a few companies.

The broader market companies beyond the top 100-200 companies have been decimated and a lot of companies are available below liquidation value.

The broader market companies beyond the top 100-200 companies have been decimated and a lot of companies are available below liquidation value.

Read on Twitter

Read on Twitter