If you& #39;re new to #Uranium Bull Market  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> Tribeca& #39;s Guy Keller recently walked #investors thru

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> Tribeca& #39;s Guy Keller recently walked #investors thru

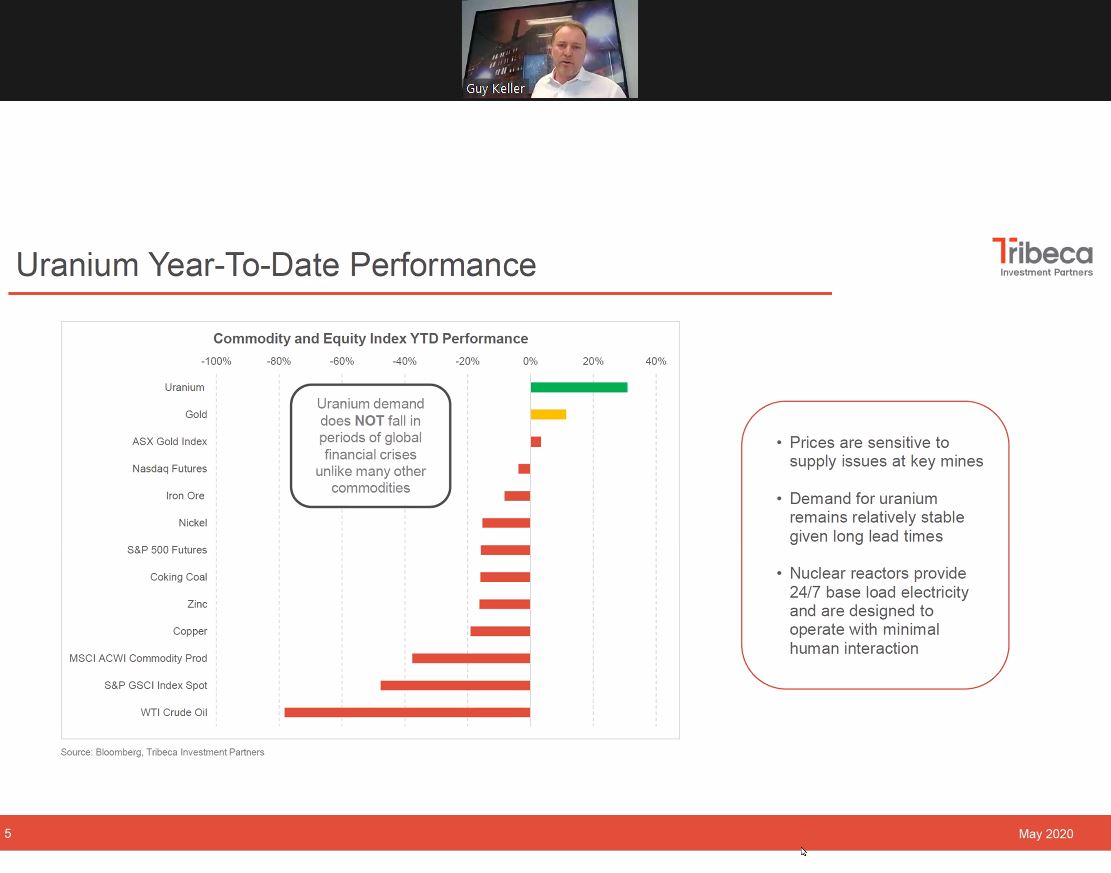

the story https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧑💼" title="Office worker" aria-label="Emoji: Office worker"> beginning today where world& #39;s best performing YTD commodity #U3O8 is up 36%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧑💼" title="Office worker" aria-label="Emoji: Office worker"> beginning today where world& #39;s best performing YTD commodity #U3O8 is up 36% https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> amidst #COVID19 #SupplyShock

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> amidst #COVID19 #SupplyShock https://abs.twimg.com/emoji/v2/... draggable="false" alt="😷" title="Face with medical mask" aria-label="Emoji: Face with medical mask">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😷" title="Face with medical mask" aria-label="Emoji: Face with medical mask"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> while #Nuclear demand remains "relatively stable"

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> while #Nuclear demand remains "relatively stable" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign">..

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign">..

the story

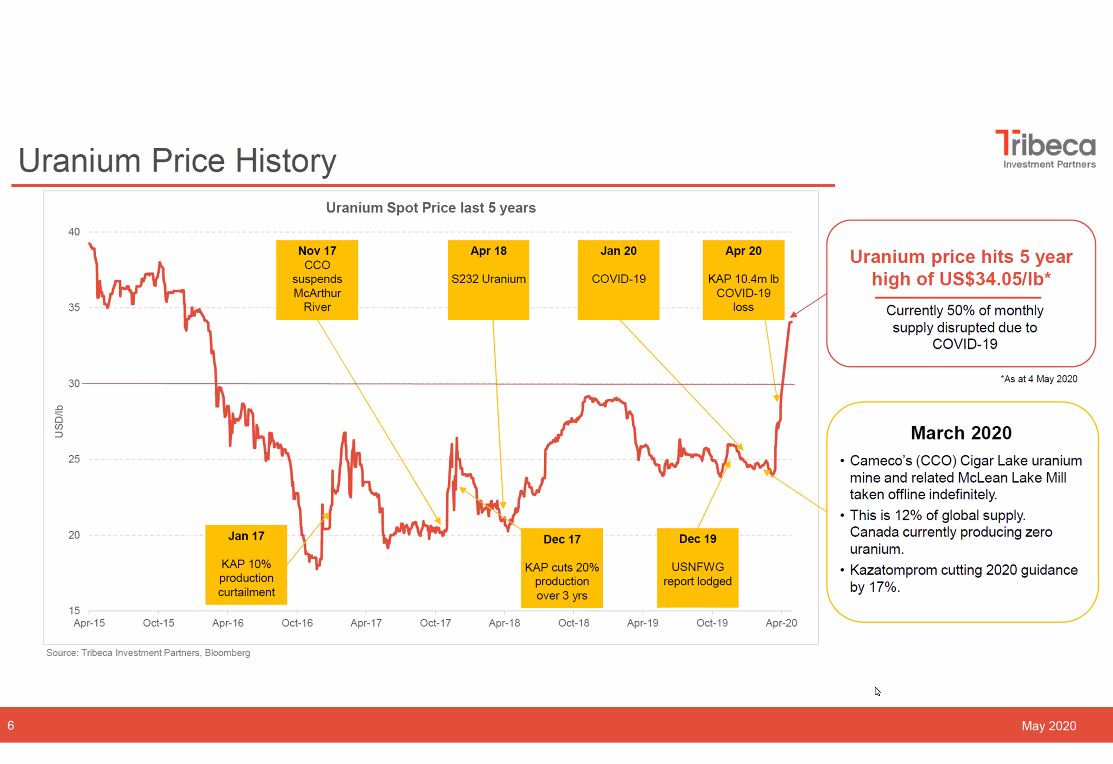

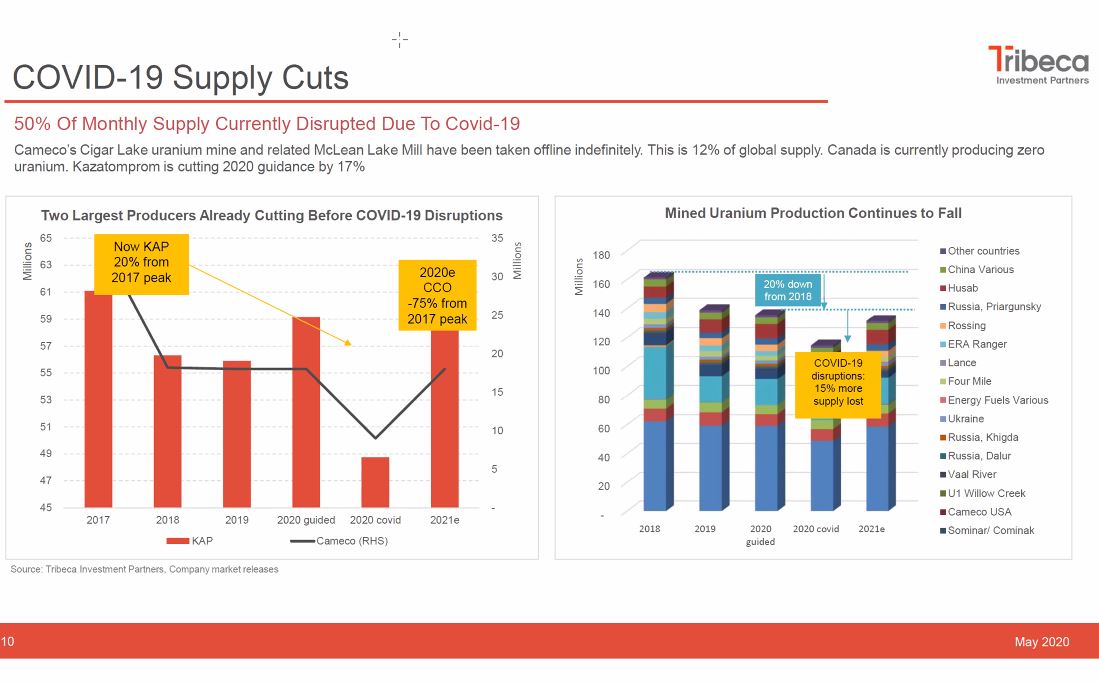

2) Lead-up to #Uranium Bull run was 3+ years of supply destruction https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> including 20% cut for 3yrs by largest #U3O8 miner $KAP & indefinite closure of world& #39;s largest U mine, Cameco& #39;s McArthur/Key.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> including 20% cut for 3yrs by largest #U3O8 miner $KAP & indefinite closure of world& #39;s largest U mine, Cameco& #39;s McArthur/Key. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Factory" aria-label="Emoji: Factory"> #COVID19 has triggered more mine suspensions, cutting >50% of monthly supply

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Factory" aria-label="Emoji: Factory"> #COVID19 has triggered more mine suspensions, cutting >50% of monthly supply https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards">...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards">...

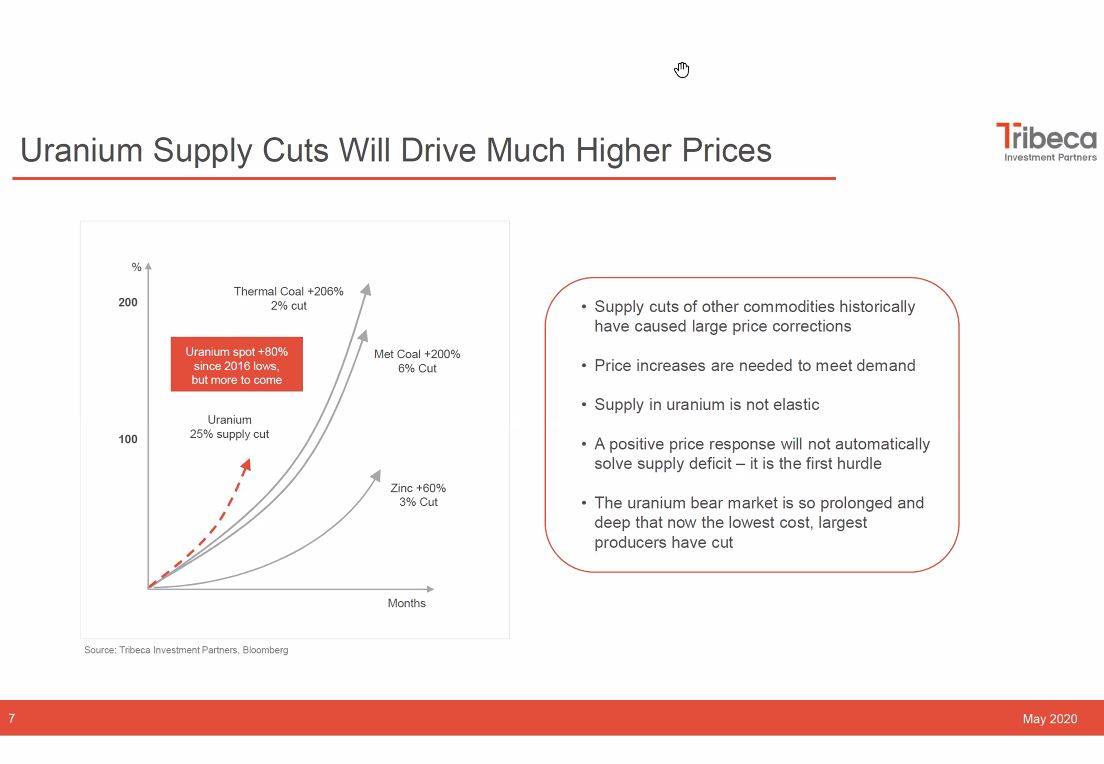

3) Supply cuts in other commodities have historically caused large price corrections https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards"> needed to trigger production to meet demand. Supply in #uranium is not elastic & price increase is just first hurdle.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards"> needed to trigger production to meet demand. Supply in #uranium is not elastic & price increase is just first hurdle.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏇" title="Horse racing" aria-label="Emoji: Horse racing"> Spot #U3O8 price is up over 80% since 2016 low but more to come.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏇" title="Horse racing" aria-label="Emoji: Horse racing"> Spot #U3O8 price is up over 80% since 2016 low but more to come.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> ...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> ...

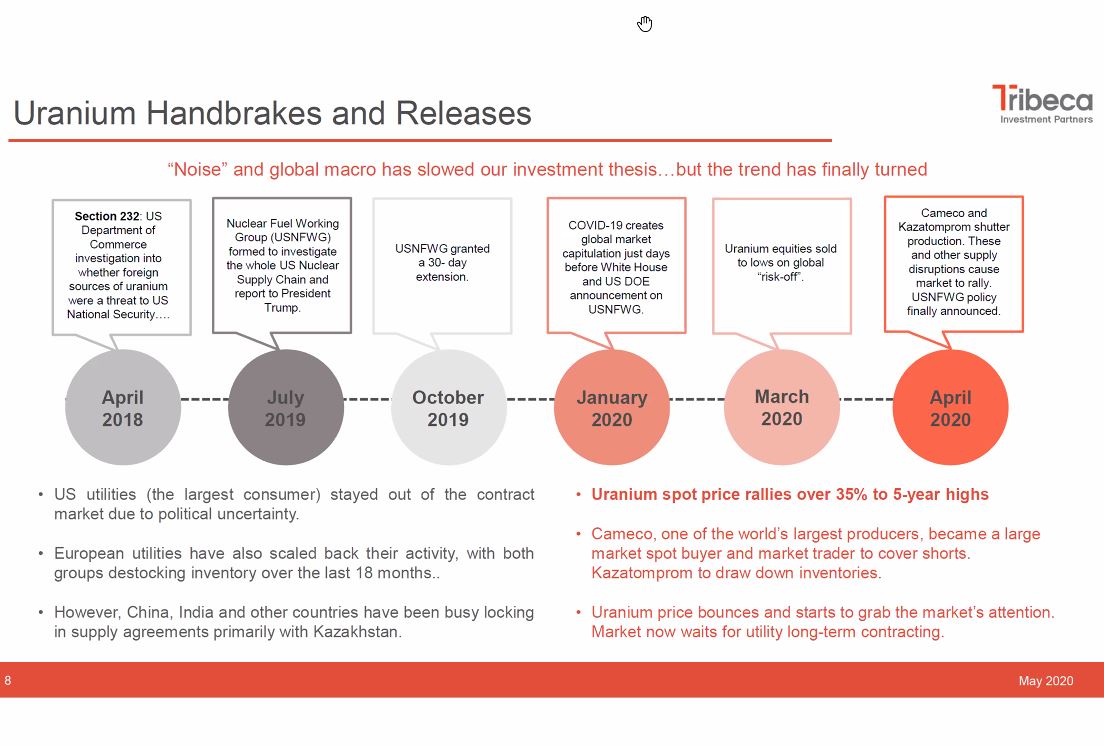

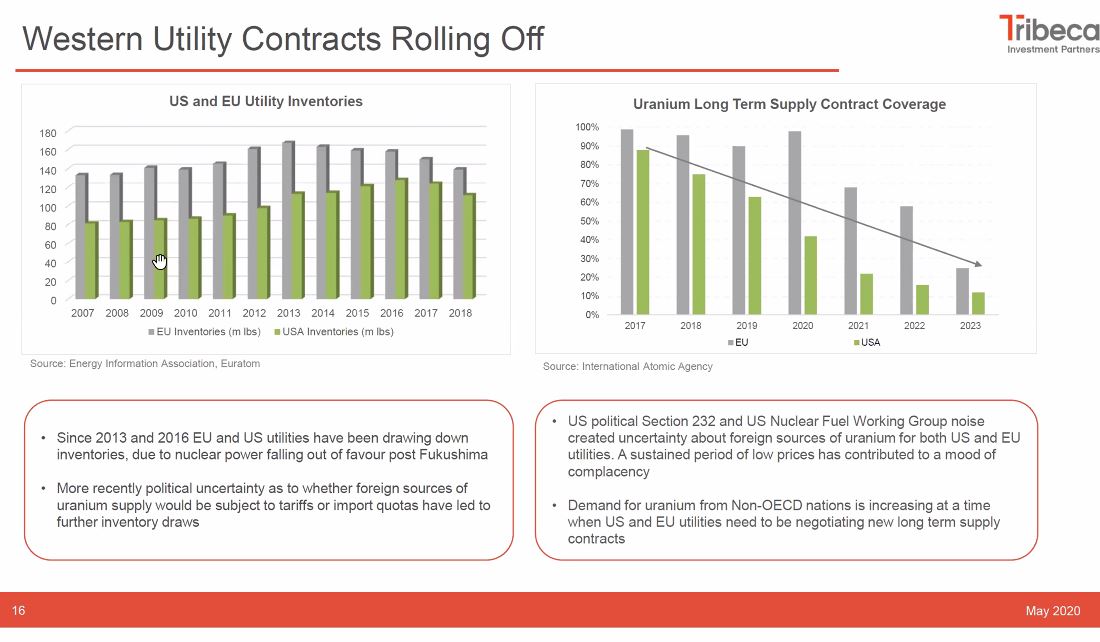

4) For over 2 years there& #39;ve been many "handbrakes" slowing market response to #Uranium supply cuts.. US #Section232 & subsequent #Nuclear Fuel Working Group sent utility buyers to sidelines, then 2020 #COVID19 market crash.. but now those are released & trend has turned up! https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">...

5) #COVID19 sent shockwaves thru #Uranium mining sector, leading to indefinite suspension of all production in #Canada, a 17.5% cut in #Kazakhstan & stoppages in #Namibia resulting in over 50% of global monthly #U3O8 production disrupted https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> = 12% global supply destruction ...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> = 12% global supply destruction ...

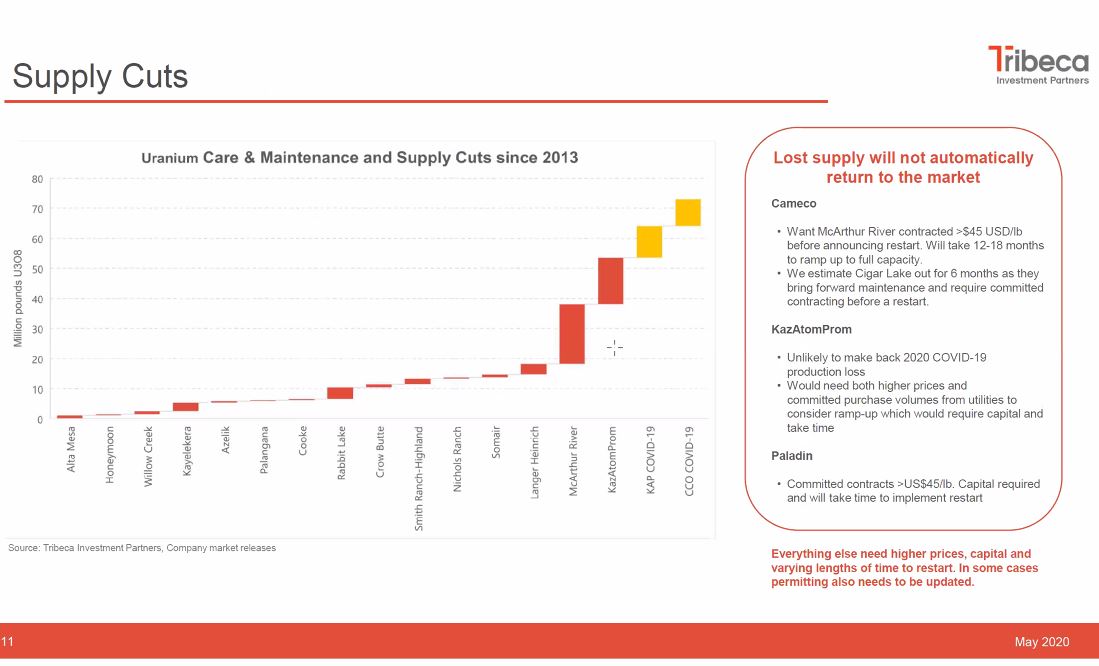

6) Since 2013 there have been a long series of #Uranium mine supply cuts & #U3O8 mines placed into long term Care & Maintenance.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> To bring production back will require U prices in excess of US$45/lb at a minimum, plus significant Capital

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> To bring production back will require U prices in excess of US$45/lb at a minimum, plus significant Capital https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag"> & signed long-term contracts

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag"> & signed long-term contracts https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Scroll" aria-label="Emoji: Scroll">...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Scroll" aria-label="Emoji: Scroll">...

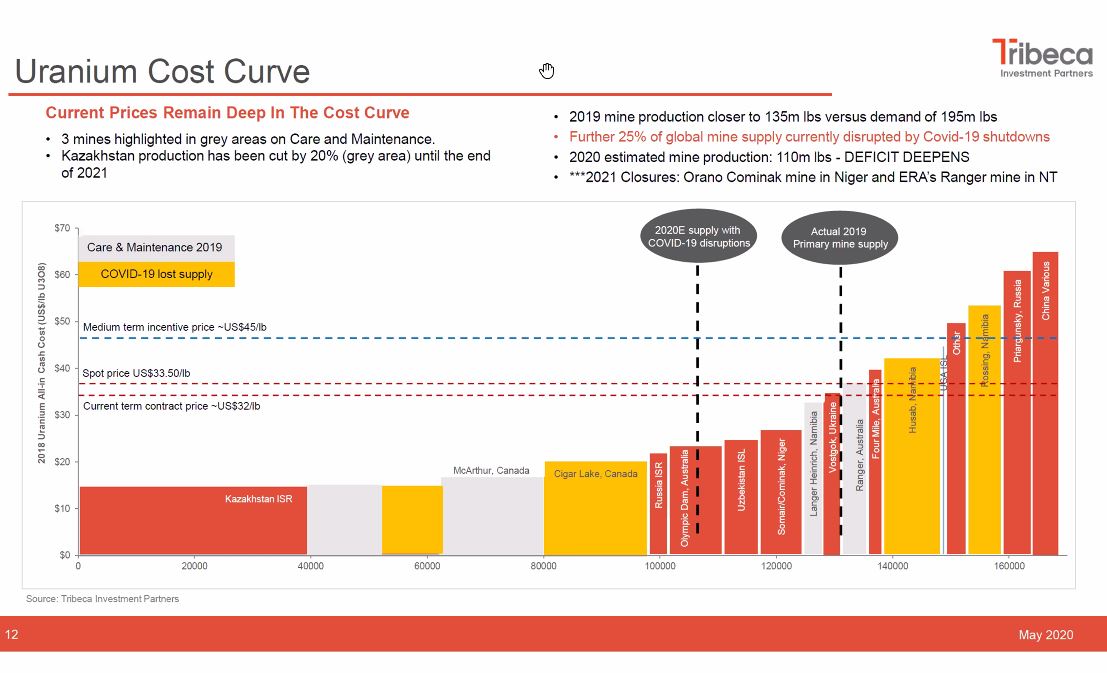

7) 2019 Global #Uranium production was close to 135M lbs #U3O8 (vs #Nuclear fuel requirement of nearly 200M lbs) but #COVID19 #SupplyShock https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign"> is cutting 2020 production estimate to 110M lbs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign"> is cutting 2020 production estimate to 110M lbs https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> deepening deficit heading to 2 permanent mine closures in 2021, Ranger & Cominak.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> deepening deficit heading to 2 permanent mine closures in 2021, Ranger & Cominak. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign"> ...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign"> ...

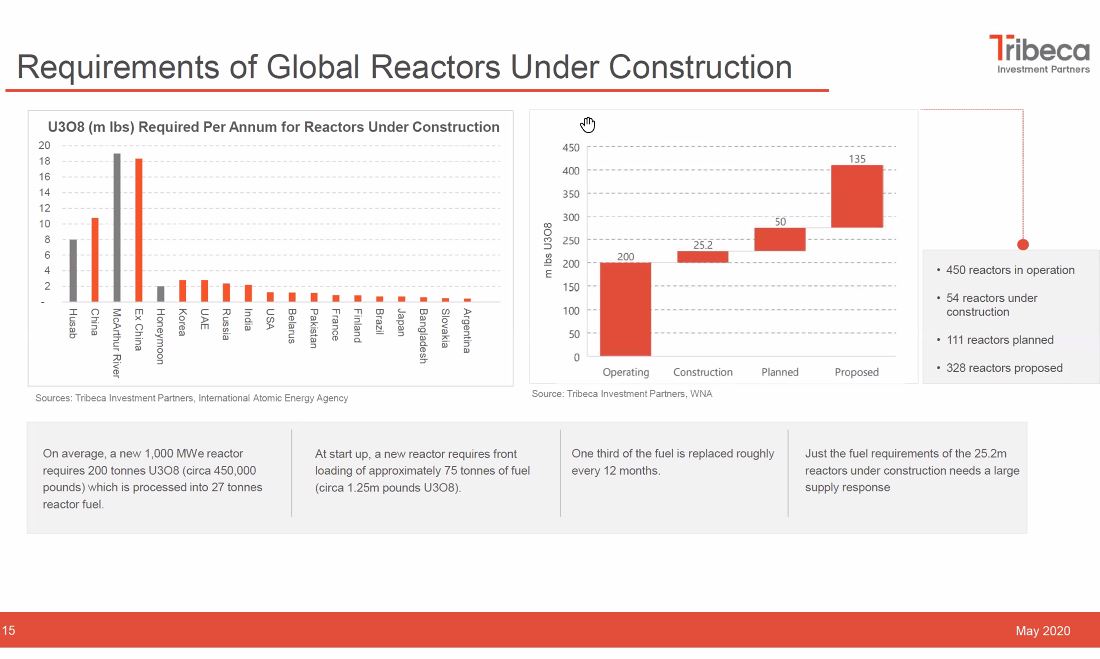

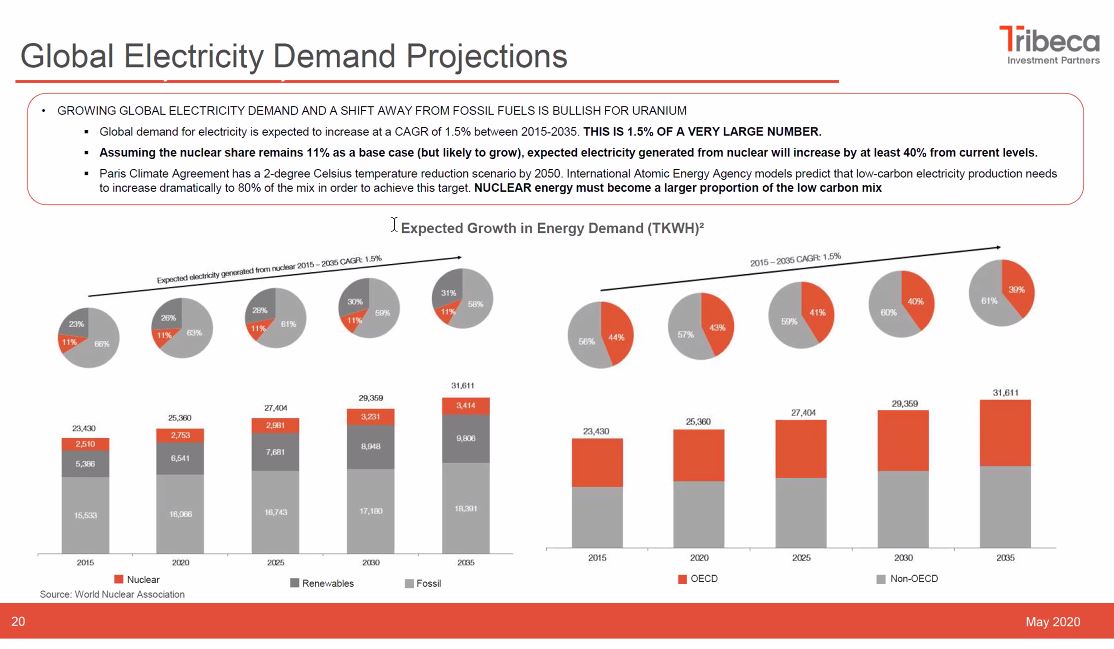

8) In 2019 the World #Nuclear Association, for first time in 10 years, modelled #Uranium demand increases in all 3 of its #U3O8 demand scenarios to 2040. https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="North east arrow" aria-label="Emoji: North east arrow"> Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="North east arrow" aria-label="Emoji: North east arrow"> Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">...

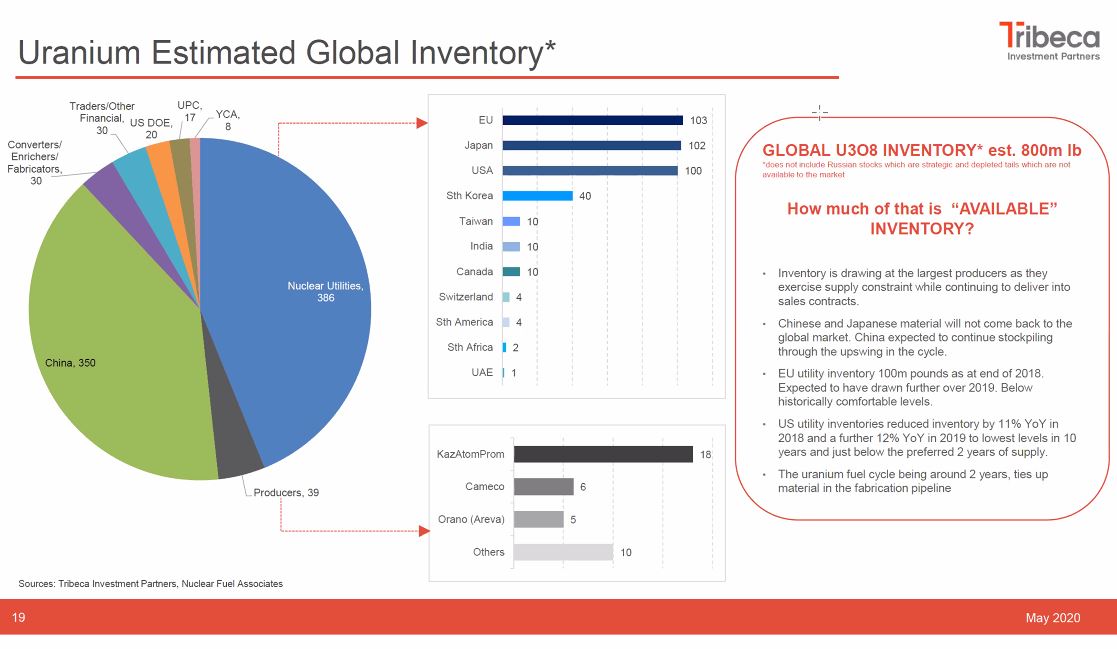

9) With 2020 #uranium production at 110M lbs, #nuclear demand near 200M lbs, utilities have been depleting inventory for many years & must now begin a restocking cycle https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛒" title="Shopping cart" aria-label="Emoji: Shopping cart"> to cover future fuel needs & replenish stockpiles simultaneous with demand from new reactors = #SupplyRisk

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛒" title="Shopping cart" aria-label="Emoji: Shopping cart"> to cover future fuel needs & replenish stockpiles simultaneous with demand from new reactors = #SupplyRisk https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign">..

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign">..

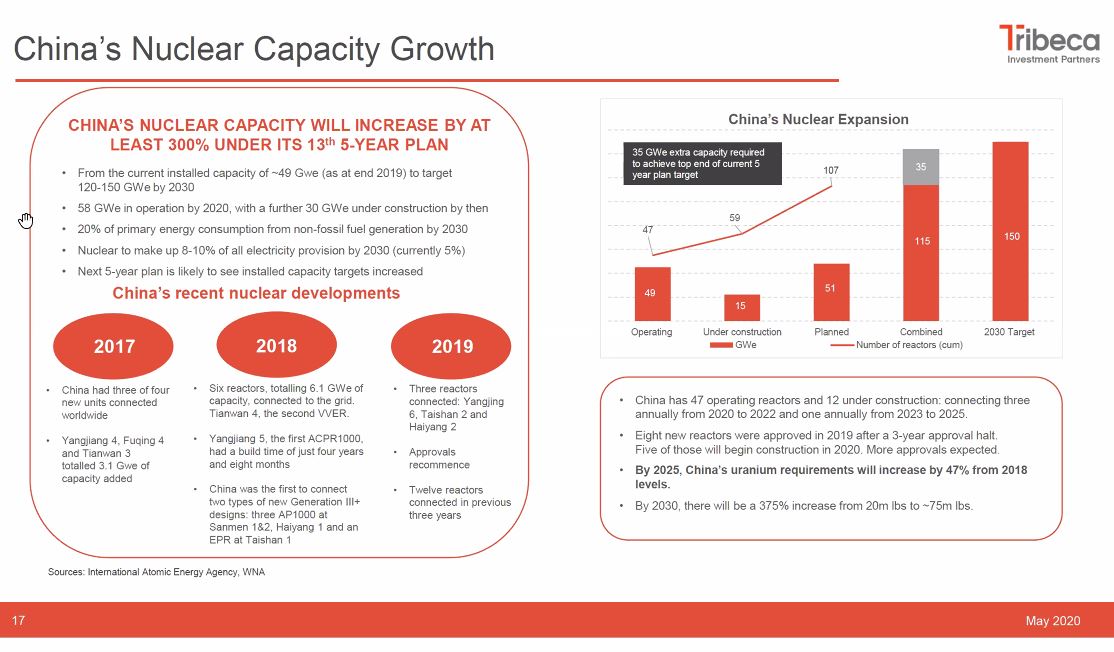

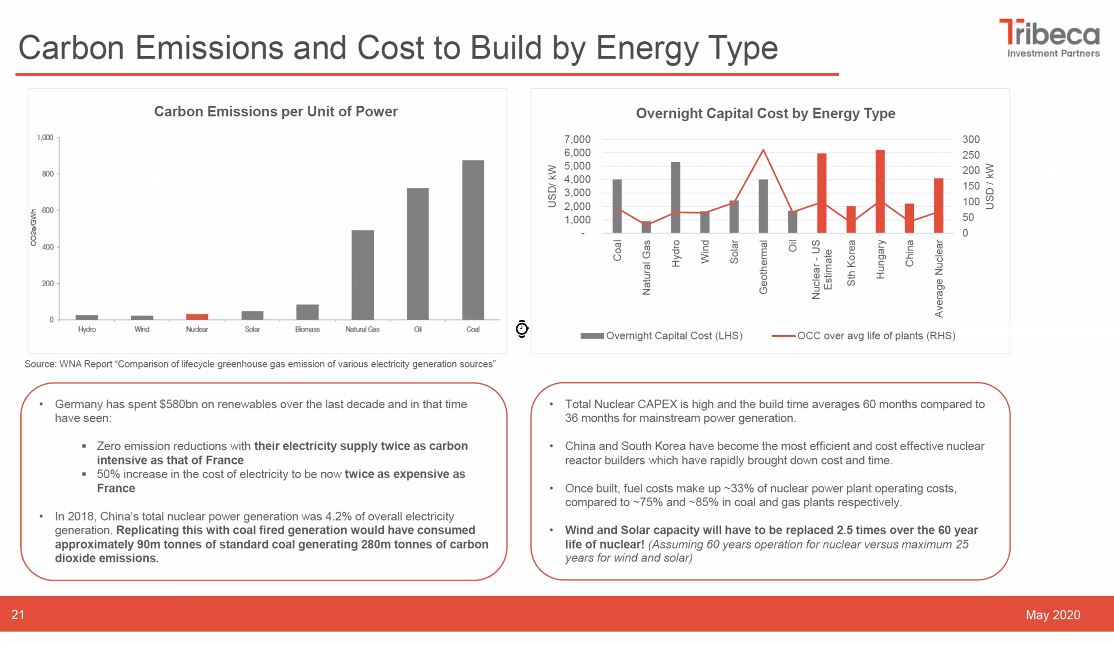

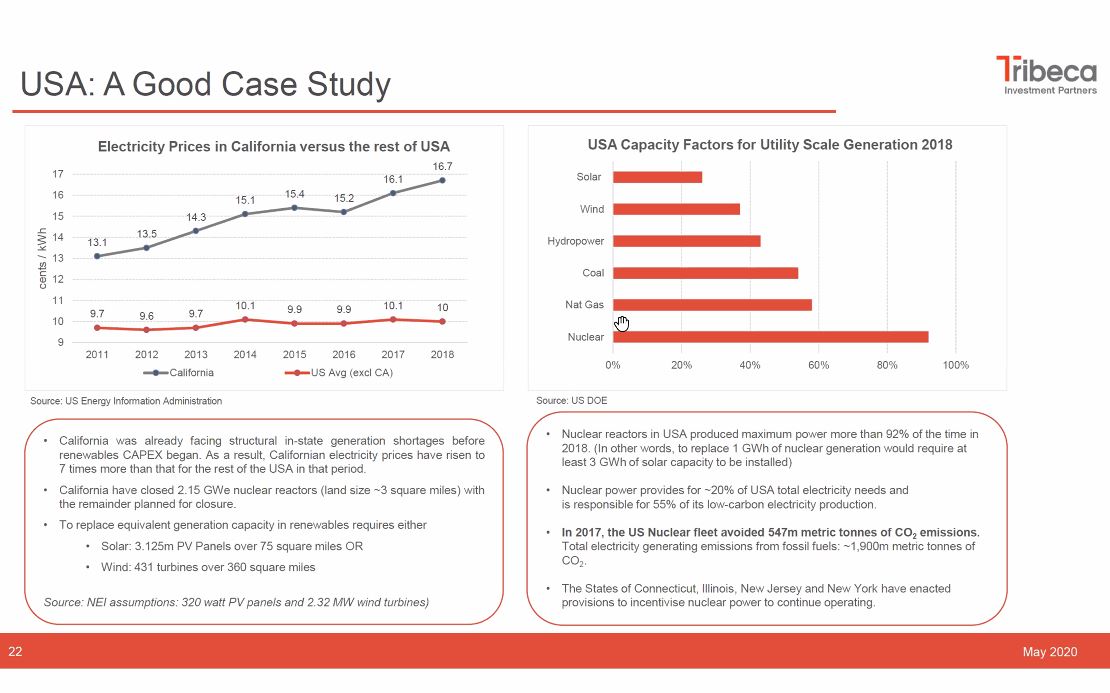

10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...

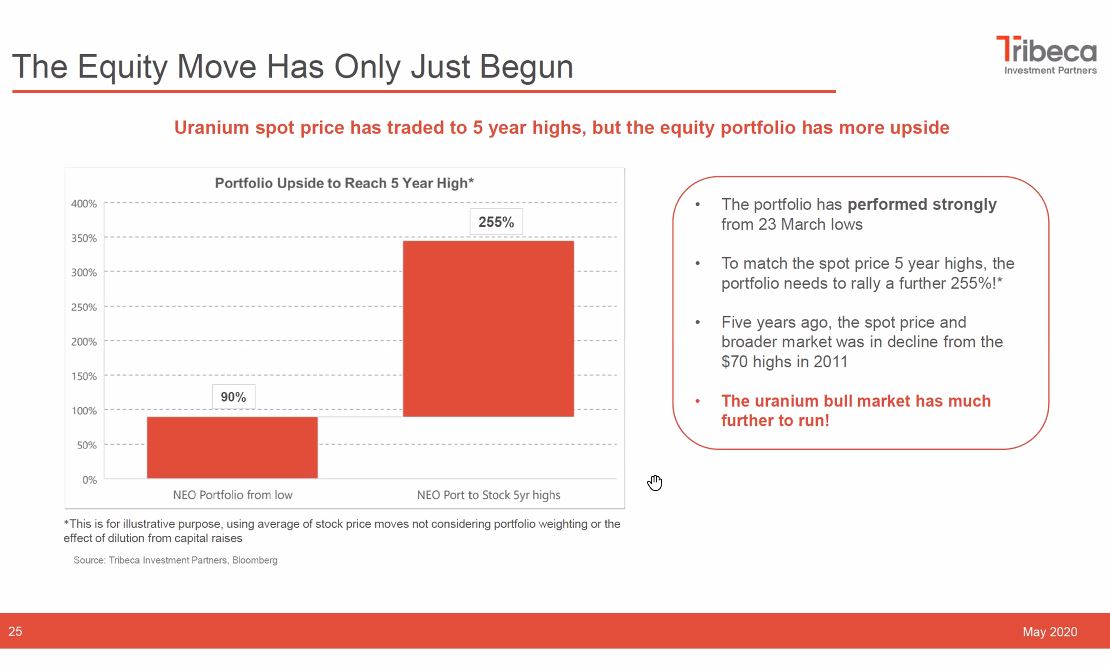

11) Lastly, Global supply of "available" #uranium inventory has shrunk, #U3O8 Spot supply is now tight https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Compression" aria-label="Emoji: Compression">& U3O8 Bull Market is underway

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Compression" aria-label="Emoji: Compression">& U3O8 Bull Market is underway https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot price

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot price https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> Tribeca& #39;s Guy Keller recently walked #investors thru the storyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧑💼" title="Office worker" aria-label="Emoji: Office worker"> beginning today where world& #39;s best performing YTD commodity #U3O8 is up 36%https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> amidst #COVID19 #SupplyShockhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😷" title="Face with medical mask" aria-label="Emoji: Face with medical mask">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> while #Nuclear demand remains "relatively stable"https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign">.." title="If you& #39;re new to #Uranium Bull Market https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> Tribeca& #39;s Guy Keller recently walked #investors thru the storyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧑💼" title="Office worker" aria-label="Emoji: Office worker"> beginning today where world& #39;s best performing YTD commodity #U3O8 is up 36%https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> amidst #COVID19 #SupplyShockhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😷" title="Face with medical mask" aria-label="Emoji: Face with medical mask">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> while #Nuclear demand remains "relatively stable"https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign">.." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> Tribeca& #39;s Guy Keller recently walked #investors thru the storyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧑💼" title="Office worker" aria-label="Emoji: Office worker"> beginning today where world& #39;s best performing YTD commodity #U3O8 is up 36%https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> amidst #COVID19 #SupplyShockhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😷" title="Face with medical mask" aria-label="Emoji: Face with medical mask">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> while #Nuclear demand remains "relatively stable"https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign">.." title="If you& #39;re new to #Uranium Bull Market https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> Tribeca& #39;s Guy Keller recently walked #investors thru the storyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧑💼" title="Office worker" aria-label="Emoji: Office worker"> beginning today where world& #39;s best performing YTD commodity #U3O8 is up 36%https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> amidst #COVID19 #SupplyShockhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😷" title="Face with medical mask" aria-label="Emoji: Face with medical mask">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> while #Nuclear demand remains "relatively stable"https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign">.." class="img-responsive" style="max-width:100%;"/>

including 20% cut for 3yrs by largest #U3O8 miner $KAP & indefinite closure of world& #39;s largest U mine, Cameco& #39;s McArthur/Key.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Factory" aria-label="Emoji: Factory"> #COVID19 has triggered more mine suspensions, cutting >50% of monthly supplyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards">..." title="2) Lead-up to #Uranium Bull run was 3+ years of supply destructionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> including 20% cut for 3yrs by largest #U3O8 miner $KAP & indefinite closure of world& #39;s largest U mine, Cameco& #39;s McArthur/Key.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Factory" aria-label="Emoji: Factory"> #COVID19 has triggered more mine suspensions, cutting >50% of monthly supplyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards">..." class="img-responsive" style="max-width:100%;"/>

including 20% cut for 3yrs by largest #U3O8 miner $KAP & indefinite closure of world& #39;s largest U mine, Cameco& #39;s McArthur/Key.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Factory" aria-label="Emoji: Factory"> #COVID19 has triggered more mine suspensions, cutting >50% of monthly supplyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards">..." title="2) Lead-up to #Uranium Bull run was 3+ years of supply destructionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> including 20% cut for 3yrs by largest #U3O8 miner $KAP & indefinite closure of world& #39;s largest U mine, Cameco& #39;s McArthur/Key.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏭" title="Factory" aria-label="Emoji: Factory"> #COVID19 has triggered more mine suspensions, cutting >50% of monthly supplyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards">..." class="img-responsive" style="max-width:100%;"/>

needed to trigger production to meet demand. Supply in #uranium is not elastic & price increase is just first hurdle. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏇" title="Horse racing" aria-label="Emoji: Horse racing"> Spot #U3O8 price is up over 80% since 2016 low but more to come. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> ..." title="3) Supply cuts in other commodities have historically caused large price correctionshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards"> needed to trigger production to meet demand. Supply in #uranium is not elastic & price increase is just first hurdle. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏇" title="Horse racing" aria-label="Emoji: Horse racing"> Spot #U3O8 price is up over 80% since 2016 low but more to come. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> ..." class="img-responsive" style="max-width:100%;"/>

needed to trigger production to meet demand. Supply in #uranium is not elastic & price increase is just first hurdle. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏇" title="Horse racing" aria-label="Emoji: Horse racing"> Spot #U3O8 price is up over 80% since 2016 low but more to come. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> ..." title="3) Supply cuts in other commodities have historically caused large price correctionshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards"> needed to trigger production to meet demand. Supply in #uranium is not elastic & price increase is just first hurdle. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏇" title="Horse racing" aria-label="Emoji: Horse racing"> Spot #U3O8 price is up over 80% since 2016 low but more to come. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> ..." class="img-responsive" style="max-width:100%;"/>

..." title="4) For over 2 years there& #39;ve been many "handbrakes" slowing market response to #Uranium supply cuts.. US #Section232 & subsequent #Nuclear Fuel Working Group sent utility buyers to sidelines, then 2020 #COVID19 market crash.. but now those are released & trend has turned up!https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">..." class="img-responsive" style="max-width:100%;"/>

..." title="4) For over 2 years there& #39;ve been many "handbrakes" slowing market response to #Uranium supply cuts.. US #Section232 & subsequent #Nuclear Fuel Working Group sent utility buyers to sidelines, then 2020 #COVID19 market crash.. but now those are released & trend has turned up!https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">..." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> = 12% global supply destruction ..." title="5) #COVID19 sent shockwaves thru #Uranium mining sector, leading to indefinite suspension of all production in #Canada, a 17.5% cut in #Kazakhstan & stoppages in #Namibia resulting in over 50% of global monthly #U3O8 production disruptedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> = 12% global supply destruction ..." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> = 12% global supply destruction ..." title="5) #COVID19 sent shockwaves thru #Uranium mining sector, leading to indefinite suspension of all production in #Canada, a 17.5% cut in #Kazakhstan & stoppages in #Namibia resulting in over 50% of global monthly #U3O8 production disruptedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> = 12% global supply destruction ..." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> To bring production back will require U prices in excess of US$45/lb at a minimum, plus significant Capitalhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag"> & signed long-term contractshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Scroll" aria-label="Emoji: Scroll">..." title="6) Since 2013 there have been a long series of #Uranium mine supply cuts & #U3O8 mines placed into long term Care & Maintenance. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> To bring production back will require U prices in excess of US$45/lb at a minimum, plus significant Capitalhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag"> & signed long-term contractshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Scroll" aria-label="Emoji: Scroll">..." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> To bring production back will require U prices in excess of US$45/lb at a minimum, plus significant Capitalhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag"> & signed long-term contractshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Scroll" aria-label="Emoji: Scroll">..." title="6) Since 2013 there have been a long series of #Uranium mine supply cuts & #U3O8 mines placed into long term Care & Maintenance. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Pick" aria-label="Emoji: Pick">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↘️" title="South east arrow" aria-label="Emoji: South east arrow"> To bring production back will require U prices in excess of US$45/lb at a minimum, plus significant Capitalhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag"> & signed long-term contractshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Scroll" aria-label="Emoji: Scroll">..." class="img-responsive" style="max-width:100%;"/>

is cutting 2020 production estimate to 110M lbshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> deepening deficit heading to 2 permanent mine closures in 2021, Ranger & Cominak.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign"> ..." title="7) 2019 Global #Uranium production was close to 135M lbs #U3O8 (vs #Nuclear fuel requirement of nearly 200M lbs) but #COVID19 #SupplyShockhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign"> is cutting 2020 production estimate to 110M lbshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> deepening deficit heading to 2 permanent mine closures in 2021, Ranger & Cominak.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign"> ..." class="img-responsive" style="max-width:100%;"/>

is cutting 2020 production estimate to 110M lbshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> deepening deficit heading to 2 permanent mine closures in 2021, Ranger & Cominak.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign"> ..." title="7) 2019 Global #Uranium production was close to 135M lbs #U3O8 (vs #Nuclear fuel requirement of nearly 200M lbs) but #COVID19 #SupplyShockhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡️" title="High voltage sign" aria-label="Emoji: High voltage sign"> is cutting 2020 production estimate to 110M lbshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤵️" title="Arrow pointing rightwards then curving downwards" aria-label="Emoji: Arrow pointing rightwards then curving downwards"> deepening deficit heading to 2 permanent mine closures in 2021, Ranger & Cominak.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign"> ..." class="img-responsive" style="max-width:100%;"/>

Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">..." title="8) In 2019 the World #Nuclear Association, for first time in 10 years, modelled #Uranium demand increases in all 3 of its #U3O8 demand scenarios to 2040.https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="North east arrow" aria-label="Emoji: North east arrow"> Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">...">

Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">..." title="8) In 2019 the World #Nuclear Association, for first time in 10 years, modelled #Uranium demand increases in all 3 of its #U3O8 demand scenarios to 2040.https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="North east arrow" aria-label="Emoji: North east arrow"> Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">...">

Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">..." title="8) In 2019 the World #Nuclear Association, for first time in 10 years, modelled #Uranium demand increases in all 3 of its #U3O8 demand scenarios to 2040.https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="North east arrow" aria-label="Emoji: North east arrow"> Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">...">

Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">..." title="8) In 2019 the World #Nuclear Association, for first time in 10 years, modelled #Uranium demand increases in all 3 of its #U3O8 demand scenarios to 2040.https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="North east arrow" aria-label="Emoji: North east arrow"> Today there are 450 reactors in operation, 54 more under construction, 111/328 more planned/proposed = Growth story.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Building construction" aria-label="Emoji: Building construction">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom symbol" aria-label="Emoji: Atom symbol">...">

to cover future fuel needs & replenish stockpiles simultaneous with demand from new reactors = #SupplyRiskhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign">.." title="9) With 2020 #uranium production at 110M lbs, #nuclear demand near 200M lbs, utilities have been depleting inventory for many years & must now begin a restocking cyclehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🛒" title="Shopping cart" aria-label="Emoji: Shopping cart"> to cover future fuel needs & replenish stockpiles simultaneous with demand from new reactors = #SupplyRiskhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign">.." class="img-responsive" style="max-width:100%;"/>

to cover future fuel needs & replenish stockpiles simultaneous with demand from new reactors = #SupplyRiskhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign">.." title="9) With 2020 #uranium production at 110M lbs, #nuclear demand near 200M lbs, utilities have been depleting inventory for many years & must now begin a restocking cyclehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🛒" title="Shopping cart" aria-label="Emoji: Shopping cart"> to cover future fuel needs & replenish stockpiles simultaneous with demand from new reactors = #SupplyRiskhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign">.." class="img-responsive" style="max-width:100%;"/>

Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">..." title="10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...">

Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">..." title="10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...">

Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">..." title="10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...">

Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">..." title="10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...">

Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">..." title="10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...">

Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">..." title="10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...">

Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">..." title="10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...">

Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">..." title="10) #China is leading #Nuclear growth & #Uranium demand, aided by rising global #CarbonFree #electricity demand in an age of #ClimateChange & #ExtremeWeather.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Cyclone" aria-label="Emoji: Cyclone"> Renewables "fantasy" has failed miserably, making Nuclear best #CarbonFree tool in global #CleanEnergy tool box https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sun with face" aria-label="Emoji: Sun with face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧰" title="Toolbox" aria-label="Emoji: Toolbox">...">

& U3O8 Bull Market is underwayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">" title="11) Lastly, Global supply of "available" #uranium inventory has shrunk, #U3O8 Spot supply is now tighthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Compression" aria-label="Emoji: Compression">& U3O8 Bull Market is underwayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">">

& U3O8 Bull Market is underwayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">" title="11) Lastly, Global supply of "available" #uranium inventory has shrunk, #U3O8 Spot supply is now tighthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Compression" aria-label="Emoji: Compression">& U3O8 Bull Market is underwayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">">

& U3O8 Bull Market is underwayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">" title="11) Lastly, Global supply of "available" #uranium inventory has shrunk, #U3O8 Spot supply is now tighthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Compression" aria-label="Emoji: Compression">& U3O8 Bull Market is underwayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">">

& U3O8 Bull Market is underwayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">" title="11) Lastly, Global supply of "available" #uranium inventory has shrunk, #U3O8 Spot supply is now tighthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Compression" aria-label="Emoji: Compression">& U3O8 Bull Market is underwayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rocket" aria-label="Emoji: Rocket"> on a >80% price rise since 2016... BUT #uranium #stocks have fallen way behind & need to rebound an average +255% to catch up with Spot pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⤴️" title="Arrow pointing rightwards then curving upwards" aria-label="Emoji: Arrow pointing rightwards then curving upwards">">