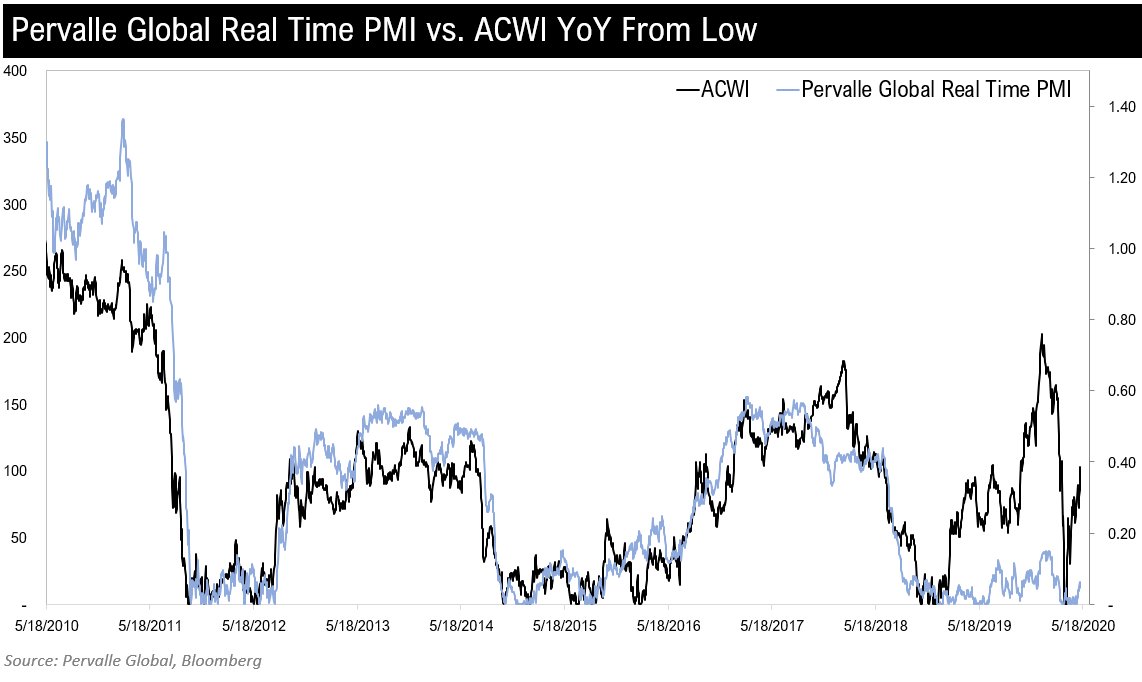

Global equities for the second time in a year price in a growth rebound that our Real Time PMI model does not confirm.

The chart above is important, specifically the signal of the past two yrs. It is clear that equity indices have progressively lost their ability to discount the future. Whether it& #39;s due to algo/vol strats, low rates, CBs, etc is less relevant than being able to adapt to it.

Good example. I created this thread on Feb 6th. The stock market hit an ATH on the 19th. Anyone with an mobile phone and twitter could see the virus coming, but for some reason the equity mkt couldnt. https://twitter.com/teddyvallee/status/1225381837121474560?s=21">https://twitter.com/teddyvall... https://twitter.com/teddyvallee/status/1225381837121474560">https://twitter.com/teddyvall...

Read on Twitter

Read on Twitter