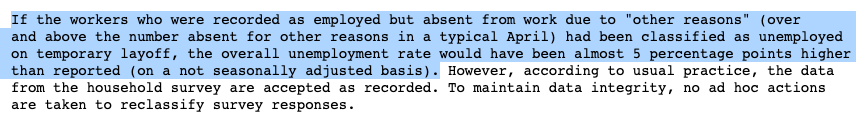

Friday& #39;s employment report was devastating — and reality almost surely worse. The BLS itself says that the unemployment number was probably understated 1/ https://www.bls.gov/news.release/empsit.nr0.htm">https://www.bls.gov/news.rele...

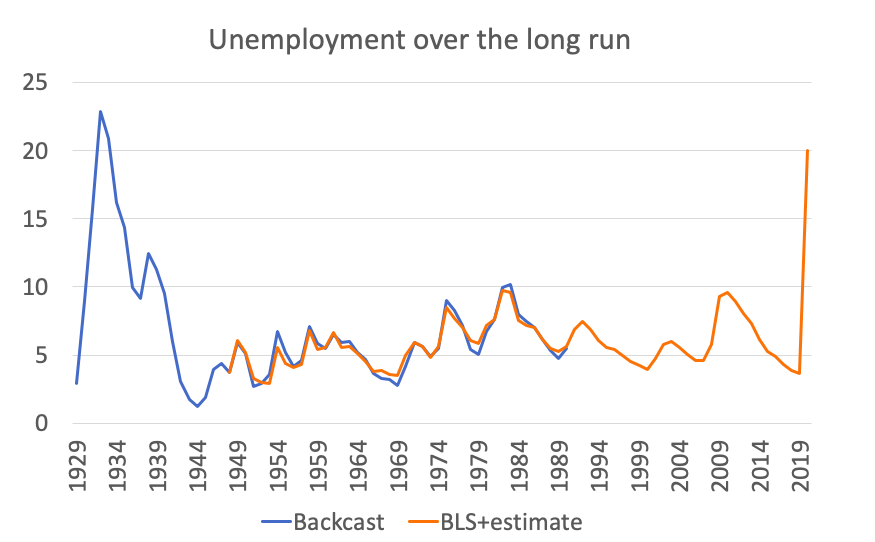

True unemployment probably ~20%. If so, worse than all but the worst 2 years of the Great Depression, according to estimates that try to apply modern concepts to available historical data 2/

But how long does this go on? Short answer is nobody knows. Long answer, I think, is that it depends hugely on the course of the pandemic — which may seem like a "well, duh" proposition but a bit more to it than that 3/

First of all, maybe a good idea to stop talking about whether there will be a V-shaped recovery, bc unclear what that means. Growth in 1934-6 was very fast, but not nearly enough to bring tolerable unemployment 4/

Reasonably certain that we will have something like a Nike swoosh — recovery much slower than initial descent, but q is how fast. 5/

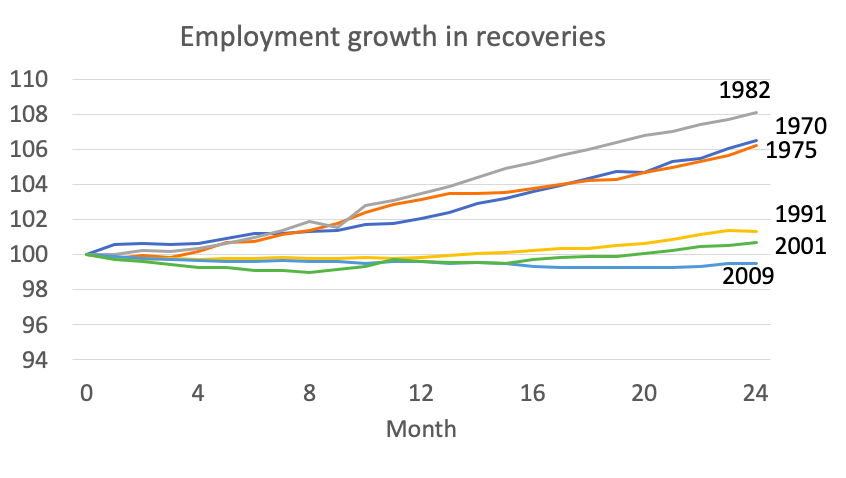

Past 6 recessions show two very different kinds of recovery — rapid surges after pre-1990, extended "jobless recovery" in later cycles 6/

I think we understand the difference. Slumps like 1979-82 brought on by the Fed raising rates to squeeze down inflation; as soon as it relented demand sprang back. Later slumps were Minsky moments, when the private sector realized it had overreached. Much harder to restart 7/

So where does the Covid-19 slump fit? Despite myself, I& #39;m (very) guardedly optimistic. The virus is arguably more like the shock of temporarily high interest rates than like an overhang of excess household debt. So fairly fast recovery seems possible 8/

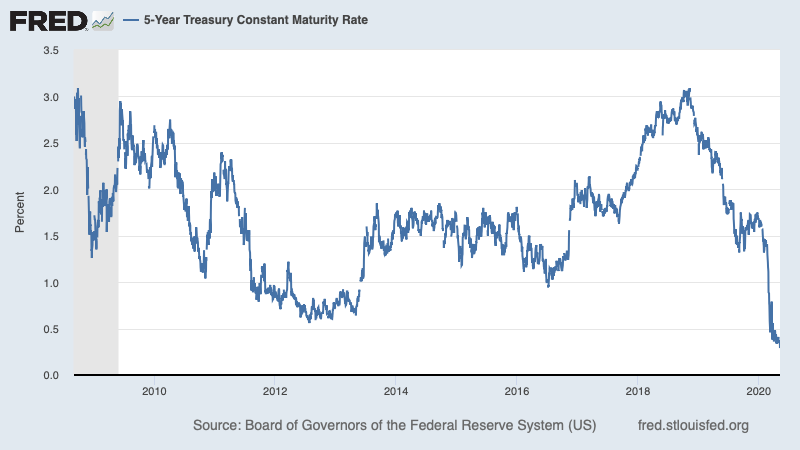

The market doesn& #39;t seem to agree! Never mind stocks: medium-term interest rates suggest that the market expects policy rates to be near zero for a long time 9/

I ran that chart back to 2008 in order to show that markets can be wrong. In early stages of recovery from 2008 crisis markets effectively bet on a V-shaped recovery that never arrived. Making the same mistake in reverse now? 10/

Two big caveats: First, recovery depends on dramatic decline in social distancing, which depends on virus/fear of virus. If premature opening leads to extended plateau or 2nd wave, slump can go on and on 11/

Second, while structural problems didn& #39;t bring on the slump, slump may create problems that extend its shadow — eg state fiscal crises, widespread household and business bankruptcies etc 12/

Some political irony here: Trump/GOP demands for early opening and refusal to extend relief may be what prolongs the slump, so that people are still miserable in November 13/

Read on Twitter

Read on Twitter