THREAD

Netflix - A business on a treadmill. Developing a & #39;bear case& #39;; how it would be difficult to continue on current growth path

Full article: https://marginalfutility.substack.com/p/netflix-a-business-on-a-treadmill?r=1ybh1&utm_campaign=post&utm_medium=web&utm_source=copy

Plz">https://marginalfutility.substack.com/p/netflix... R/T if useful

@anmolm_ @aviralbhat would love to hear your thoughts!

cc. @finbloggers

#Netflix

(1/n)

Netflix - A business on a treadmill. Developing a & #39;bear case& #39;; how it would be difficult to continue on current growth path

Full article: https://marginalfutility.substack.com/p/netflix-a-business-on-a-treadmill?r=1ybh1&utm_campaign=post&utm_medium=web&utm_source=copy

Plz">https://marginalfutility.substack.com/p/netflix... R/T if useful

@anmolm_ @aviralbhat would love to hear your thoughts!

cc. @finbloggers

#Netflix

(1/n)

Netflix has grown its subscribers at a very fast clip! Has close to 170mn paid subscribers globally (2/n)

Netflix flywheel: Spend heavily on originating content; the better content attracts more subscribers, Netflix invests most of the added cash flow to originate better content. It has also incorporated higher personalization in the flywheel, leading to more engagement. (3/n)

Goal: Get enough consumers hooked, and make enough from subscriptions, to make more money than the cost of serving up a nearly endless well of content. Building scale on top of fixed costs and hoping growth of the former continues to outpace the growth of the latter. (4/n)

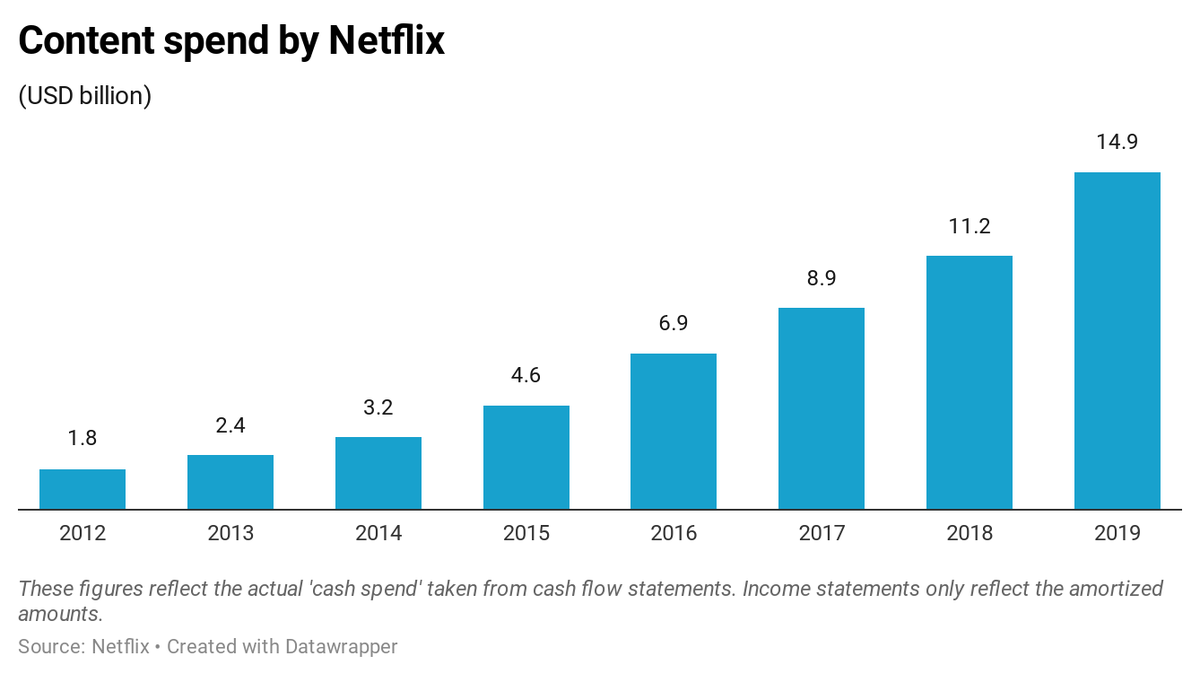

Here& #39;s how much Netflix has spent on content over the years (5/n)

While initially focusing on acting as a distributor, it understood the importance of producing its own content. If online streaming is the future, only a matter of time until other media companies entered the field themselves instead of licensing their content to Netflix (6/n)

Developing the bear case:

Reason 1: Market saturation in USA, its core market. Has 70 mn subscribers there. USA has 126mn households. Due to account sharing, penetration well above 60%.

Result: Slowing growth in USA (7/n)

Reason 1: Market saturation in USA, its core market. Has 70 mn subscribers there. USA has 126mn households. Due to account sharing, penetration well above 60%.

Result: Slowing growth in USA (7/n)

Reason 2: Customers not as price elastic as expected

Till recently, Netflix has competed mainly with linear TV bundles at one-fifth the price, and offered a compelling value proposition. Now, Netflix operates in a crowded space where it is one of the most expensive options (8/n)

Till recently, Netflix has competed mainly with linear TV bundles at one-fifth the price, and offered a compelling value proposition. Now, Netflix operates in a crowded space where it is one of the most expensive options (8/n)

In Jan& #39;19, Netflix raised its prices in some regions (increases ranging from USD 1 – 2 p.m.). In the foll. quarter, lost 123,000 U.S. subscribers. International subscriber count also failed to reach Netflix& #39;s forecasts (9/n)

Reason 3: Growth from international markets comes with its own share of troubles. Requires increasing investment in local language content + lower ARPUs (10/n)

Reason 4: Return from content spend may not be high enough

Netflix wants to build a content library that it can own in perpetuity, essentially incurring a fixed cost now and benefit from it over several years / decades.

However, content has an expiry date. (11/n)

Netflix wants to build a content library that it can own in perpetuity, essentially incurring a fixed cost now and benefit from it over several years / decades.

However, content has an expiry date. (11/n)

Industry estimate suggest that the average ‘shelf life’ of original content would be 3-4 years, and hence, it seems that the ‘perpetual content ownership’ argument breaks down. on a per unit of content basis, Netflix lags its competitors (see article for detailed data) (12/n)

Netflix& #39;s business model is like running on a treadmill: Constantly needs more subscribers, constantly needs to generate content, constantly needs to ensure its content is on more in-demand than its competitors. Failing to do one of them means failing to do any of them. (13/n)

For full article, https://marginalfutility.substack.com/p/netflix-a-business-on-a-treadmill?r=1ybh1&utm_campaign=post&utm_medium=web&utm_source=copy">https://marginalfutility.substack.com/p/netflix...

Read on Twitter

Read on Twitter