Reversal Patterns Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

#Candlestick

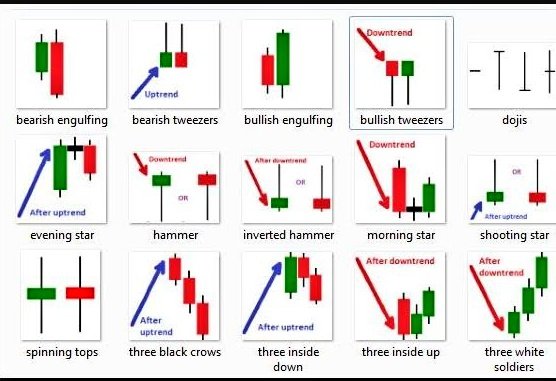

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are two types of reversal patterns in candlestick

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are two types of reversal patterns in candlestick

1.Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

2.Bearish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bear face" aria-label="Emoji: Bear face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bear face" aria-label="Emoji: Bear face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Bullish reversal pattern mostly occurs in downtrend or during intermediate corrections of uptrend,

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Bullish reversal pattern mostly occurs in downtrend or during intermediate corrections of uptrend,

Vice Versa for Bearish reversal pattern

1/n

#Candlestick

1.Bullish

2.Bearish

Vice Versa for Bearish reversal pattern

1/n

Reversal Patterns Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

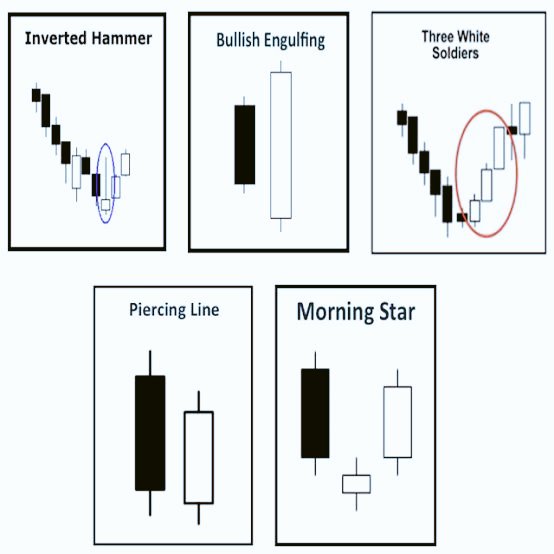

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Some common bullish reversal patterns identifed by traders on charts are

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Some common bullish reversal patterns identifed by traders on charts are

1.Bullish Engulfing

2.Three White Soldiers

3.Morning Star

4.Piercing Line

5.Inverted Hammer

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">All patterns to be confirmed with price move & other indicators

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">All patterns to be confirmed with price move & other indicators

2/n

Bullish

1.Bullish Engulfing

2.Three White Soldiers

3.Morning Star

4.Piercing Line

5.Inverted Hammer

2/n

Reversal Patterns Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

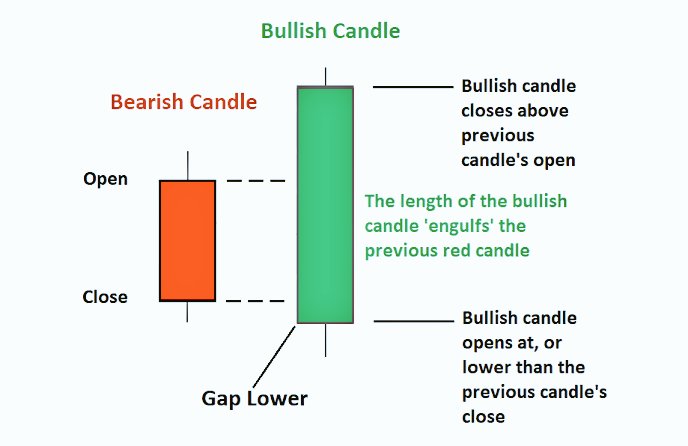

Bullish Engulfing

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its a reversal pattern in which second candle (Green) completely engulfs the real body of the first(Red) candle

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its a reversal pattern in which second candle (Green) completely engulfs the real body of the first(Red) candle

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day price opens lower than the previous day low & close above previous day high

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day price opens lower than the previous day low & close above previous day high

3/n

#Candlestick

Bullish Engulfing

3/n

#Candlestick

Reversal Patterns Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

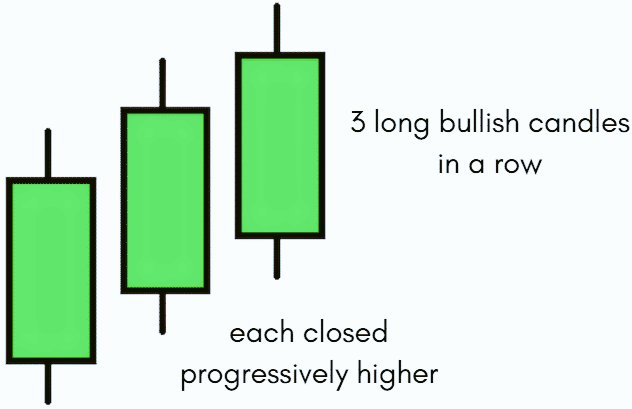

Three White Soldiers

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of 3 long green candles with consecutive closes above yesterday& #39;s low

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of 3 long green candles with consecutive closes above yesterday& #39;s low

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Each candle opens higher than the previous open and closes near the high of the day

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Each candle opens higher than the previous open and closes near the high of the day

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It appeares in downtrend or after consolidation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It appeares in downtrend or after consolidation

4/n

Three White Soldiers

4/n

Reversal Patterns Simplified  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

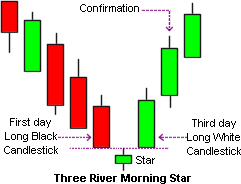

Morning Star https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> It consists of 3 candles: one small candle (doji) between a preceding long red candle and a succeeding long green one.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> It consists of 3 candles: one small candle (doji) between a preceding long red candle and a succeeding long green one.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">This pattern comes with a bullish ray of hope in downtrend

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">This pattern comes with a bullish ray of hope in downtrend

Example - #Nifty made MS pattern near 7500

5/n

Morning Star

Example - #Nifty made MS pattern near 7500

5/n

Reversal Patterns Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

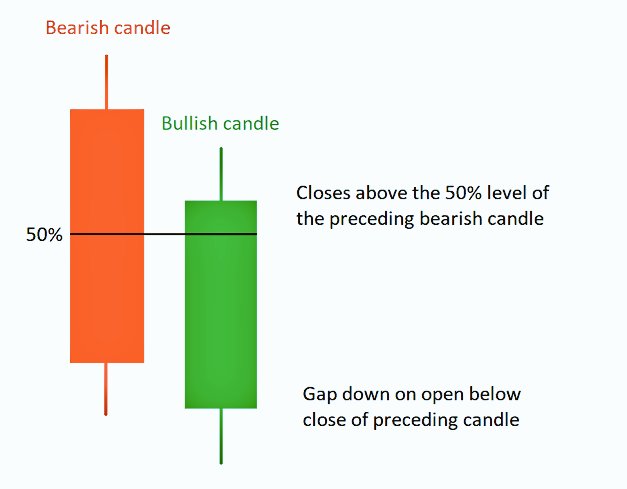

Piercing Line https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Its a pattern in which first long red candle is followed by a green candle that opens lower than the previous close &

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Its a pattern in which first long red candle is followed by a green candle that opens lower than the previous close &

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day it closes above the halfway mark or more into the real body of previous day red candle

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day it closes above the halfway mark or more into the real body of previous day red candle

6/n

Piercing Line

6/n

Reversal Patterns Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

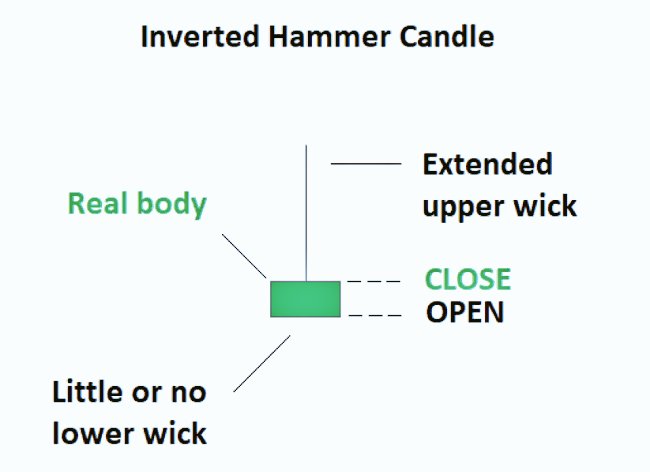

Inverted Hammer https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It a bullish reversal pattern occurs near a bottom of the downtrend

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It a bullish reversal pattern occurs near a bottom of the downtrend

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of short candle with a longer lower shadow & small body

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of short candle with a longer lower shadow & small body

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Next few days candles must be watched for better confirmation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Next few days candles must be watched for better confirmation

End of Thread

Thanks https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

Inverted Hammer

End of Thread

Thanks

Read on Twitter

Read on Twitter #Candlestick https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are two types of reversal patterns in candlestick1.Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">2.Bearish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bear face" aria-label="Emoji: Bear face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Bullish reversal pattern mostly occurs in downtrend or during intermediate corrections of uptrend,Vice Versa for Bearish reversal pattern1/n" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger"> #Candlestick https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are two types of reversal patterns in candlestick1.Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">2.Bearish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bear face" aria-label="Emoji: Bear face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Bullish reversal pattern mostly occurs in downtrend or during intermediate corrections of uptrend,Vice Versa for Bearish reversal pattern1/n" class="img-responsive" style="max-width:100%;"/>

#Candlestick https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are two types of reversal patterns in candlestick1.Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">2.Bearish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bear face" aria-label="Emoji: Bear face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Bullish reversal pattern mostly occurs in downtrend or during intermediate corrections of uptrend,Vice Versa for Bearish reversal pattern1/n" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger"> #Candlestick https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are two types of reversal patterns in candlestick1.Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">2.Bearish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐻" title="Bear face" aria-label="Emoji: Bear face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Bullish reversal pattern mostly occurs in downtrend or during intermediate corrections of uptrend,Vice Versa for Bearish reversal pattern1/n" class="img-responsive" style="max-width:100%;"/>

Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Some common bullish reversal patterns identifed by traders on charts are1.Bullish Engulfing2.Three White Soldiers3.Morning Star4.Piercing Line5.Inverted Hammerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">All patterns to be confirmed with price move & other indicators2/n" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Some common bullish reversal patterns identifed by traders on charts are1.Bullish Engulfing2.Three White Soldiers3.Morning Star4.Piercing Line5.Inverted Hammerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">All patterns to be confirmed with price move & other indicators2/n" class="img-responsive" style="max-width:100%;"/>

Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Some common bullish reversal patterns identifed by traders on charts are1.Bullish Engulfing2.Three White Soldiers3.Morning Star4.Piercing Line5.Inverted Hammerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">All patterns to be confirmed with price move & other indicators2/n" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Bullish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Some common bullish reversal patterns identifed by traders on charts are1.Bullish Engulfing2.Three White Soldiers3.Morning Star4.Piercing Line5.Inverted Hammerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">All patterns to be confirmed with price move & other indicators2/n" class="img-responsive" style="max-width:100%;"/>

Bullish Engulfinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its a reversal pattern in which second candle (Green) completely engulfs the real body of the first(Red) candlehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day price opens lower than the previous day low & close above previous day high3/n #Candlestick" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Bullish Engulfinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its a reversal pattern in which second candle (Green) completely engulfs the real body of the first(Red) candlehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day price opens lower than the previous day low & close above previous day high3/n #Candlestick" class="img-responsive" style="max-width:100%;"/>

Bullish Engulfinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its a reversal pattern in which second candle (Green) completely engulfs the real body of the first(Red) candlehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day price opens lower than the previous day low & close above previous day high3/n #Candlestick" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Bullish Engulfinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its a reversal pattern in which second candle (Green) completely engulfs the real body of the first(Red) candlehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day price opens lower than the previous day low & close above previous day high3/n #Candlestick" class="img-responsive" style="max-width:100%;"/>

Three White Soldiershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of 3 long green candles with consecutive closes above yesterday& #39;s lowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Each candle opens higher than the previous open and closes near the high of the dayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It appeares in downtrend or after consolidation 4/n" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Three White Soldiershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of 3 long green candles with consecutive closes above yesterday& #39;s lowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Each candle opens higher than the previous open and closes near the high of the dayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It appeares in downtrend or after consolidation 4/n" class="img-responsive" style="max-width:100%;"/>

Three White Soldiershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of 3 long green candles with consecutive closes above yesterday& #39;s lowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Each candle opens higher than the previous open and closes near the high of the dayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It appeares in downtrend or after consolidation 4/n" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Three White Soldiershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of 3 long green candles with consecutive closes above yesterday& #39;s lowhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Each candle opens higher than the previous open and closes near the high of the dayhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It appeares in downtrend or after consolidation 4/n" class="img-responsive" style="max-width:100%;"/>

Morning Starhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> It consists of 3 candles: one small candle (doji) between a preceding long red candle and a succeeding long green one.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">This pattern comes with a bullish ray of hope in downtrendExample - #Nifty made MS pattern near 7500 5/n" title="Reversal Patterns Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Morning Starhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> It consists of 3 candles: one small candle (doji) between a preceding long red candle and a succeeding long green one.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">This pattern comes with a bullish ray of hope in downtrendExample - #Nifty made MS pattern near 7500 5/n" class="img-responsive" style="max-width:100%;"/>

Morning Starhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> It consists of 3 candles: one small candle (doji) between a preceding long red candle and a succeeding long green one.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">This pattern comes with a bullish ray of hope in downtrendExample - #Nifty made MS pattern near 7500 5/n" title="Reversal Patterns Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Morning Starhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> It consists of 3 candles: one small candle (doji) between a preceding long red candle and a succeeding long green one.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">This pattern comes with a bullish ray of hope in downtrendExample - #Nifty made MS pattern near 7500 5/n" class="img-responsive" style="max-width:100%;"/>

Piercing Linehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Its a pattern in which first long red candle is followed by a green candle that opens lower than the previous close &https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day it closes above the halfway mark or more into the real body of previous day red candle6/n" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Piercing Linehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Its a pattern in which first long red candle is followed by a green candle that opens lower than the previous close &https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day it closes above the halfway mark or more into the real body of previous day red candle6/n" class="img-responsive" style="max-width:100%;"/>

Piercing Linehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Its a pattern in which first long red candle is followed by a green candle that opens lower than the previous close &https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day it closes above the halfway mark or more into the real body of previous day red candle6/n" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Piercing Linehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Its a pattern in which first long red candle is followed by a green candle that opens lower than the previous close &https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">On the second day it closes above the halfway mark or more into the real body of previous day red candle6/n" class="img-responsive" style="max-width:100%;"/>

Inverted Hammerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It a bullish reversal pattern occurs near a bottom of the downtrendhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of short candle with a longer lower shadow & small bodyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Next few days candles must be watched for better confirmationEnd of ThreadThanks https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Inverted Hammerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It a bullish reversal pattern occurs near a bottom of the downtrendhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of short candle with a longer lower shadow & small bodyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Next few days candles must be watched for better confirmationEnd of ThreadThanks https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" class="img-responsive" style="max-width:100%;"/>

Inverted Hammerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It a bullish reversal pattern occurs near a bottom of the downtrendhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of short candle with a longer lower shadow & small bodyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Next few days candles must be watched for better confirmationEnd of ThreadThanks https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" title="Reversal Patterns Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Inverted Hammerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ox" aria-label="Emoji: Ox">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It a bullish reversal pattern occurs near a bottom of the downtrendhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It consists of short candle with a longer lower shadow & small bodyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Next few days candles must be watched for better confirmationEnd of ThreadThanks https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" class="img-responsive" style="max-width:100%;"/>