Ever since #COVID19 began spreading in #Maldives the need of the hour has been emergency measures to control the spread & to mitigate the impact on lives & livelihoods.

Whilst State agencies have implemented many critical steps, other measures can only be imposed through law.

Whilst State agencies have implemented many critical steps, other measures can only be imposed through law.

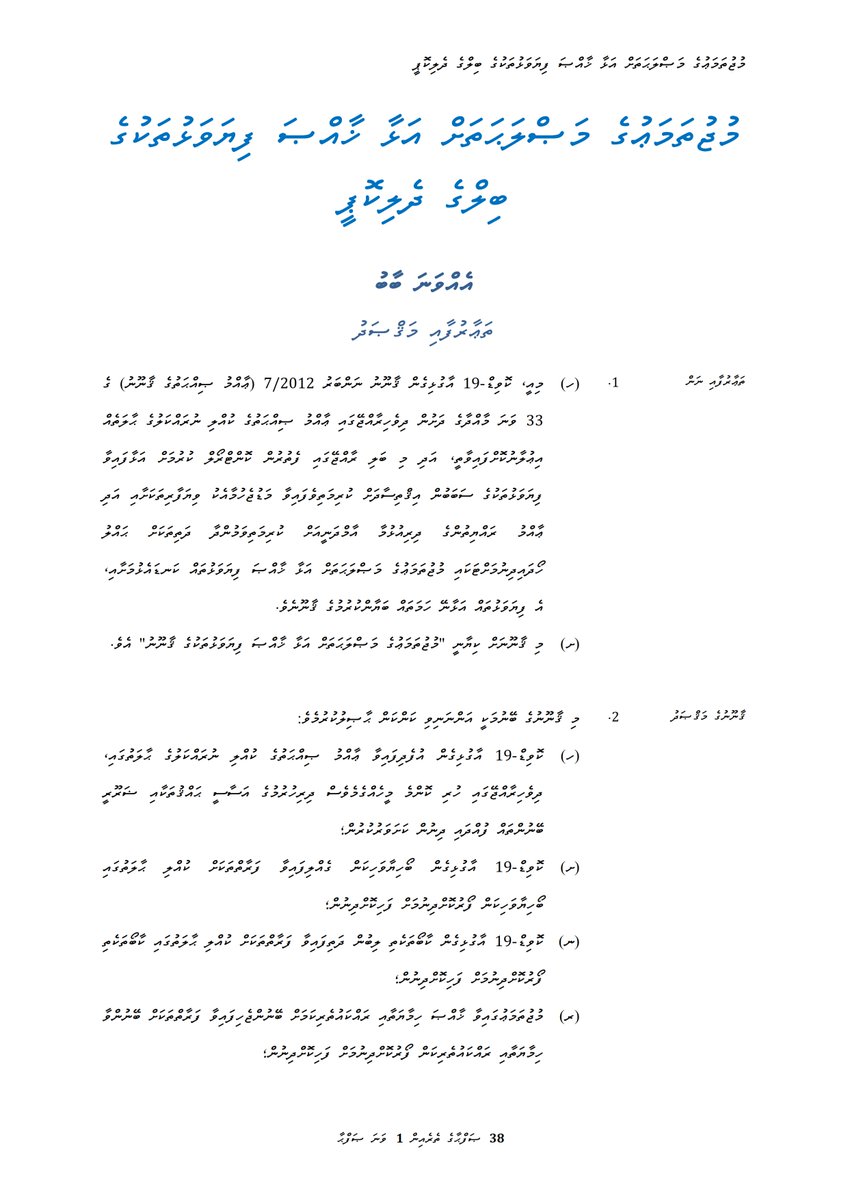

Here& #39;s a proposal for a #COVID19 Emergency Measures Bill that shows how such legislation might be structured  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> https://drive.google.com/file/d/10FMiiIexeeWyBWiM9uO1p6Srfah4KcYN/view?usp=sharing

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> https://drive.google.com/file/d/10FMiiIexeeWyBWiM9uO1p6Srfah4KcYN/view?usp=sharing

For">https://drive.google.com/file/d/10... those who don& #39;t want to wade through 38 pages of "legalese" (um, so, basically everyone https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">), the (relatively) short version follows...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">), the (relatively) short version follows...

For">https://drive.google.com/file/d/10... those who don& #39;t want to wade through 38 pages of "legalese" (um, so, basically everyone

The proposals cover the issues of:

- shelter

- food

- rent increases

- evictions

- rent relief

- profiteering

- employment

- unemployment benefits

- mental well-being

- public utilities & internet charges

- loan relief

- State expenses

- wages of higher-earning State officials

- shelter

- food

- rent increases

- evictions

- rent relief

- profiteering

- employment

- unemployment benefits

- mental well-being

- public utilities & internet charges

- loan relief

- State expenses

- wages of higher-earning State officials

If enacted into law, a 𝗦𝗽𝗲𝗰𝗶𝗮𝗹 𝗣𝗿𝗼𝘁𝗲𝗰𝘁𝗶𝗼𝗻 𝗣𝗲𝗿𝗶𝗼𝗱 will be designated where the 𝗦𝗽𝗲𝗰𝗶𝗮𝗹 𝗣𝗿𝗼𝘁𝗲𝗰𝘁𝗶𝘃𝗲 𝗠𝗲𝗮𝘀𝘂𝗿𝗲𝘀 of the law will apply.

Some measures will be activated by a 𝗦𝗽𝗲𝗰𝗶𝗮𝗹 𝗠𝗲𝗮𝘀𝘂𝗿𝗲𝘀 𝗗𝗲𝗰𝗿𝗲𝗲 of the President.

Some measures will be activated by a 𝗦𝗽𝗲𝗰𝗶𝗮𝗹 𝗠𝗲𝗮𝘀𝘂𝗿𝗲𝘀 𝗗𝗲𝗰𝗿𝗲𝗲 of the President.

The Special Protection Period will run from 1 𝗠𝗮𝗿𝗰𝗵 2020 until whichever occurs last:

- 31 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿 2020, or the lifting of

- the current State of Public Health Emergency or

- any State of Emergency declared under the Constitution to help control the pandemic.

- 31 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿 2020, or the lifting of

- the current State of Public Health Emergency or

- any State of Emergency declared under the Constitution to help control the pandemic.

Persons who are to be given additional protections are designated 𝗦𝗽𝗲𝗰𝗶𝗮𝗹𝗹𝘆 𝗣𝗿𝗼𝘁𝗲𝗰𝘁𝗲𝗱 𝗣𝗲𝗿𝘀𝗼𝗻𝘀. They are those who are:

- homeless or starving

- infected or at high risk of being infected

- single parents

- persons with special needs

- guardians of minors

- homeless or starving

- infected or at high risk of being infected

- single parents

- persons with special needs

- guardians of minors

Other Specially Protected Persons are:

- health professionals

- emergency service providers

- anyone unable to return to their usual place of residence due to COVID-19

- migrant workers abandoned by their employers

- health professionals

- emergency service providers

- anyone unable to return to their usual place of residence due to COVID-19

- migrant workers abandoned by their employers

𝗦𝗵𝗲𝗹𝘁𝗲𝗿

The following acts will be prohibited during the Special Protection Period:

- increasing rent

- terminating rent agreements

- evictions

- obstructing provision of public utilities

- hindering tenants& #39; access to premises

- any act intended to force tenants to vacate

The following acts will be prohibited during the Special Protection Period:

- increasing rent

- terminating rent agreements

- evictions

- obstructing provision of public utilities

- hindering tenants& #39; access to premises

- any act intended to force tenants to vacate

Any of the prohibited acts committed between 1 March 2020 & the day the law comes into effect 𝗺𝘂𝘀𝘁 𝗯𝗲 𝗿𝗲𝘃𝗲𝗿𝘀𝗲𝗱 𝗯𝘆 𝘁𝗵𝗲 𝗹𝗮𝗻𝗱𝗹𝗼𝗿𝗱 𝘄𝗶𝘁𝗵𝗶𝗻 3 𝗱𝗮𝘆𝘀 of the law coming into effect.

Where any rent increase has already been paid, the tenant may deduct that amount from the rent payment for the following month.

Tenants do not need to request for the relief to be granted; it is the responsibility of the landlord to ensure the relief is provided.

Tenants do not need to request for the relief to be granted; it is the responsibility of the landlord to ensure the relief is provided.

Rent reductions & waivers entitle the landlord to tax credits.

To qualify, rent reductions must be not less than 20% of the rent & the reduced amount must not be payable at a later date.

Rent waivers must be of the entire month& #39;s rent for however many months.

To qualify, rent reductions must be not less than 20% of the rent & the reduced amount must not be payable at a later date.

Rent waivers must be of the entire month& #39;s rent for however many months.

The monthly rent of premises leased for residential purposes from entities with State shareholding is adjusted for the Special Protection Period:

- 20% waived

- 30% deferred for not less than 1 year

This adjustment covers instalment payments for "Social Housing" projects.

- 20% waived

- 30% deferred for not less than 1 year

This adjustment covers instalment payments for "Social Housing" projects.

Specially Protected Persons are granted a higher rate of relief for rent/instalment payments to entities with State shareholding:

- 30% waived

- 40% deferred for not less than 1 year

𝗧𝗮𝘅 𝗰𝗿𝗲𝗱𝗶𝘁𝘀 for rent reductions range from 15 - 50%

For waivers, the rate is 25 - 75%

- 30% waived

- 40% deferred for not less than 1 year

𝗧𝗮𝘅 𝗰𝗿𝗲𝗱𝗶𝘁𝘀 for rent reductions range from 15 - 50%

For waivers, the rate is 25 - 75%

The State must establish 𝗘𝗺𝗲𝗿𝗴𝗲𝗻𝗰𝘆 𝗦𝗵𝗲𝗹𝘁𝗲𝗿𝘀 in each administrative district, in association with local councils, CSOs, volunteers & businesses.

All costs of housing migrant workers in Emergency Shelters must be borne by the respective employers of those workers.

All costs of housing migrant workers in Emergency Shelters must be borne by the respective employers of those workers.

Any resort that has temporarily ceased operations may be taken over by the govt as an Emergency Shelter.

No fees are payable by the govt for such use of resorts, but an appropriate amount (as decided by the President) may be deducted from future head lease payments.

No fees are payable by the govt for such use of resorts, but an appropriate amount (as decided by the President) may be deducted from future head lease payments.

𝗙𝗼𝗼𝗱

The State must establish 𝗘𝗺𝗲𝗿𝗴𝗲𝗻𝗰𝘆 𝗙𝗼𝗼𝗱 𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻 𝗖𝗲𝗻𝘁𝗿𝗲𝘀 in every inhabited island, in association with local councils, CSOs, volunteers & businesses.

Any party assisting in providing food from such Centres is entitled to tax credits.

The State must establish 𝗘𝗺𝗲𝗿𝗴𝗲𝗻𝗰𝘆 𝗙𝗼𝗼𝗱 𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻 𝗖𝗲𝗻𝘁𝗿𝗲𝘀 in every inhabited island, in association with local councils, CSOs, volunteers & businesses.

Any party assisting in providing food from such Centres is entitled to tax credits.

It will be prohibited to increase prices of food, goods or services beyond 5% of their usual (pre-emergency) price.

Where the govt believes the price has been set to take undue advantage of the public& #39;s situation, then it may control the price of such food, goods or services.

Where the govt believes the price has been set to take undue advantage of the public& #39;s situation, then it may control the price of such food, goods or services.

Any party found to have profiteered during the Special Protection Period must surrender all such profits within 7 days. The govt may impose fines for non-compliance.

All surrendered profits will go to a 𝗡𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗙𝘂𝗻𝗱 𝗳𝗼𝗿 𝗖𝗼𝗺𝗺𝘂𝗻𝗶𝘁𝘆 𝗥𝗲𝗰𝗼𝘃𝗲𝗿𝘆.

All surrendered profits will go to a 𝗡𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗙𝘂𝗻𝗱 𝗳𝗼𝗿 𝗖𝗼𝗺𝗺𝘂𝗻𝗶𝘁𝘆 𝗥𝗲𝗰𝗼𝘃𝗲𝗿𝘆.

𝗘𝗺𝗽𝗹𝗼𝘆𝗺𝗲𝗻𝘁

Effective from 1 March 2020 & including anyone who was an employee on 29 Feb 2020, all unilateral decisions by employers to reduce employees& #39; wages, withhold Ramazan benefits, or subject them to unpaid leave or temporary lay-offs or redundancy are annulled.

Effective from 1 March 2020 & including anyone who was an employee on 29 Feb 2020, all unilateral decisions by employers to reduce employees& #39; wages, withhold Ramazan benefits, or subject them to unpaid leave or temporary lay-offs or redundancy are annulled.

Any employee who was placed on unpaid leave, or temporary laid-off, or made redundant after 29 February 2020 will instead be deemed to have been placed on "𝗳𝘂𝗿𝗹𝗼𝘂𝗴𝗵" with 𝗻𝗼 𝗹𝗼𝘀𝘀 𝗼𝗳 𝗲𝗺𝗽𝗹𝗼𝘆𝗺𝗲𝗻𝘁 & 𝗻𝗼 𝗿𝗲𝗱𝘂𝗰𝘁𝗶𝗼𝗻 𝗶𝗻 𝘄𝗮𝗴𝗲𝘀.

Employees on furlough will be paid their normal wages, apportioned between the employer (20 - 40%) & the State (60 - 80%).

All payments made by the State are reimbursable by the employer. In making this reimbursement, employers may not make deductions from the employee& #39;s wages.

All payments made by the State are reimbursable by the employer. In making this reimbursement, employers may not make deductions from the employee& #39;s wages.

Employers who make use of the furlough scheme must undergo a special audit by the Auditor General or his nominee.

For this special audit, those employers must submit to the Auditor General within 7 days 𝗮𝗹𝗹 𝘁𝗵𝗲𝗶𝗿 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗿𝗲𝗰𝗼𝗿𝗱𝘀 for the past 5 years.

For this special audit, those employers must submit to the Auditor General within 7 days 𝗮𝗹𝗹 𝘁𝗵𝗲𝗶𝗿 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗿𝗲𝗰𝗼𝗿𝗱𝘀 for the past 5 years.

Employers who choose to not use the furlough scheme & dismiss employees will be 𝗱𝗲𝗲𝗺𝗲𝗱 𝗶𝗻 𝗯𝗿𝗲𝗮𝗰𝗵 of the Employment Act.

In addition to imposing penalties under the Employment Act, the Employment Tribunal is to award 2 months& #39; wages as compensation to the employee.

In addition to imposing penalties under the Employment Act, the Employment Tribunal is to award 2 months& #39; wages as compensation to the employee.

All probation periods are to be suspended with no loss of employment.

Where any employee has not been paid Ramazan benefits, the govt is to pay those benefits before the end of Ramazan. The benefits paid by the govt are to be reimbursed to the govt by the respective employers.

Where any employee has not been paid Ramazan benefits, the govt is to pay those benefits before the end of Ramazan. The benefits paid by the govt are to be reimbursed to the govt by the respective employers.

Any employee within the category of Specially Protected Persons 𝗺𝗮𝘆 𝗻𝗼𝘁 𝗯𝗲 𝗱𝗶𝘀𝗺𝗶𝘀𝘀𝗲𝗱 𝗳𝗼𝗿 𝗮𝗻𝘆 𝗿𝗲𝗮𝘀𝗼𝗻 during the Special Protection Period.

There is no hindrance to the imposition during this period of disciplinary measures under the Employment Act.

There is no hindrance to the imposition during this period of disciplinary measures under the Employment Act.

The State is to pay monthly benefits to

- self-employed persons and freelancers, based on their average monthly income between 1 December 2019 & 29 February 2020

- unemployed persons

Such benefits paid by the State are 𝗻𝗼𝘁 𝘁𝗼 𝗯𝗲 𝗰𝗼𝗻𝘀𝗶𝗱𝗲𝗿𝗲𝗱 𝗹𝗼𝗮𝗻𝘀 in any way.

- self-employed persons and freelancers, based on their average monthly income between 1 December 2019 & 29 February 2020

- unemployed persons

Such benefits paid by the State are 𝗻𝗼𝘁 𝘁𝗼 𝗯𝗲 𝗰𝗼𝗻𝘀𝗶𝗱𝗲𝗿𝗲𝗱 𝗹𝗼𝗮𝗻𝘀 in any way.

Two special types of leaves are to be created. Both are to be separate (& not deductible) from any leave currently granted by the Employment Act.

Each employee is entitled to paid leave of up to 2 days per month as 𝗺𝗲𝗻𝘁𝗮𝗹 𝘄𝗲𝗹𝗹-𝗯𝗲𝗶𝗻𝗴 𝗿𝗲𝘃𝗶𝘃𝗮𝗹 𝗹𝗲𝗮𝘃𝗲.

Each employee is entitled to paid leave of up to 2 days per month as 𝗺𝗲𝗻𝘁𝗮𝗹 𝘄𝗲𝗹𝗹-𝗯𝗲𝗶𝗻𝗴 𝗿𝗲𝘃𝗶𝘃𝗮𝗹 𝗹𝗲𝗮𝘃𝗲.

Apart from the request itself, 𝗻𝗼 𝗱𝗼𝗰𝘂𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻 𝗺𝗮𝘆 𝗯𝗲 𝗿𝗲𝗾𝘂𝗶𝗿𝗲𝗱 𝗳𝗿𝗼𝗺 𝘁𝗵𝗲 𝗲𝗺𝗽𝗹𝗼𝘆𝗲𝗲.

No adverse impact is permitted on the career of any employee who takes such leave.

No adverse impact is permitted on the career of any employee who takes such leave.

𝗖𝗢𝗩𝗜𝗗-19 𝘁𝗿𝗲𝗮𝘁𝗺𝗲𝗻𝘁 𝗹𝗲𝗮𝘃𝗲 may be availed by any employee who has been:

- infected or admitted for treatment

- requested to self-isolate by health authorities or

- residing in a place under monitoring status

- quarantined

- infected or admitted for treatment

- requested to self-isolate by health authorities or

- residing in a place under monitoring status

- quarantined

𝗣𝘂𝗯𝗹𝗶𝗰 𝘂𝘁𝗶𝗹𝗶𝘁𝗶𝗲𝘀 & 𝗶𝗻𝘁𝗲𝗿𝗻𝗲𝘁 𝗰𝗵𝗮𝗿𝗴𝗲𝘀

During the Special Protection Period, charges for public utilities & internet & phone services must be reduced by between 25 – 40%, as decided by the govt.

During the Special Protection Period, charges for public utilities & internet & phone services must be reduced by between 25 – 40%, as decided by the govt.

Public utilities & internet & phone services may not be suspended during the Special Protection Period.

The following is also prohibited:

- increase in fees

- changes to usage calculation

The following is also prohibited:

- increase in fees

- changes to usage calculation

𝗟𝗼𝗮𝗻 𝗿𝗲𝗹𝗶𝗲𝗳 & 𝗦𝘁𝗮𝘁𝗲 𝗲𝘅𝗽𝗲𝗻𝗱𝗶𝘁𝘂𝗿𝗲

- repayments of certain types of loans to be suspended

- no interest to accrue

- maximum interest rate permitted shall not exceed 3% p.a

- compound interest prohibited

- enforcement of mortgage agreements to be suspended

- repayments of certain types of loans to be suspended

- no interest to accrue

- maximum interest rate permitted shall not exceed 3% p.a

- compound interest prohibited

- enforcement of mortgage agreements to be suspended

The Auditor General must make special rules in line with recommendations by the ACC for public finance expenditure

Wages of State officials & employees of entities with State shareholding

- under 20k: no deductions

- 20 to 30k: 10%

- 30 to 50k: 25%

- 50k & above: capped at 50k

Wages of State officials & employees of entities with State shareholding

- under 20k: no deductions

- 20 to 30k: 10%

- 30 to 50k: 25%

- 50k & above: capped at 50k

Other measures

- refusing service to health professionals & expatriates prohibited

- wages of SOE board members to not exceed Permanent Secretaries& #39; wages

- employers to whose staff the State has paid benefits may not bid for public contracts until they have reimbursed the State

- refusing service to health professionals & expatriates prohibited

- wages of SOE board members to not exceed Permanent Secretaries& #39; wages

- employers to whose staff the State has paid benefits may not bid for public contracts until they have reimbursed the State

Read on Twitter

Read on Twitter https://drive.google.com/file/d/10... those who don& #39;t want to wade through 38 pages of "legalese" (um, so, basically everyone https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">), the (relatively) short version follows..." title="Here& #39;s a proposal for a #COVID19 Emergency Measures Bill that shows how such legislation might be structured https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> https://drive.google.com/file/d/10... those who don& #39;t want to wade through 38 pages of "legalese" (um, so, basically everyone https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">), the (relatively) short version follows..." class="img-responsive" style="max-width:100%;"/>

https://drive.google.com/file/d/10... those who don& #39;t want to wade through 38 pages of "legalese" (um, so, basically everyone https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">), the (relatively) short version follows..." title="Here& #39;s a proposal for a #COVID19 Emergency Measures Bill that shows how such legislation might be structured https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> https://drive.google.com/file/d/10... those who don& #39;t want to wade through 38 pages of "legalese" (um, so, basically everyone https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">), the (relatively) short version follows..." class="img-responsive" style="max-width:100%;"/>