1/ I& #39;ve been thinking about the impact of COVID on climate change. Reduction in pollution during shutdowns is probably immaterial. Here& #39;s a thread about medium-to-longer-run. I think the big factors long run are:

(1) lower interest rates

(2) lower oil prices

(3) policy impact

(1) lower interest rates

(2) lower oil prices

(3) policy impact

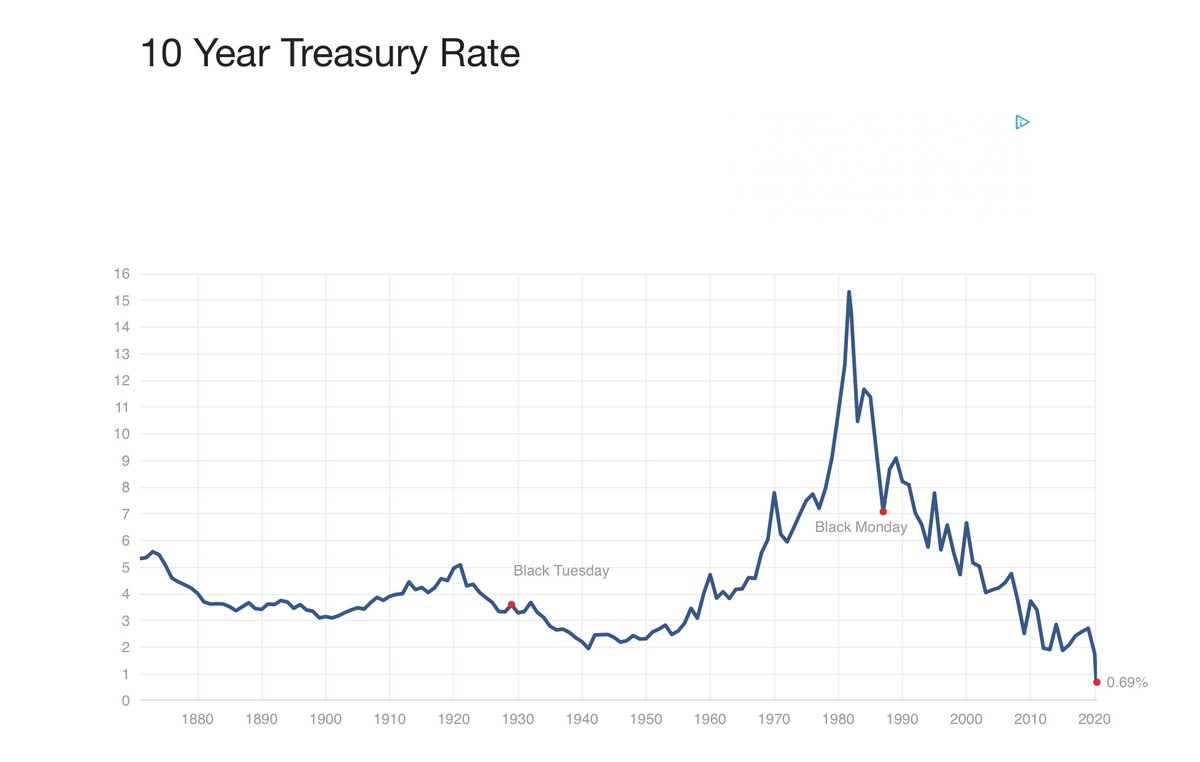

2/ Lower interest rates greatly favor renewables, since renewables (solar, wind, and batteries) are all capital intensive, while conventional energy costs are dominated by fuels. I& #39;m no macroeconomist, but it looks to me like rate cycles persist for a number of years.

3/ Risk premiums for renewables are also likely to be low, partly because the dividend covaries positively with energy prices, and because there is lower downside risk or stranded assets problem. Cost of capital should be close to municipal bond rates.

4/ While the risk premiums have probably always been a factor, it may loom larger now that risk premiums have risen, making the renewable advantage even greater.

5/ So, good news for renewables the climate!

Not so fast...

Not so fast...

6/ Lower oil prices are a compensating differential. Cheap oil means cheap gas and more driving, which is bad for climate change, bad for local pollution, bad for congestion, and probably bad for traffic fatalities -- bring on the super-sized Hummer! EVs less attractive.

7/ I am hopeful that EV demand will continue to grow, mainly because the cost of ownership will soon be less than gas cars, even with cheap gas. And more importantly, Tesla and others have made EVs cool and fun. Still, low gas prices will slow the trend.

8/ Maybe the EV slowdown is less of a concern anyway, as some prominent energy economists find that in some places, EVs are more polluting than gas cars, because they use dirty electricity. By the time oil prices rise again, the grid will be greener, and ready for more EVs.

9/ Another dynamic that colleagues and I are trying to model in more detail, concerns links between oil and gas markets. Since oil and gas are often co-generated, if the fracking boom is killed by low oil prices, the medium-run outlook gets murkier.

10/ The implications for the gas market and its associated emissions are where I struggle. Near term, gas is king, and may help or hurt climate at the margin, depending on the energy source it displaces (e.g., coal vs. nuclear vs. wind). Methane leaks also loom large.

11 / Medium to long term, however, we& #39;ll want to move away from gas, and it seems at least conceivable that gas prices could be higher even as oil prices get crushed by Saudi and Russian supply (not exactly COVID related), massive inventories, and diminishing demand due to EVs.

12 / Finally, in a rational world, lower interest rates should encourage greater policy action on climate change, since it lowers the cost of reducing emissions and increases the present value of future benefits. Policy is not rational, but it may respond to incentives.

13 / While policy in the United States is clearly dependent on the outcomes of the next election, other countries at least seem to be rallying behind the idea of stepping up climate action in response to COVID.

14/ So, what does it all mean? I think the implications of COVID for the climate are highly uncertain, but quite possibly positive on balance, despite the countervailing effects of lower oil prices. We shall see... /End.

Read on Twitter

Read on Twitter