1/ Thread on $AON

AON is primarily an insurance broker which is, admittedly, not an exciting business.

However, every single company in this "boring" industry has handily outperformed $SPY in almost every time frame.

Curious now? Let& #39;s dive into the business then

AON is primarily an insurance broker which is, admittedly, not an exciting business.

However, every single company in this "boring" industry has handily outperformed $SPY in almost every time frame.

Curious now? Let& #39;s dive into the business then

2/ Broadly speaking, $AON has two segments: insurance broking (60-70%) and consulting (30-40%).

More than half of its revenue comes from outside US. So it& #39;s pretty global and has operations in 120 countries.

More than half of its revenue comes from outside US. So it& #39;s pretty global and has operations in 120 countries.

3/ I like the broking business more than consulting. Why?

1. Largely non-discretionary + ~95% customer retention = Highly recurring revenue

2. More stable organic topline growth (LSD to MSD)

3. Higher margin than consulting

1. Largely non-discretionary + ~95% customer retention = Highly recurring revenue

2. More stable organic topline growth (LSD to MSD)

3. Higher margin than consulting

4/ $AON& #39;s reporting segments changed a lot over the years, but looking at $MMC, their closest peer, gives us a better comparison between these two segments.

During GFC, $MMC& #39;s broking arms i.e. Marsh and Guy Carpenter& #39;s organic revenue were -1% and +8%

During GFC, $MMC& #39;s broking arms i.e. Marsh and Guy Carpenter& #39;s organic revenue were -1% and +8%

5/ Consulting arms i.e. Mercer and Oliver Wyman& #39;s organic revenue were -4% and -15%. But it also rebounded faster.

$MMC is more consulting heavy than $AON. But over the cycle, both posted ~3-4% organic growth.

$MMC is more consulting heavy than $AON. But over the cycle, both posted ~3-4% organic growth.

6/ Broking& #39;s operating margin is ~20-25% whereas consulting margins are in the mid-teens.

Both are capital light businesses (2-2.5% of sales).

Salaries are 55-60% of total opex. Very little fixed costs, so margins are not very volatile.

Both are capital light businesses (2-2.5% of sales).

Salaries are 55-60% of total opex. Very little fixed costs, so margins are not very volatile.

7/ Wait, why do we even need brokers? Can& #39;t they possibly be disintermediated?

"disintermediation risk" is in the air for quite some time, but nothing much has changed.

InsurTech platforms are mainly focusing on individual/SMB segments. Those are indeed ripe for disruption.

"disintermediation risk" is in the air for quite some time, but nothing much has changed.

InsurTech platforms are mainly focusing on individual/SMB segments. Those are indeed ripe for disruption.

8/ $AON, $MMC primarily serve large corporates i.e. Fortune 500s.

Some of the InsurTech co& #39;s are also being acquired by these large brokers e.g. CoverWallet by AON in 2019.

Some of the InsurTech co& #39;s are also being acquired by these large brokers e.g. CoverWallet by AON in 2019.

9/ Thanks to ever increasing complexity of risk, large corporates increasingly prefer large brokers over smaller ones.

Large brokers have decades of proprietary premium data by customer, segment, geography, and risk which can be difficult to replicate for smaller players.

Large brokers have decades of proprietary premium data by customer, segment, geography, and risk which can be difficult to replicate for smaller players.

10/ 20/30 years ago, brokers would create one CAT model for big accounts. Now they create two/three models for all customers.

Many of the smaller brokers also don& #39;t have the expertise to create these models by themselves.

Many of the smaller brokers also don& #39;t have the expertise to create these models by themselves.

11/ How important is it to be right about P&C cycle?

Not much. As already mentioned, 30-40% revenue comes from consulting. Of the rest, 2/3rd is commission (5-10% of premium), and 1/3rd is fees.

So being right on P&C cycle is not terribly important. Rates are firming though.

Not much. As already mentioned, 30-40% revenue comes from consulting. Of the rest, 2/3rd is commission (5-10% of premium), and 1/3rd is fees.

So being right on P&C cycle is not terribly important. Rates are firming though.

12/ Apart from firming rates, there can also be some tailwind from increased insurance penetration.

Greg Case, $AON CEO, has been talking about this. And AON is better positioned for risks such as Cyber risks.

Greg Case, $AON CEO, has been talking about this. And AON is better positioned for risks such as Cyber risks.

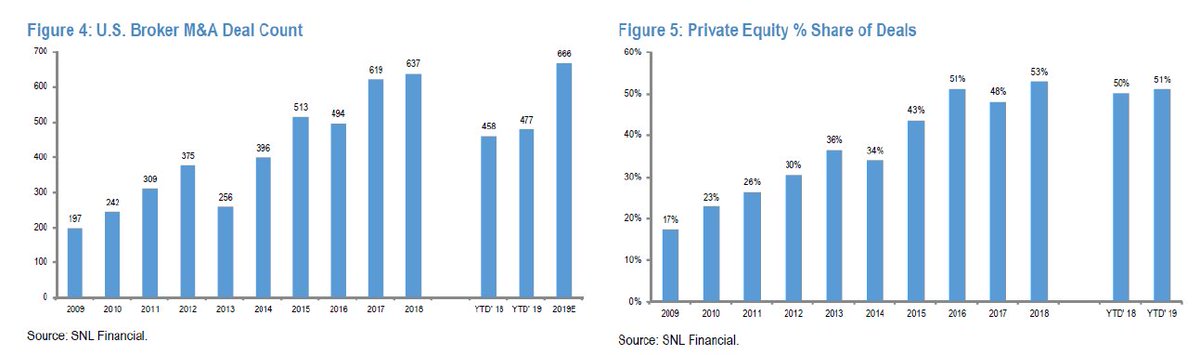

13/ Both $MMC and $AON have been serial acquirers. PE firms have also been very active in recent years.

Thanks to these acquisitions (and divestments), restructuring expense has been recurring theme.

Earnings quality is certainly less than ideal.

Thanks to these acquisitions (and divestments), restructuring expense has been recurring theme.

Earnings quality is certainly less than ideal.

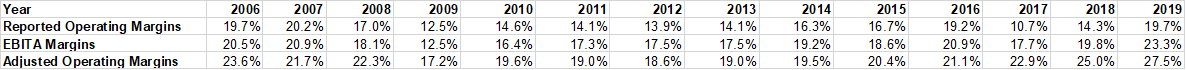

14/ Just look at the gulf of the difference among reported operating margins, EBITA margins, and adjusted operating margins.

Adjustments include amortization, restructuring/integration expense, other non-recurring expense (litigation, lease closure etc)

Adjustments include amortization, restructuring/integration expense, other non-recurring expense (litigation, lease closure etc)

15/ Because of all these restructuring going on, FCF conversion has been volatile.

Reported FCF to adjusted earnings is ~75% in last 14 years. If FCF is adjusted for restructuring expenses, it becomes 90% during this period. The rest gets lost to working capital management.

Reported FCF to adjusted earnings is ~75% in last 14 years. If FCF is adjusted for restructuring expenses, it becomes 90% during this period. The rest gets lost to working capital management.

16/ Obviously NOT a fan of these bonanza of adjustments.

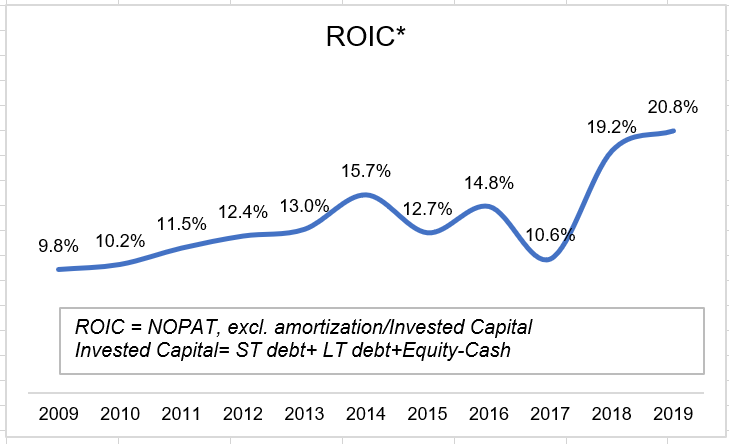

I do think management has done a good job in integrating these acquisitions. $AON also divested a lot of low growth, low margin businesses in last few years.

Just look at ROIC (NOPAT excl. amort./invested capital) trend

I do think management has done a good job in integrating these acquisitions. $AON also divested a lot of low growth, low margin businesses in last few years.

Just look at ROIC (NOPAT excl. amort./invested capital) trend

17/ If you aren& #39;t fan of these adjustments, buckle up. On March 09, 2020, $AON declared to acquire $WLTW.

It& #39;s an all-stock deal. $WLTW shareholders will get 1.08 $AON shares.

Market didn& #39;t like the deal despite $AON saying it& #39;s going to be accretive in year 1. $AON was -16%

It& #39;s an all-stock deal. $WLTW shareholders will get 1.08 $AON shares.

Market didn& #39;t like the deal despite $AON saying it& #39;s going to be accretive in year 1. $AON was -16%

18/ The cost savings target don& #39;t seem too aggressive tbh.

It& #39;s ~10% of $WLTW& #39;s total opex in 2019.

For $AON& #39;s last two major acquisitions, Benfield and Hewitt, they either met or exceeded cost savings target.

Deal may require some divestment from regulators.

It& #39;s ~10% of $WLTW& #39;s total opex in 2019.

For $AON& #39;s last two major acquisitions, Benfield and Hewitt, they either met or exceeded cost savings target.

Deal may require some divestment from regulators.

19/ The question is whether there will be revenue dis-synergy. Not unlikely.

Also, in terms of size, the deal is ~5x larger than the next biggest deal in this industry.

Integrating a $30 Bn company is never fun and easy, and can also introduce whole lot of unforeseen risks.

Also, in terms of size, the deal is ~5x larger than the next biggest deal in this industry.

Integrating a $30 Bn company is never fun and easy, and can also introduce whole lot of unforeseen risks.

20/ But it& #39;s also an opportunity to own a capital light steady business with attractive ROIC at discount.

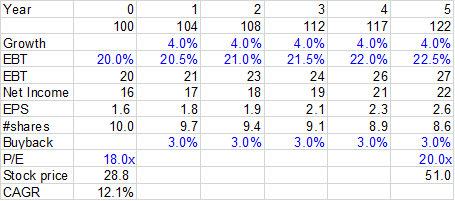

EPS algorithm: 3-5% topline growth+ ~50-100 bps margin improvement + 3% buyback (~30% decline in share count in last 8 yrs) = 7-8% growth

$AON is trading at 18x P/E but...

EPS algorithm: 3-5% topline growth+ ~50-100 bps margin improvement + 3% buyback (~30% decline in share count in last 8 yrs) = 7-8% growth

$AON is trading at 18x P/E but...

Read on Twitter

Read on Twitter