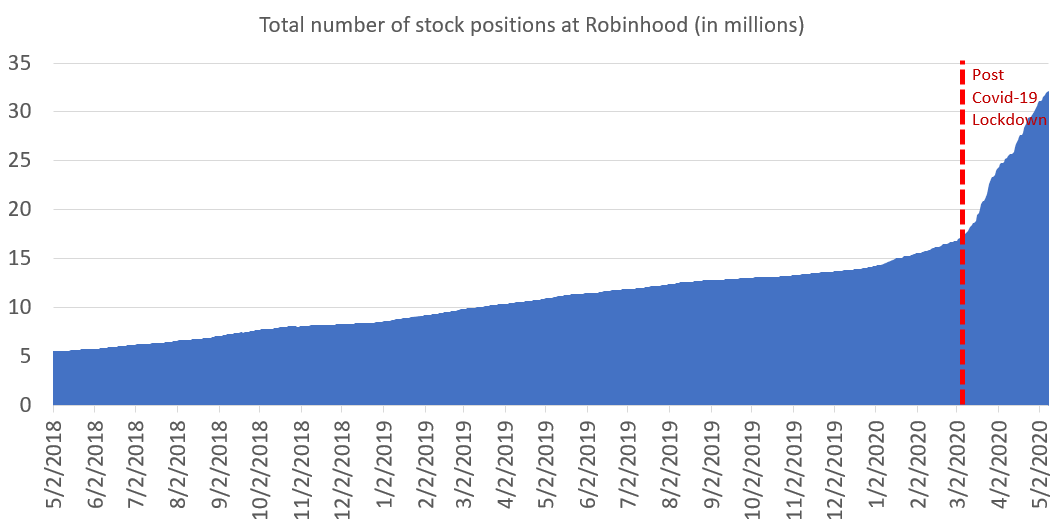

If you are wondering what has been fueling the stock market, daytrading and retail investor flows are alive and well. Robinhood, source: Robintrack/Robinhood API data. Good proxy for what all retail US stock traders are doing.

Since March 1st, total number of stock positions across all accounts up 100% !! Yet, new accounts at Robinhood up 30% or so over same period. Points to plenty of dip buying. Likely similar activity at other larger brokers.

My questions: How much is this is rear-view mirror? Is there more retail $ in waiting to fuel these markets? (likely not, I would guess) Is there another catalyst to create even more new retail flows? Smaller buybacks, collapsing earnings in future unless virus goes away.

Read on Twitter

Read on Twitter