I& #39;m amazed at how many reports insist that the stock market rise means that investors are betting on a V-shaped recovery. No, they aren& #39;t 1/ https://www.wsj.com/articles/why-is-the-stock-market-rallying-when-the-economy-is-so-bad-11588974327?mod=hp_lead_pos2">https://www.wsj.com/articles/...

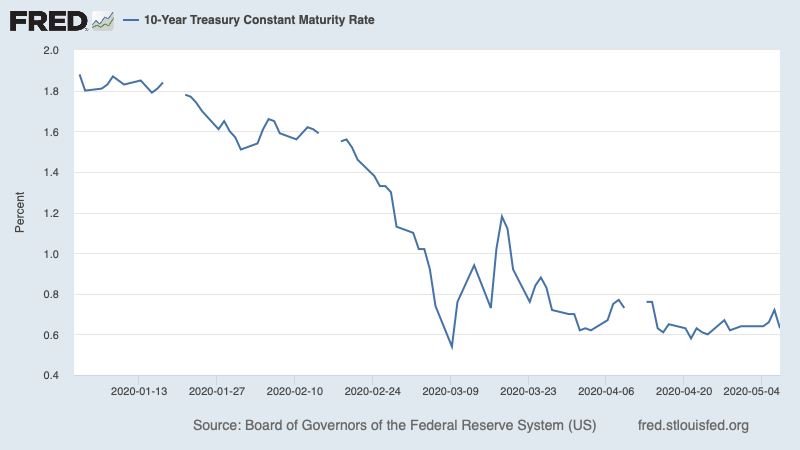

If investors really believed in a V-shaped recovery, the steep decline in interest rates that took place as the Covid threat became apparent would have reversed. It hasn& #39;t — not at all 2/

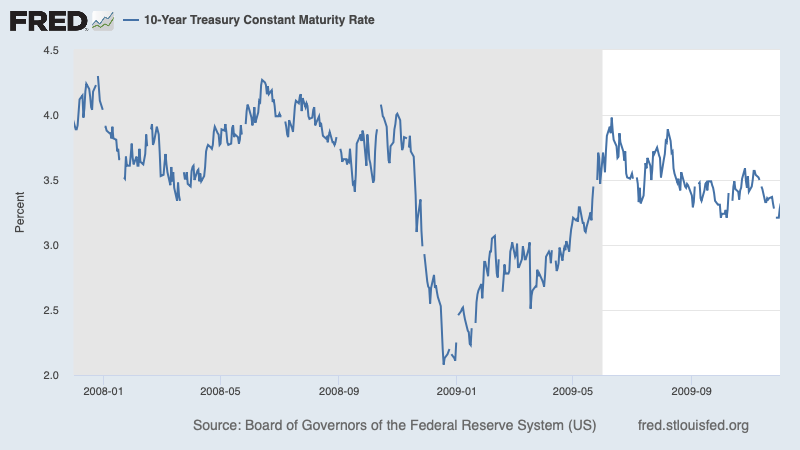

For comparison, consider 2009, when investors really did believe (wrongly) in a V-shaped recovery. Long-term rates sprang right back 3/

Although there were many people claiming that it was about debt fears (and way too much reportage simply stating this as a fact, which it wasn& #39;t) 4/ https://www.wsj.com/articles/SB124347148949660783">https://www.wsj.com/articles/...

The article I linked to barely mentions the obvious explanation: we had an incipient financial crisis in March, which drove corporate borrowing costs up and stocks down; but the Fed contained that crisis, so stocks rebounded 5/

One unintended consequence of the Fed& #39;s success here may be that Trump and friends really do think the stock market is signaling the all-clear; so no more economic relief 6/

Read on Twitter

Read on Twitter