The @IRR_SouthAfrica are part of the Flat Earth Society of the economics world. Amazing how much media space they get. I’m going to enjoy dismantling this dinosaur’s flawed logic piece by piece and making him eat his words. Stay tuned. https://twitter.com/meneer_mann/status/1259062678334705664">https://twitter.com/meneer_ma...

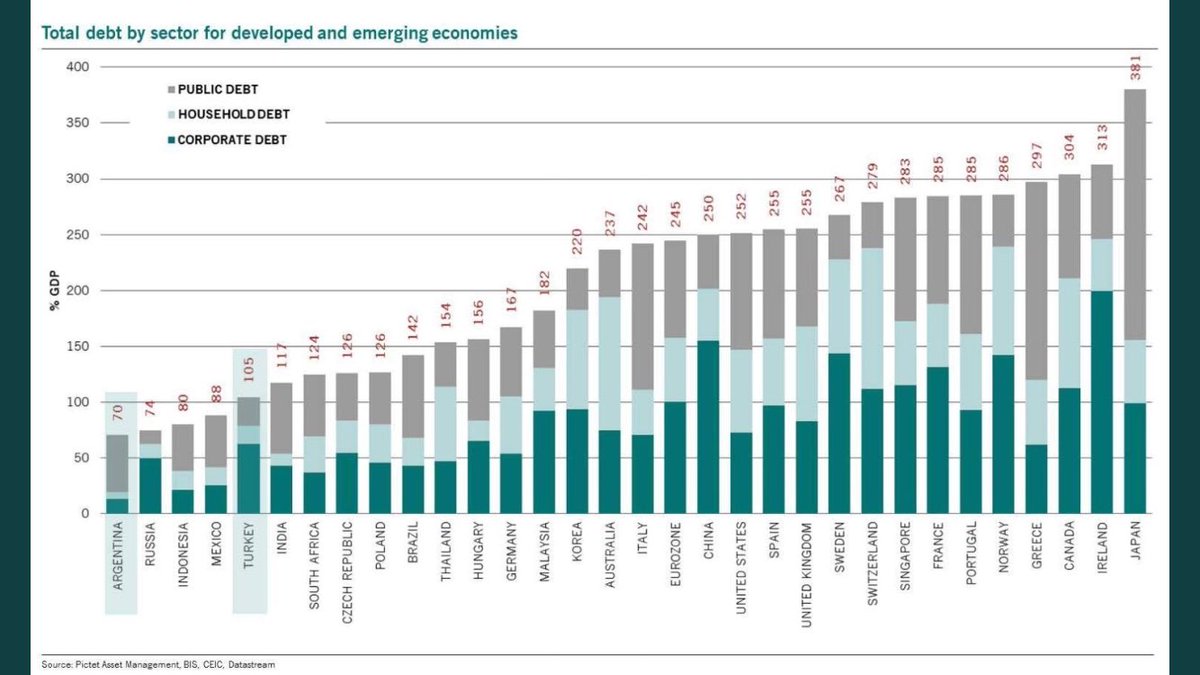

Firstly. Let’s look at the deficit and SAn debt. SAs debt to pre covid GDP is relatively mild compared to most countries @Meneer_Mann thinks we should emulate. Our problem is more the high interest paid on our debt...which is entirely due to SARB not providing cheaper credit.

Instead of the @SAReserveBank providing cheap credit to our productive sector & government, thus reducing taxes & cost of capital, making our businesses more competitive, and reducing the costs push driving our inflation, SA pays R600bn per year in interest to our financiers.

The @SAReserveBank says it keeps interest rates high in order to attract money from overseas to keep the Rand strong...so we pay around 10% to import money being “printed” by the trillion by foreign central banks and gifted to our “investors” at near 0%.

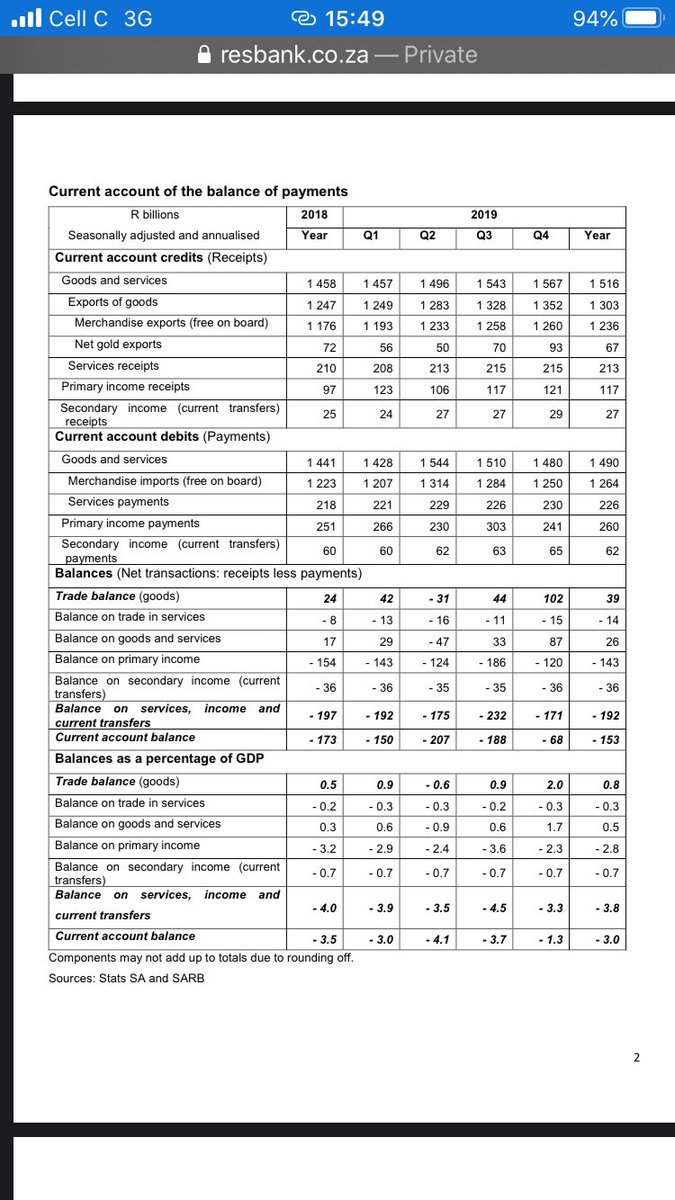

But SAs trade account has been mostly surplus.

Our current account deficit is almost entirely due to foreign investors removing interest, dividends & profit (primary income).

We import credit at high interest just to pay high interest on imported credit.

This drives R weaker.

Our current account deficit is almost entirely due to foreign investors removing interest, dividends & profit (primary income).

We import credit at high interest just to pay high interest on imported credit.

This drives R weaker.

The other reason given by @SAReserveBank for our high interest rates is that high interest rates control inflation by reducing spending power of SAn consumers. But our inflation is not demand driven but cost pushed. Demand is too low. High interest adds costs & reduces demand.

SA’s current account deficit is mostly due to foreign investors extracting interest, dividends & profit.

CA deficit = foreign sector surplus.

Sectoral balances dictate that a foreign sector surplus must be funded by SAn deficit.

Deficit = increased debt or selling off our assets.

CA deficit = foreign sector surplus.

Sectoral balances dictate that a foreign sector surplus must be funded by SAn deficit.

Deficit = increased debt or selling off our assets.

While our current account deficit is driven mostly by paying interest, dividends & profit to foreign investors (primary income in graphs below), it follows that our political choice to rely on foreign investment instead of local investment is also the cause of SAs increasing debt

Will do another thread explaining how unemployment & low tax revenue fits into all of this.

SAs extreme unemployment & apparent shortage of revenue is entirely due to policies based on the fallacy that the SAn state is financially constrained (can run out of money) and that it is reliant on tax income and borrowing from the private sector. This is not true at all.

The SARB is the organ of SAn state which issues all Rands (bank reserves & physical cash in supply).

The state spends and lends (via licensed banks) those Rands into the economy.

Tax and interest rates just return those Rands back to the state.

The state spends and lends (via licensed banks) those Rands into the economy.

Tax and interest rates just return those Rands back to the state.

Because all Rands originate from the state, it is the state that funds the private sector and not the private sector that funds the state.

Tax revenue & interest payments by private sector do not fund gov spending & lending.

Gov spending & lending funds tax & interest payments.

Tax revenue & interest payments by private sector do not fund gov spending & lending.

Gov spending & lending funds tax & interest payments.

The state can spend & lend as much money as it likes into the economy, so it can fund itself and our productive sector at 0% interest if it wishes...spending and lending to increase employment, improve education, health, policing etc etc.

However, there is one constraint to how much money the state can spend and lend: Inflation.

If it spends faster than the rate at which the supply of goods and services can be increased, then that spending will drive up inflation. Inflation should be avoided.

If it spends faster than the rate at which the supply of goods and services can be increased, then that spending will drive up inflation. Inflation should be avoided.

So we should replace the question “can we afford this” with “how will this affect inflation”.

Investment which increases local production (subsidies, grants & low interest loans for producers) & productivity (education, infrastructure) leads to greater supply of goods & services.

Investment which increases local production (subsidies, grants & low interest loans for producers) & productivity (education, infrastructure) leads to greater supply of goods & services.

So it follows while inflation is mild & cost pushed, & demand, growth & employment is too low, gov should be spending & lending more into the economy in ways that incentivize local productive investment (utilizing private sector money already in supply & keeping profit onshore).

But that kind of inclusive, productive growth can only happen if gov stops listening to paid for “think tanks” like @IRR_SouthAfrica who wittingly or unwittingly spread a false understanding of the economy that only benefits the financial sector, foreign investors and the rich.

Our productive sector would be paying less tax if we understood that tax is useful only to reduce inflation, reduce inequality, increase demand for Rands & disincentivize harmful behaviors like smoking & carbon emission etc. But economic flat earthers ensist tax must fund gov.

Sadly, instead of calling for SARB to reduce the R600bn in interest per year SAn productive sector & gov pays our financiers on our debt & insisting @SAReserveBank funds gov & private sector more cheaply, @IRR_SouthAfrica blames our poorest workers for making SA uncompetitive.

The “structural reforms” the @IRR_SouthAfrica and other paid for libertarian “think tanks” promote always involve the poor sacrificing more, but never mention high interest.

Interest is simply basic income for those that already have money.

That kind of charity is ok apparently.

Interest is simply basic income for those that already have money.

That kind of charity is ok apparently.

Read on Twitter

Read on Twitter