What exactly happened in the Eurozone this week? Something about a German court & the ECB?

It& #39;s complicated, but has implications for the Eurozone& #39;s #COVID19 recovery & the EU itself.

What follows is my attempt to help me (& my students) understand what happened

[THREAD]

It& #39;s complicated, but has implications for the Eurozone& #39;s #COVID19 recovery & the EU itself.

What follows is my attempt to help me (& my students) understand what happened

[THREAD]

Let& #39;s start with some background.

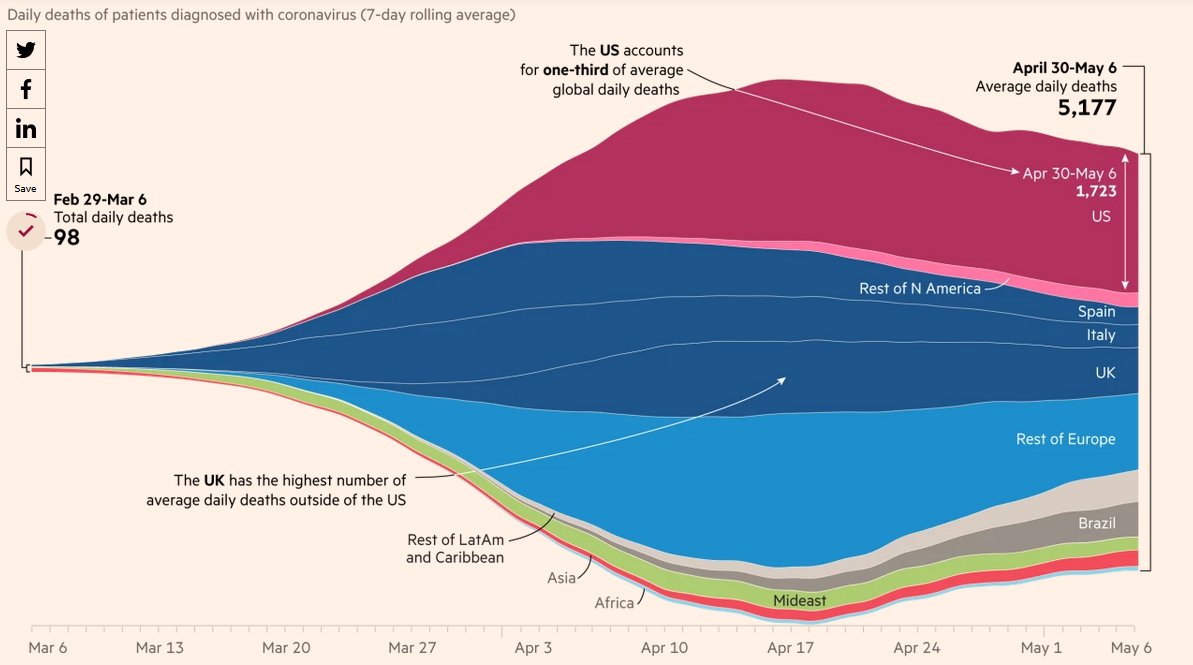

As is now well know, European countries have been hit hard by #COVID19 (graph from @FT)

As is now well know, European countries have been hit hard by #COVID19 (graph from @FT)

The European countries responding with quarantines, with the subsequent economic hardships (as @javilopezEU wrote about back in March) https://www.socialeurope.eu/europe-under-quarantine">https://www.socialeurope.eu/europe-un...

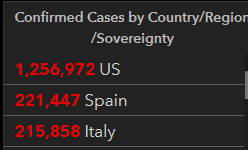

But the economic pain was not shared equally. As is well known, hardest hit by the virus was Italy, which was already one of the weaker economies in the eurozone. Same for Spain

Source: https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6">https://gisanddata.maps.arcgis.com/apps/opsd...

Source: https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6">https://gisanddata.maps.arcgis.com/apps/opsd...

This matters because it reinforced what is known as the "North-South" divide in Europe: the relatively wealthier northern countries v the relatively poorer southern countries.

https://www.europeaninstitute.org/index.php/ei-blog/155-european-affairs/ea-august-2012/1614-europes-north-south-dividea-stubborn-chasm">https://www.europeaninstitute.org/index.php...

https://www.europeaninstitute.org/index.php/ei-blog/155-european-affairs/ea-august-2012/1614-europes-north-south-dividea-stubborn-chasm">https://www.europeaninstitute.org/index.php...

Debate over crafting a European response to the economic consequences of #COVID19 -- rather than just leaving it in the hands of individual countries -- basically broke along those lines, as @adam_tooze explained https://www.socialeurope.eu/corona-bonds-and-europes-north-south-divide">https://www.socialeurope.eu/corona-bo...

Most notably, this divide hung over a late April meeting of European leaders to craft a joint economic response. As @ProfKMcNamara & @m2matthijs wrote (in @monkeycageblog) the hope of the meeting was to issue joint bonds ("coronabonds") to fund recovery https://www.washingtonpost.com/politics/2020/04/21/europes-leaders-meet-this-week-confront-coronavirus/">https://www.washingtonpost.com/politics/...

But a deal wasn& #39;t reached, largely due to the north-south fissure. As @SeanDEhrlich wrote at @duckofminerva, this echoed earlier failures at a joint european economic response (such as during the 2008 eurocrisis)

https://duckofminerva.com/2020/04/deja-vu-all-over-again-the-eu-coronavirus-and-the-eurozone-crisis.html">https://duckofminerva.com/2020/04/d...

https://duckofminerva.com/2020/04/deja-vu-all-over-again-the-eu-coronavirus-and-the-eurozone-crisis.html">https://duckofminerva.com/2020/04/d...

The lack of a "fiscal" response means the only means of responding is with monetary policy. In the Eurozone, that means the European Central Bank

So what has the ECB done? Well, it& #39;s been doing a lot for quite some time.

Without getting into the various acronyms, it& #39;s been involved in "quantitative easy" (i.e. pump money by purchasing a wider arrange of financial assets from banks) since 2015 https://www.ecb.europa.eu/explainers/show-me/html/app_infographic.en.html">https://www.ecb.europa.eu/explainer...

Without getting into the various acronyms, it& #39;s been involved in "quantitative easy" (i.e. pump money by purchasing a wider arrange of financial assets from banks) since 2015 https://www.ecb.europa.eu/explainers/show-me/html/app_infographic.en.html">https://www.ecb.europa.eu/explainer...

In light of the economic crisis created by #COVID19, the ECB has expanded its role, effectively determining economic policy for the member states https://www.cnbc.com/2020/03/19/ecb-launches-new-820-billion-coronavirus-package.html">https://www.cnbc.com/2020/03/1...

And ECB President @Lagarde acknowledged the unprecedented nature of the ECB actions https://twitter.com/Lagarde/status/1240414918966480896">https://twitter.com/Lagarde/s...

But this was apparantly the last straw for the German High Court, which finally ruled a a long term legal challenge to ECB actions by German politicians and economists

With that background, let& #39;s turn to the ruling itself.

In a nutshell, the German High Court said that the ECB needed to backoff of "quantitative easing" https://www.politico.eu/article/german-high-court-warns-ecb-that-bond-buying-could-be-illegal/">https://www.politico.eu/article/g...

In a nutshell, the German High Court said that the ECB needed to backoff of "quantitative easing" https://www.politico.eu/article/german-high-court-warns-ecb-that-bond-buying-could-be-illegal/">https://www.politico.eu/article/g...

This decision goes against an earlier decision by the European Court of Justice had issued a separate ruling on the ECB& #39;s expanded monetary actions, saying they are "OK" https://www.bloomberg.com/news/articles/2018-12-11/ecb-wins-eu-top-court-fight-over-legality-of-qe-program">https://www.bloomberg.com/news/arti...

@syrpis offers a helpful and detailed thread of the decision& #39;s legal aspects. The key point is this: the German court is claiming superiority over the ECJ to interpret European Law. It& #39;s striking down a ECJ ruling. https://twitter.com/syrpis/status/1258018951843450880">https://twitter.com/syrpis/st...

That& #39;s controversial because it essentially flips the script: EU Law is subordinate to Member state law. It& #39;s not supposed to work that way.

But as @rdanielkelemen & Federico Fabbrini wrote in yesterday& #39;s @monkeycageblog, this shouldn& #39;t be shocking: "Germany’s Federal Constitutional Court has been barking at the European Union’s high court...for years. This week, it finally bit." https://www.washingtonpost.com/politics/2020/05/07/germany-may-be-plunging-europe-into-constitutional-crisis/">https://www.washingtonpost.com/politics/...

Similarly, @HelenHet20 says that the historical context is all important. If you take that into account, the German court decision is not surprising https://twitter.com/HelenHet20/status/1257987288908382208">https://twitter.com/HelenHet2...

@HelenHet20 is pointing to the deeper historical context: that Germany & France were the key players in creating the Maastricht Treaty (which officially established the EU & the Euro) https://twitter.com/ProfPaulPoast/status/1192838454121553920">https://twitter.com/ProfPaulP...

So what does this mean?

At a broad level, this event illustrates why the euro is simply not ready to be a full competitor to the dollar. The "shared sovereignty" of the eurozone is too fragile of a foundation on which to place a reserve currency https://academic.oup.com/isp/article-abstract/21/2/109/5762967?redirectedFrom=fulltext">https://academic.oup.com/isp/artic...

At a broad level, this event illustrates why the euro is simply not ready to be a full competitor to the dollar. The "shared sovereignty" of the eurozone is too fragile of a foundation on which to place a reserve currency https://academic.oup.com/isp/article-abstract/21/2/109/5762967?redirectedFrom=fulltext">https://academic.oup.com/isp/artic...

Benjamin Haddad points to this more fundamental issue: a lack of common European fiscal policy (or, more precisely, fiscal coordination on the part of the European states) https://twitter.com/benjaminhaddad/status/1258069994316931072">https://twitter.com/benjaminh...

But it also points to the fragility in the EU itself. Keep in mind that #Brexit just took place on Jan 31. https://www.bbc.com/news/uk-politics-32810887">https://www.bbc.com/news/uk-p...

Read on Twitter

Read on Twitter