Why I like Viad $VVI, a thread

Sure, covid will have a huge impact, but right now the market is suggesting a pending bankruptcy, yet they have:

1) Solid cash position

2) One-of-a-kind collection of assets

3) 90% of costs are variable

4) High CF generative business

EV/EBIT 2.8x

Sure, covid will have a huge impact, but right now the market is suggesting a pending bankruptcy, yet they have:

1) Solid cash position

2) One-of-a-kind collection of assets

3) 90% of costs are variable

4) High CF generative business

EV/EBIT 2.8x

Since 1926, Viad has spun off over 20 businesses. Two remain.

GES segment offers services for conferences (ouch).

As the market leader, the business is relationship-driven with high renewal rates.

It& #39;s a boring niche business which consistently generates cash for the company

GES segment offers services for conferences (ouch).

As the market leader, the business is relationship-driven with high renewal rates.

It& #39;s a boring niche business which consistently generates cash for the company

The other segment, Pursuit, covers 60% of EBIT.

Pursuit is a hospitality company that owns a collection of unique tourist attractions in National Parks in places like Alaska, Alberta & Montana.

Many hotels are near-irreplaceable assets, properties people protect and care about:

Pursuit is a hospitality company that owns a collection of unique tourist attractions in National Parks in places like Alaska, Alberta & Montana.

Many hotels are near-irreplaceable assets, properties people protect and care about:

Pursuit owns 27 hotels in total.

Viad invests most of their cash flow in Pursuit, with good capital allocation so far:

* In 2017, Viad invested $22 million in the Banff Gondola, which increased sales by 43% per visit

* Revenues had 11% and 8% organic growth in 2019 and 2018

Viad invests most of their cash flow in Pursuit, with good capital allocation so far:

* In 2017, Viad invested $22 million in the Banff Gondola, which increased sales by 43% per visit

* Revenues had 11% and 8% organic growth in 2019 and 2018

The stock has been absolutely massacred this year. At the March lows, it was down 80% to the lowest level since 1990.

It& #39;s still down 70% YTD.

And yes, 2020 will be a massacre - but it& #39;s not going out of business, unlike many companies in the same industry.

It& #39;s still down 70% YTD.

And yes, 2020 will be a massacre - but it& #39;s not going out of business, unlike many companies in the same industry.

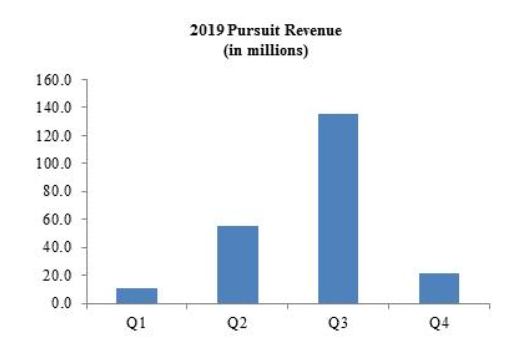

First of all, Pursuit is a seasonal business, with 60% of sales in Q3.

Thousands of people could exit their quarantine in Q3, hungry to experience natural parks

Thousands of people could exit their quarantine in Q3, hungry to experience natural parks

Further, Pursuit owns all their assets.

So, they can close their hotels all summer, while comparable businesses have to deal with landlords.

And: 90% of Viad& #39;s costs are variable, so in that scenario, cash burn should be minimal.

So, they can close their hotels all summer, while comparable businesses have to deal with landlords.

And: 90% of Viad& #39;s costs are variable, so in that scenario, cash burn should be minimal.

As for their balance sheet, they had $62 million in cash on Dec 31, and borrowed additonal $123 million at 4.25% in mid-march to maintain financial position.

Viad can efficiently cut costs while keeping $180 million in cash on hand, which should be enough liquidity.

Viad can efficiently cut costs while keeping $180 million in cash on hand, which should be enough liquidity.

Viad is a collection of valuable assets priced to the verge of BK, even if it:

* Generated 105% of its current market cap in cash flow over the past 5 years

* Has a moat with its Pursuit assets

* Barriers of entry in both segments

* EBITDA CAGR of 19% since 2013

* Generated 105% of its current market cap in cash flow over the past 5 years

* Has a moat with its Pursuit assets

* Barriers of entry in both segments

* EBITDA CAGR of 19% since 2013

Up 20% today.

Down 70% YTD.

Down 70% YTD.

Read on Twitter

Read on Twitter