Quick thread on central bank liquidity swaps and global dollar liquidity.

Since the GFC, there have been three periods of major swap line usage; 2008, 2012, and 2020, shown in blue below.

Since the GFC, there have been three periods of major swap line usage; 2008, 2012, and 2020, shown in blue below.

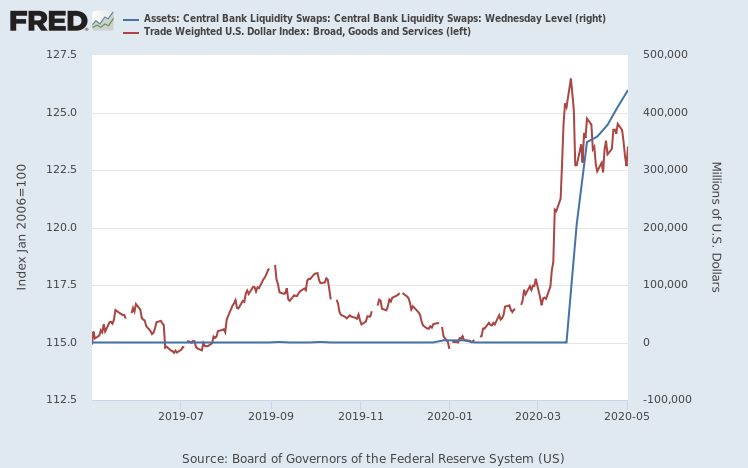

Currently in 2020, the Fed& #39;s swaps with other nations are over $400 billion. They& #39;ve done this to provide dollar liquidity outside of the United States, in part to stem foreign selling of U.S. Treasuries, which in April began to work (no more net selling).

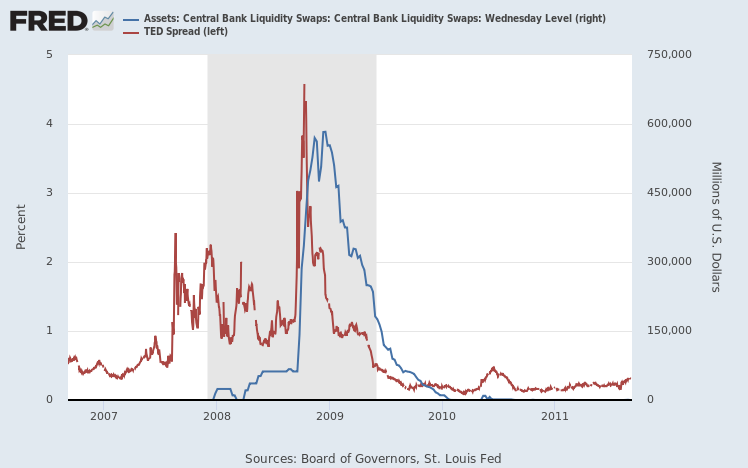

We had a big spike in the TED spread (T-bill vs eurodollar spread) in March, indicating an acute shortage of ex-USA dollar liquidity, which has so far come back down in April and May (for now at least) as swaps went up.

Back in 2008, liquidity swaps were even larger than today, but today& #39;s liquidity swaps are still growing so we don& #39;t know the ultimate height yet. By the time liquidity swaps got serious in 2008, the final TED spread spike was in.

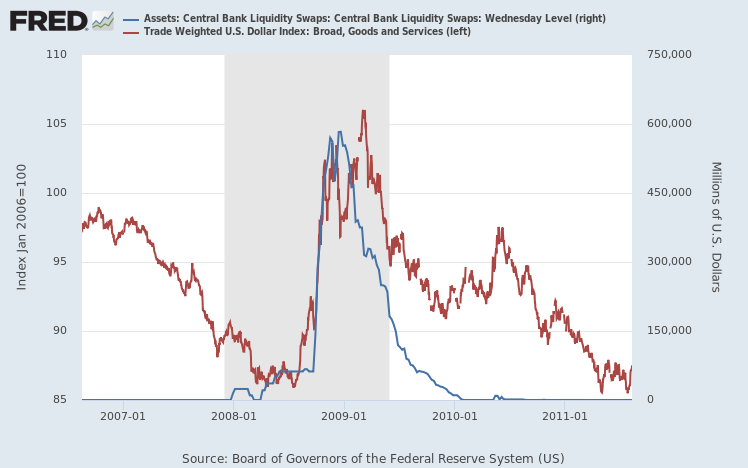

However, in 2008, after getting those swap lines up and providing dollar liquidity and pushing the TED spread back down, the U.S. dollar traded at an elevated range well into 2009.

Here& #39;s the swap/dollar relationship so far in 2020.

My article here explains why ex-USA dollar liquidity is the Fed& #39;s concern. (Short version: they either provide enough dollar liquidity as the reserve currency for much of that ex-USA dollar debt, or they face foreigners selling U.S. assets to get dollars). https://seekingalpha.com/article/4336136-40-trillion-problem">https://seekingalpha.com/article/4...

Read on Twitter

Read on Twitter