In the wake of this Banda Homes story, here& #39;s a quick reminder of con schemes from the past

1/

In 1982, Ugandan Grace Aluma arrived in Nairobi masquerading as a billionaire. She told her gullible victims that she was engaged in uranium business and was scouting for big deals

1/

In 1982, Ugandan Grace Aluma arrived in Nairobi masquerading as a billionaire. She told her gullible victims that she was engaged in uranium business and was scouting for big deals

2/

Top names, including politicians, fell for the trick and hoping to have a share of the $100 million (Sh10 billion at current exchange rate) which Aluma claimed to have in a Kenyan bank.

Top names, including politicians, fell for the trick and hoping to have a share of the $100 million (Sh10 billion at current exchange rate) which Aluma claimed to have in a Kenyan bank.

3/

As an “investor”, she had managed to sell her story to some diplomats and was on the verge of selling International Life House to a diplomatic mission when she was smoked out. But that was not before she had conned Kenya Commercial Bank, Swissair and Westlands Motors

As an “investor”, she had managed to sell her story to some diplomats and was on the verge of selling International Life House to a diplomatic mission when she was smoked out. But that was not before she had conned Kenya Commercial Bank, Swissair and Westlands Motors

4/

In 1985, Eric Awori claimed that he could drive in reverse from Mombasa to Nairobi in a 7-ton Mercedez-Benz truck and that the Guinness Book of Records was in town to record the event.

DT Dobie offered to donate a Mercedes Benz truck and fuel worth Sh10K

In 1985, Eric Awori claimed that he could drive in reverse from Mombasa to Nairobi in a 7-ton Mercedez-Benz truck and that the Guinness Book of Records was in town to record the event.

DT Dobie offered to donate a Mercedes Benz truck and fuel worth Sh10K

5/

The truck was flagged off in Mombasa by Shariff Nassir, an assistant minister but its progress thereafter remained hazy, with the country keeping track through updates from Kenya News Agency.

The truck was flagged off in Mombasa by Shariff Nassir, an assistant minister but its progress thereafter remained hazy, with the country keeping track through updates from Kenya News Agency.

6/

Finally, Eric Awori was unmasked and charged in court. It was also discovered that he never drove in reverse gear from Mombasa to Nairobi and that the update telexes announcing his progress had emanated from an office in Westlands and another on Mama Ngina Street.

Finally, Eric Awori was unmasked and charged in court. It was also discovered that he never drove in reverse gear from Mombasa to Nairobi and that the update telexes announcing his progress had emanated from an office in Westlands and another on Mama Ngina Street.

7/

In 1987, Dick Berg, a US citizen, convinced sports ministry officials that he could help collect over Sh224 million to exclusively market the All-African Games and even bring Michael Jackson to Kenya.

The ministry only received Sh5mn, we got Jermaine Jackson and Berg fled...

In 1987, Dick Berg, a US citizen, convinced sports ministry officials that he could help collect over Sh224 million to exclusively market the All-African Games and even bring Michael Jackson to Kenya.

The ministry only received Sh5mn, we got Jermaine Jackson and Berg fled...

8/

In 2006, brothers Artur Margaryan and Artur Sargsyan arrived in the country and managed to hoodwink everyone. They were international criminals who had managed to worm themselves into the Kenya security system and got “appointed” as Deputy Commissioners of Police.

In 2006, brothers Artur Margaryan and Artur Sargsyan arrived in the country and managed to hoodwink everyone. They were international criminals who had managed to worm themselves into the Kenya security system and got “appointed” as Deputy Commissioners of Police.

9/

At a house in Runda, they threw overnight parties, drove diplomatic cars and carried guns openly. They were implicated in the raid on the Standard. After they assaulted immigration officers, President Kibaki sacked CID director Joseph Kamau and formed a commission of inquiry.

At a house in Runda, they threw overnight parties, drove diplomatic cars and carried guns openly. They were implicated in the raid on the Standard. After they assaulted immigration officers, President Kibaki sacked CID director Joseph Kamau and formed a commission of inquiry.

10/

In 2007, Clip Investment Cooperative Society has been promising to pay 120 per cent interest

Thousands of people in Mombasa deposited Sh28mn in the scheme and only 321 were able to be traced by a committee coordinating the recovery of the money.

https://www.nation.co.ke/news/1056-194926-m9ugyez/index.html">https://www.nation.co.ke/news/1056...

In 2007, Clip Investment Cooperative Society has been promising to pay 120 per cent interest

Thousands of people in Mombasa deposited Sh28mn in the scheme and only 321 were able to be traced by a committee coordinating the recovery of the money.

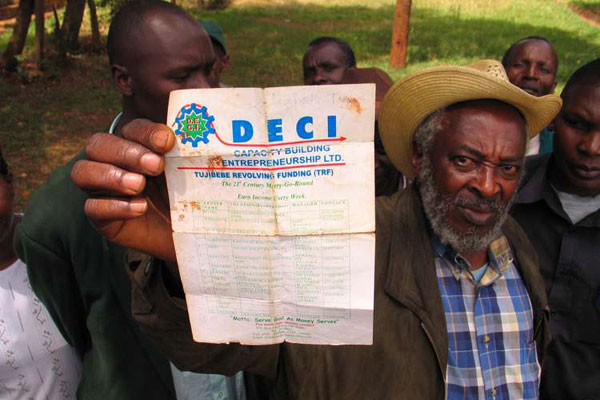

https://www.nation.co.ke/news/1056-194926-m9ugyez/index.html">https://www.nation.co.ke/news/1056...

11/

In 2009, Co-operatives Minister Joseph Nyagah reported that nearly 148,784 investors lost Sh8.2bn in pyramid scheme thefts in two years.

When the noose began to tighten, some directors converted 17 of the pyramid schemes into co-operative societies to avoid investigation.

In 2009, Co-operatives Minister Joseph Nyagah reported that nearly 148,784 investors lost Sh8.2bn in pyramid scheme thefts in two years.

When the noose began to tighten, some directors converted 17 of the pyramid schemes into co-operative societies to avoid investigation.

12/

Besides Deci, Clip investments, Kenya Business Community, Sasanet and Jitegemee Investment Sacco, Circuit Investment, Family in Need Organisation, Global Entrepreneurship, Spell Investment and Mont Blanque Afrique collapsed with Sh7.3bn from investors https://www.standardmedia.co.ke/article/1144020804/investors-lost-sh8-billion-in-pyramid-scams-house-told">https://www.standardmedia.co.ke/article/1...

Besides Deci, Clip investments, Kenya Business Community, Sasanet and Jitegemee Investment Sacco, Circuit Investment, Family in Need Organisation, Global Entrepreneurship, Spell Investment and Mont Blanque Afrique collapsed with Sh7.3bn from investors https://www.standardmedia.co.ke/article/1144020804/investors-lost-sh8-billion-in-pyramid-scams-house-told">https://www.standardmedia.co.ke/article/1...

13/

Then there was MMM

Run by a well-known Russian con artist who was once jailed in Russia for the same fraud (Sergey Mavrodi), MMM first came to prominence in 1997 when Mavrodi created the biggest finance pyramid in Moscow before it collapsed. https://bitcoinafrica.io/2018/04/02/mmm-kenya-collapses-as-founder-mavrodi-dies/">https://bitcoinafrica.io/2018/04/0...

Then there was MMM

Run by a well-known Russian con artist who was once jailed in Russia for the same fraud (Sergey Mavrodi), MMM first came to prominence in 1997 when Mavrodi created the biggest finance pyramid in Moscow before it collapsed. https://bitcoinafrica.io/2018/04/02/mmm-kenya-collapses-as-founder-mavrodi-dies/">https://bitcoinafrica.io/2018/04/0...

14/

Remember VIP Portal?

The online forex trading firm VIP Portal owned by Alfred Wangai and his wife Mercy Nkatha started out in Limuru in 2013 and within one year, it had received over Sh1bn from farmers and Limuru residents https://www.the-star.co.ke/counties/central/2019-02-20-couple-starts-to-repay-sh1bn-obtained-falsely-from-public/">https://www.the-star.co.ke/counties/...

Remember VIP Portal?

The online forex trading firm VIP Portal owned by Alfred Wangai and his wife Mercy Nkatha started out in Limuru in 2013 and within one year, it had received over Sh1bn from farmers and Limuru residents https://www.the-star.co.ke/counties/central/2019-02-20-couple-starts-to-repay-sh1bn-obtained-falsely-from-public/">https://www.the-star.co.ke/counties/...

15/

And who could forget Public Likes, a website on which users earned merely by clicking on ‘adverts’?

Not only was Public Likes a Ponzi Scheme, it was an intricate online fraud that has seen advertisers lose close to Sh2tn in advertising revenues. https://www.standardmedia.co.ke/business/article/2001249724/how-">https://www.standardmedia.co.ke/business/...

And who could forget Public Likes, a website on which users earned merely by clicking on ‘adverts’?

Not only was Public Likes a Ponzi Scheme, it was an intricate online fraud that has seen advertisers lose close to Sh2tn in advertising revenues. https://www.standardmedia.co.ke/business/article/2001249724/how-">https://www.standardmedia.co.ke/business/...

16/

In 2016, traders in Kirinyaga County, among them hawkers and boda boda riders lost Sh10.8 million to Small Traders Initiative and Empowerment Programme, which claimed to be a microfinance only requiring daily deposits of Sh200

https://www.nation.co.ke/counties/kirinyaga/Hawkers-boda-boda-riders-in-Kirinyaga-conned-Sh11m-/3444752-3284170-11h16hiz/index.html">https://www.nation.co.ke/counties/...

In 2016, traders in Kirinyaga County, among them hawkers and boda boda riders lost Sh10.8 million to Small Traders Initiative and Empowerment Programme, which claimed to be a microfinance only requiring daily deposits of Sh200

https://www.nation.co.ke/counties/kirinyaga/Hawkers-boda-boda-riders-in-Kirinyaga-conned-Sh11m-/3444752-3284170-11h16hiz/index.html">https://www.nation.co.ke/counties/...

17/

Simple Homes Developers Consortium upped and left after their victims had parted with over Sh500 million. https://www.nation.co.ke/counties/mombasa/Simple-Homes-scandal-mastermind-arrested-in-Mombasa/1954178-5463788-aqrimr/index.html">https://www.nation.co.ke/counties/...

Simple Homes Developers Consortium upped and left after their victims had parted with over Sh500 million. https://www.nation.co.ke/counties/mombasa/Simple-Homes-scandal-mastermind-arrested-in-Mombasa/1954178-5463788-aqrimr/index.html">https://www.nation.co.ke/counties/...

18/

Earlier this year, Maalin Group Companies headed by Abdalle Mohamed Ali and running a forex trading business in Nairobi collapsed with what is said to be Sh15bn in funds. https://www.pd.co.ke/news/national/how-russian-pyramid-scheme-sank-with-kenyans-foreigners-billions-of-shillings-28759/">https://www.pd.co.ke/news/nati...

Earlier this year, Maalin Group Companies headed by Abdalle Mohamed Ali and running a forex trading business in Nairobi collapsed with what is said to be Sh15bn in funds. https://www.pd.co.ke/news/national/how-russian-pyramid-scheme-sank-with-kenyans-foreigners-billions-of-shillings-28759/">https://www.pd.co.ke/news/nati...

19/

Remember Goldenscape and their glitz?

This was in 2019...

"Goldenscape Greenhouses and Silverstone properties on Wednesday launched a real estate investment of Ksh.1.65 billion to their existing greenhouse investors dubbed Amal Haven investments."

https://citizentv.co.ke/business/goldenscape-group-rolls-out-ksh-1-6-billion-housing-plan-233522/">https://citizentv.co.ke/business/...

Remember Goldenscape and their glitz?

This was in 2019...

"Goldenscape Greenhouses and Silverstone properties on Wednesday launched a real estate investment of Ksh.1.65 billion to their existing greenhouse investors dubbed Amal Haven investments."

https://citizentv.co.ke/business/goldenscape-group-rolls-out-ksh-1-6-billion-housing-plan-233522/">https://citizentv.co.ke/business/...

20/

Founder Peter Wangai was arrested in March of this year

According to DCI, Kenyans lost millions of their hard-earned cash after being lured to invest in greenhouses in Ol Kalou and Nyahururu and other places by the suspect and his proxies. https://www.standardmedia.co.ke/article/2001365867/goldenscape-ceo-arrested-over-bogus-greenhouse-investment-deals">https://www.standardmedia.co.ke/article/2...

Founder Peter Wangai was arrested in March of this year

According to DCI, Kenyans lost millions of their hard-earned cash after being lured to invest in greenhouses in Ol Kalou and Nyahururu and other places by the suspect and his proxies. https://www.standardmedia.co.ke/article/2001365867/goldenscape-ceo-arrested-over-bogus-greenhouse-investment-deals">https://www.standardmedia.co.ke/article/2...

21/

Greenhouses seem to be the way to go it seems...

The greenhouses tell a story of pain for hundreds of bitter city investors who have lost over Sh3 billion in untested agro ventures in places like Kitengela, Isinya, Kajiado, Thika, Mt Kenya, Aberdares https://www.standardmedia.co.ke/business/article/2001315960/property-rush-kenyans-lose-millions-in-bad-investments">https://www.standardmedia.co.ke/business/...

Greenhouses seem to be the way to go it seems...

The greenhouses tell a story of pain for hundreds of bitter city investors who have lost over Sh3 billion in untested agro ventures in places like Kitengela, Isinya, Kajiado, Thika, Mt Kenya, Aberdares https://www.standardmedia.co.ke/business/article/2001315960/property-rush-kenyans-lose-millions-in-bad-investments">https://www.standardmedia.co.ke/business/...

22/

In 2017, Ms Esther Muthoni invested Sh3.2 million in Velox 10 Global looking to make a killing trading bitcoins.

She lost her life savings. She became desperate, sick and confused.

She also became the face of Kenyans conned by endless ponzi schemes. https://www.nation.co.ke/news/Brazil-bitcoin-con-scheme-gobbles-Kenyans--cash/1056-5007738-hfykxqz/index.html">https://www.nation.co.ke/news/Braz...

In 2017, Ms Esther Muthoni invested Sh3.2 million in Velox 10 Global looking to make a killing trading bitcoins.

She lost her life savings. She became desperate, sick and confused.

She also became the face of Kenyans conned by endless ponzi schemes. https://www.nation.co.ke/news/Brazil-bitcoin-con-scheme-gobbles-Kenyans--cash/1056-5007738-hfykxqz/index.html">https://www.nation.co.ke/news/Braz...

23/

Velox, a Brazilian ponzi scheme had a local agent.

"Kenyans attended the launch and were taught how to wire money to the bank account of Velox agent Daniel Karobia Gichuki."

He was charged in 2019 with obtaining money by false pretenses.

Velox, a Brazilian ponzi scheme had a local agent.

"Kenyans attended the launch and were taught how to wire money to the bank account of Velox agent Daniel Karobia Gichuki."

He was charged in 2019 with obtaining money by false pretenses.

24/

At Diamond Property Merchants, more than 700 people have collectively lost more than Sh500 million in 2018

Each customer bought an eighth at Sh450K, required to remit extra Sh290K for erection and then received Sh120K yearly https://www.standardmedia.co.ke/business/article/2001268752/300m-diamond-property-greenhouse-investment-goes-awry">https://www.standardmedia.co.ke/business/...

At Diamond Property Merchants, more than 700 people have collectively lost more than Sh500 million in 2018

Each customer bought an eighth at Sh450K, required to remit extra Sh290K for erection and then received Sh120K yearly https://www.standardmedia.co.ke/business/article/2001268752/300m-diamond-property-greenhouse-investment-goes-awry">https://www.standardmedia.co.ke/business/...

25/

Finally, let& #39;s not forget Suraya https://twitter.com/surambaya/status/1139821065314525184?lang=en">https://twitter.com/surambaya...

Finally, let& #39;s not forget Suraya https://twitter.com/surambaya/status/1139821065314525184?lang=en">https://twitter.com/surambaya...

26/

Special Request: Ekeza Sacco

David Kariuki (Gakuyo) marketed land and housing, convincing members to register with Sh20K to be eligible for 3-br houses at Sh3.5mn and Sh10K for 2-br houses at Sh1.5mn.

He failed to hand over the houses to members https://www.nation.co.ke/business/Property-dealers-prey-on-investors/996-5168602-7bfm2oz/index.html">https://www.nation.co.ke/business/...

Special Request: Ekeza Sacco

David Kariuki (Gakuyo) marketed land and housing, convincing members to register with Sh20K to be eligible for 3-br houses at Sh3.5mn and Sh10K for 2-br houses at Sh1.5mn.

He failed to hand over the houses to members https://www.nation.co.ke/business/Property-dealers-prey-on-investors/996-5168602-7bfm2oz/index.html">https://www.nation.co.ke/business/...

27/

The recruitment drive also saw Gakuyo combine Gakuyo and Ekeza’s marketing with the Kiambu gubernatorial campaigns.

He spent Sh6mn in 2015, Sh50mn in 2016 and Sh78mn in 2017 on vernacular radio and TV stations marketing campaigns that the media aired live.

The recruitment drive also saw Gakuyo combine Gakuyo and Ekeza’s marketing with the Kiambu gubernatorial campaigns.

He spent Sh6mn in 2015, Sh50mn in 2016 and Sh78mn in 2017 on vernacular radio and TV stations marketing campaigns that the media aired live.

28/

In 2015, Dinara Properties with Mazuri Side I apartments in Thika pulled off an elaborate scheme on Ms Roseteller Okubo and her husband Yufnalis Okubo, both directors of Malcedian Properties Ltd https://www.nation.co.ke/lifestyle/dn2/Risks-of-buying--home-off-plan/957860-4714930-mg0v6c/index.html">https://www.nation.co.ke/lifestyle...

In 2015, Dinara Properties with Mazuri Side I apartments in Thika pulled off an elaborate scheme on Ms Roseteller Okubo and her husband Yufnalis Okubo, both directors of Malcedian Properties Ltd https://www.nation.co.ke/lifestyle/dn2/Risks-of-buying--home-off-plan/957860-4714930-mg0v6c/index.html">https://www.nation.co.ke/lifestyle...

29/

Information seems to indicate that things have gotten progressively worse since that time https://twitter.com/munene_kelvins/status/1257236636645146624">https://twitter.com/munene_ke...

Information seems to indicate that things have gotten progressively worse since that time https://twitter.com/munene_kelvins/status/1257236636645146624">https://twitter.com/munene_ke...

30/

AIM Global also seems rather interesting

To join and qualify for thousands of shillings a day, members pay a one-time regn fee of Sh23K. If one wishes to make more money, they pay Sh69K for lifetime membership or Sh161K for international membership. https://www.standardmedia.co.ke/article/2001280819/how-aim-global-lures-many-with-promise-of-millions">https://www.standardmedia.co.ke/article/2...

AIM Global also seems rather interesting

To join and qualify for thousands of shillings a day, members pay a one-time regn fee of Sh23K. If one wishes to make more money, they pay Sh69K for lifetime membership or Sh161K for international membership. https://www.standardmedia.co.ke/article/2001280819/how-aim-global-lures-many-with-promise-of-millions">https://www.standardmedia.co.ke/article/2...

31/

The name Baracuda Airways was a dead giveaway...

CEO Kimeria Boddie Maina and directors John Odhiambo Majiwa and Elizabeth Wanjiku Kinyanjui cheated job seekers of Sh9.7mn with promises of training as pilots and cabin crew in South Africa and Dubai. https://www.businessdailyafrica.com/corporate/Baracuda-Airways-CEO--employees-court-fraud-jobseekers/539550-3830010-ffq2i2z/index.html">https://www.businessdailyafrica.com/corporate...

The name Baracuda Airways was a dead giveaway...

CEO Kimeria Boddie Maina and directors John Odhiambo Majiwa and Elizabeth Wanjiku Kinyanjui cheated job seekers of Sh9.7mn with promises of training as pilots and cabin crew in South Africa and Dubai. https://www.businessdailyafrica.com/corporate/Baracuda-Airways-CEO--employees-court-fraud-jobseekers/539550-3830010-ffq2i2z/index.html">https://www.businessdailyafrica.com/corporate...

32/

In 2018, Nurucoin was launched with much fanfare

The new cryptocurrency, dubbed Nurucoin, has been developed by the owners of e-commerce platform BlazeBay, itself a subsidiary of Churchblaze Christian Association... https://www.businessdailyafrica.com/corporate/companies/Kenyan-group-launches--Nurucoin--digital-currency/4003102-4287946-gqubqkz/index.html">https://www.businessdailyafrica.com/corporate...

In 2018, Nurucoin was launched with much fanfare

The new cryptocurrency, dubbed Nurucoin, has been developed by the owners of e-commerce platform BlazeBay, itself a subsidiary of Churchblaze Christian Association... https://www.businessdailyafrica.com/corporate/companies/Kenyan-group-launches--Nurucoin--digital-currency/4003102-4287946-gqubqkz/index.html">https://www.businessdailyafrica.com/corporate...

33/

Not long after, the mining operation came to a screeching halt...

"Police are investigating a man calling himself pastor (Isaac Muthui), accused of conning thousands of Kenyans Sh2.7bn under the guise of investment in a virtual currency scheme."

https://www.standardmedia.co.ke/article/2001355550/police-hunt-for-pastor-in-sh2-7b-con-game?__twitter_impression=true">https://www.standardmedia.co.ke/article/2...

Not long after, the mining operation came to a screeching halt...

"Police are investigating a man calling himself pastor (Isaac Muthui), accused of conning thousands of Kenyans Sh2.7bn under the guise of investment in a virtual currency scheme."

https://www.standardmedia.co.ke/article/2001355550/police-hunt-for-pastor-in-sh2-7b-con-game?__twitter_impression=true">https://www.standardmedia.co.ke/article/2...

34/

Remember Fountain Enterprise (FEP)?

"He came armed with a Bible, silver tongue and hope. But a decade and about Sh6 billion worth of investments later, the bounty dividends that architect John Kithaka promised have not been delivered." https://www.nation.co.ke/news/Firm-that-promised-sun-and-moon-but-delivered-false-hope/1056-5150102-7pbnq0/index.html">https://www.nation.co.ke/news/Firm...

Remember Fountain Enterprise (FEP)?

"He came armed with a Bible, silver tongue and hope. But a decade and about Sh6 billion worth of investments later, the bounty dividends that architect John Kithaka promised have not been delivered." https://www.nation.co.ke/news/Firm-that-promised-sun-and-moon-but-delivered-false-hope/1056-5150102-7pbnq0/index.html">https://www.nation.co.ke/news/Firm...

35/

FEP included include companies like...

MobiKash

Fountain Media

Fountain Sacco

Fountain Safaris

Citadelle Security

Kisima Real Estate

Suntec Supermarket

Fountain Technologies

Nobel Insurance Agency

Fountain Credit Services

Fountain Group of Schools

https://www.nation.co.ke/lifestyle/money/Architect-wealth-dream/435440-2432412-7e463p/index.html">https://www.nation.co.ke/lifestyle...

FEP included include companies like...

MobiKash

Fountain Media

Fountain Sacco

Fountain Safaris

Citadelle Security

Kisima Real Estate

Suntec Supermarket

Fountain Technologies

Nobel Insurance Agency

Fountain Credit Services

Fountain Group of Schools

https://www.nation.co.ke/lifestyle/money/Architect-wealth-dream/435440-2432412-7e463p/index.html">https://www.nation.co.ke/lifestyle...

36/

Thousands of Kenyans both at home and abroad put their savings in Fountain Enterprises Programme (FEP) and, 12 years later, they are yet to receive their dividends.

It got so bad, diaspora was reaching out to both DCI and FBI to investigate.... https://ksnmedia.com/2019/06/fep-fbi-invited-to-investigate-firm-that-used-the-bible-to-promise-investors-the-moon-but-delivered-false-hope/">https://ksnmedia.com/2019/06/f...

Thousands of Kenyans both at home and abroad put their savings in Fountain Enterprises Programme (FEP) and, 12 years later, they are yet to receive their dividends.

It got so bad, diaspora was reaching out to both DCI and FBI to investigate.... https://ksnmedia.com/2019/06/fep-fbi-invited-to-investigate-firm-that-used-the-bible-to-promise-investors-the-moon-but-delivered-false-hope/">https://ksnmedia.com/2019/06/f...

37/

Learning a little more about Clip Sacco

Using a Nairobi law firm, Iseme, Kamau & Maema Advocates, Peter Alfred Ndakwe, the chairman of Clip Investment Sacco, registered the 2 shell companies in Panama to hide the ownership of 11 local companies.

https://www.nation.co.ke/news/-pyramid-scheme-money/1056-3146136-10a0xyjz/index.html">https://www.nation.co.ke/news/-pyr...

Learning a little more about Clip Sacco

Using a Nairobi law firm, Iseme, Kamau & Maema Advocates, Peter Alfred Ndakwe, the chairman of Clip Investment Sacco, registered the 2 shell companies in Panama to hide the ownership of 11 local companies.

https://www.nation.co.ke/news/-pyramid-scheme-money/1056-3146136-10a0xyjz/index.html">https://www.nation.co.ke/news/-pyr...

38/

The church angle

Mr Ndakwe was an author of several Christian books whose born-again credentials endeared him to the pyramid scheme victims. He also ran another company, Kings Script Publishers Ltd

The church angle

Mr Ndakwe was an author of several Christian books whose born-again credentials endeared him to the pyramid scheme victims. He also ran another company, Kings Script Publishers Ltd

39/

Ndakwe was accused by 5,846 victims of fleecing them of more than Sh1.9 billion. Clip was the second largest pyramid scheme after Deci — founded by George Odinga Donde and Mary Odinga — which took Sh2.4 billion from its 93,485 members.

Ndakwe was accused by 5,846 victims of fleecing them of more than Sh1.9 billion. Clip was the second largest pyramid scheme after Deci — founded by George Odinga Donde and Mary Odinga — which took Sh2.4 billion from its 93,485 members.

40/

Then there& #39;s Prof Clyde Rivers, Chancellor of Educational Development Worldwide who in 2010 was liberally handing out PhDs to anyone willing to pay between $2,500 to $6,000 for the honor.

It& #39;s rumoured that a certain wild pastor is a degree holder.

https://www.nation.co.ke/news/Honorary-degrees-raise-eyebrows-/1056-959130-a688s5z/index.html">https://www.nation.co.ke/news/Hono...

Then there& #39;s Prof Clyde Rivers, Chancellor of Educational Development Worldwide who in 2010 was liberally handing out PhDs to anyone willing to pay between $2,500 to $6,000 for the honor.

It& #39;s rumoured that a certain wild pastor is a degree holder.

https://www.nation.co.ke/news/Honorary-degrees-raise-eyebrows-/1056-959130-a688s5z/index.html">https://www.nation.co.ke/news/Hono...

41/

The impressive list of those who have been honoured include:

Janet Museveni

Yoweri Museveni

Zipporah Kittony

Kalonzo Musyoka

Kenneth Marende

Burundi Pres Pierre Nkurunziza

Fmr Nigerian Pres Olusegun Obasanjo

Fmr Mozambican Pres Joaquim Chissano https://www.standardmedia.co.ke/article/2000013995/us-varsity-floods-kenya-with-phds">https://www.standardmedia.co.ke/article/2...

The impressive list of those who have been honoured include:

Janet Museveni

Yoweri Museveni

Zipporah Kittony

Kalonzo Musyoka

Kenneth Marende

Burundi Pres Pierre Nkurunziza

Fmr Nigerian Pres Olusegun Obasanjo

Fmr Mozambican Pres Joaquim Chissano https://www.standardmedia.co.ke/article/2000013995/us-varsity-floods-kenya-with-phds">https://www.standardmedia.co.ke/article/2...

42/

In 2001, Ala Najat Marine Shipping asked Kenyans to pay Sh9,500 for registration, medical examination and passport was no big deal in return for jobs paying US$800+ bonuses

https://www.standardmedia.co.ke/article/2000103994/tragedy-of-fake-cruise-ship-jobs-and-millions-lost">https://www.standardmedia.co.ke/article/2...

In 2001, Ala Najat Marine Shipping asked Kenyans to pay Sh9,500 for registration, medical examination and passport was no big deal in return for jobs paying US$800+ bonuses

https://www.standardmedia.co.ke/article/2000103994/tragedy-of-fake-cruise-ship-jobs-and-millions-lost">https://www.standardmedia.co.ke/article/2...

43/

The deal sounded really sweet.

In Parliament, MPs made fervent noise to force the government to speed up the processing of requisite documents such as passports and medical certificates to enable unemployed youths secure the promised 50,000 vacancies.

The deal sounded really sweet.

In Parliament, MPs made fervent noise to force the government to speed up the processing of requisite documents such as passports and medical certificates to enable unemployed youths secure the promised 50,000 vacancies.

44/

By the time Labour and Human Resources Development Minister Joseph Ngutu, who had given the deal a clean bill of health announced that there were no jobs after all, at least 10,031 Kenyans had lost a combined amount of Sh100 million.

By the time Labour and Human Resources Development Minister Joseph Ngutu, who had given the deal a clean bill of health announced that there were no jobs after all, at least 10,031 Kenyans had lost a combined amount of Sh100 million.

45/

On Jan 30 2020, Manases Karanja, a director of Interweb Global was arraigned in court charged with obtaining Sh3.7mn by false pretences while promising a 20% monthly commission on funds invested.

CMA claimed this was a ponzi scheme & not licensed. https://www.nation.co.ke/business/Forex-scam-victims-protest-in-court/996-5437036-12ece3b/index.html">https://www.nation.co.ke/business/...

On Jan 30 2020, Manases Karanja, a director of Interweb Global was arraigned in court charged with obtaining Sh3.7mn by false pretences while promising a 20% monthly commission on funds invested.

CMA claimed this was a ponzi scheme & not licensed. https://www.nation.co.ke/business/Forex-scam-victims-protest-in-court/996-5437036-12ece3b/index.html">https://www.nation.co.ke/business/...

46/

In 2016, World Ventures promised discounted dream trips on payment of $199 membership and monthly fees of $54, waived if one enrolled others.

Norwegians declared it a pyramid scheme because

revenues are from recruitment of members not sale of travel

https://www.nation.co.ke/oped/blogs/dot9/thangwa/2274536-3354684-37ektgz/index.html">https://www.nation.co.ke/oped/blog...

In 2016, World Ventures promised discounted dream trips on payment of $199 membership and monthly fees of $54, waived if one enrolled others.

Norwegians declared it a pyramid scheme because

revenues are from recruitment of members not sale of travel

https://www.nation.co.ke/oped/blogs/dot9/thangwa/2274536-3354684-37ektgz/index.html">https://www.nation.co.ke/oped/blog...

47/

Urithi Housing Co-op was started in 2012 and has 8,000 members.

Gakuyo was a founding member but left in 2013

In 2016, Urithi Housing acquired land in Gatanga for Sh1bn from a bank defaulter agreeing to repay the Sh500mn balance in five years. https://www.nation.co.ke/news/Urithi-s-housing-bubble-bursts-as-bank-puts-up-land-for-sale/1056-5150994-8hu1if/index.html">https://www.nation.co.ke/news/Urit...

Urithi Housing Co-op was started in 2012 and has 8,000 members.

Gakuyo was a founding member but left in 2013

In 2016, Urithi Housing acquired land in Gatanga for Sh1bn from a bank defaulter agreeing to repay the Sh500mn balance in five years. https://www.nation.co.ke/news/Urithi-s-housing-bubble-bursts-as-bank-puts-up-land-for-sale/1056-5150994-8hu1if/index.html">https://www.nation.co.ke/news/Urit...

48/

Panorama Gardens was marketed and sold by Urithi as ready plots for immediate development and attracted 400 investors, with an eighth of an acre going for Sh2.25 million.

3 years 70% cleared their balances but no titles were forthcoming and no construction happening

Panorama Gardens was marketed and sold by Urithi as ready plots for immediate development and attracted 400 investors, with an eighth of an acre going for Sh2.25 million.

3 years 70% cleared their balances but no titles were forthcoming and no construction happening

49/

Jane Njeri had taken the gamble quite seriously, investing in three projects: Juja Gem Mantionate, Ruiru Ridges and now Osten Terrace Gardens but none seems to be forthcoming.

She& #39;s not received any title to date. https://www.standardmedia.co.ke/business/article/2001315964/dream-of-owning-land-and-houses-turns-into-painful-wait-for-group">https://www.standardmedia.co.ke/business/...

Jane Njeri had taken the gamble quite seriously, investing in three projects: Juja Gem Mantionate, Ruiru Ridges and now Osten Terrace Gardens but none seems to be forthcoming.

She& #39;s not received any title to date. https://www.standardmedia.co.ke/business/article/2001315964/dream-of-owning-land-and-houses-turns-into-painful-wait-for-group">https://www.standardmedia.co.ke/business/...

50/

Obadiah Maina and Rachel Wachira were in September 2019 charged with more than 40 counts of conspiracy to defraud members of more than Sh1bn through Good Life Savings and Cooperative Society. Their SACCO license was cancelled and liquidators appointed https://www.nation.co.ke/news/sacco-staff-charged-with-Sh1bn-fraud/1056-5261484-bm42hd/index.html">https://www.nation.co.ke/news/sacc...

Obadiah Maina and Rachel Wachira were in September 2019 charged with more than 40 counts of conspiracy to defraud members of more than Sh1bn through Good Life Savings and Cooperative Society. Their SACCO license was cancelled and liquidators appointed https://www.nation.co.ke/news/sacco-staff-charged-with-Sh1bn-fraud/1056-5261484-bm42hd/index.html">https://www.nation.co.ke/news/sacc...

51/

Some 1,500 Kenyans may have lost billions of shillings in yet another suspected investment fraud.

Wallace Mwaura, the chairman of E-Firm, said the society had collapsed and the offices closed after squabbles within the board and among investors.

https://www.standardmedia.co.ke/the-standard-insider/article/2001375320/billions-lost-in-another-suspected-farm-scam">https://www.standardmedia.co.ke/the-stand...

Some 1,500 Kenyans may have lost billions of shillings in yet another suspected investment fraud.

Wallace Mwaura, the chairman of E-Firm, said the society had collapsed and the offices closed after squabbles within the board and among investors.

https://www.standardmedia.co.ke/the-standard-insider/article/2001375320/billions-lost-in-another-suspected-farm-scam">https://www.standardmedia.co.ke/the-stand...

Read on Twitter

Read on Twitter