#IRAQ, $AR, This is a great piece on oil and i concur with it 100%. How am i playing it- as the author states, oil production will take many years to come back- so this is highly bullish for NG & I’m playing It with $AR. In addition I believe that frontier markets like IRAQ that https://twitter.com/OpenSquareCap/status/1255221885849272326">https://twitter.com/OpenSquar...

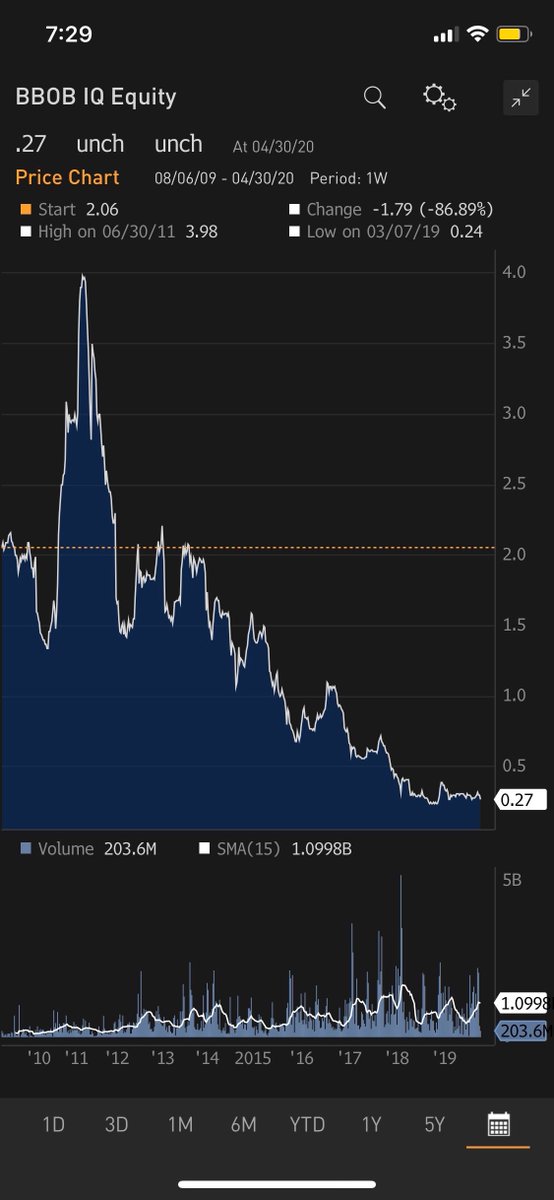

Are down 75% over the past decade, with stocks that are unbelievably cheap such as Bank of Baghdad (the “HDFC Bank” ) of iraq are the levered way to play a market at 4% mkt cap/gdp. Many noticed yesterday that the Oracle of Omaha net sold last month. Warren loves mkt cap to gdp

Ratios & the US at 160% is at an all time high (esp with denominator imploding). Buying a market with so much bad news priced in where few if any foreigners are invested, where if Open Square is right and oil rips higher in 2 years provides you a monster return with $ coming back

And without the contango nonsense of playing $USO (which is the worst instrument ever created) or with highly levered oil companies which may or may not make the cycle. You see ive noticed that by buying the best bank (levered instrument to an economy) you usually do incredibly

Well over a cycle. Bank of Baghdad at 0.25x PBR, 25% ROE, 13% dividend yield offers me a levered way to play an improving economy, bombed out sentiment that can only improve and a way to play oil recovering with the best bank in the Market. & oh yeah the leading shareholder just

Transferred its stake to a related party at 4x the current price implying what they think of the value of their stake. The related party is an asset mgr so will have to wear a huge loss should the stock not recover. They obviously feel confident it will, or else they wouldn’t

Follow @AMTabaqchali for great insight on the market. If you want to buy the stock its fairly simple with opening an a/c. Both Rabee securities http://www.rs.iq/ ">https://www.rs.iq/">... & karmal https://isx-karmal.com/ ">https://isx-karmal.com/">... provide you an easy platform to open an a/c and trade. Most of my friends &

Family think I’m nuts trading iraq. Many of you also thought i was nuts buying nat gas a few months ago too. I’m willing to think that buying a bombed out market with low sentiment, 4% Mkt cap/gdp, few foreign investors & an explosive way to play an oil recovery makes for an

Explosive and highly contrarian investment. (Symbol on Bloomberg is BBOB IQ)

Read on Twitter

Read on Twitter