Finding SUPPLY and DEMAND pressure using candlesticks.

Candlesticks can be used to find supply and demand pressure, specially in intra-day trading.

I hope this changes how you view and use candlesticks on a daily basis.

A thread.

Candlesticks can be used to find supply and demand pressure, specially in intra-day trading.

I hope this changes how you view and use candlesticks on a daily basis.

A thread.

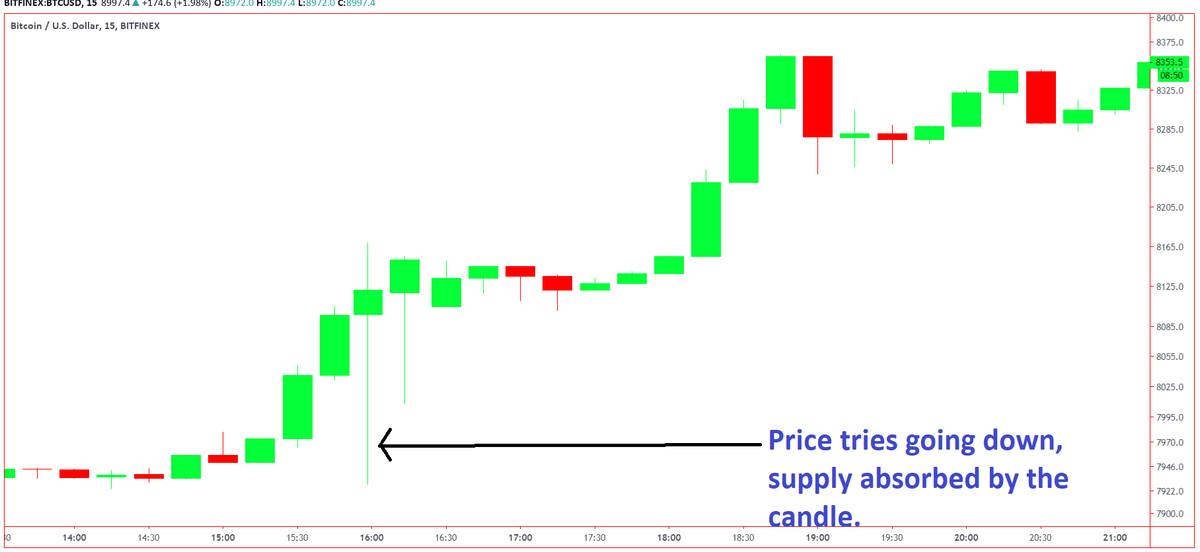

Candlesticks with a long tail wick, about 2-3 times their body have overcome a big supply zone.

This means that below that candle existed a huge supply order which was absorbed .

This is generally bullish, means the demand in that zone was able to overcome the supply.

See Pic

This means that below that candle existed a huge supply order which was absorbed .

This is generally bullish, means the demand in that zone was able to overcome the supply.

See Pic

At this zone, traders could look for a safe long entry.

1. Look for candles with a long tail.

2. It should have bounced off of a previous resistance now turned support.

3. Wait for the price to break a resistance above.

1. Look for candles with a long tail.

2. It should have bounced off of a previous resistance now turned support.

3. Wait for the price to break a resistance above.

The same principle is applicable with candles with a long overhead wick.

This implies that the candle was not able to absorb all the supply above itself, which is generally bearish.

We should look for signs of reversal at this level.

This implies that the candle was not able to absorb all the supply above itself, which is generally bearish.

We should look for signs of reversal at this level.

In a similar manner, on confirmation of a candle which failed to absorb the supply above, a safe short entry can be made.

1. Look for candle with long overhead wick.

2. Wait for previous supply to be broken.

See pic below for a short entry.

1. Look for candle with long overhead wick.

2. Wait for previous supply to be broken.

See pic below for a short entry.

I hope this gives you a new perspective into candlesticks.

Trading is easy if we stick to the basics and keep things simple.

Stick to the study of price, everything else will follow.

Trading is easy if we stick to the basics and keep things simple.

Stick to the study of price, everything else will follow.

Read on Twitter

Read on Twitter