If you’ve been looking for a SAFE place to invest and get your money to work for you, then this thread is for you.

In this thread, I’ll try to explain how Cowrywise works and why you might want to try it out too. I also talk about emergency funds and how you can use them.

This https://twitter.com/iam_tpoj/status/1252288092591001607">https://twitter.com/iam_tpoj/...

In this thread, I’ll try to explain how Cowrywise works and why you might want to try it out too. I also talk about emergency funds and how you can use them.

This https://twitter.com/iam_tpoj/status/1252288092591001607">https://twitter.com/iam_tpoj/...

is quite long but I guarantee you that it’d be worth every second of your time.

Cowrywise is a platform that helps users save and invest safely in opportunities that offer higher returns than what most traditional banks offer.

Safety:

Cowrywise invests the money saved with

Cowrywise is a platform that helps users save and invest safely in opportunities that offer higher returns than what most traditional banks offer.

Safety:

Cowrywise invests the money saved with

them in the "safest" investments available, Government instruments. These investments are "so safe" that Finance professionals call them "risk-free" investments. They also have the savings of users held and monitored by Meristem Trustees Limited. This helps to reduce the risk of

just one company holding, controlling and being able to "run away" with our money.

For more information about the security of the platform, you can check out this link https://cowrywise.com/security

I">https://cowrywise.com/security&... explained why it is unlikely that they would run away with people& #39;s money in here: https://twitter.com/JE_dna/status/1239863231306489859">https://twitter.com/JE_dna/st...

For more information about the security of the platform, you can check out this link https://cowrywise.com/security

I">https://cowrywise.com/security&... explained why it is unlikely that they would run away with people& #39;s money in here: https://twitter.com/JE_dna/status/1239863231306489859">https://twitter.com/JE_dna/st...

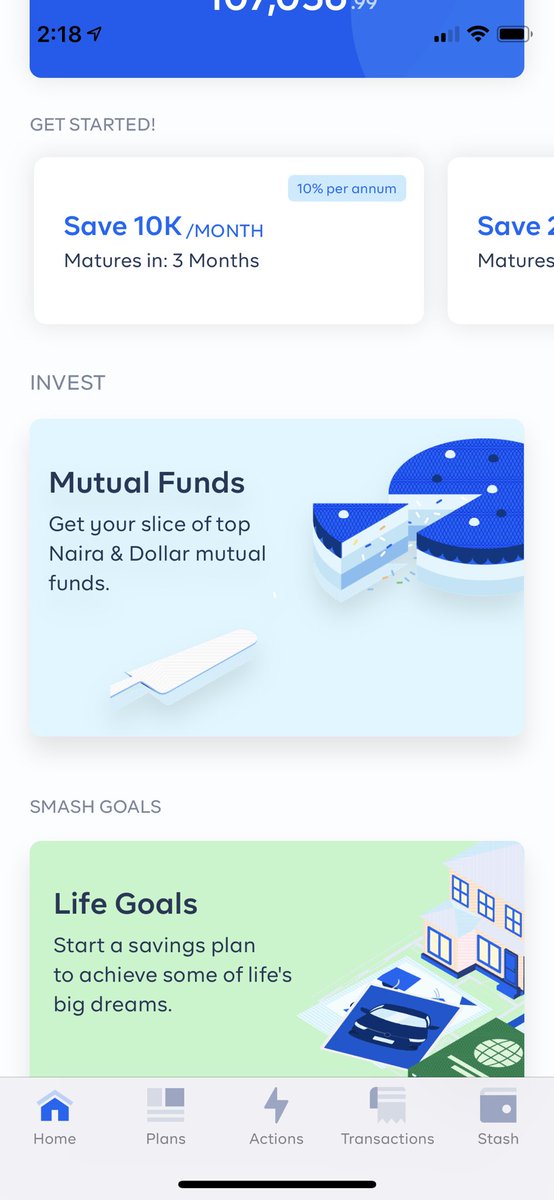

You can use Cowrywise for 3 main purposes:

1. Savings

2. Investment

3. Plans

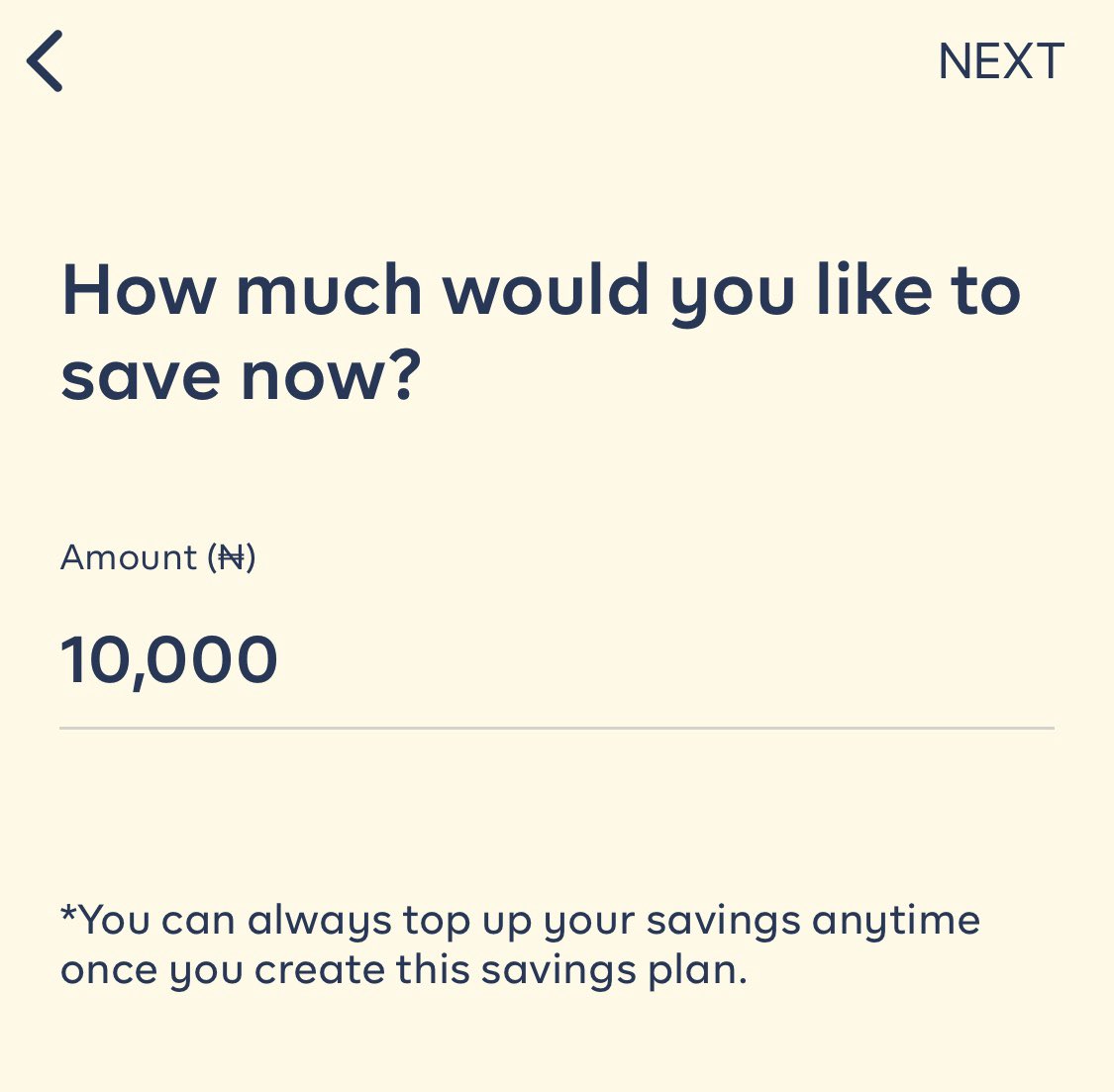

SAVINGS:

You can save your money with Cowrywise and get interest that is a lot higher than what traditional banks offer. They have 4 already designed plans that you can use. If you want something more

1. Savings

2. Investment

3. Plans

SAVINGS:

You can save your money with Cowrywise and get interest that is a lot higher than what traditional banks offer. They have 4 already designed plans that you can use. If you want something more

unique to you, you can create your own unique savings plan where you can save alone or you can save with your friends. You can also create a savings plan which does not pay interest called Halal savings.

This is a great option for people who just got internships or contract work

This is a great option for people who just got internships or contract work

or youth corps to save their full or a part of their salary.

Plus you never have to worry about card or account maintenance fees. Whether you want to get interest or not, you can be sure that you would either get the exact amount you put in or you would get more and never less.

Plus you never have to worry about card or account maintenance fees. Whether you want to get interest or not, you can be sure that you would either get the exact amount you put in or you would get more and never less.

INVESTMENTS:

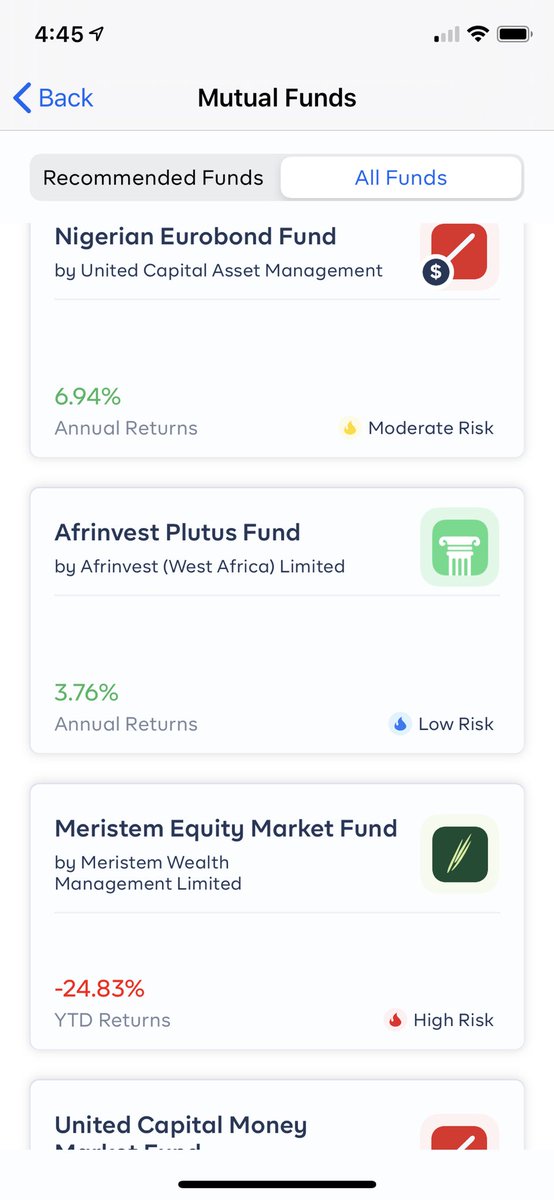

Currently, the investments you can get with Cowrywise are in Funds. A fund is a pool of investment from different individuals given to a single entity called a fund manager for them to invest in assets like bonds, shares etc. Some of the funds on Cowrywise have

Currently, the investments you can get with Cowrywise are in Funds. A fund is a pool of investment from different individuals given to a single entity called a fund manager for them to invest in assets like bonds, shares etc. Some of the funds on Cowrywise have

yielded as high as 40% returns in a year in the past and as low as -25%.

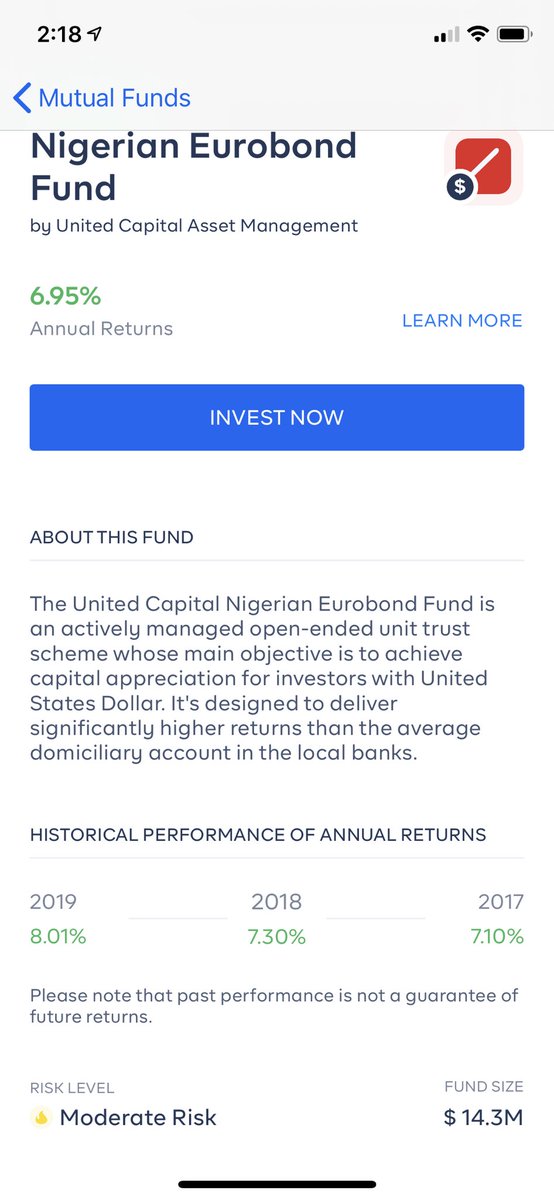

If you see any fund you like, you can open it, see the historical returns for 2017, 2018 and 2019 and you can also see the description of the fund and download the fund prospectus.

There is also a dollar

If you see any fund you like, you can open it, see the historical returns for 2017, 2018 and 2019 and you can also see the description of the fund and download the fund prospectus.

There is also a dollar

fund that you can invest in if. you want to invest in dollars. Currently, the fund is offering 6.94% annual returns but that can change in the future depending on how the fund performs.

Two of the coolest things Cowrywise does that I appreciate are:

1. You can perform a basic

Two of the coolest things Cowrywise does that I appreciate are:

1. You can perform a basic

personal risk assessment on the platform

2. Based on that risk assessment, the platform will RECOMMEND investments to you

What does this mean for you?

The basic rule is investment is "the more risk you take, the more money you can make" or in Finance terms, the higher your risk

2. Based on that risk assessment, the platform will RECOMMEND investments to you

What does this mean for you?

The basic rule is investment is "the more risk you take, the more money you can make" or in Finance terms, the higher your risk

the higher your returns. This is why investments like Forex or Cryptocurrency like Bitcoin have high returns, because of the high risk.

A lot of new investors don& #39;t understand their risk appetite. Some people just want to "cash-out" and make 900 million profit in 90 days or 100%

A lot of new investors don& #39;t understand their risk appetite. Some people just want to "cash-out" and make 900 million profit in 90 days or 100%

returns in 1 year. If you are like this, you would need to take A LOT of risk and this means that you have a HUGE chance of losing ALL the money you invested. Do you have the heart for this?

This is where Cowrywise comes in. The first time you invest on the platform, the app’ll

This is where Cowrywise comes in. The first time you invest on the platform, the app’ll

ask you some very basic questions that would help them determine what kind of investor you are. Are you

1. An aggressive investor (risk lover)

2. Conservative investor (risk avoider)

3. Balanced investor (mix of both)

PS: since this is a very basic test, the risk assessment is

1. An aggressive investor (risk lover)

2. Conservative investor (risk avoider)

3. Balanced investor (mix of both)

PS: since this is a very basic test, the risk assessment is

not a STRICT definition of the kind of risk you are comfortable taking. It is more like a guide that would help them recommend funds to you and also help you know the kind of risk you might be comfortable with.

You can look outside the recommended funds for investments you might

You can look outside the recommended funds for investments you might

be interested in. The best part is all their investments have risk assessment attached to them. You see by the side "high risk", "medium risk" and "low risk". So you can always get a rough idea of the kind of risk you take and remember, the higher the risk you take, the more you

can make AND the higher the risk you take, the more money you can LOSE.

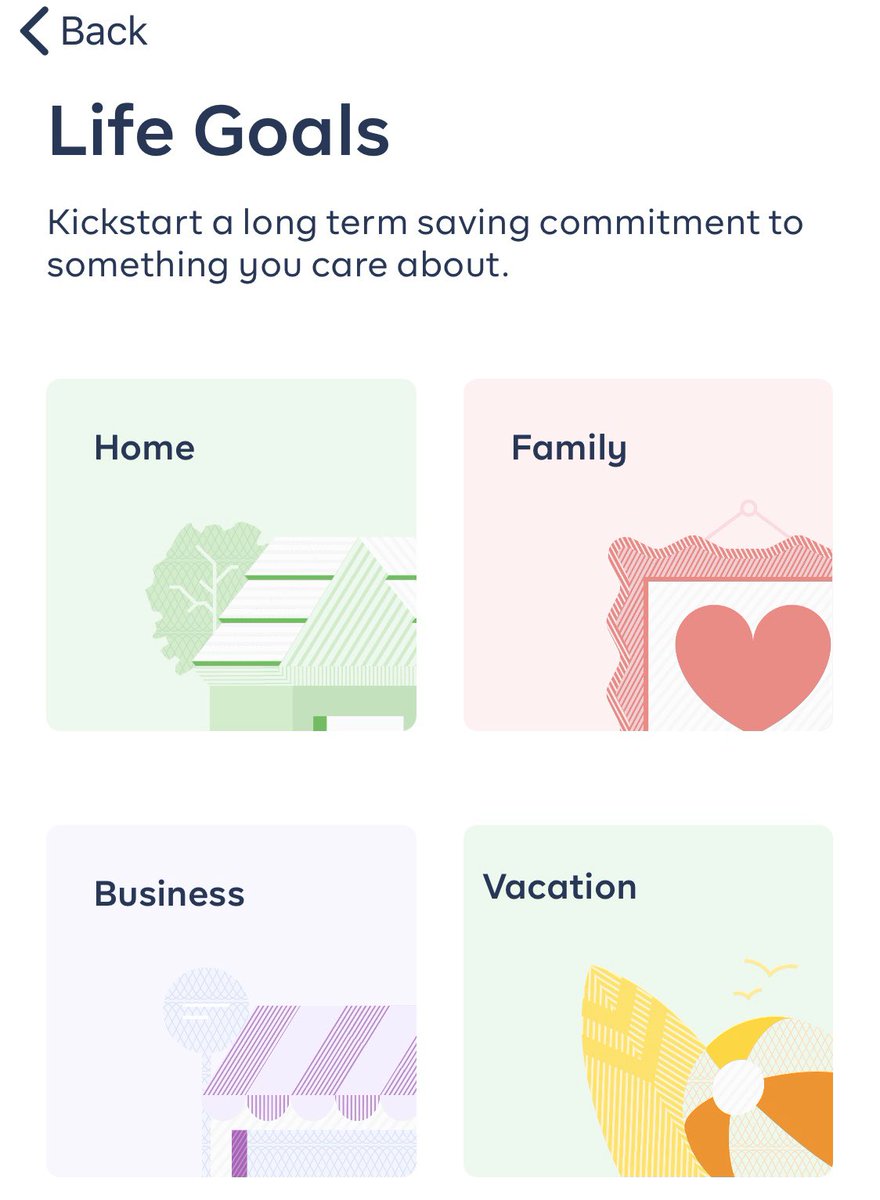

PLANS:

Another cool feature that Cowrywise has is, it allows you to save towards goals like a home, family, business, vacation, education, retirement and an emergency fund.

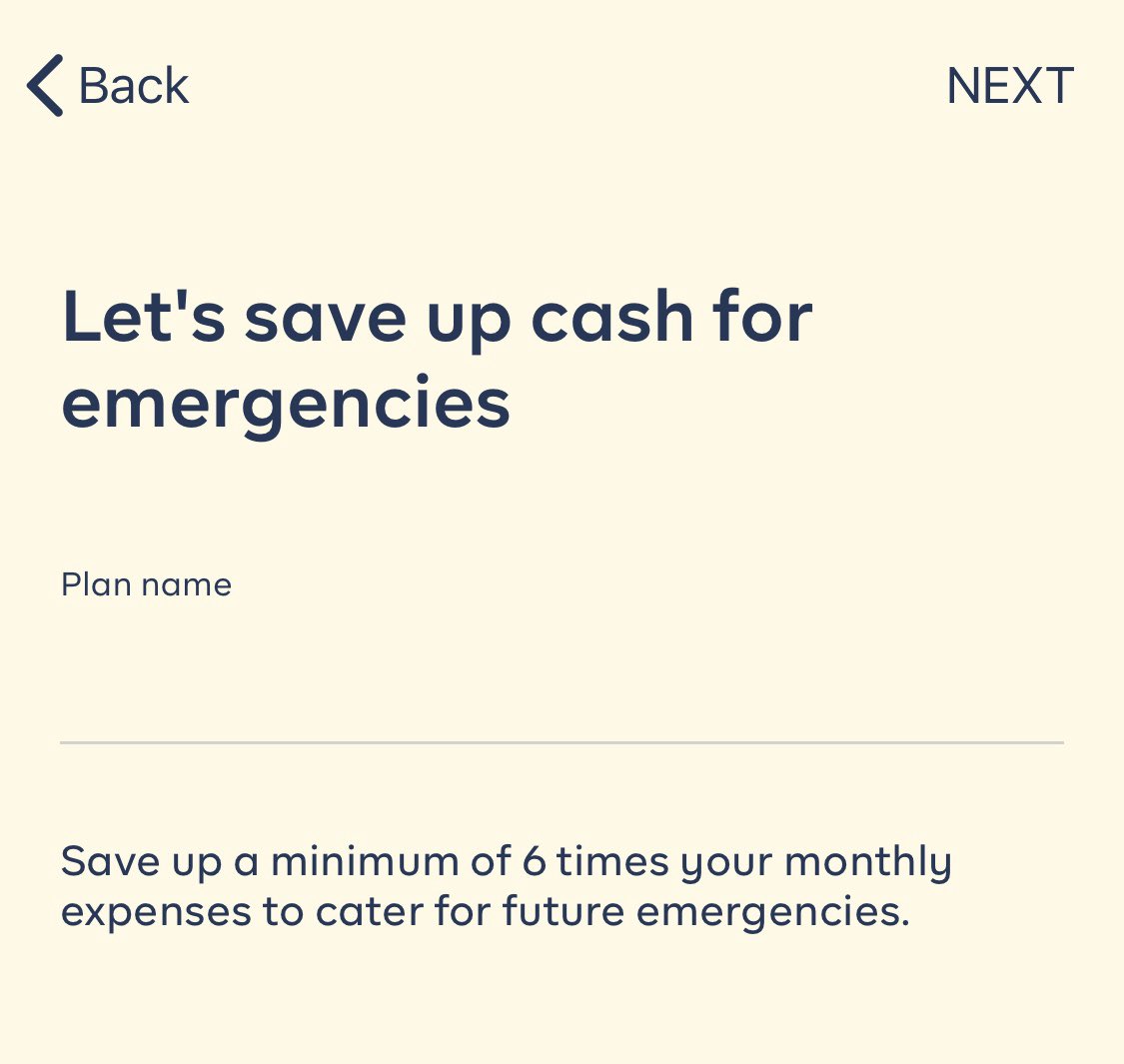

What is an emergency fund?

An

PLANS:

Another cool feature that Cowrywise has is, it allows you to save towards goals like a home, family, business, vacation, education, retirement and an emergency fund.

What is an emergency fund?

An

emergency fund is 3-6 months of your monthly expenses. This helps you take care of yourself in an emergency situation. A good example would be this Pandemic. If you had an emergency fund, you can be assured that even if the lockdown lasted for 6 months or your income reduces, you

would have some money to care for yourself.

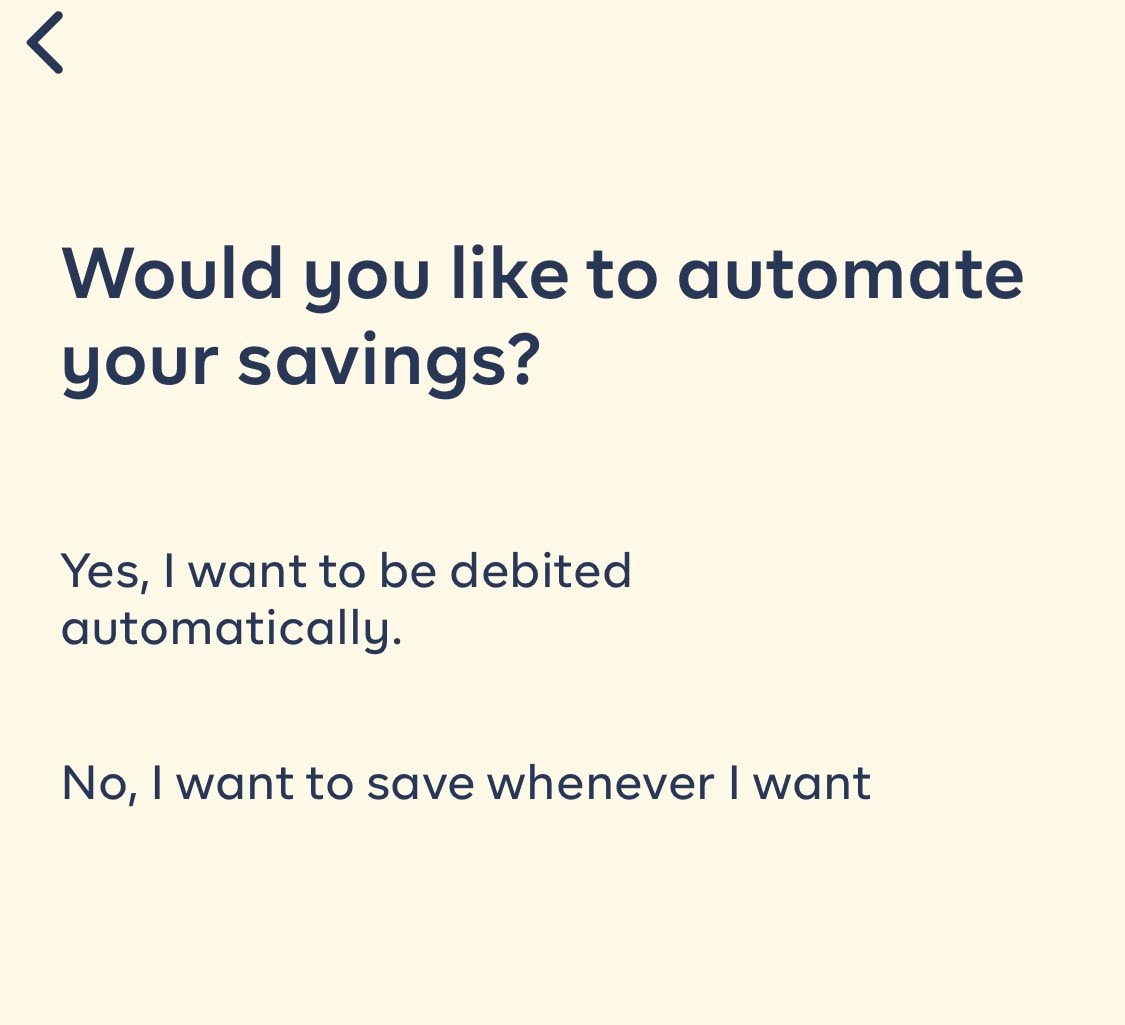

Because emergencies don& #39;t typically send a warning before they arrive, it is best for you to set aside money that you can easily access if you need to without losing some of the money you kept. You DO NOT invest your emergency fund in

Because emergencies don& #39;t typically send a warning before they arrive, it is best for you to set aside money that you can easily access if you need to without losing some of the money you kept. You DO NOT invest your emergency fund in

securities like shares or forex or an agricultural project because when an emergency comes up, your investment might either not be mature (that is, you cannot get the money) or the investment might be in a bad state and selling it might reduce your money.

While keeping your

While keeping your

money in a bank account might seem like a good idea, as we have come to learn, most banks eat up our money with their bank charges and they don& #39;t offer good interest on our savings.

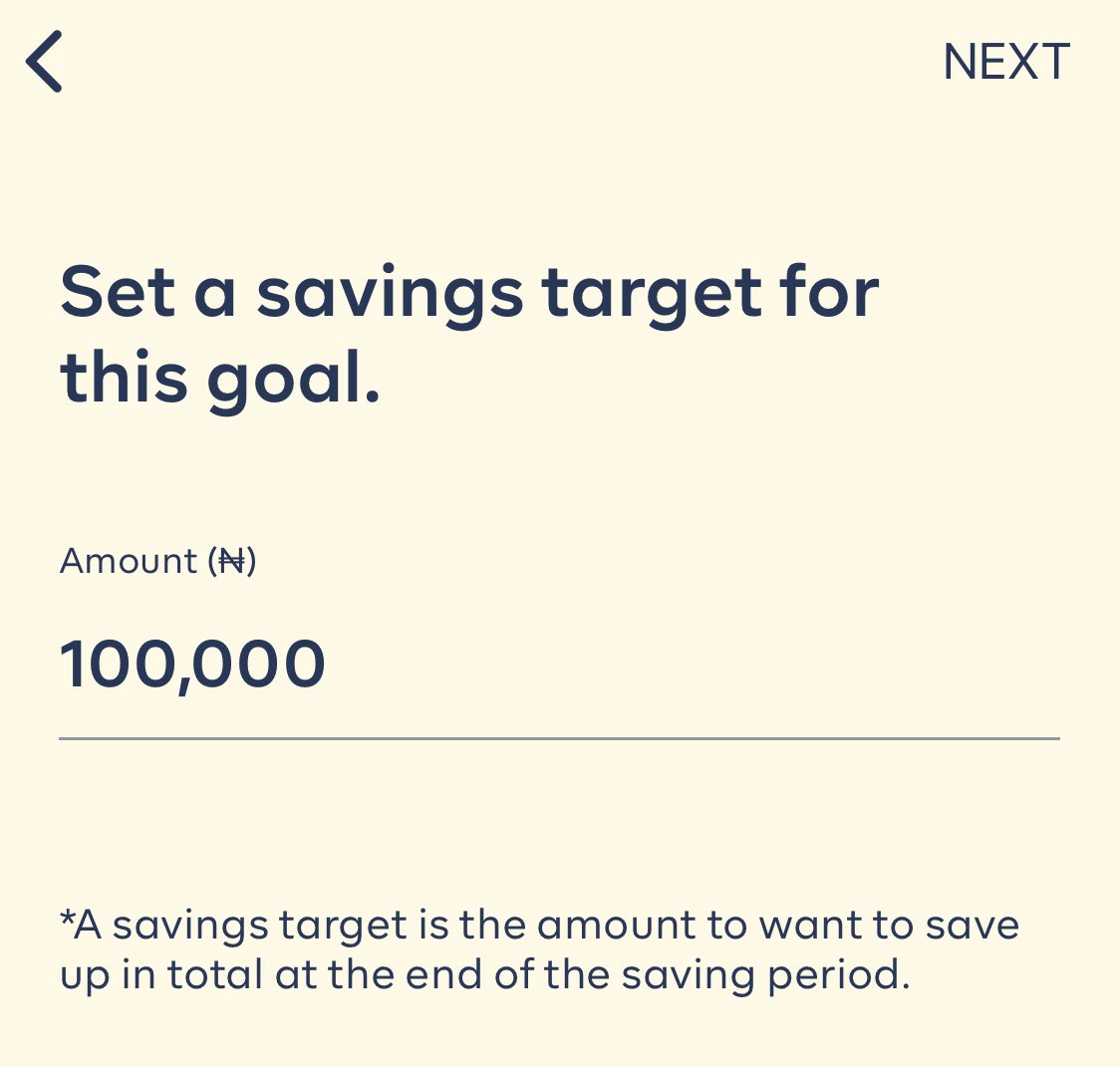

How do you start and use an emergency fund?

Calculate how your monthly expenses x 6

How do you start and use an emergency fund?

Calculate how your monthly expenses x 6

Set a target to save that amount

Start saving

Keep reviewing the emergency fund and make sure it is up to date with your current spending

When an emergency occurs, after you spend the money to take care of the emergency, ensure you refill the emergency fund so next time you will

Start saving

Keep reviewing the emergency fund and make sure it is up to date with your current spending

When an emergency occurs, after you spend the money to take care of the emergency, ensure you refill the emergency fund so next time you will

have somewhere to take money from.

If this thread inspired you to tryout Cowrywise: you can get a ₦250 cash bonus when you signup and save ₦1,000 on the Cowrywise app with this link: https://get.cowrywise.com/r/OghenNiF ">https://get.cowrywise.com/r/OghenNi... or code: OGHENNIF

Now let’s talk about “Ope from @cowrywise” https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

If this thread inspired you to tryout Cowrywise: you can get a ₦250 cash bonus when you signup and save ₦1,000 on the Cowrywise app with this link: https://get.cowrywise.com/r/OghenNiF ">https://get.cowrywise.com/r/OghenNi... or code: OGHENNIF

Now let’s talk about “Ope from @cowrywise”

Love (him or her) or hate (him or her), you can’t deny that Ope has to be arguably the most engaging Nigerian Fintech social media Handler. Always stressing us out with (his/her) regular updates and shaming us for our financial decisions (even when we didn’t do anything wrong  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">)

Most importantly, sending us emails and notifications almost every week; like Ope take the hint, we are never getting back together... like evurrrr  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">

I also like the mystery they’ve put behind the Ope character, the gender and such. I sometimes wonder if Ope is a real person,

I also like the mystery they’ve put behind the Ope character, the gender and such. I sometimes wonder if Ope is a real person,

maybe he/she started as a real person and later it just became a title... like Bosley for Charlie’s Angels... who knows

I think it’s good that they keep Ope a mystery though because let’s not lie if some of us catch Ope, it’s gonna be on sight https://abs.twimg.com/emoji/v2/... draggable="false" alt="😑" title="Ausdrucksloses Gesicht" aria-label="Emoji: Ausdrucksloses Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😑" title="Ausdrucksloses Gesicht" aria-label="Emoji: Ausdrucksloses Gesicht"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Lachend auf dem Boden rollen" aria-label="Emoji: Lachend auf dem Boden rollen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Lachend auf dem Boden rollen" aria-label="Emoji: Lachend auf dem Boden rollen">

Finally, I need to say this.

I think it’s good that they keep Ope a mystery though because let’s not lie if some of us catch Ope, it’s gonna be on sight

Finally, I need to say this.

At this point, some of you might be wondering, what are my brand affiliations? Why do I talk about PiggyVest today, Pettysave yesterday and Cowrywise tomorrow?

Well because I’m just an investor who likes making money and taking advantage of the great opportunities I can find.

Well because I’m just an investor who likes making money and taking advantage of the great opportunities I can find.

I already explained in the thread I made about Pettysave vs Piggyvest that I don’t necessarily see them as competitors because investors like me can use ALL three at the same time and I use all 3 of them and find them to be great!

I already said in another thread that I try to

I already said in another thread that I try to

only talk about apps that I’ve used personally and I find to be good because beyond being an investor I really care about helping users like myself who may not necessarily know how to decide on which platform to use. And the best way for me to give information that I’m confident

about is to talk from experience, observation and knowledge.

That’s why I do what I do.

So should you use Piggyvest, Cowrywise OR Pettysave?

It doesn’t have to be a choice. If you can use all three, USE ALL THREE. THAT’S WHAT I DO

End of thread

That’s why I do what I do.

So should you use Piggyvest, Cowrywise OR Pettysave?

It doesn’t have to be a choice. If you can use all three, USE ALL THREE. THAT’S WHAT I DO

End of thread

Read on Twitter

Read on Twitter