How can we get the pessimistic price forecasts from the bears (tanker shares should be at 0). I& #39;m going to value $EURN in a few different ways so we can get an idea. Let& #39;s start with assets and liabilities from end Q4.

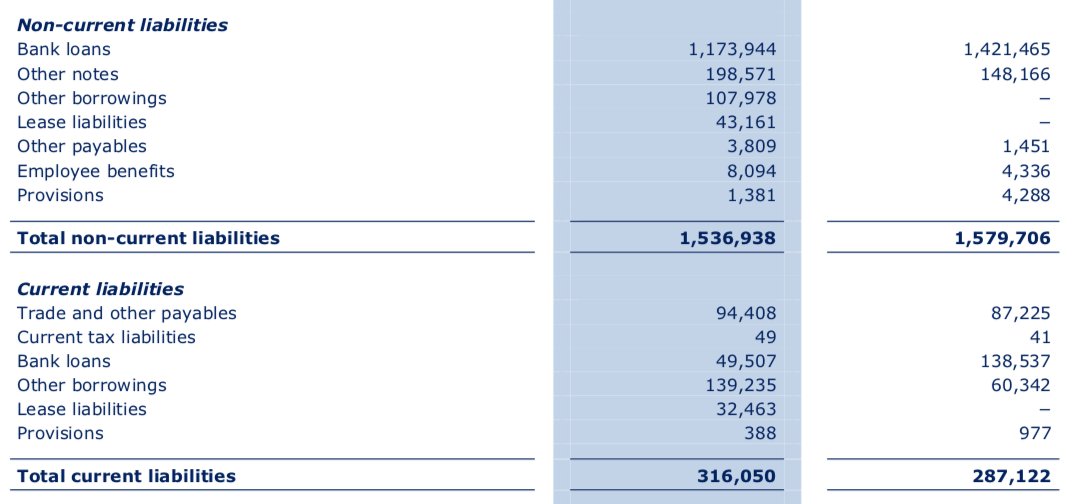

$1.85B in liabilities. $4.1B assets. 216M shares. $10.40 BV

$1.85B in liabilities. $4.1B assets. 216M shares. $10.40 BV

Let& #39;s first look at their NON FLEET assets. If we exclude vessels we have around $1B in value. Some of that is fuel and it was either used or lost value (oil price), so let& #39;s write that down to $900M. Now add cash they made in Q1 (I estimate ~$300M). $1.2B. $5.55 per share.

Now let& #39;s look at the fleet vs liabilities. Fleet book value is $3.2B. Total liabilities $1.85B. How good is that valuation?

Steel value ($315/ldt vs 15yr historical average $385), 46 VLCC ($12.5M) + 25 Suez ($9.45M), + 4 FSO/VPLUS ($15M) gives us $876M in STEEL.

Steel value ($315/ldt vs 15yr historical average $385), 46 VLCC ($12.5M) + 25 Suez ($9.45M), + 4 FSO/VPLUS ($15M) gives us $876M in STEEL.

So if we assume the 2 years it takes to build a ship, the operational knowledge, the employees, the company registrations, the bank accounts, the credit lines, are all worth NOTHING, the steel and non fleet assets pay for the debt and leave around $1/share left over.

The 15 year low for steel was during the financial crisis when it was around $285/ton. If we go with the 15 year average ($385) we get $1.1B in steel value.

So, if we discount everything that could be discounted. $EURN is worth $1-2 per share in raw materials.

So, if we discount everything that could be discounted. $EURN is worth $1-2 per share in raw materials.

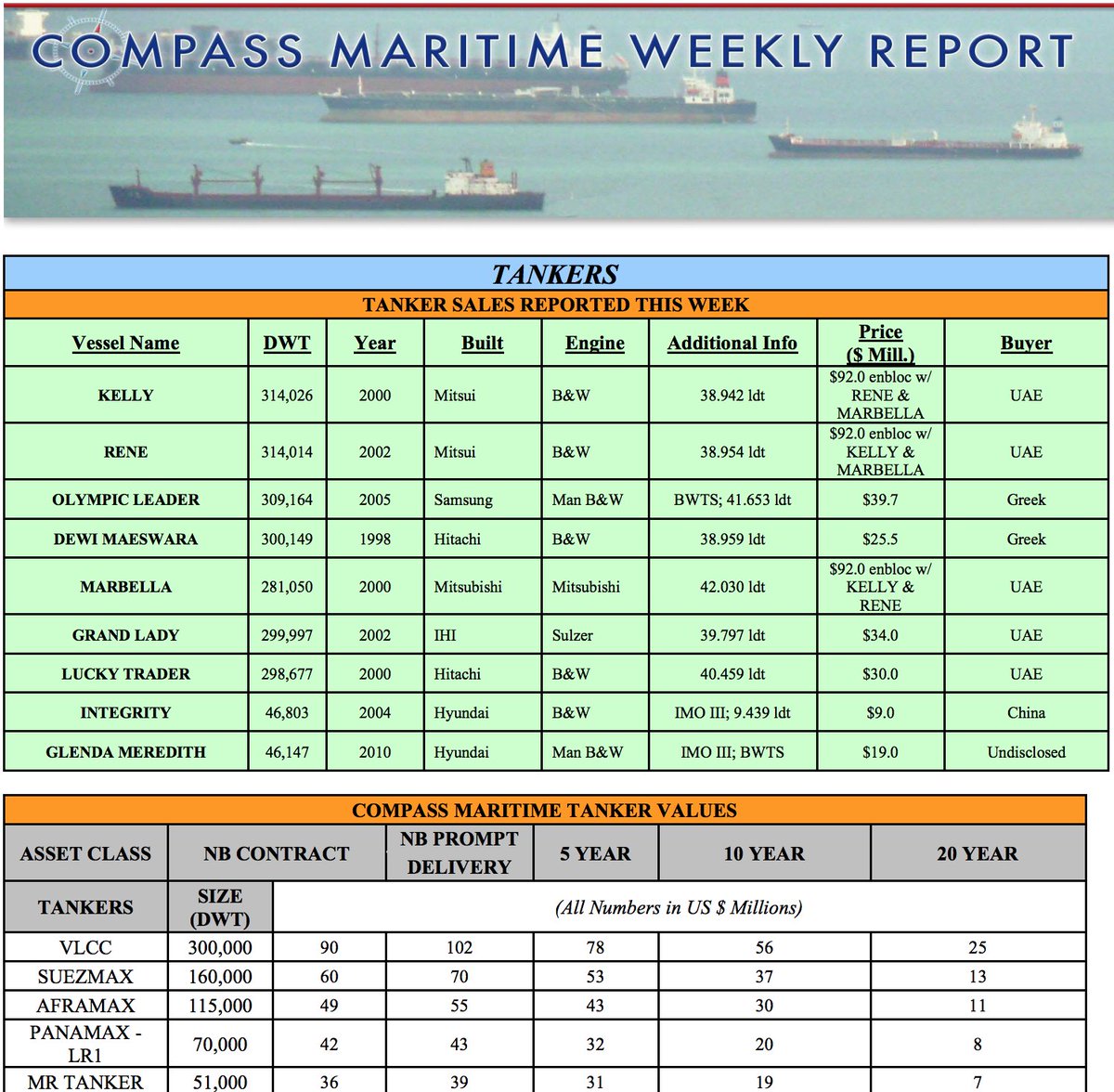

Obviously that& #39;s ridiculous. We should use market values of ships to estimate the value. So let& #39;s use values based on recent sales and broker assessed values.

$EURN fleet age is ~6 years for their VLCCs and 10 years for their Suezmaxes, while their FSOs/ULCCs are 17 yrs old.

$EURN fleet age is ~6 years for their VLCCs and 10 years for their Suezmaxes, while their FSOs/ULCCs are 17 yrs old.

If we go with broker assessed values, we& #39;d get around $70M per VLCC and $30M per Suezmax. We can assess the FSOs/ULCCs at around $32M. So, (70 * 46) + (30 * 25) + (4 * 32) gets us $4.1B, or $18.9 per share. If we subtract the debt we& #39;re left with $10.40 per share. Interesting!

So between broker assessed ship values and non fleet assets, we have a value of ~$16/share AFTER DEBT! So the intrinsic value of the fleet is clearly higher than the book value. How can this be?

For one, $EURN depreciates ALL of its vessels to $0 over 20 years.

For one, $EURN depreciates ALL of its vessels to $0 over 20 years.

Most companies depreciate to scrap, so for $EURN there is a residual value of at least the steel value ($4/share), which doesn& #39;t show up on the book value! In other words, $EURN trades right now at around 65% of broker assessed value.

But is broker assessed value really representative of the CURRENT market? Let& #39;s plugin in some sale values from this week. Three 20 yr old tankers recently went for $30-32M each, 20% more than the Broker suggested price. So should we be revising the fleet value up 10 or 15%?

If we do this, we get an intrinsic value for $EURN closer to $18/share.

Wait, you say, NAV can change. NAV should be based on the discounted cash flows of an asset over its lifetime. The market is pricing VLCCs wrong! They are all dumb! So let& #39;s assess the DCF for $EURN assets

Wait, you say, NAV can change. NAV should be based on the discounted cash flows of an asset over its lifetime. The market is pricing VLCCs wrong! They are all dumb! So let& #39;s assess the DCF for $EURN assets

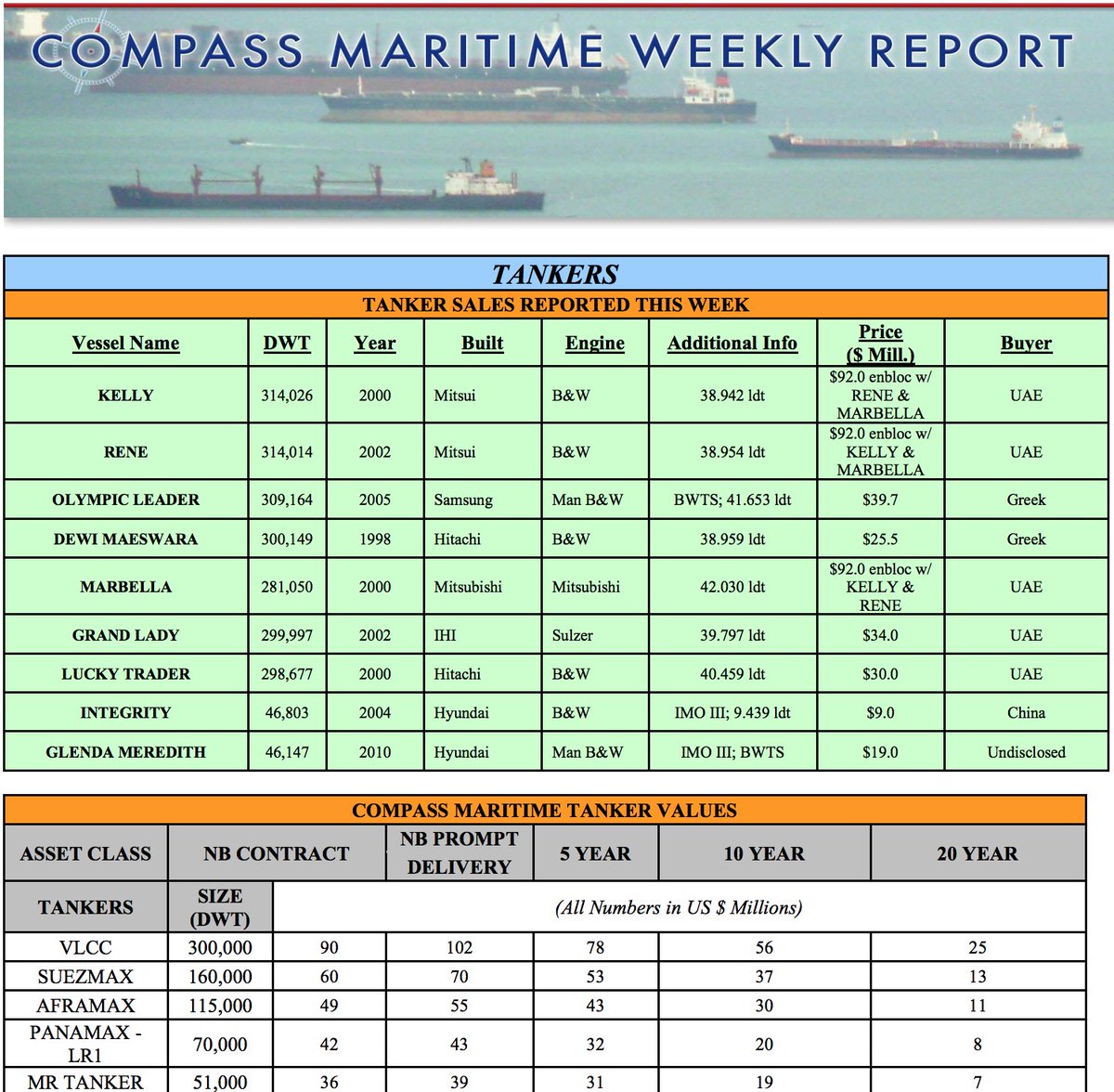

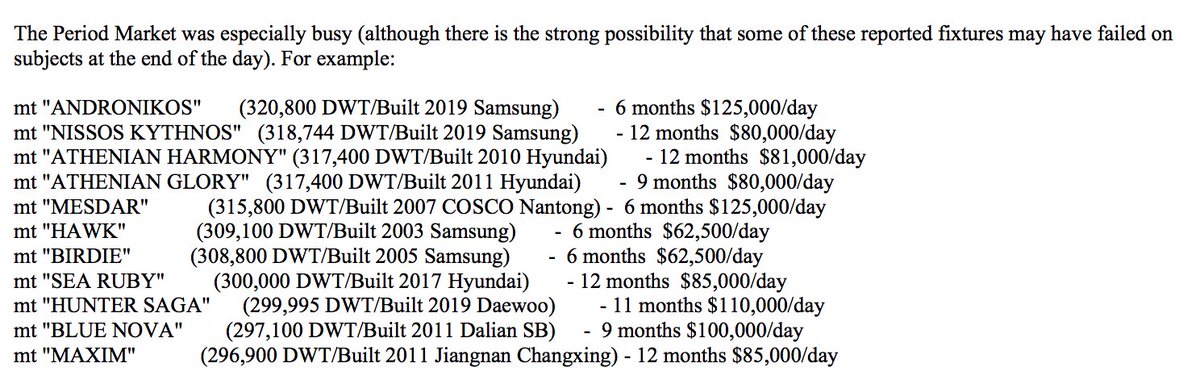

First, we need a benchmark. How do we expect VLCCs to perform? Let& #39;s start by looking at 12 months deals done this week. Surely some OPEC+ cut pessimism would have priced itself into the shipping market by now?

Looks like 12 months deals should go for ~$90k/day...

Looks like 12 months deals should go for ~$90k/day...

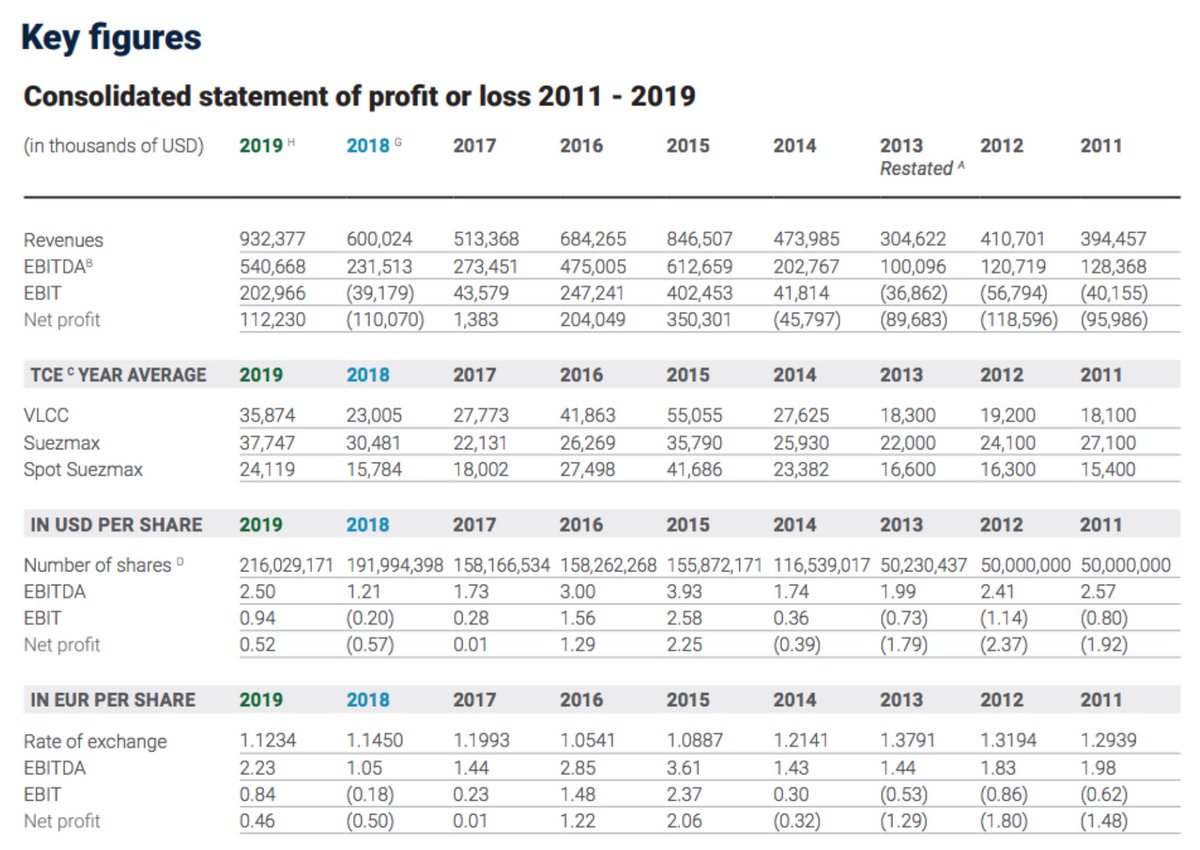

Historical averages for VLCCs ($44.5k - last 17 yrs)

2020 YTD - 105k

2019 - 36k

2018 - 23k

2017 - 27.7k

2016 - 41.9k

2015 - 55k

2014 - 27.6k

2013 - 18.3k

2012 - 19.2k

2011 - 18.1k

2010 - 35.9k

2009 - 38.3k

2008 - 74.5k

2007 - 45.7k

2006 - 56.8k

2005 - 57.4k

2004 - 78k

2020 YTD - 105k

2019 - 36k

2018 - 23k

2017 - 27.7k

2016 - 41.9k

2015 - 55k

2014 - 27.6k

2013 - 18.3k

2012 - 19.2k

2011 - 18.1k

2010 - 35.9k

2009 - 38.3k

2008 - 74.5k

2007 - 45.7k

2006 - 56.8k

2005 - 57.4k

2004 - 78k

Let& #39;s take the 17 yr average! We pay $93M for a VLCC, financed at 6.5% with a 20% down payment of $18.6M. Over its 20 year life we assume a $44.5k average with 80% utilization, and a $15M scrap value at the end (based on 20 yr average scrap price), and an $8k opex.

I selected 80% as it is around the lowest utilization rate seen in recent history.

Historic VLCC utilization rates:

2019: 86%

2018: 79%

2017: 80%

2016: 85%

2015: 91%

2014: 84%

2013: 82%

2012: 81%

2011: 81%

2010: 83%

2009: 81%

2008: 95%

2007: 91%

Average: 84.5%

Historic VLCC utilization rates:

2019: 86%

2018: 79%

2017: 80%

2016: 85%

2015: 91%

2014: 84%

2013: 82%

2012: 81%

2011: 81%

2010: 83%

2009: 81%

2008: 95%

2007: 91%

Average: 84.5%

Profit = (365*UTILIZATION RATE*DAY RATE)-FINANCE COST-(VLCC VALUE/20)-(OPEX*365)

Average 2.9M/yr in interest payments

Profit = (365*UTILIZATION*44.5)-2900-(93000/20)-(8.165*365)

80% utilization: $2.4M/yr

85% utilization: $3.275M/yr

95% utilization: $4.9M/yr

$15M scrap value

Average 2.9M/yr in interest payments

Profit = (365*UTILIZATION*44.5)-2900-(93000/20)-(8.165*365)

80% utilization: $2.4M/yr

85% utilization: $3.275M/yr

95% utilization: $4.9M/yr

$15M scrap value

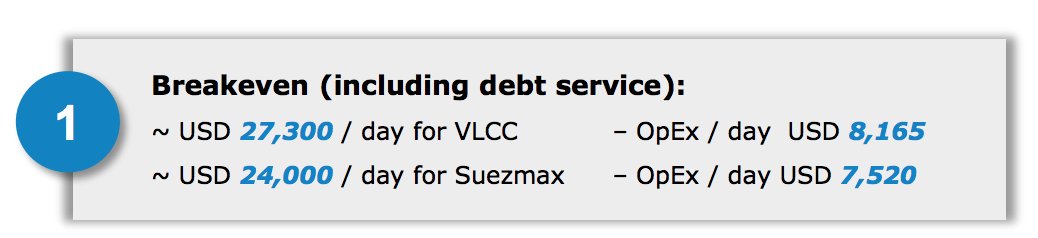

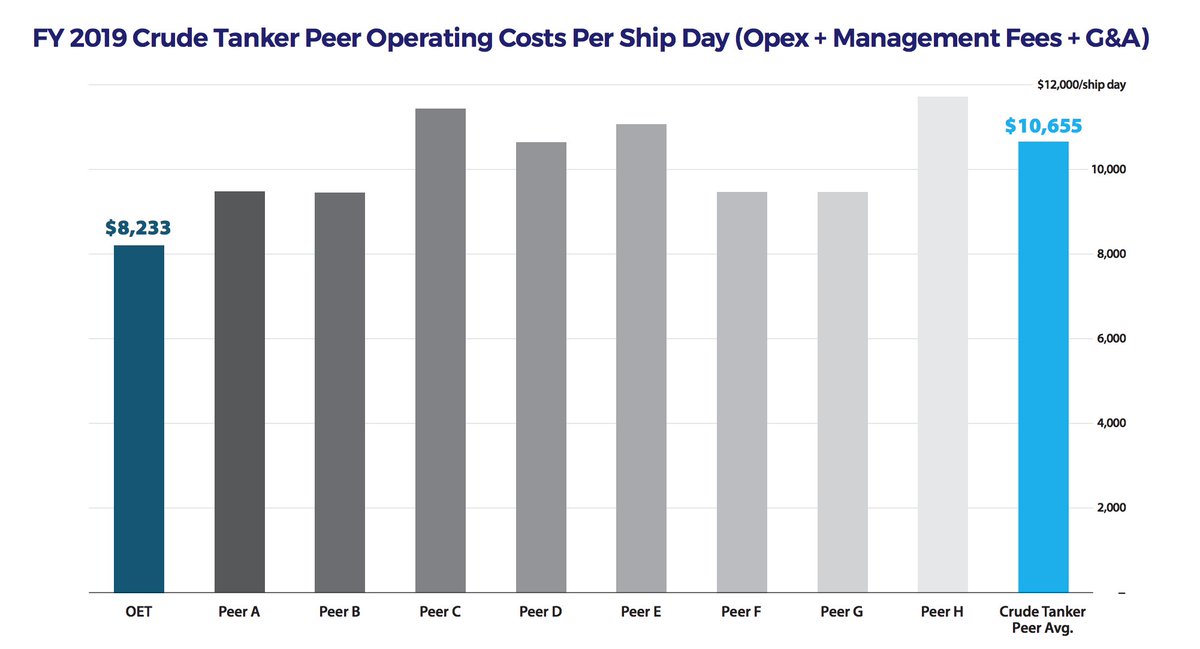

Let& #39;s double check math. We need management fees and g&a. A slide from $OET suggests this should add a few more thousand per day at most to our $8.165k opex and $7.9k finance cost...so we can assume a VLCC breakeven between around 20k. An $INSW slide also supports this idea.

At this point let& #39;s review all in breakeven for our hypothetical VLCC:

OPEX $8.165k

G&A, Management Fees $2k

Finance Cost $7.9k

Depreciation $4.65k

$22.7k daily. So we should make a profit near there.

Let& #39;s check $EURN results to confirm...2018 and 2017 give us a good guide!

OPEX $8.165k

G&A, Management Fees $2k

Finance Cost $7.9k

Depreciation $4.65k

$22.7k daily. So we should make a profit near there.

Let& #39;s check $EURN results to confirm...2018 and 2017 give us a good guide!

So how good is this investment? Well, in the average case, we risked $18.6M in capital for an annual profit of 18%, and an asset worth $15M (based on average long term steel rates) at the end of its life, vs an average market return of 14% over the past ten years.

But surely the bears aren& #39;t crazy, right? This has to be a bad investment! Tanker stocks lost money! Just look at the long term charts!

These companies are "destroyers of capital" they say! Terrible management they say! Crooks and pirates!

These companies are "destroyers of capital" they say! Terrible management they say! Crooks and pirates!

What do we see? Pre 2004-2008, good. 2014-2016, good. Most other times, bad. Let& #39;s isolate average rates for those "cycles":

2004-2009: $58k

2010-2013: $22.9k

2014-2016: $41.5k

2017-2018: $25.35k

2019-2020: $70.5k (so far)

2004-2009: $58k

2010-2013: $22.9k

2014-2016: $41.5k

2017-2018: $25.35k

2019-2020: $70.5k (so far)

Clearly, these companies were over valued in the good years, and I believe clearly, under valued in the bad years (and now).

NAV is supposed to take the DCF the vessel earns and adjust for the cycle. The thinking is owners will at least appropriately price vessels.

NAV is supposed to take the DCF the vessel earns and adjust for the cycle. The thinking is owners will at least appropriately price vessels.

Oil tankers specifically, we all know that we probably won& #39;t be using oil *forever*. At some point We won& #39;t use it anymore. The EIA estimates oil will peak in 2040, but it may not disappear entirely for much longer. Clearly even now, the world will need oil tankers for decades.

Perhaps a "rational" market would discount this. These companies have a finite usefulness, at least in their current business focus. But what company doesn& #39;t? What company has remained constant through decades and centuries? None have. So I believe we must value the cash flows.

Some companies still exist, sure. Some companies are still trading 150 years later (Mitsui, for instance), or Beretta, the Italian Gun Maker, Ford Motors. But do we really care about what happens in fifty years? So what& #39;s an 18% return on cash worth, assuming little compounding?

Now we get to DCF calculation. Let& #39;s assume some various discount rates. Now, the discount rate is supposed to be the *risk free* rate of return.

S&P 500: 11% average return since 1926. As we learned recently, $SPY is certainly not risk free.

Federal Funds Rate: 0.25%

Gold: 2.3%

S&P 500: 11% average return since 1926. As we learned recently, $SPY is certainly not risk free.

Federal Funds Rate: 0.25%

Gold: 2.3%

Against those benchmarks, a stock that generates $1 in earnings with 0 growth is worth:

S&P 500: $9.09

Federal Funds Rate: $400

Gold: $43.48

Well, interest rates are fucked and we see the problem with gold (no earnings), so let& #39;s stick with the S&P 500.

S&P 500: $9.09

Federal Funds Rate: $400

Gold: $43.48

Well, interest rates are fucked and we see the problem with gold (no earnings), so let& #39;s stick with the S&P 500.

At what rate can we expect a company like $EURN to grow? Remember, the 18% is earnings for shareholders. The company is paying for the principal on its assets and has market and operational expertise. A well capitalized and disciplined company can "play the cycle".

Let& #39;s assume a few compounding rates and establish a new fair value:

2%: $11.55

4%: $14.86

6%: $21.20

How quickly do we think $EURN can compound returns? An example of playing the cycle is recently a 20 year old vessel for more than double scrap value. https://splash247.com/euronav-confirms-suezmax-sale/">https://splash247.com/euronav-c...

2%: $11.55

4%: $14.86

6%: $21.20

How quickly do we think $EURN can compound returns? An example of playing the cycle is recently a 20 year old vessel for more than double scrap value. https://splash247.com/euronav-confirms-suezmax-sale/">https://splash247.com/euronav-c...

Forgot one thing. At the end we have an asset worth 16% of what we started with, perhaps more as the steel price increases with inflation.

The 16% return can be spread across the entire period, making 19.25%, or more, if the asset can be resold (as shown above).

The 16% return can be spread across the entire period, making 19.25%, or more, if the asset can be resold (as shown above).

Read on Twitter

Read on Twitter