. @UMAprotocol did an Initial Uniswap listing.

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

(1/19)

A thread

(1/19)

First of all - what is it? It is basically the next step after ICO -> IEO (initial exchange offering) -> IDO (initial DEX offering)

It is a primary offering of tokens to the public but now instead of using a specific sales mechanism (ICO) or a CEX (IEO) its using a DEX.

(2/19)

It is a primary offering of tokens to the public but now instead of using a specific sales mechanism (ICO) or a CEX (IEO) its using a DEX.

(2/19)

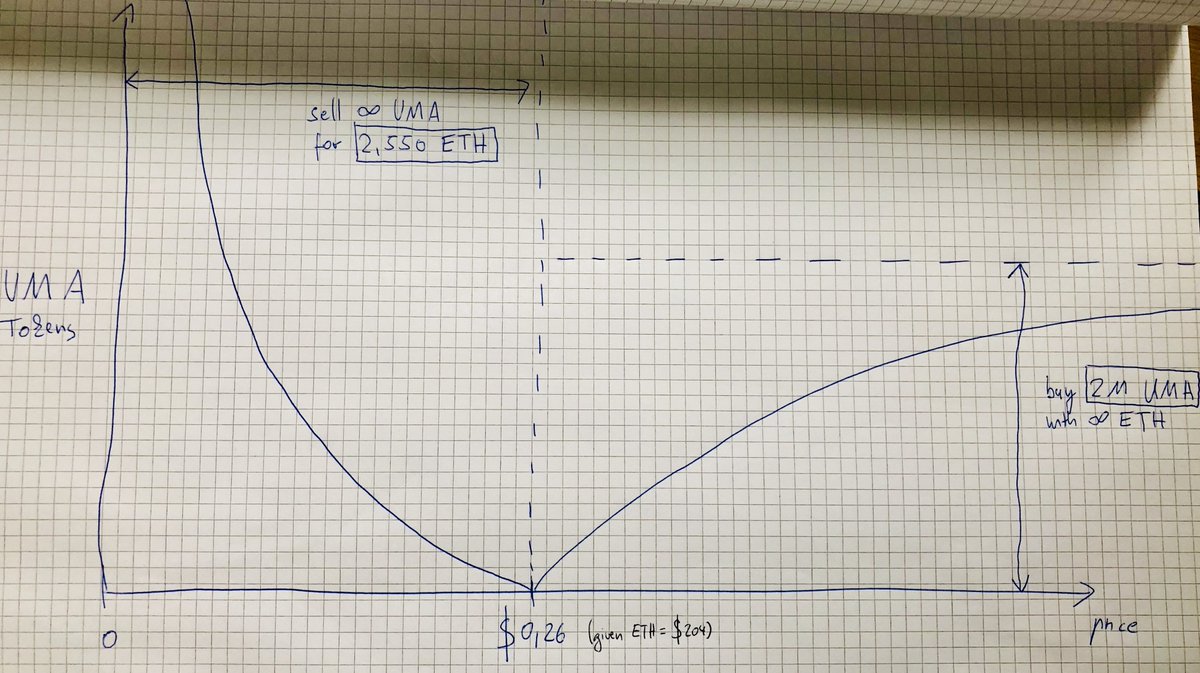

UMA decided to use @UniswapProtocol as the DEX to facilitate this sale. 2% of the total supply have been put into Uniswap for sale with a start price of $0.26 per token. (the same price as investors apparently could buy $UMA tokens)

(3/19)

(3/19)

Now, it is first important to understand how Uniswap works, and that if the start price is $0.26 the number of tokens you can buy at this price is literally 0. You need to move the price up to buy tokens. (4/19)

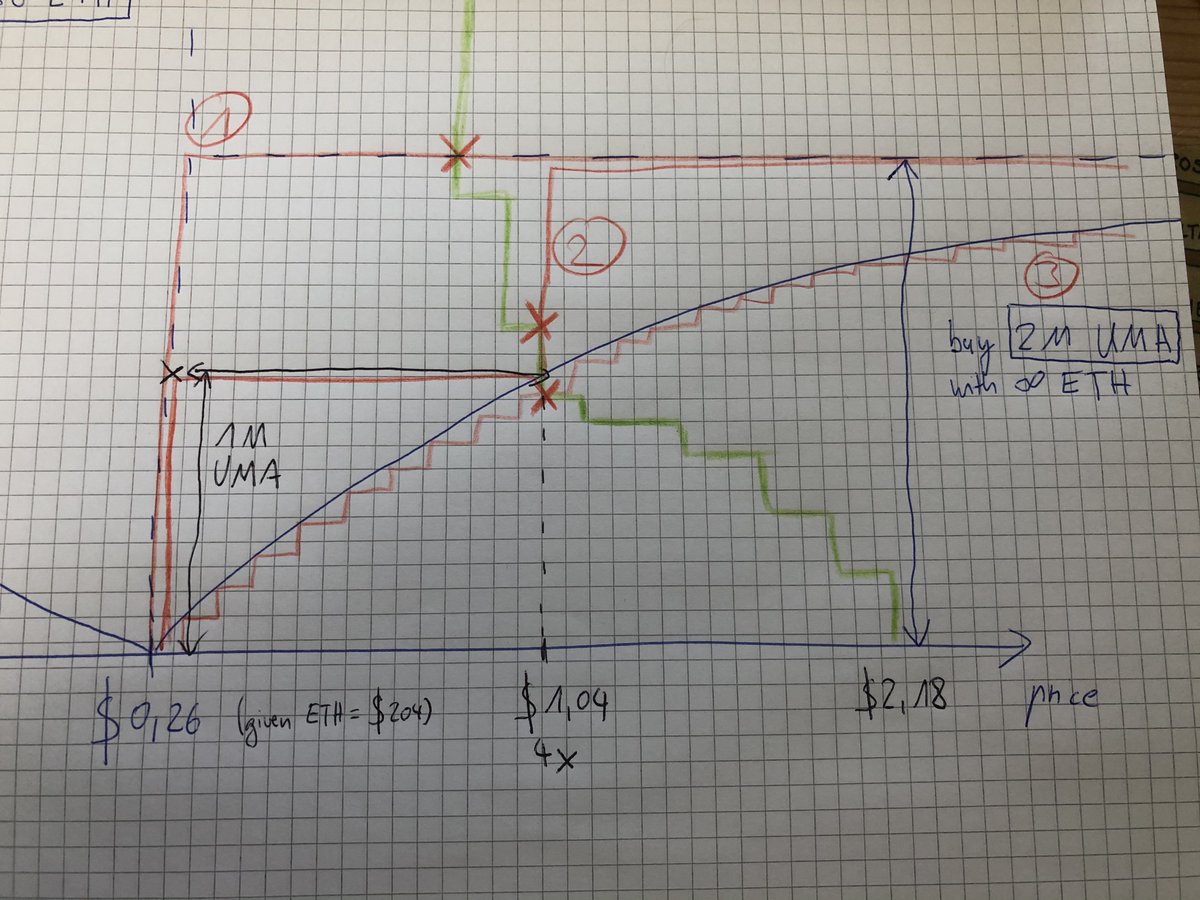

If you would plot the Uniswap automated maker maker (x*y=k) as a supply and demand function (similar to this view from the Kraken €/BTC order book) you would see that you can buy 2M UMA tokens in total but you would need to pay infinite ETH for it. (5/19)

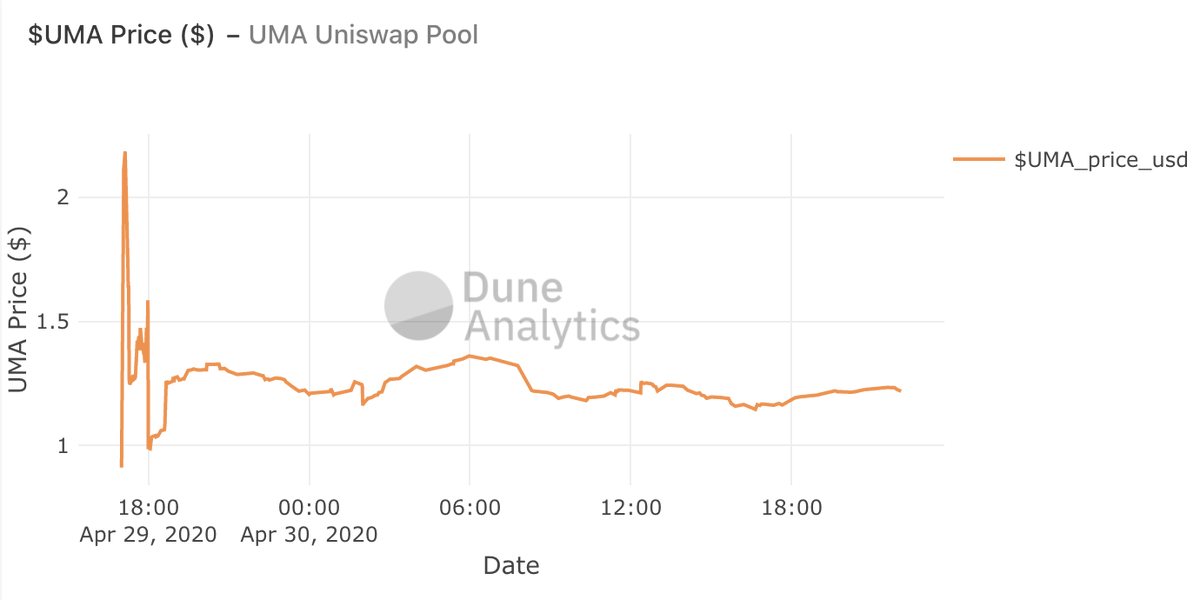

So what happened? After 3 days the price has roughly stabilized at around 4x the initial price.

https://explore.duneanalytics.com/public/dashboards/YCmHZqHfTkO0B1N1C0YZnLSOLtIHBtZfyuXji8iG">https://explore.duneanalytics.com/public/da... (6/19)

https://explore.duneanalytics.com/public/dashboards/YCmHZqHfTkO0B1N1C0YZnLSOLtIHBtZfyuXji8iG">https://explore.duneanalytics.com/public/da... (6/19)

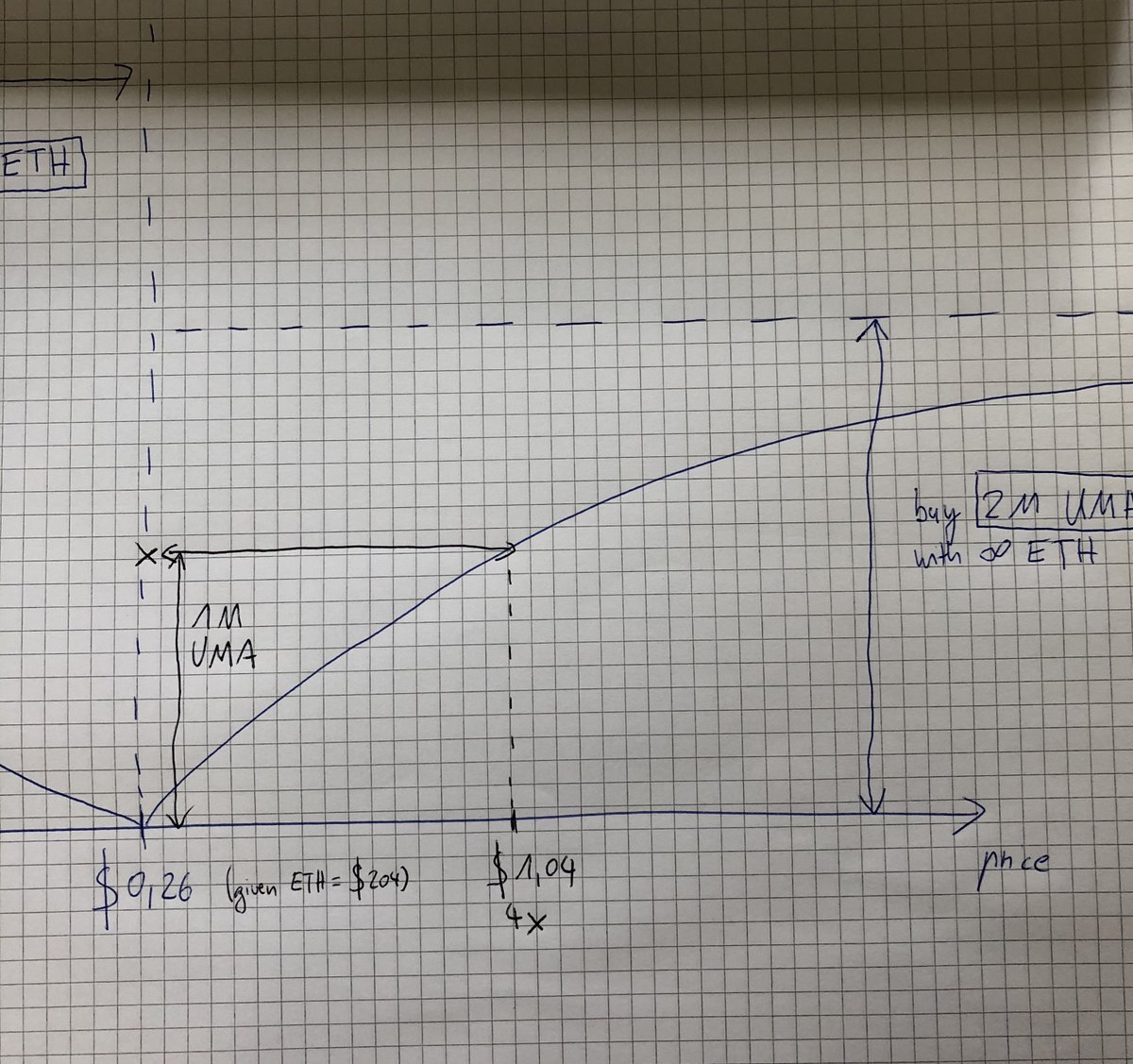

A 4x increase means on Uniswap that half of the tokens for sale (2M) have been sold. The new state is ~5100 ETH and 1M UMA tokens held in Uniswap. So in aggregate UMA sold 1M UMA for (5100-2550)= 2,550ETH. (for this calc I assume ETH = $204) So: 1M UMA for $520,200. (7/19)

This means the average price per sold $UMA was $0.5202 although the current equilibrium price is $1.04. This shows some inefficiencies of this approach and explains why 100+ GWEI transactions have been sent to buy tokens at the initial start price. (8/19)

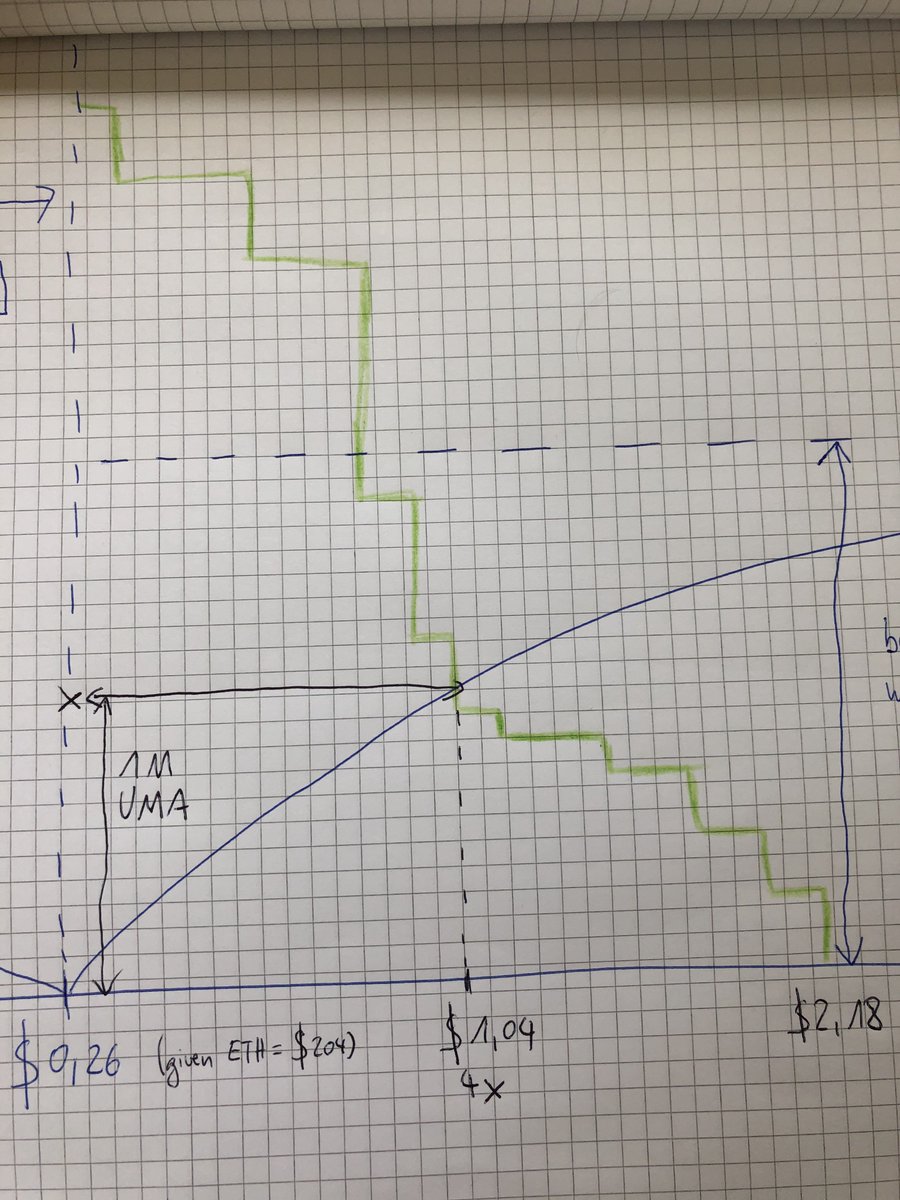

Now, we can only guess how the exact demand curve for $UMA tokens from the open market looks like but we have some indications from e.g. the peak price on Uniswap at $2.18. So this is one example:

(9/19)

(9/19)

Now - who won and who lost in this game?

Winner: everyone who could buy below the current price; Miners: since they can effectively decide who can do the first trades, the long term expectation of those games is that most value would go to miners (check @phildaian MEV) (10/19)

Winner: everyone who could buy below the current price; Miners: since they can effectively decide who can do the first trades, the long term expectation of those games is that most value would go to miners (check @phildaian MEV) (10/19)

Who lost? To some extend a) UMA for selling tokens at less than they could (although selling tokens at a discount to the most enthusiastic users can also be a wise move) but b) those users that bought at e.g. >$2.

(11/19)

(11/19)

Overall in a short period of time (a few hours) users payed prices in almost a range of >8x ($0.26 - $2,18). So the question is - can we do better?

Yes we can! Let me shill you Gnosis Protocol.

https://www.theblockcrypto.com/post/61622/consensys-spin-off-gnosis-launches-decentralized-exchange-with-focus-on-best-price-execution

(12/19)">https://www.theblockcrypto.com/post/6162...

Yes we can! Let me shill you Gnosis Protocol.

https://www.theblockcrypto.com/post/61622/consensys-spin-off-gnosis-launches-decentralized-exchange-with-focus-on-best-price-execution

(12/19)">https://www.theblockcrypto.com/post/6162...

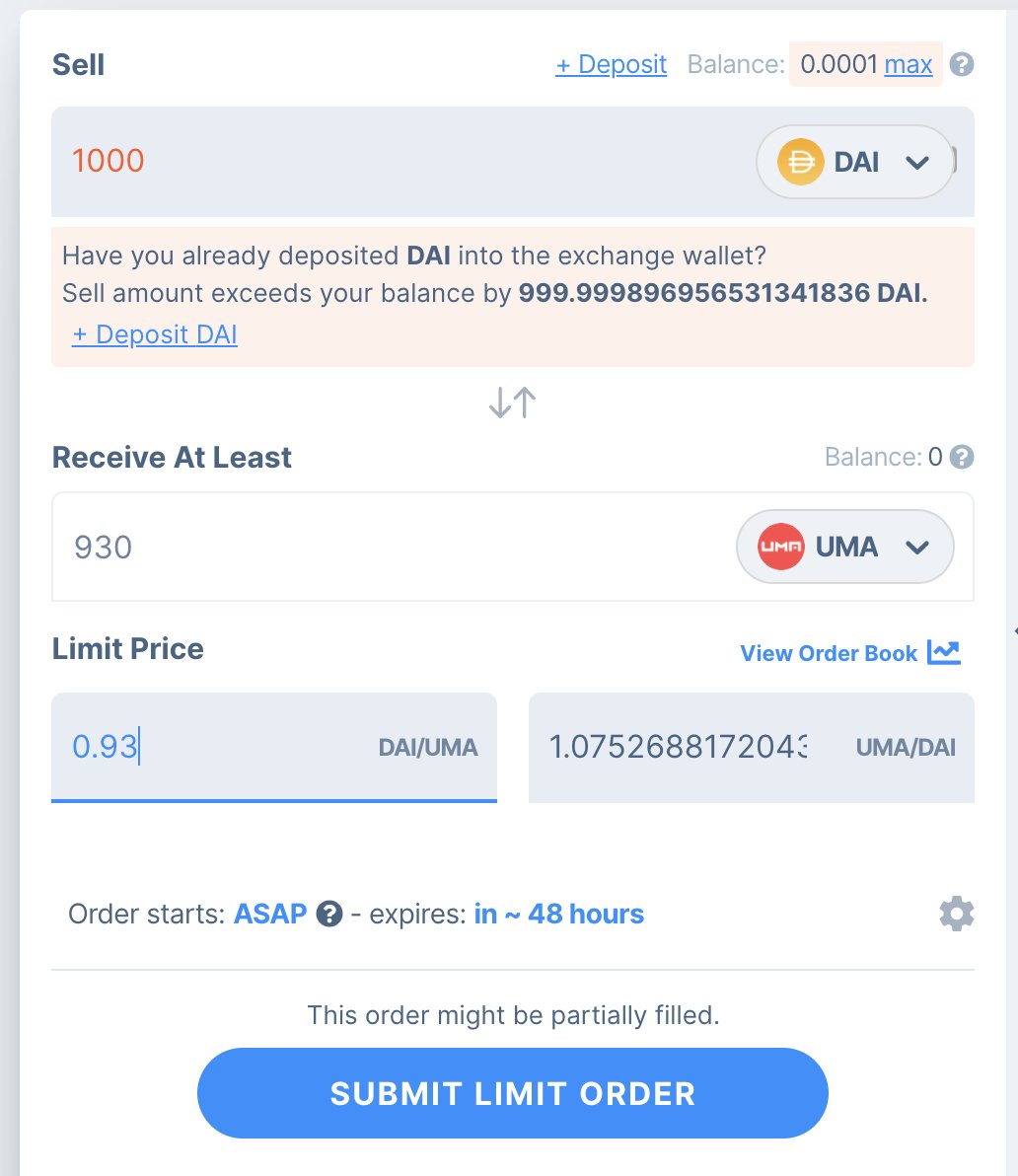

In Gnosis Protocol trades are cleared in batches with single price clearing. Roughly that means all orders (buy and sell) are collected over a period of time and then all trades are executed at ONE CLEARING PRICE.

(13/19)

(13/19)

So roughly how this could have worked: UMA team could have prepared public sell orders that are valid at a specific time in the future (e.g. in 2 weeks). During this time anyone (without any race conditions) could have placed a buy order and at the time...

(14/19)

(14/19)

Here are 3 different suggestions to sell: 1) simply sell 2M at $0.26 - result could have been e.g. a sell of all 2M at $0.91.

2) sell 1M at $0.26 and 1M at $1.04 or 3) to copy the Uniswap curve you can approximate it with many small orders.

(16/19)

2) sell 1M at $0.26 and 1M at $1.04 or 3) to copy the Uniswap curve you can approximate it with many small orders.

(16/19)

In cases 2 and 3 the clearing price would likely have been around the current Uniswap price.

Advantages for UMA - higher average sales price, Advantages for user: no wired front-running games, no risk to pay double than everyone else.

(17/19)

Advantages for UMA - higher average sales price, Advantages for user: no wired front-running games, no risk to pay double than everyone else.

(17/19)

Potentially the team could have sold even much more than just 2% of the tokens because in this approach they would not have been limited by the amount of ETH they need to supply to Uniswap to list the token (even with just 2% and a low starting price it was 2,550 ETH)

(18/19)

(18/19)

So in conclusion: Congrats to @hal2001, @allilulllc and @UMAprotocol to pioneer a new mechanism. DEXs could soon regularly facilitate initial offerings of tokens. Potentially mechanisms with single clearing price can make this process fairer for the average user.

(19/19)

(19/19)

Read on Twitter

Read on Twitter