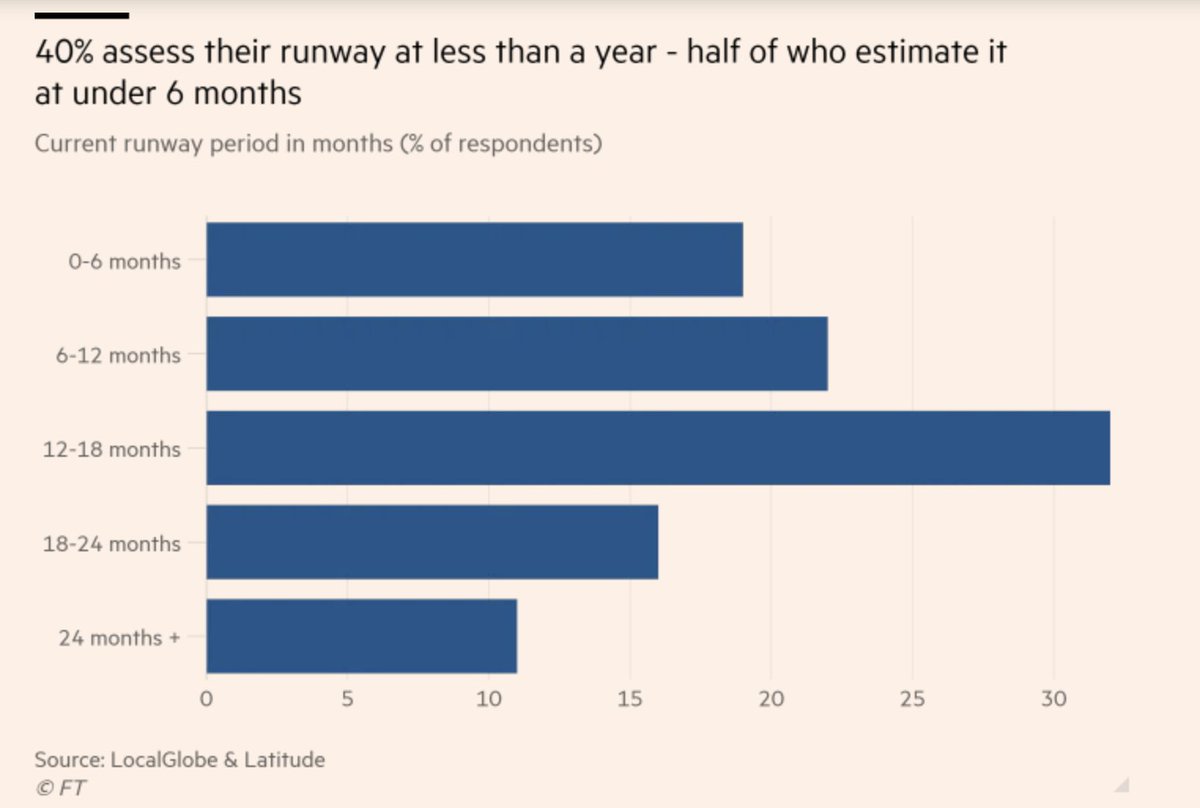

Two out of five UK startups have less than 12 months cash left according to an @localglobe survey... which is worrying for those founders but then I realised that 1/n

.. many large established, storied firms have less than 12 months of cash left at current demand levels.

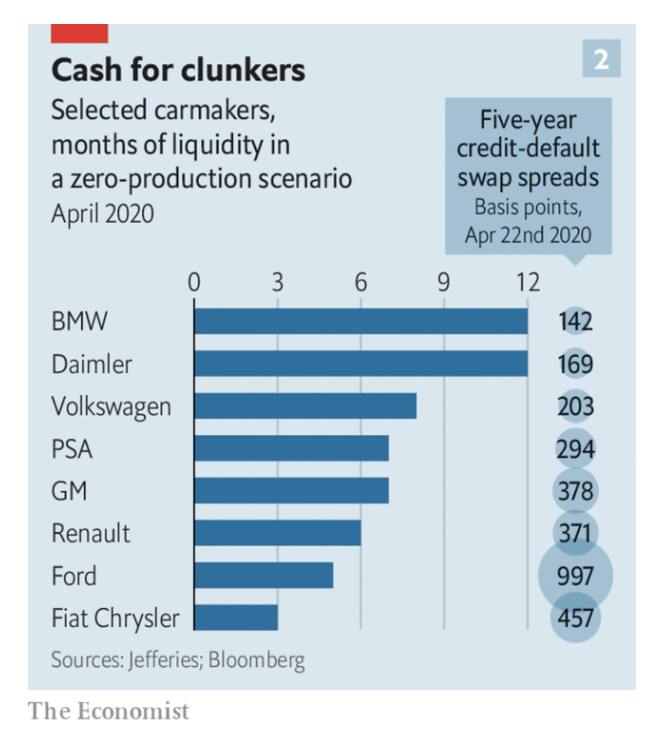

See the car industry where six of the eight largest have less than 9 months cash 2/n

See the car industry where six of the eight largest have less than 9 months cash 2/n

many other industries (like airlines, hotels) are in similar situations, and small business in a far worse pickle 3/n

One difference for startups is that they should remain relevant for the future construction of the economy, whatever comes next. (See: https://www.exponentialview.co/p/-for-startups-relevance-matters">https://www.exponentialview.co/p/-for-st... ) 4/n

Whereas car firms have to contend with managing an old/bad business model (dealerships, ICE platforms, leasing businesses) and a new/good business model (EVs, sharing models, automation, direct-to-consumer. 5/n

It is also a stark reminder that incumbency and heritage and billions don& #39;t confer an advantage in longevity -- especially if your fixed costs are too high and the ratio of relevance to residual in your business model is skewif. 6/n

If you are a car company looking for investor support today and a bunch of the capital you need is for your OLD ICE business model strikes me as an unappealing offer compared to supporting a younger startup. 7/n

Links:

FT Survey on Startups: https://www.ft.com/content/979031de-970d-48e9-bb53-5b21e43a4a92

Economist">https://www.ft.com/content/9... on car companies: https://www.economist.com/briefing/2020/04/23/the-worlds-car-giants-need-to-move-fast-and-break-things

8/n">https://www.economist.com/briefing/...

FT Survey on Startups: https://www.ft.com/content/979031de-970d-48e9-bb53-5b21e43a4a92

Economist">https://www.ft.com/content/9... on car companies: https://www.economist.com/briefing/2020/04/23/the-worlds-car-giants-need-to-move-fast-and-break-things

8/n">https://www.economist.com/briefing/...

Have a nice someday!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😄" title="Smiling face with open mouth and smiling eyes" aria-label="Emoji: Smiling face with open mouth and smiling eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😄" title="Smiling face with open mouth and smiling eyes" aria-label="Emoji: Smiling face with open mouth and smiling eyes">

Read on Twitter

Read on Twitter