Book Value & PBR Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value is the value of company& #39;s net assets after reducing all the liabilities

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value is the value of company& #39;s net assets after reducing all the liabilities

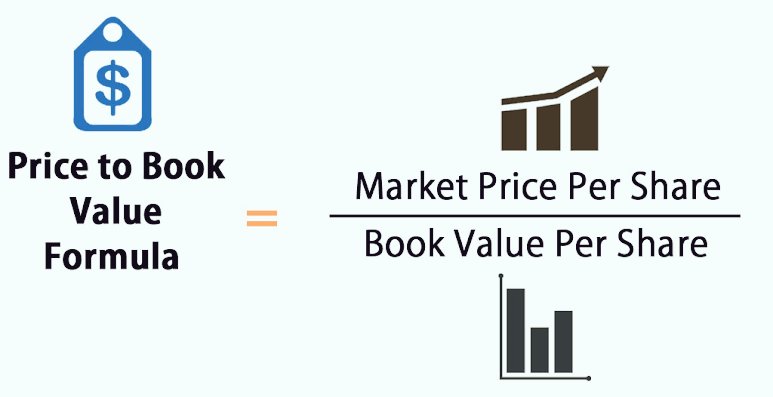

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">(PBR)Price to book value is a ratio between company& #39;s share price & its book value

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">(PBR)Price to book value is a ratio between company& #39;s share price & its book value

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR is part of every fundamental analyst& #39;s checklist

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR is part of every fundamental analyst& #39;s checklist https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">

1/n

#StockMarket

1/n

#StockMarket

BV & PBR Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

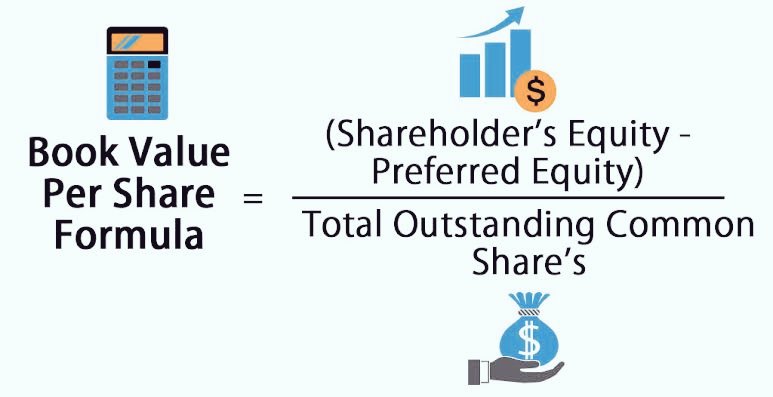

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">BV is calculated as

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">BV is calculated as

Total assets - Total liabilities / number of outstanding shares

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value can be higher or lower than market value of the company depending its financial position

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value can be higher or lower than market value of the company depending its financial position

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Market value is the value of share price of the company

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Market value is the value of share price of the company

2/n

Total assets - Total liabilities / number of outstanding shares

2/n

BV & PBR Simplified  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR compares company& #39;s market value to its book value

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR compares company& #39;s market value to its book value

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR varies from sector to sector

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR varies from sector to sector

(i.e - A good PBR for one industry might be poor for another)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 considerd as value opportunity by long term investors

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 considerd as value opportunity by long term investors

3/n

#StockMarket #Fundamentals

(i.e - A good PBR for one industry might be poor for another)

3/n

#StockMarket #Fundamentals

BV & PBR Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 doesn& #39;t mean undervalued always

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 doesn& #39;t mean undervalued always

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Lower PBR also reflects the company& #39;s inability to grow better than market expectations

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Lower PBR also reflects the company& #39;s inability to grow better than market expectations

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">High growth companies or sector leaders generally have high PBR as investors pay high premium to these companies

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">High growth companies or sector leaders generally have high PBR as investors pay high premium to these companies

4/n

4/n

BV & PBR Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

#investing check points https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buy

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buy https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">High PBR-High ROE as investors willing to pay higher

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">High PBR-High ROE as investors willing to pay higher

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buy

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buy https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Low PBR-High ROE as investors ignoring it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Low PBR-High ROE as investors ignoring it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Avoid/Research more incase

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Avoid/Research more incase

Low PBR-Low ROE as it could be a value trap

End of Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">

Thanks & RT if u have Learned https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

#investing check points

Low PBR-Low ROE as it could be a value trap

End of Thread

Thanks & RT if u have Learned

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value is the value of company& #39;s net assets after reducing all the liabilitieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">(PBR)Price to book value is a ratio between company& #39;s share price & its book valuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR is part of every fundamental analyst& #39;s checklisthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">1/n #StockMarket" title="Book Value & PBR Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value is the value of company& #39;s net assets after reducing all the liabilitieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">(PBR)Price to book value is a ratio between company& #39;s share price & its book valuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR is part of every fundamental analyst& #39;s checklisthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">1/n #StockMarket" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value is the value of company& #39;s net assets after reducing all the liabilitieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">(PBR)Price to book value is a ratio between company& #39;s share price & its book valuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR is part of every fundamental analyst& #39;s checklisthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">1/n #StockMarket" title="Book Value & PBR Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value is the value of company& #39;s net assets after reducing all the liabilitieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">(PBR)Price to book value is a ratio between company& #39;s share price & its book valuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR is part of every fundamental analyst& #39;s checklisthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">1/n #StockMarket" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">BV is calculated asTotal assets - Total liabilities / number of outstanding shareshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value can be higher or lower than market value of the company depending its financial positionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Market value is the value of share price of the company2/n" title="BV & PBR Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">BV is calculated asTotal assets - Total liabilities / number of outstanding shareshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value can be higher or lower than market value of the company depending its financial positionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Market value is the value of share price of the company2/n" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">BV is calculated asTotal assets - Total liabilities / number of outstanding shareshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value can be higher or lower than market value of the company depending its financial positionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Market value is the value of share price of the company2/n" title="BV & PBR Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">BV is calculated asTotal assets - Total liabilities / number of outstanding shareshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Book value can be higher or lower than market value of the company depending its financial positionhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Market value is the value of share price of the company2/n" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR compares company& #39;s market value to its book valuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR varies from sector to sector(i.e - A good PBR for one industry might be poor for another)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 considerd as value opportunity by long term investors3/n #StockMarket #Fundamentals" title="BV & PBR Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR compares company& #39;s market value to its book valuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR varies from sector to sector(i.e - A good PBR for one industry might be poor for another)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 considerd as value opportunity by long term investors3/n #StockMarket #Fundamentals" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR compares company& #39;s market value to its book valuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR varies from sector to sector(i.e - A good PBR for one industry might be poor for another)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 considerd as value opportunity by long term investors3/n #StockMarket #Fundamentals" title="BV & PBR Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR compares company& #39;s market value to its book valuehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR varies from sector to sector(i.e - A good PBR for one industry might be poor for another)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 considerd as value opportunity by long term investors3/n #StockMarket #Fundamentals" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 doesn& #39;t mean undervalued alwayshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Lower PBR also reflects the company& #39;s inability to grow better than market expectationshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">High growth companies or sector leaders generally have high PBR as investors pay high premium to these companies 4/n" title="BV & PBR Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 doesn& #39;t mean undervalued alwayshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Lower PBR also reflects the company& #39;s inability to grow better than market expectationshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">High growth companies or sector leaders generally have high PBR as investors pay high premium to these companies 4/n" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 doesn& #39;t mean undervalued alwayshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Lower PBR also reflects the company& #39;s inability to grow better than market expectationshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">High growth companies or sector leaders generally have high PBR as investors pay high premium to these companies 4/n" title="BV & PBR Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">PBR below 1 doesn& #39;t mean undervalued alwayshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Lower PBR also reflects the company& #39;s inability to grow better than market expectationshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">High growth companies or sector leaders generally have high PBR as investors pay high premium to these companies 4/n" class="img-responsive" style="max-width:100%;"/>

#investing check pointshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">High PBR-High ROE as investors willing to pay higherhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Low PBR-High ROE as investors ignoring ithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Avoid/Research more incaseLow PBR-Low ROE as it could be a value trapEnd of Threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">Thanks & RT if u have Learnedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" title="BV & PBR Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger"> #investing check pointshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">High PBR-High ROE as investors willing to pay higherhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Low PBR-High ROE as investors ignoring ithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Avoid/Research more incaseLow PBR-Low ROE as it could be a value trapEnd of Threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">Thanks & RT if u have Learnedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" class="img-responsive" style="max-width:100%;"/>

#investing check pointshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">High PBR-High ROE as investors willing to pay higherhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Low PBR-High ROE as investors ignoring ithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Avoid/Research more incaseLow PBR-Low ROE as it could be a value trapEnd of Threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">Thanks & RT if u have Learnedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" title="BV & PBR Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger"> #investing check pointshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">High PBR-High ROE as investors willing to pay higherhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Buyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Low PBR-High ROE as investors ignoring ithttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Avoid/Research more incaseLow PBR-Low ROE as it could be a value trapEnd of Threadhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">Thanks & RT if u have Learnedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" class="img-responsive" style="max-width:100%;"/>