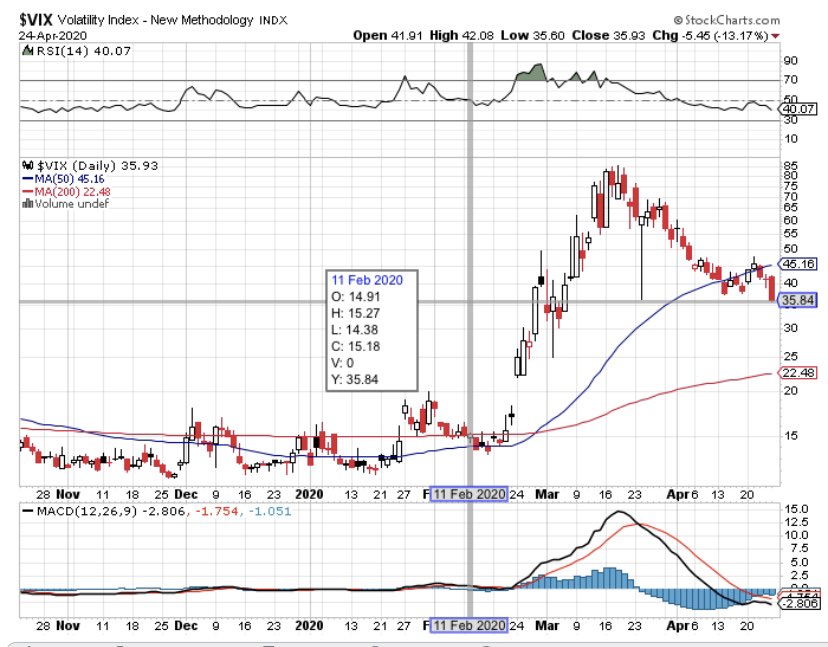

Two observations about the VIX and its possible implications for the historic rally:

A) In the past two days the rate of change in the $VIX relative to the S&P has increased dramatically, last Friday the VIX closed down -13.5% while the S&P was up less than 2%, this means traders

A) In the past two days the rate of change in the $VIX relative to the S&P has increased dramatically, last Friday the VIX closed down -13.5% while the S&P was up less than 2%, this means traders

started to worry less about the down side as they come to grasp with the fact that we will not see a retest of the lows as the FOMO crowd and the largest market Put in history(the FED) are both in play.

On a personal note, this rally makes no sense whatsoever and has zero correlation to the economy and the state of affairs. However, in many instances the VIX rate of change has proven to be a leading indicator to the stock market.

This is bullish for stocks and such a divergence usually leads to further gains.

B) I am currently looking to see the VIX close under 35 for two consecutive days to confirm this move, I will have higher conviction if I see the VIX do that on negative or flat S&P days.

B) I am currently looking to see the VIX close under 35 for two consecutive days to confirm this move, I will have higher conviction if I see the VIX do that on negative or flat S&P days.

Read on Twitter

Read on Twitter