For anyone else wondering: "what is going on with the stock market?" I pulled some data and did some rudimentary analysis.

The last time the S&P 500 hit the current price was around February, 2019. What& #39;s going on? Is our outlook no worse than a year ago?

The last time the S&P 500 hit the current price was around February, 2019. What& #39;s going on? Is our outlook no worse than a year ago?

To answer that question, let& #39;s dig deeper. I grabbed a CSV with the individual tickers for each company in the S&P500. I then pulled each individual price from 2019-02-22 and compared it to the price of the stock today.

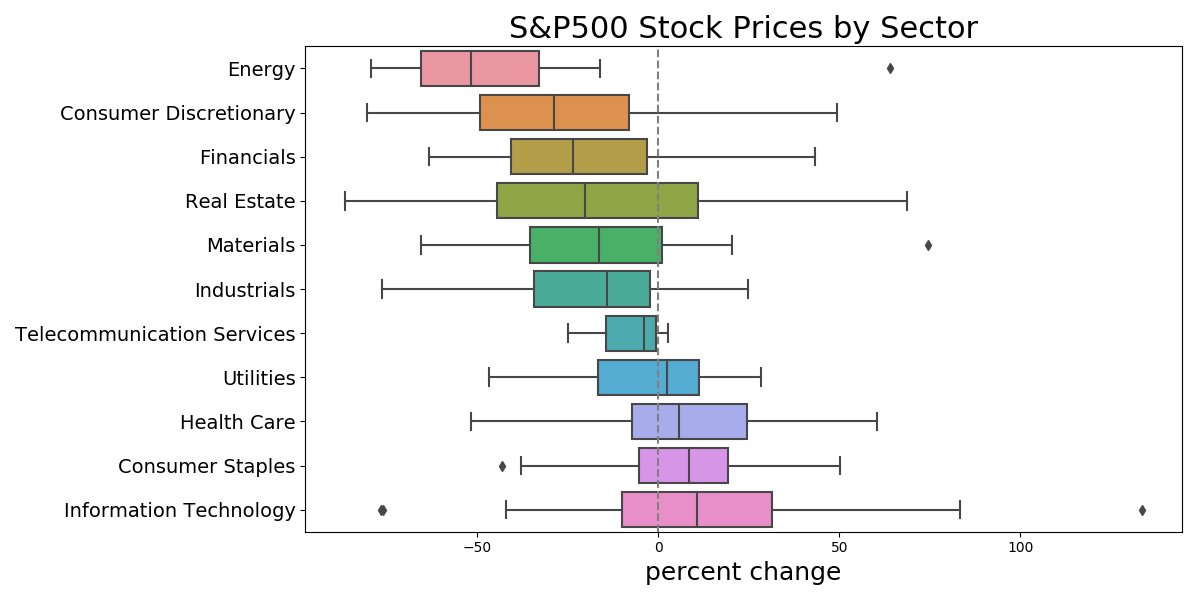

Most sectors are down...

- energy -50%

- consumer discretionary -27%

- financials -22%.

But a few are up...

- health care +5%

- consumer staples +6.5%

- information technology +8.5%

- energy -50%

- consumer discretionary -27%

- financials -22%.

But a few are up...

- health care +5%

- consumer staples +6.5%

- information technology +8.5%

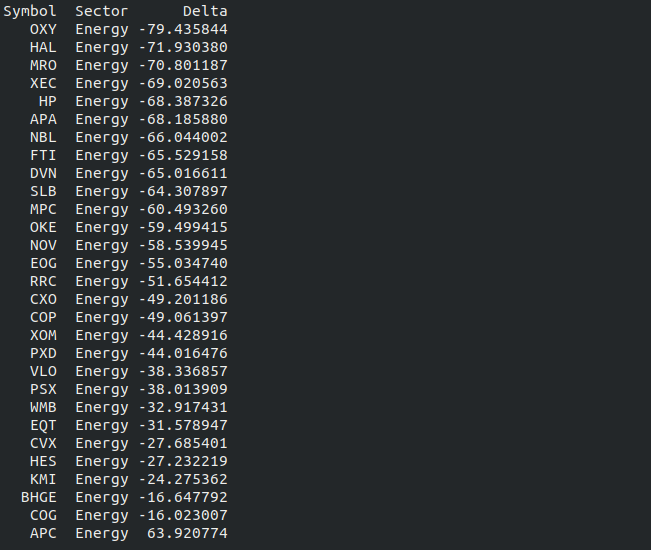

Let& #39;s take a closer look at energy. Literally every firm aside from $APC is down more than 15% since February 2019.

With shelter-in-place and quarantine restrictions, it makes sense that the world& #39;s demand for oil and travel is at an all-time low.

So, where is that money going?

So, where is that money going?

In short: moving online.

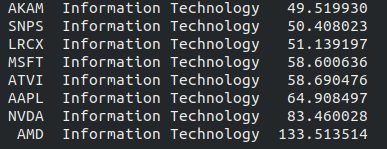

Companies in the Information Technology sector are continuing to surge, and yet they are surging asymmetrically. AMD, NVDIA, Apple, Microsoft, and Activision are up more than 50%.

Companies in the Information Technology sector are continuing to surge, and yet they are surging asymmetrically. AMD, NVDIA, Apple, Microsoft, and Activision are up more than 50%.

Other tech stocks ($ADS, $DXC, $HPE) are not so lucky. They have fallen sharply, due more to disruption than macro forces.

Of the large cap companies in this sector, 75% have grown in the last year.

Of the large cap companies in this sector, 75% have grown in the last year.

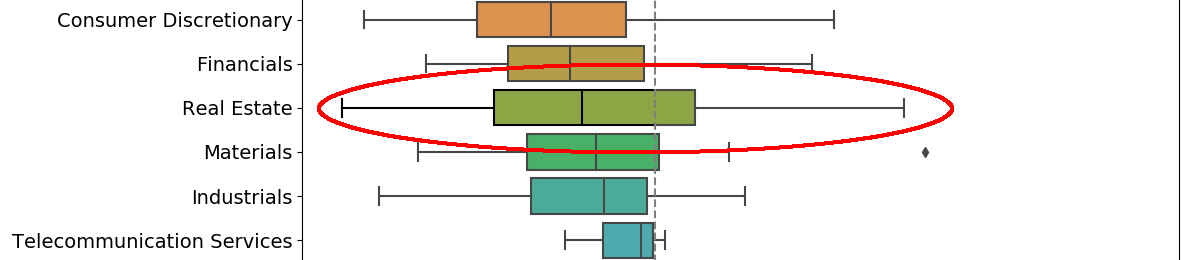

What about real estate? The sector is down (as we might expect, fewer moves happening, less commercial leasing), but the variance is very wide. What& #39;s bringing it up?

Unlike the energy companies, there are a few real estate companies doing incredibly well...

- $SBAC +68%

- $EQIX +60%

- $AMT +38%

- $CCI +34%

- $SBAC +68%

- $EQIX +60%

- $AMT +38%

- $CCI +34%

If you are like me, you have never heard of these companies

- $SBAC "operates wireless infrastructure"

- $EQIX "specializes in datacenters"

- $AMT "operator of wireless and broadcast communications infrastructure"

- $CCI "provider of shared communications infrastructure"

Well.

- $SBAC "operates wireless infrastructure"

- $EQIX "specializes in datacenters"

- $AMT "operator of wireless and broadcast communications infrastructure"

- $CCI "provider of shared communications infrastructure"

Well.

To sum up my understanding...

- many sectors of the economy *are* down, as are most companies.

- the current pandemic has pushed more $ to business which operate online

- the market cap of the S&P500 hasn& #39;t changed dramatically, but the distribution of that money has

- many sectors of the economy *are* down, as are most companies.

- the current pandemic has pushed more $ to business which operate online

- the market cap of the S&P500 hasn& #39;t changed dramatically, but the distribution of that money has

TL;DR: investors will continue to look for places to put their money. Index prices may not have changed drastically, but the individual stock prices have. These heavily favor companies with an online business model.

Read on Twitter

Read on Twitter