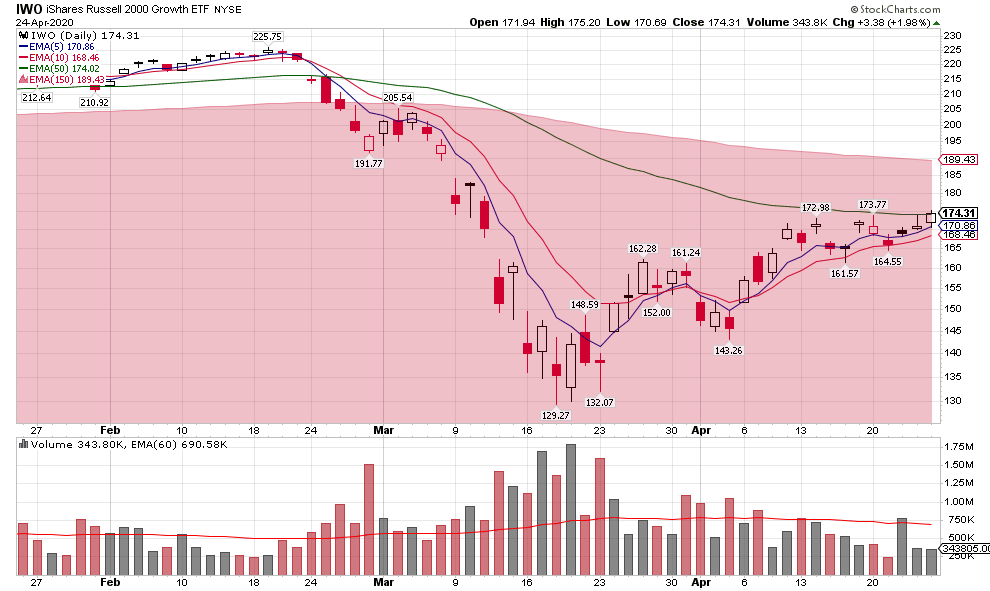

1) $IWO is trending up with a new high back to March 11th, 5ema>10ema (it stopped right at the 50ema on Friday).

I& #39;m holding 10 positions in growth account & will remain that way until I see red flags with price action.

$TTD

$LVGO

$AYX

$OKTA

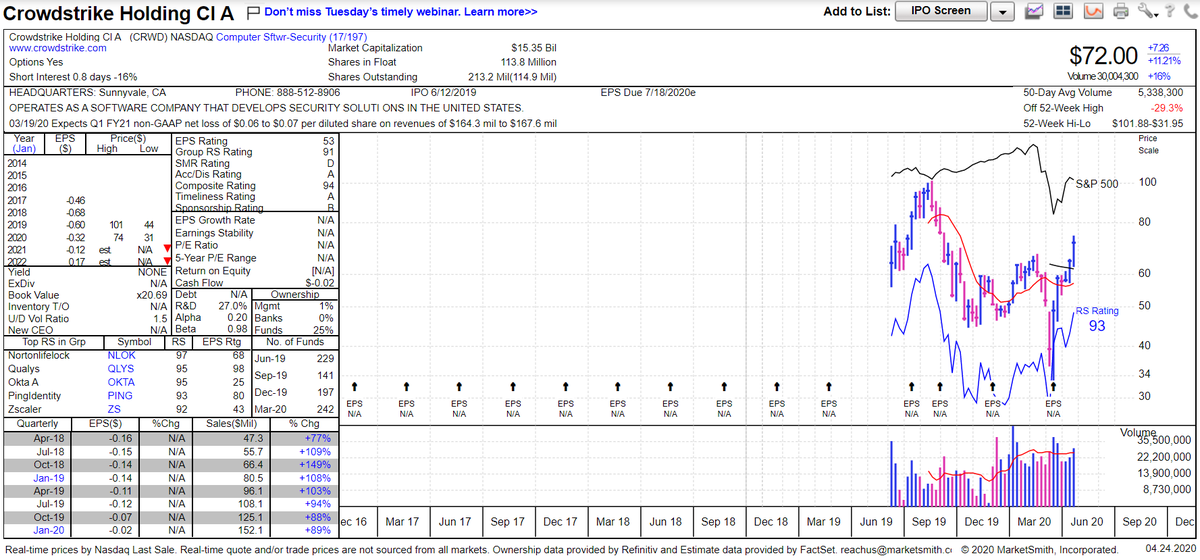

$CRWD

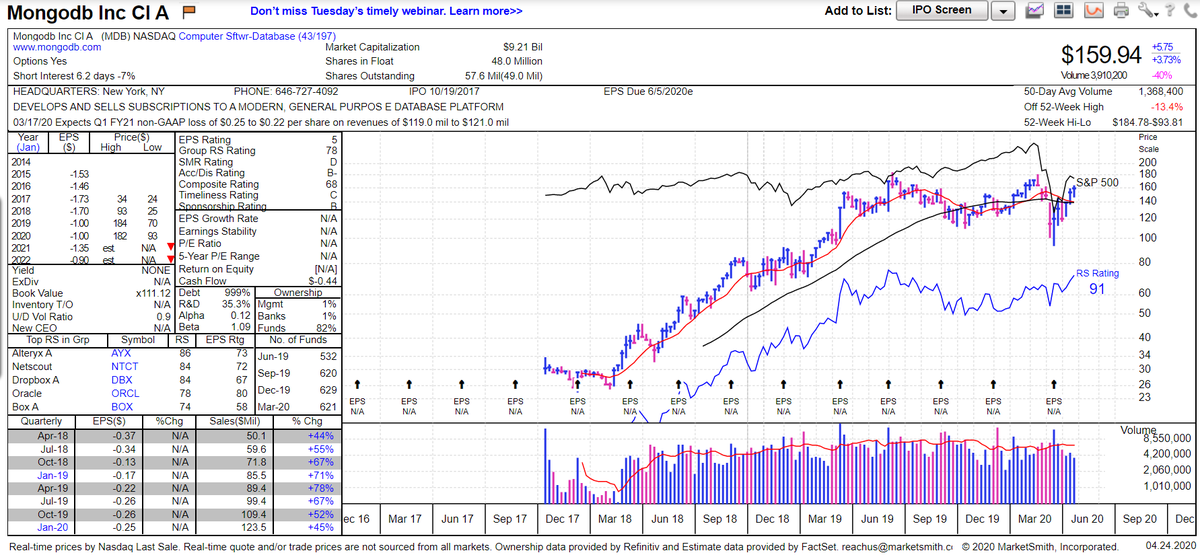

$MDB

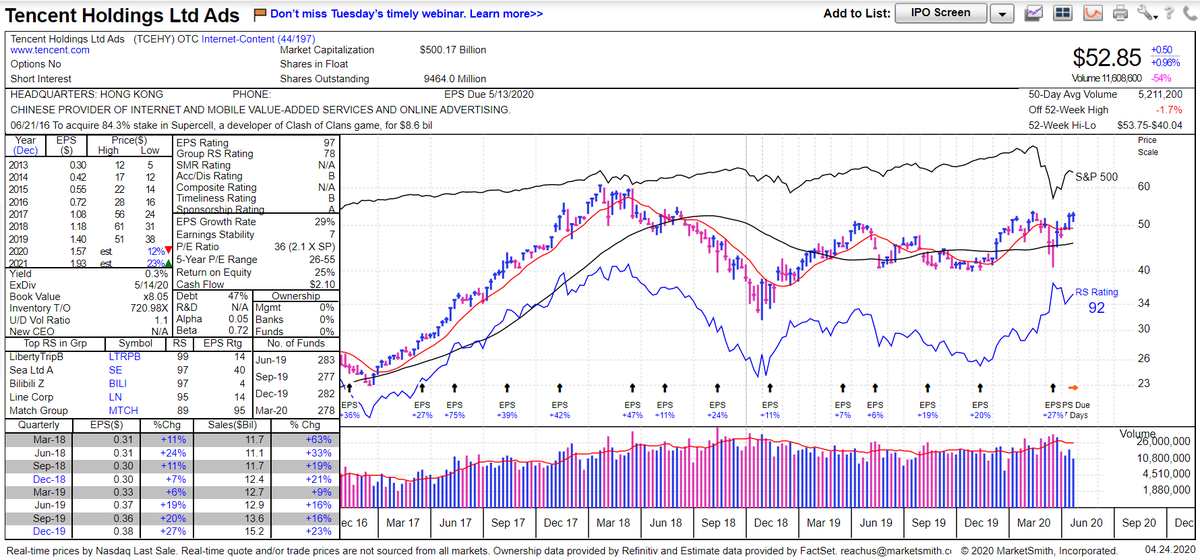

$TCEHY

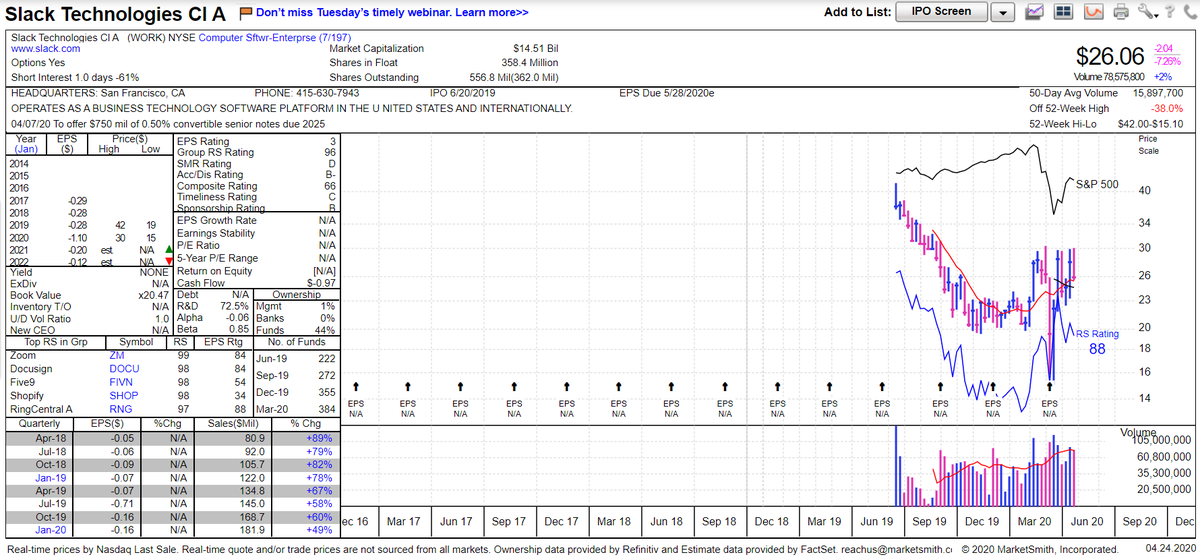

$WORK

$ROKU

$SQ

I& #39;m holding 10 positions in growth account & will remain that way until I see red flags with price action.

$TTD

$LVGO

$AYX

$OKTA

$CRWD

$MDB

$TCEHY

$WORK

$ROKU

$SQ

2) $TTD - $256.63, up 49.68% since purchase on 3/17/20 at $171.45. I had my eye on this one for a while but didn& #39;t own so I took the opportunity to grab in the March slide.

Chart via @MarketSmith

Chart via @MarketSmith

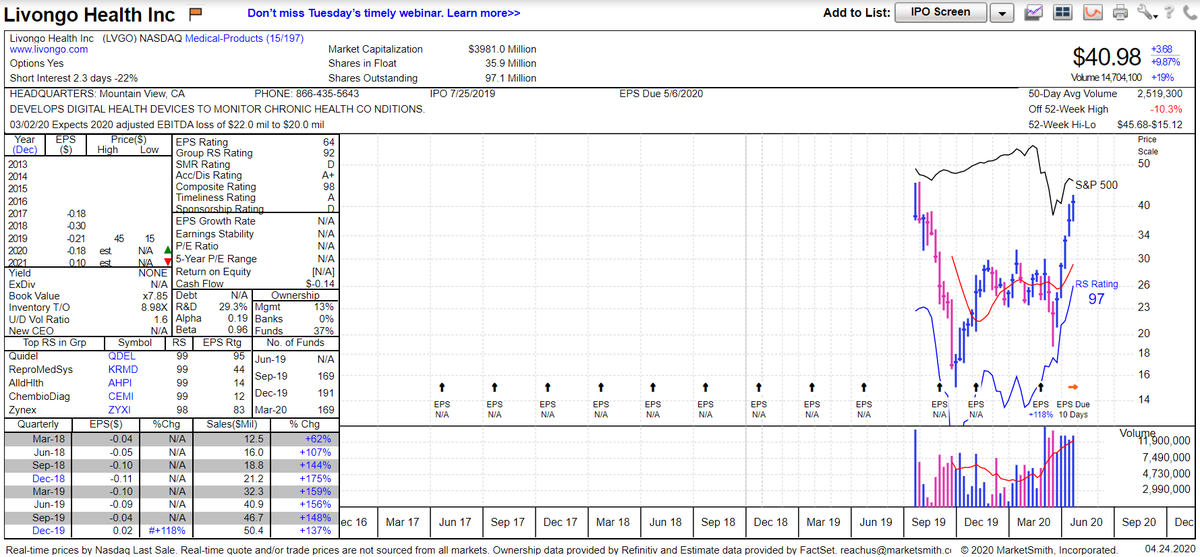

3) $LVGO - $40.98, up 44.65% since purchase on 1/22/20 at $28.33. Was a stock to watch coming into the year so I grabbed back in January. I didn& #39;t get the low but happy with my position right now.

Chart via @MarketSmith

Chart via @MarketSmith

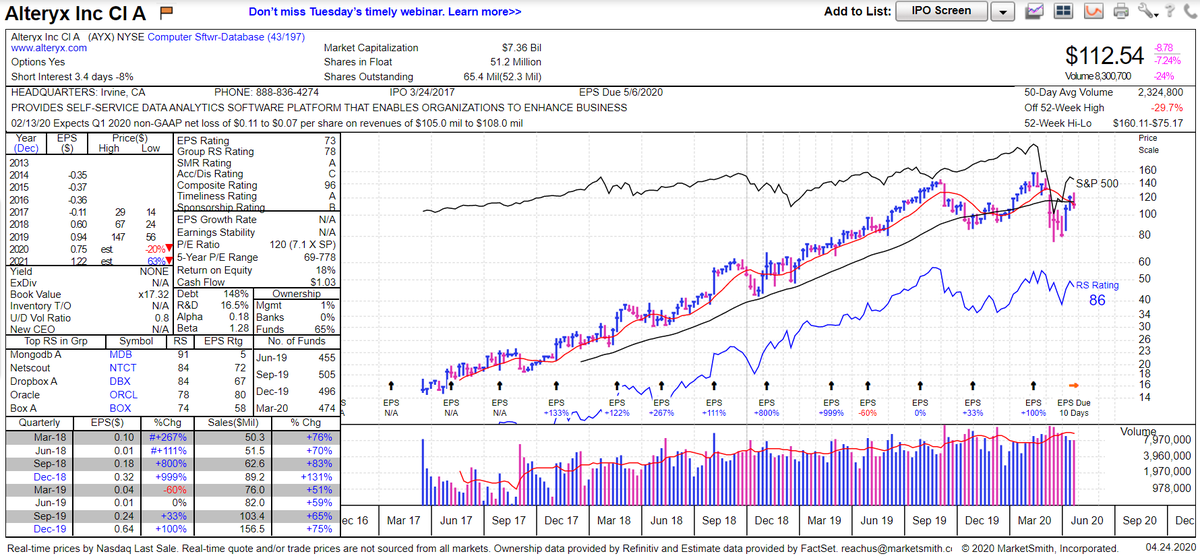

4) $AYX - $112.54, up 31.47% since purchase on 3/16/20 at $85.60. Like $TTD, I didn& #39;t own and wanted to get in so I jumped at the opportunity in March.

Chart via @MarketSmith

Chart via @MarketSmith

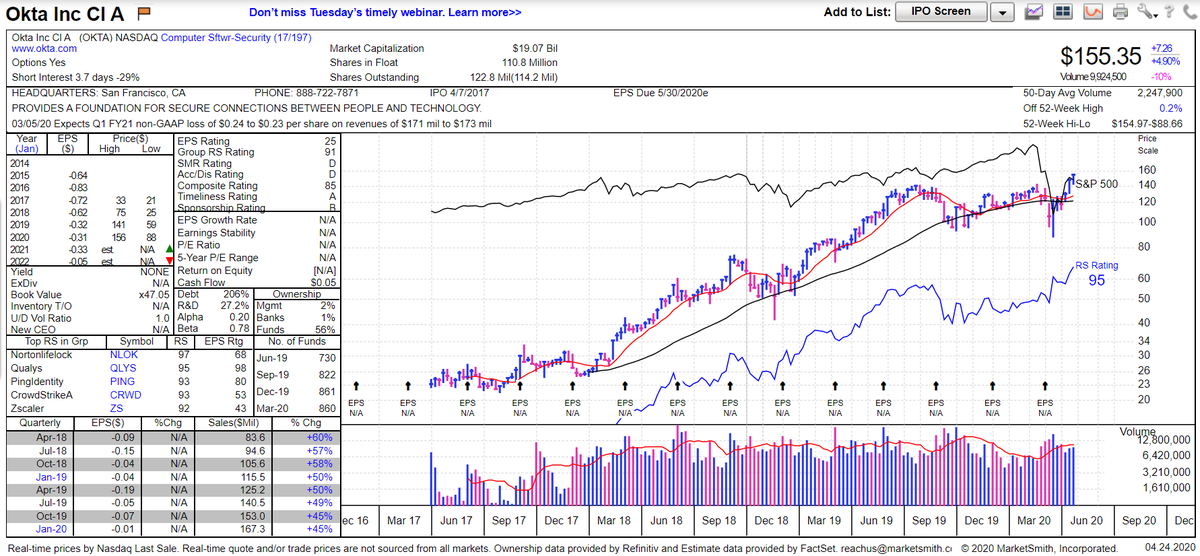

5) $OKTA - $155.35, up 27.14% since purchase on 1/06/20 at $122.19. Looking at notes, I should have pulled the trigger a few times at lower prices. I& #39;m in which is good and I like the push to new highs.

Chart via @MarketSmith

Chart via @MarketSmith

6) $CRWD - $72.00, up 26.87% since purchase on 2/25/20 at $56.75. A bit early on the buy (hindsight analysis) but happy with position. I could have grabbed more in March but decided to play it safe and ride what I owned.

Chart via @MarketSmith

Chart via @MarketSmith

7) $MDB - $159.94, up 24.91% since purchase on 3/10/20 at $128.04. A week early as I could have had a much better cost basis had I waited to buy like $TTD and $AYX.

Chart via @MarketSmith

Chart via @MarketSmith

8) $TCEHY - $52.85, made my first purchase last May, overall showing a gain but it& #39;s been slow going the past year - chart finally looking like it may be ready to move higher. Let& #39;s see if the market allows.

Chart via @MarketSmith

Chart via @MarketSmith

9) $WORK - $26.06, up 7.69% since purchase on 3/10/20 at $24.20. I bought and sold for a loss prior to this position but currently happy with position for now.

Chart via @MarketSmith

Chart via @MarketSmith

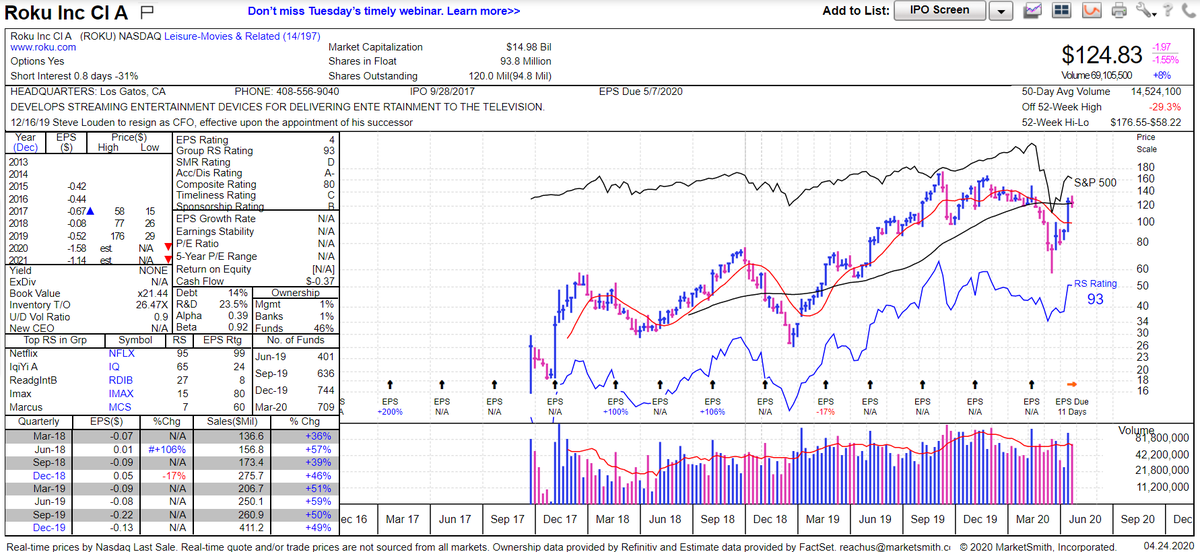

10) $ROKU - $124.83, heck of a comeback since March low. I jumped in at the end of 2019. I didn& #39;t buy more shares when it went down as I started to buy other on this list (a bit of a regret now, should have improved my cost basis).

Chart via @MarketSmith

Chart via @MarketSmith

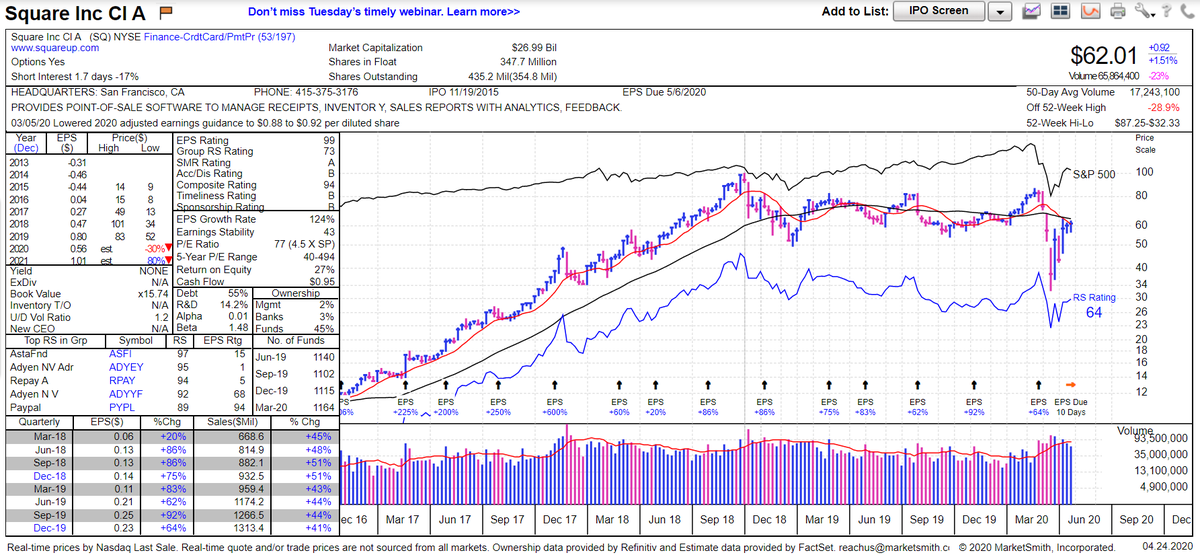

11) $SQ – $62.01, I initiated this position in March 2019 and similar to $ROKU, I regrettably ignored grabbing additional shares in the March slide (was focused on others). With that said, May earnings and guidance are important. Needs to recover 200d.

Chart via @MarketSmith

Chart via @MarketSmith

12) The key to all the stocks I own is a combination of price action (technical analysis) and strong/increasing sales & earnings (EPS takes some time to get going for some young guns so focus on sales). The @MarketSmith charts I used tonight show the QoQ sales and EPS.

Read on Twitter

Read on Twitter