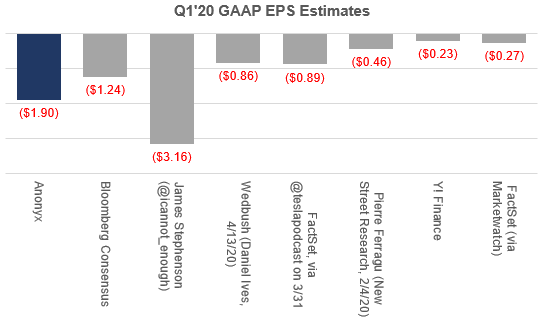

My est. for $TSLA Q1& #39;20 EPS (results on Weds 4/29):

-GAAP EPS: -$1.90

-Non-GAAP EPS: -$0.54.

This looks to be well below current cons. & most other estimates - see chart. Looks like a tough Q, w/ deliveries down 25K seq., but little relevance to LT thesis. More details below.

-GAAP EPS: -$1.90

-Non-GAAP EPS: -$0.54.

This looks to be well below current cons. & most other estimates - see chart. Looks like a tough Q, w/ deliveries down 25K seq., but little relevance to LT thesis. More details below.

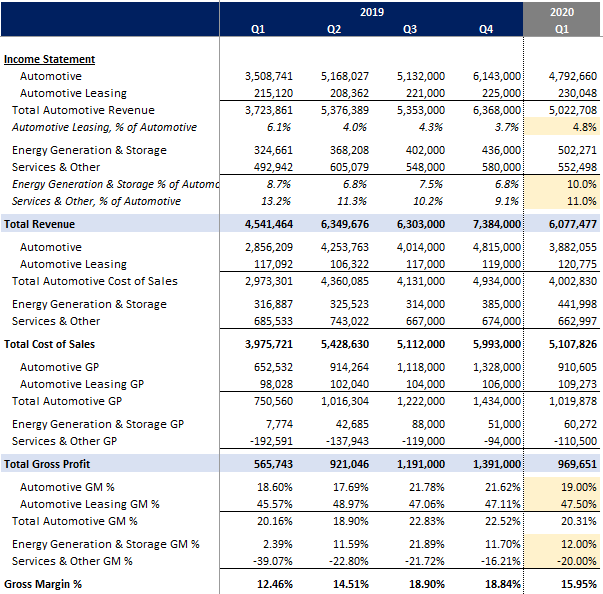

Non-leased Auto rev forecast at $4.8B for Q1’20, down 22% from $6.1B in Q4’19, but up 37% from $3.5B in Q1’19. Model Y est. courtesy of @TroyTeslike. Vehicle ASP estimates also informed by @TroyTeslike& #39;s survey.

Auto Leasing rev assumed to be similar to Q4’19, but rising (to 4.8%) as a % of Non-Leased Automotive Revenue.

Energy Storage and Service & Other assumed to increase as a % of Automotive revenue.

Overall Rev forecast at $6.1B, down 18% seq., but up 34% y/y.

Energy Storage and Service & Other assumed to increase as a % of Automotive revenue.

Overall Rev forecast at $6.1B, down 18% seq., but up 34% y/y.

Non-leased Automotive GM% assumed to be 19%, down from Q4’19 per TSLA CFO comments on Q4’19 earnings call; overall GM forecast at 16.0%, down from 18.8% in Q4’19.

SG&A assumed to be close to Q4’19; R&D assumed to be slightly higher. One-time charge of $25M assumed in connection w/ Covid-19 (a guess). Overall GAAP EPS estimated at -$1.90; non-GAAP at -$0.54

I see non-leased Automotive GM% & SG&A expense as key variables; GAAP EPS could range from mid -$1.00 range up to low -$2.00 range depending on what happens w/ those variables. Key wildcards incl. (1) regulatory credits; (2) unexpectedly large covid-19 related one-time charges.

Any thoughts or comments welcome.

Note: whether this is a tough Q or not has zero relevance to whether Tesla can deliver tens of millions of vehicles in 2030, & I still think 500K+ deliveries for 2020 is possible, but lots of uncertainty.

Thanks for reading!

Note: whether this is a tough Q or not has zero relevance to whether Tesla can deliver tens of millions of vehicles in 2030, & I still think 500K+ deliveries for 2020 is possible, but lots of uncertainty.

Thanks for reading!

Note: none of the above should be taken as investment advice one way or the other. Do your own research and make your own investment decisions based on your own individual circumstances and risk tolerance.

Read on Twitter

Read on Twitter