We don& #39;t trade the markets, we trade our beliefs about the market. --Van Tharp.

What are your beliefs based on, something you read or heard or your actual own homework?

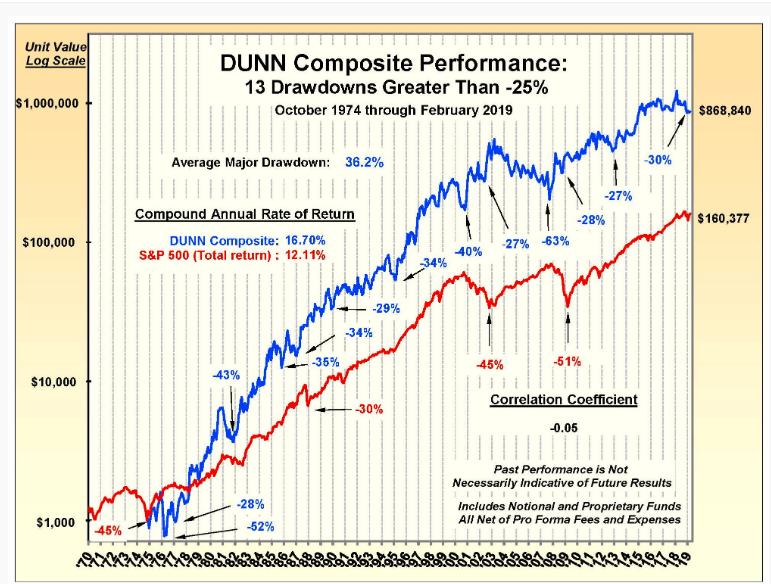

Can your personality withstand the pitfalls of certain strategies that are based on someone& #39;s beliefs that are not yours? Can you withstand these drawdowns, be honest with yourself? You go from 10k to 800k back to 250k.

With the above example, you are no longer saying to yourself that you are up 240k dollars on a 10k investment, you are now saying that you are down 600k, you view the whole thing as losing experience.

The outcome of trades are unknown, the market is dynamic. Even if you have a coin that you know that 70% of the time it will come up heads, you still don& #39;t know the outcome of every flip.

The risk-reward is dynamic, it changes with the action the underlying. As a short-term swing trader, you want the first day to be the day when your risk is the highest, then you want to reduce that risk without choking the trade. What is the final R/R on the trade attached?

I believe targets are made up and targets should be based on market structure, not based on random numbers you throw out. If you believe that stocks move in small bursts then you should take what the market gives you during that burst.

In certain market environments, you will get more than others. Last month if the market gave you 5% that was a lot, last 2 weeks if the market gave you only 10% that& #39;s too low based on the current environment.

As a daily swing trader, you are in the moving business, you want to hop on a trade when it& #39;s just getting started and then hop off on the way up and repeat that over and over again, as I explain here https://youtu.be/RKSmifGmqnY ">https://youtu.be/RKSmifGmq... U don& #39;t want to sit through consolidations or pullbacks

Find solutions to your trading, diversify your timeframe, diversify your sell orders, diversify your stops. If you find that stocks are moving a lot more after you sell then leave a piece on every trade and see what happens.

At the end of 100 trades you will end up wishing you would& #39;ve sold all the ones that came back down at your original sale price and vice versa. Find clarity.

A short term trader will have to learn to live with seeing stocks that he sold for +20% go up 100% and the long term investor will have to learn how to live seeing open profits disappear.

Do not grade your trades based on what happened after the fact. We all want to sell something and see it go down immediately, if that happens we consider that a good exit, but if the opposite happens and stock continues to go up we consider a bad exit, that is not right.

If you are on a fast break and no one is in front of you and you pull up and take a half-court shot, regardless if the shot goes in, that is still a bad shot.

Let& #39;s say for example you did 3-trades in all 3 you booked 20% profits, however on the 1st two trades after you sold the stock went all the way back down to your breakeven price, but on the third trade, after you sold for+20%, the stock went up 50%, which 20% is worth more?

Are trades one and two good trades and trade 3 a bad trade?

If you took ten trades this week and all ten trades were losers, and the following week you took ten trades and all were winners, do you call the first week overtrading and the second-week great trading?

Read on Twitter

Read on Twitter